Investors will be paying close attention to what Warner Bros. Discovery management has to say about their cost cutting efforts, debt paydown plans and cash flow generation ideas developed over the last quarter. Dimitrios Kambouris

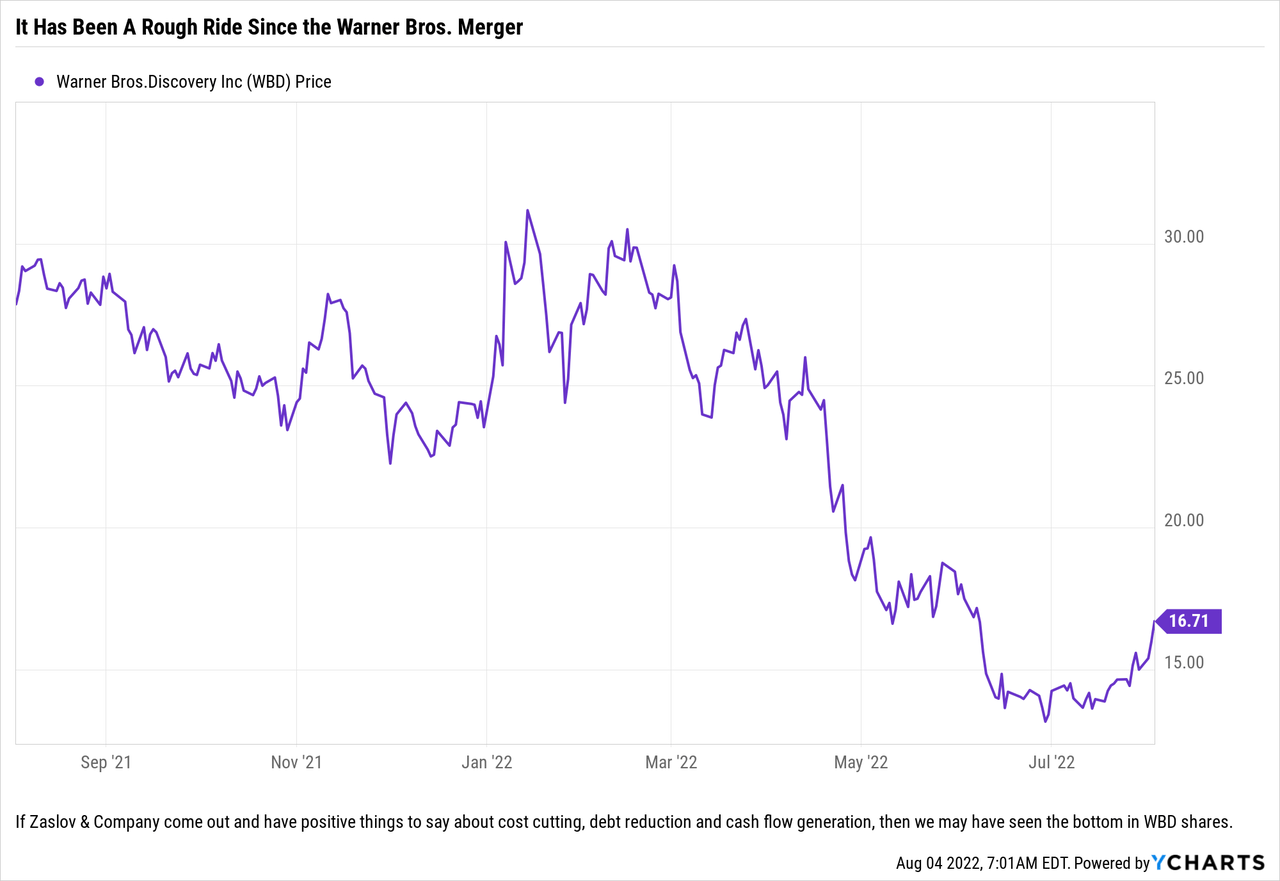

It has been a while since we last wrote about Warner Brothers Discovery (NASDAQ:WBD) back on May 10th. Overall, the stock is down around 5% since then on really no news. Market sentiment has changed, investors who were more interested in owning AT&T (T) shares continued to exit the Warner Bros. Discovery shares they received in the spinoff and a new narrative around streaming has emerged which has weighed on the company and its peers. While the stock is only down about 5% since our article a few months ago, that is only because investors have recently bid up shares from around $13/share to yesterday’s close of $16.71/share.

We came into earnings season extremely bullish Warner Bros. Discovery shares and had been carrying significant exposure to the name via puts that we had sold. The last position we had matured about two weeks ago and had a strike of $14/share. With the recent strength in the stock, we were unable to write a new position that made sense ahead of earnings, so our only exposure since then has been through our equity holdings.

This will be the first full quarter of results since the merger of Warner Media and Discovery, and we suspect that management will be able to announce cost savings, on an annual basis, of between $500 million to $1 billion (and we think that if the company does give a number that it will be closer to $500 million than $1 billion). If the reports this morning of combining the Discovery+ streaming app with that of HBO Max are true, that will provide some savings, but we think that the largest savings going forward will be due to savings from headcount reduction (already announced for some areas including sales) and the decision to shut down the CNN+ streaming service.

Cost cutting is a key component of David Zaslav’s strategy here, and arguably the lowest hanging fruit. The other key area that investors need to pay attention to is cash flow. Due to cost cutting, investors will have to carefully look at this data as there will be one time charges for buyouts, payouts, etc. We would hope that cash flow generation is higher, especially at the old Warner Media properties that had basically generating no cash flow over its last 15 months of AT&T ownership – even though it generated $40 billion in revenues. That is a fact that still baffles us but is also one of the reasons we believe that the stock has considerable upside from current levels.

With Warner Bros. Discovery announcing earnings after today’s close, here are a few ways to trade the stock:

Bullish

For those who are still bullish at current prices, buying the shares outright and selling covered calls to generate some income seems like a good play right now, especially after the run over the last week or so. Using yesterday’s closing price of $16.71/share, we think investors who are bullish would do well to buy the stock and simultaneously sell the August 12, 2022 Calls with a $19/share strike price for $0.22/share, or $22 per contract. This option contract is not for this week, instead we think going out a week better serves investors because they are able to take advantage of implied volatility by writing a contract with a strike price about 13.70% above where they purchase the stock and generate an options premium of 1.32%. So even if called on shares in about a week and a half, the investor can make a total profit of just over 15% while maintaining some optionality to buyback, roll or let expire the short call position over the next week or so.

This trade also works for those who already own the company’s shares and are looking at potentially locking in profits on another leg higher. Locking in a 1.32% options premium yield on a stock that does not pay a dividend in exchange for offering to sell shares 13.70%+ higher than current prices seems prudent and could be quite beneficial for those shareholders interested in income.

Bullish But Cautious

We are in the camp that is bullish Warner Bros. Discovery stock long-term, but are a little trigger shy due to the recent run-up. We have made decent money selling puts on the name, but have had the majority of our put writing end with us just having to roll the position rather than having shares assigned to us. Since we want to be a little more conservative now that shares have rallied over $3/share from recent lows, we will focus on writing puts and setting up a more attractive entry point.

We think that using the August 12, 2022 Puts with a $16/share strike price makes sense for this trade as it should generate an options premium of roughly $0.58/share or $58 per contract. By utilizing next week’s options you have a little bit of time and optionality to react to the company’s earnings release tonight, however in a worse case scenario, where the stock is down sharply after results, this structure would lower your cost basis to $15.42/share, or roughly 7.72% below current prices and still enable you to be able to write covered calls and generate what should be decent options premiums going forward.

Own The Shares But See Little Upside

For those who own the shares and think that shares are fully valued in the short-term but maybe not the long-term, there may be a trade for you as well. With the stock currently at $16.71/share, an investor could sell the August 5, 2022 Calls with a strike price of $17/share for about $0.64/share or $64 per contract and buy the August 5, 2022 Puts with a strike price of $16.50/share which should cost right around $0.64/share or $64 per contract. The selling of your upside (the call) covers the cost of your insurance policy (the put) and if Warner Bros. Discovery shares do head lower, your loss is only the difference between the current price, $16.71/share and the strike price of the put, $16.50/share. This caps potential losses at under 1.26% but also limits your potential upside to only 1.74%. This is not a trade we are interested in, but would be useful for those who think that the stock either trades sideways or heads lower after the company’s quarterly results.

Conclusion

We want to own Warner Bros. Discovery shares, but also want to own the shares at attractive prices. It is our opinion that the options market can be used right now to create some cash flows and help investors manage their positions based on their expectations for potential outcomes resulting from tonight’s quarterly results and subsequent conference call.

Be the first to comment