Vasyl Dolmatov/iStock via Getty Images

Co-produced with Treading Softly

Have you ever tried to evaluate two options that seemingly were the same but you knew something had to be different between them?

The grocery store can be a place of such confusion. Is store-brand cereal really the same as a name brand? What about store-brand black beans? The cans hold the same type of beans, so is the name on the can somehow improving it? In my experience, on some items, the difference isn’t identifiable. On other items, the brand name is worth every penny.

When it comes to large parent companies, like Ares Management (ARES), you have a “brand” that it shares. You can invest directly in the parent, or you can invest in the companies they operate instead.

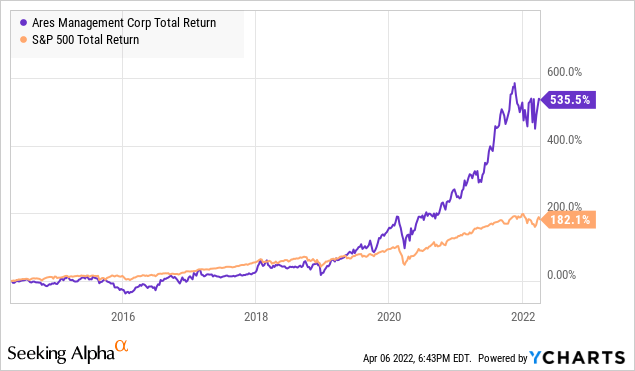

ARES has a strong track record:

As a total return investment, ARES has dominated the S&P 500 over the long haul. The problem? ARES has a yield of only 3%. As income investors, we’re interested in getting income in hand today without having to “harvest” shares to achieve our income goals. I want to be buying more shares, not selling them off over time!

This doesn’t mean we need to accept lower quality; we can benefit from ARES management skills and receive a larger income stream in return. Let’s look at two public companies managed by ARES, where brand really does matter.

Let’s dive in!

Pick #1: ACRE – Yield 9.0%

Ares Commercial Real Estate Corp. (ACRE) focuses on “senior” mortgages, making up 99% of their portfolio. This means that they are at the top of the recovery food chain, also 98% of their mortgages are floating rate.

Like most commercial mREITs, ACRE uses a structure where it both borrows and lends using floating rates. However, with rates near zero, most of their loans have “floors” that are currently binding. If rates are below the floor, the borrower has to pay the higher amount. So when rates are in the early stages of rising, earnings can actually contract a little until they are higher than the floor because the borrower doesn’t have to pay more, but ACRE will pay more on its leverage.

However, ACRE’s management recognized the historical conditions we were in with amazingly low-interest rates and recognized it wouldn’t last. It entered into two “swap agreements”.

This information can be found in the 10-K filing:

- ACRE entered into an interest rate swap (the “Swap”) with Morgan Stanley Capital Services, LLC (“Morgan Stanley Capital”) for the initial notional amount of $870.0 million, which amortizes according to an agreed-upon notional schedule. The Swap requires ACRE to pay a fixed interest rate of 0.2075% and for Morgan Stanley Capital to pay a floating rate equal to one-month LIBOR, subject to a 0.00% floor. The Swap has a termination date of December 15, 2023.

- ACRE entered into an interest rate cap (the “Cap”) with Morgan Stanley Capital for the initial notional amount of $275.0 million, which amortizes according to an agreed-upon notional schedule. The Cap is tied to a one-month LIBOR with a strike rate of 0.50%. The Cap has a termination date of December 15, 2023.

So ACRE is paying 0.2075% interest on $870 million while receiving 1-month LIBOR. Well, last year, 1-month LIBOR was 0.10%, so ACRE was the net payer, paying Morgan Stanley (MS) approximately 0.1075%. Not anymore, as the 1-month LIBOR has climbed and is now 0.445%. So ACRE is now receiving 0.2375% from MS!

With the Fed expected to raise rates again in May, we expect that LIBOR will continue to climb, and soon the 0.5% cap will be binding. As rates climb, $1.145 billion of ACRE’s debt will be effectively fixed until December of 2023. Thanks, MS!

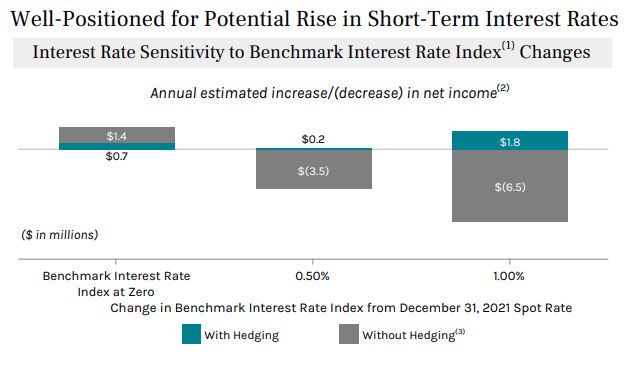

Thanks to these hedges, what would have been a headwind for ACRE’s earnings, is actually a tailwind. With 1-month LIBOR just shy of 0.5%, without the hedging, this would have reduced ACRE’s net income by $3.5 million. Instead, ACRE’s net income will be up approximately $0.2 million, and will climb further as rates rise.

Fourth Quarter and Full Year 2021 Earnings Presentation

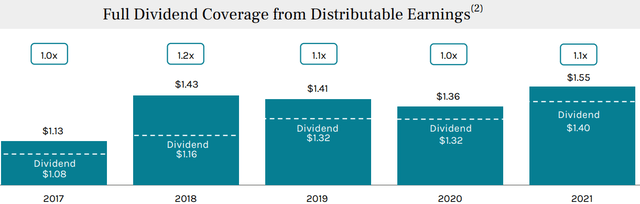

ACRE has been consistently covering its dividend with distributable earnings, with 1.1x coverage in 2021 after adding a “supplemental” dividend.

Fourth Quarter and Full Year 2021 Earnings Presentation

With interest rates rising and providing a tailwind to earnings, we can expect the $0.02 supplement dividend to stick around. It may even become a permanent raise.

ACRE is an ideal example of an opportunity to benefit from the Fed’s actions. It pays a very generous yield today, and as the Fed increases rates, it will earn even more!

Pick #2: ARCC – Yield 8.5%

Ares Capital (ARCC) is another pick that is managed by ARES.

ARCC is a BDC (Business Development Company) that uses its size and scale to invest in the larger-end of “middle-market” companies. The companies that ARCC invests in have an average EBITDA of over $127 million/year.

The investments that ARCC makes are a combination of debt and equity. The debt investments provide regular recurring income, while the equity investments provide opportunities for upside.

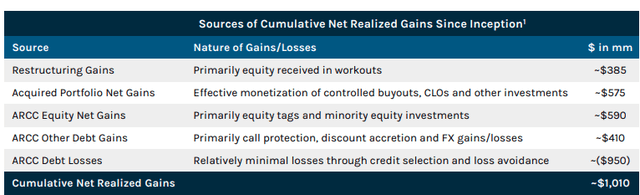

ARCC has a great track record of underwriting, with minimal credit losses from borrowers defaulting. The ability to turn a bad situation into a profitable gain makes ARCC really special. The equity positions that ARCC has monetized have resulted in gains that have substantially exceeded credit losses.

Investor Presentation Quarter Ended December 31, 2021

This is something you don’t see with banks, which are quick to simply write off losses, sell them to a debt collection agency and move on, whereas ARCC puts the development in a business development company. Approaching the borrowers as an investor, not just a lender. ARCC seeks to provide the company with the best opportunity to succeed, knowing that the gains from the equity position will be a rich reward.

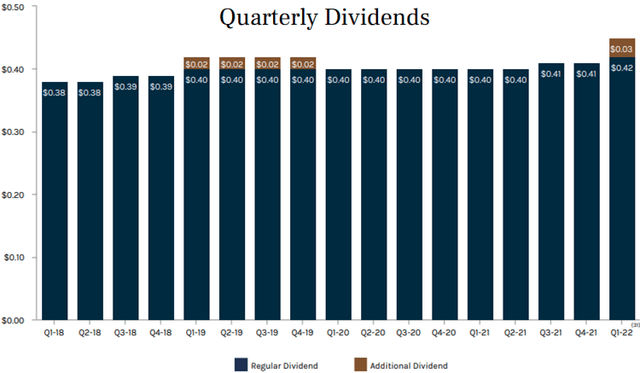

In Q4 earnings, ARCC raised its dividend twice! Due to its high dividend coverage, ARCC increased its “regular” dividend to $0.42/quarter. We can interpret this as management’s confidence that it will be able to continue paying out $0.42/quarter indefinitely out of recurring interest payments. As old loans are paid off, they will redeploy in new debt investments, and be able to consistently outearn the $0.42/quarter.

Second, ARCC announced a $0.12 dividend for the year that will be paid out in installments of $0.03/quarter. This dividend is being paid from excess gains that have accumulated. It will last for four quarters and then it might or might not continue depending on the timing of future gains.

ARCC last did one of these in 2019; they didn’t continue it into 2020 for obvious reasons.

Fourth Quarter 2021 Earnings Presentation

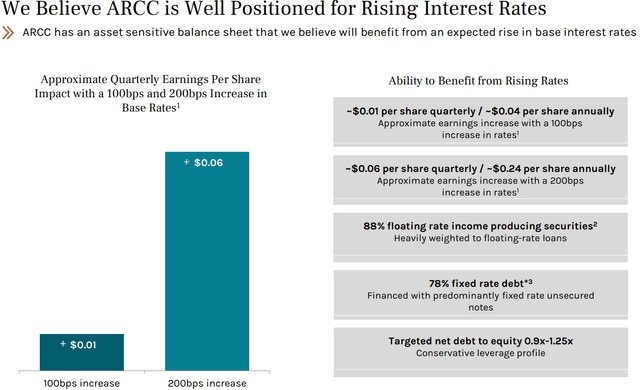

ARCC is firing on all cylinders in what has been a 0% interest rate environment. What happens if rates rise? ARCC makes more money.

Investor Presentation Quarter Ended December 31, 2021

You see, ARCC borrows primarily fixed-rate debt. Over the past couple of years, it has used its investment-grade balance sheet to issue bonds at rates under 3%. Meanwhile, the loans it makes are floating rate. A small 1% increase in interest rates will lead to “only” $0.01/quarter in higher earnings. Whereas an increase to 2%, which is what the Fed is targeting, would result in an extra $0.06/quarter – that would be a 10%+ increase, before any natural earnings growth!

ARCC surprised us with a regular dividend raise for Q1, and as rates are rising, earnings will go up as well. We could very likely see another dividend raise later this year!

BDCs are a great way to invest in the small to medium-sized companies that drive the U.S. economy. They are also a great way to directly benefit from rising interest rates. ARCC is a blue-chip in the sector and is currently trading at a very attractive price.

Shutterstock

Conclusion

ARCC and ACRE are two excellent firms managed by ARES and its team. Overall, both are excellent examples of top-notch firms in their respective fields – which again shows the quality of employees that ARES has.

ARCC has established itself as a blue-chip in the BDC sector. The younger ACRE has the pieces to develop into a serious competitor in the commercial mREIT sector.

What does this mean for you? Well, this year both ACRE and ARCC have outperformed the S&P 500 and ARES for total return, while also providing excellent income to your pocket today. ARES has been a superior total return investment. For income investors who do not want to sell shares to fund their retirement, ARCC and ACRE are superior choices.

So move over with the piddly 3% yield and let me collect up to 9% today. That 9% provides me cash into my bank account and every dollar is an opportunity to explore new experiences, see old friends again, or simply buy my favorite beverage to enjoy another sunset over my piece of land.

What would you do with 3x the income from your portfolio without sacrificing the excellence you hold? I’d love to hear about it in the comments.

Be the first to comment