Andrii Chagovets/iStock via Getty Images

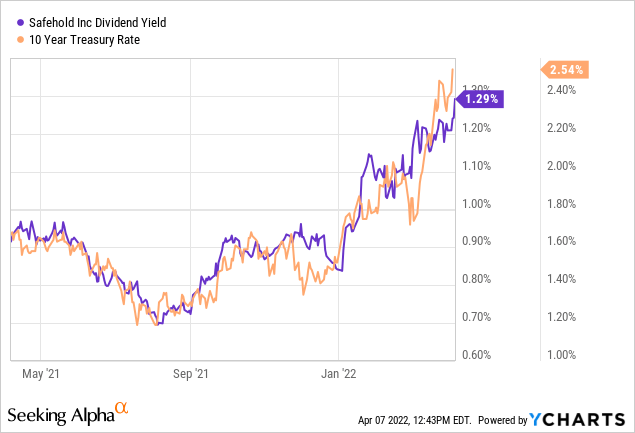

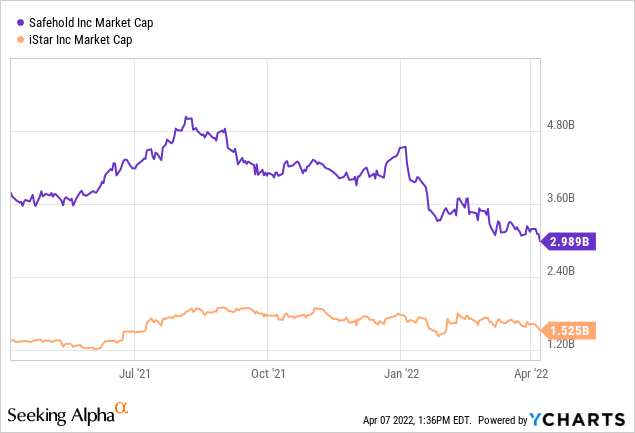

It is ok not to be impressed with every investment pitch that is thrown at you. We certainly did a “meh” when we first came across Safehold Inc. (NYSE:SAFE). While we did not find anything remotely wrong with the model, we did find a lot, and by that we mean really a lot, wrong with the valuation. That valuation was driven primarily by an extremely bearish view on 10-year Treasury notes. Since SAFE was being used as duration proxy, we felt it would get clobbered in a rate rise. Turns out we were right.

Now we dialed down the bearishness as we expect positive though not glamourous (2% compounded) 10-year total returns. While we were watching this in fascination it was hard to miss what was happening with iStar (NYSE:STAR), the parent company with a rather large retained stake in SAFE. Unlike the dislike for SAFE’s valuation, in the case of STAR, we stayed out as we had extremely low visibility into the value of the legacy assets. We also felt the interest coverage was poor and the general and administrative expenses were too high. That was clearly an incorrect decision.

The Current Opportunity

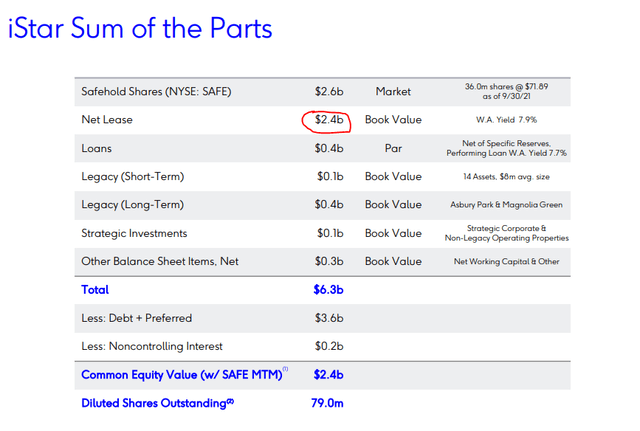

While we may have failed to see the value in STAR, management did show a laser focus in simplifying their balance sheet. This culminated with the epic deal to sell the bulk of their triple net lease portfolio for $3.07B to Carlyle Group’s (NASDAQ:CG) Global Credit platform. This should give STAR $1.1B of net cash proceeds, after repaying the associated mortgage debt and its secured term loan. One way to visualize this is to look at STAR’s internal valuation. The bulk of that $2.4 billion that STAR had on its books in the Q3-2021 presentation, was just sold for over $3.07 billion.

iStar Valuation (Q3-2021 Presentation)

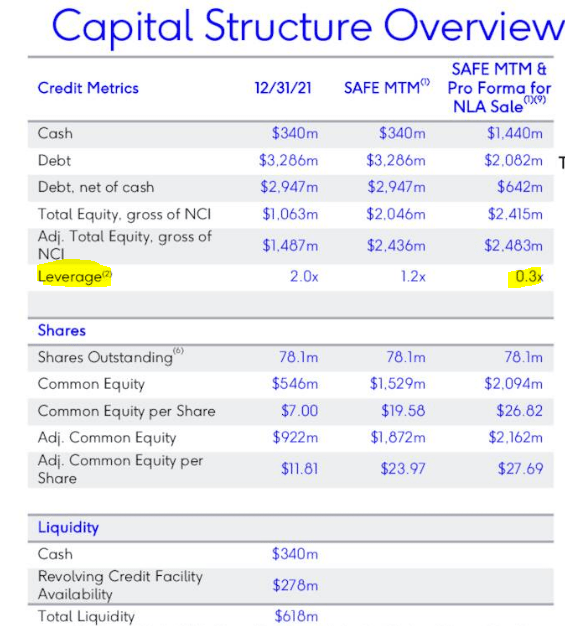

Their balance sheet adjusted for this sale, looks pristine and would be the envy of any REIT.

iStar Capital Structure (Q4-2021 Presentation)

Fascinatingly Fitch did not blink an eyelid at that. They actually kept the credit rating unchanged.

The affirmation reflects Fitch’s belief that the transaction will be neutral to iStar’s ratings. The expected improvement in leverage, funding flexibility and liquidity are offset by uncertain expected growth in leasehold loans and ground lease assets; and uncertainty around iStar’s medium-term strategy and its long-term relationship with Safehold. The remaining assets will be more heavily concentrated in business done alongside affiliate Safehold Inc. and in ownership of Safehold stock.

Rating constraints include iStar’s focus on the CRE market, which exhibits volatility through the credit cycle; multiple shifts in the firm’s strategy over time; continued, albeit declining, exposure to land and other legacy noncore assets; inconsistent operating performance and declining revenue diversity; and key person risk associated with CEO Jay Sugarman. Additionally, iStar’s performance will be highly dependent upon continued growth at SAFE, which has a relatively limited track record, given slower growth in the traditional net lease and real estate finance businesses in recent years.

The portfolio being sold consists of office, entertainment and industrial properties totaling $2.2 billion, or 39% of iStar’s portfolio at Dec. 31, 2021, which is partially financed with mortgage debt. With sale proceeds, iStar is expected to repay associated mortgage obligations and its secured term loan. Excess proceeds of $1.1 billion are expected to be used to invest in leasehold loans, ground leases and, potentially, share repurchases. Net lease assets associated with iStar’s ground lease business, specifically ground lease plus, were not included in the sale.

Fitch primarily assesses iStar’s leverage on the basis of debt-to-tangible equity, affording 50% equity credit to the preferred securities. On this basis, leverage was 3.0x at YE 2021, which is down from 4.6x at YE 2020. The decline was driven by the reclassification of assets and liabilities in connection with the transaction. Fitch expects leverage to be 1.8x at close, due to the repayment of debt and increase in equity. The reduction in leverage is viewed favorably by Fitch but it is not clear where leverage will be managed long-term.

Source: Fitch

We think this must have come as a shock to management who likely expected a slow and steady path to an investment grade rating to enable its growth plans. We were surprised as well as this level of leverage metric improvement should have given at least a one-notch upgrade.

Where We Stand

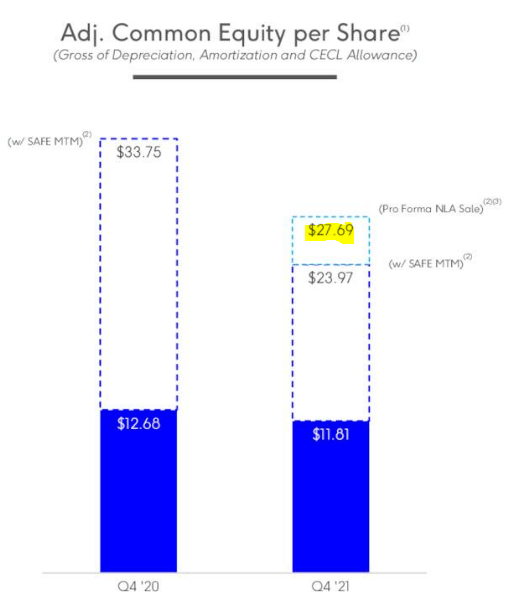

With STAR having crystallized its book, the whole show is now being run by SAFE. STAR puts its adjusted book value at $27.69.

iStar Adjusted Valuation (Q4-2021 Presentation)

Here adjusted means adjusted for items above and marking SAFE at market prices. The market price at the time was $58.78, so we are already a good 10% below that. But undervaluation still persists. The market capitalization of SAFE is close to $3.0 billion and STAR owns close to two-thirds of this.

This setup is very similar to TransAlta Corp.’s (TAC) ownership of TransAlta Renewables (OTCPK:TRSWF), where we actually did buy TAC.

Is STAR A Buy?

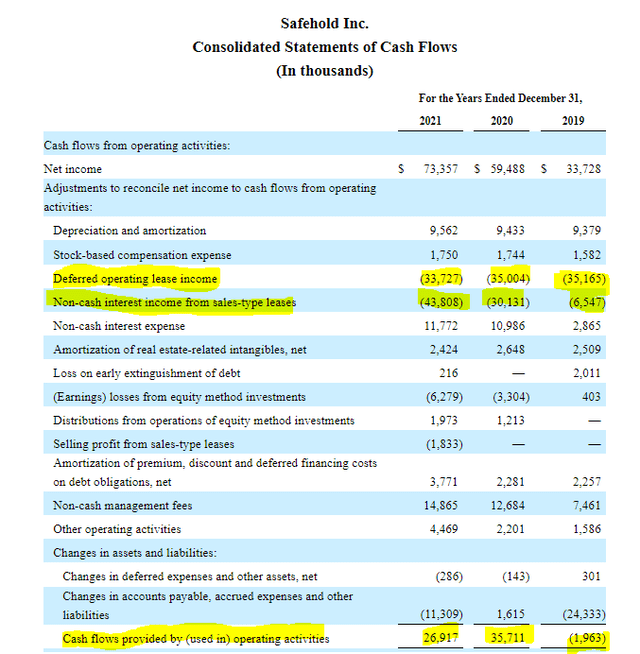

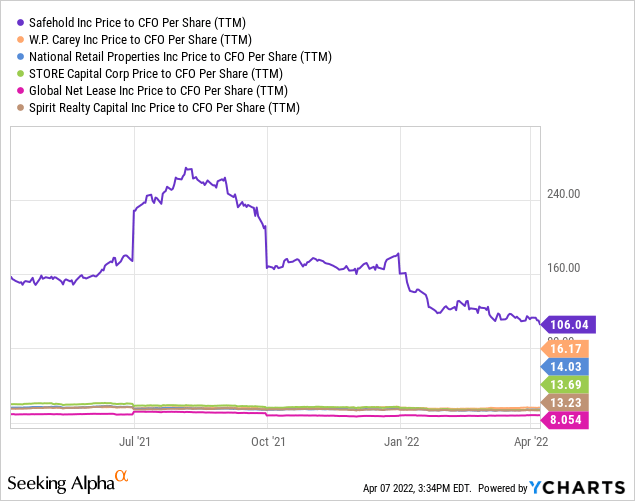

STAR certainly has cleaned up its balance sheet to the point that it deserves the market’s respect, whether Fitch sees it or not. Our problem is that we don’t view SAFE as undervalued. In fact we see big risks to the downside as the company still trades at 30X 2022 earnings estimates. Here we want to go over what makes up these earnings. Since the primary asset is land and land is not depreciated, technically earnings per share are the same as the funds from operations (FFO) you see reported by other REITs. Keep that in mind as a lot of sites have used FFO in place of EPS. So SAFE appears expensive by EPS or FFO metrics. The cash flow though takes the expensive nature to a whole different level. Due to the ultra-long leases, what is booked as GAAP revenue and hence moves to GAAP net income is not remotely representative of cash coming in today.

SAFE Op-Cash Flow (2021 Annual Report)

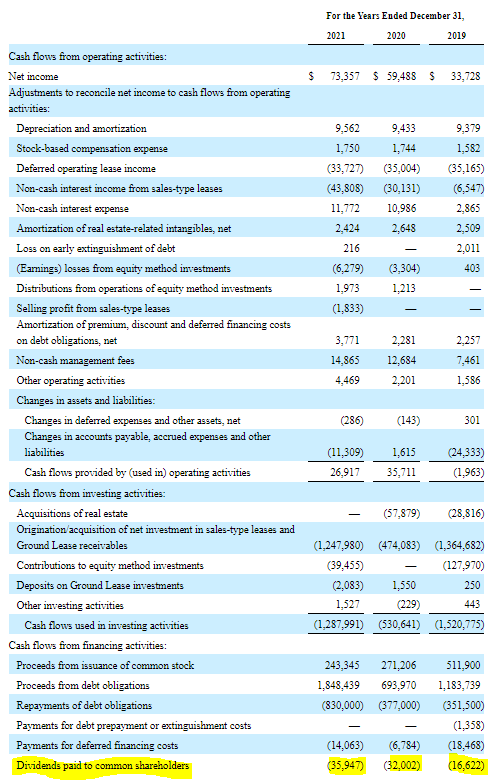

Cash flow provided by operating activities was $27 million in 2021 or 1% of the equity market capitalization. That cash flow was not even enough to cover the dividends over the last 3 years.

SAFE Dividends Paid (2021 Annual Report)

SAFE is a true stand-out among REITs in this metric.

If SAFE just paid out its current cash from operating activities, you would break even via yield in 106 years. That time is sandwiched between weighted average lease length of SAFE’s tenants (about 90 years) and the half life of polonium-209. Yes, we get the logic of how this is set up and they will get increased cash flows down the line. But this will be a very slow process where we get to the point that cash flow is even equal to the net income, rather than the other way around. Hence while STAR is undervalued relative to SAFE, we have no love for SAFE.

What We Did Do

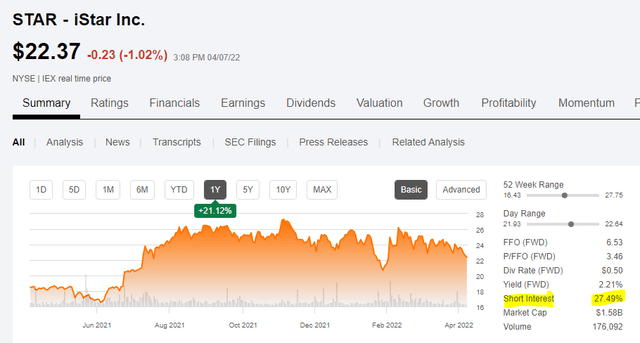

While the cash flow characteristics of SAFE are not that great, we do recognize that the quality investment grade rating (BBB+/Stable) that Fitch gives it. Ground leases defaults are going to be incredibly rare in any economy. On the other side of the equation STAR has limited abilities to fund its growth with the rating it does have in place. This increases the chances of STAR disposing most or all of its remaining assets and merging into SAFE. Combining this information with the deleveraged balance sheet, we see great opportunity for income investors in the STAR preferred shares (NYSE:STAR.PD) with an 8% coupon, (NYSE:STAR.PI) with a 7.50% coupon and (NYSE:STAR.PG) with a 7.65% coupon. All three are past their call dates and likely to be retired as STAR’s uses the merger to converge the cost of debt between the two companies. We see the preferred shares as an indirect NAV play that balances the overvaluation of SAFE with the relative undervaluation of STAR. If investors are bullish on SAFE, then we would play it only via long position on common shares of STAR. This short interest might make for a compelling squeeze should the two firms decide to merge.

iStar Short Interest (Seeking Alpha)

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment