ljubaphoto

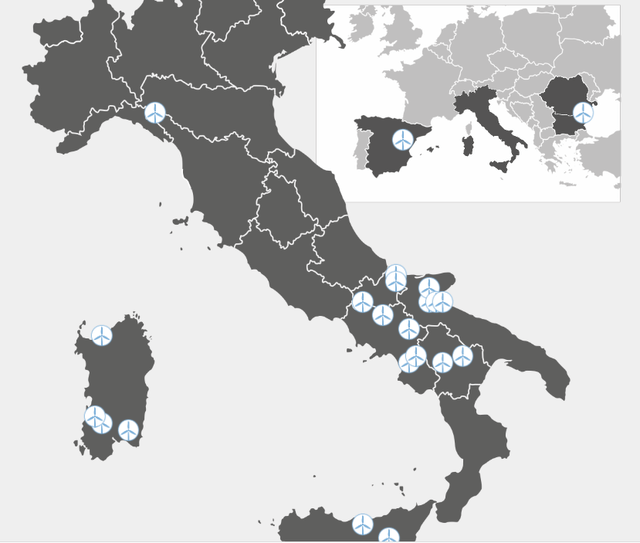

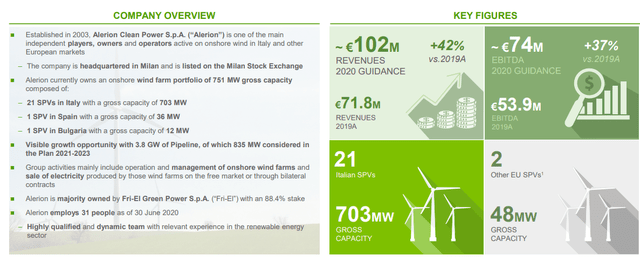

Here at the Mare Evidence Lab, we usually comment on large-cap and sector-leading companies. From time to time we focus our attention on small caps providing specific comps analysis, our latest examples were Stem vs Aton and FormFactor vs Technoprobe. Today, we are looking at Alerion Clean Power S.p.A. (OTCPK:ALRCF). The company is active in renewable energy generation with a particular focus on wind power production in the Italian peninsula, but it also engages its activities in Spain, Romania and Bulgaria.

Alerion renewable energy portfolio

Macro support

Why are we looking at Alerion? First of all, we start with some macroeconomic comments.

The outbreak of geopolitical tensions between Moscow and Kyiv certainly did not help the European energy supply which was already in a critical situation. Just yesterday, the European energy ministers kicked off what will be long talks to ensure that the country members won’t remain in the cold and dark in the event that gas supplies from Russia are interrupted following the conflict. There are many proposals on the table, including a possible intervention by the European Union to reinvest the extra profits into the renewable player companies. We already covered this topic in an Eni publication. More in specifically, the European Commission could propose that extra profits that were obtained from recent gas price increases be invested in renewable energy, energy-saving renovations, and bill support from civil and industrial customers. The news is in line with what has already been carried out by some governments, in Spain for instance.

Our internal team believes that among the major beneficiaries are renewable energy corporations (for non-incentivized productions). This is the reason why Alerion looks interesting.

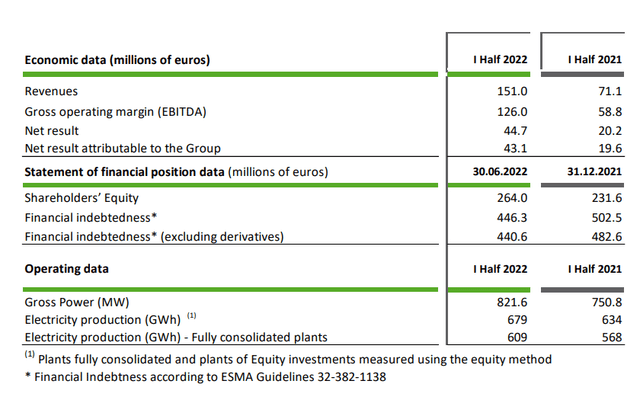

Q2 Results – Micro support

Compared to the first 2021 semester, Alerion more than doubled revenue, EBITDA and net profit. Numbers in hand, electricity production only grew by 7% but thanks to the ongoing rise in energy prices, Alerion reached top-line sales of €151 million up by 112%. We can see the same trajectory going down to the P&L, however, EBITDA was impacted by “the extraordinary measures introduced by the Italian government” to lower energy price impacts. Despite the negative one-off, EBITDA stood at €126 million compared to the €58.8 million achieved in the same period in 2021. The group’s net income was also considerably up but the most impressive number was the net debt evolution. It decreased by €56.2 million compared to last year’s end while Alerion is increasing its CAPEX investment.

Conclusion and Valuation

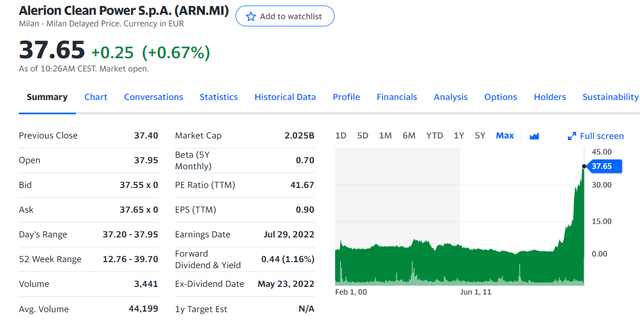

For the incredible results achieved, Alerion already increased its 2022 forecasts in Q1. Also, thanks to a new business plan for the period 2022-2025, the company estimates an increase in installed power up to 3.8 GW at the end of the period for a total CAPEX consideration of approximately €3.1 billion. Thus, according to our calculation and if we normalized the energy prices, the EBITDA level would reach approximately €440 million. In this context, the new plan is characterized by an important investment program that aims to accelerate the growth of the group in the wind and photovoltaic sectors in Europe. Our internal team believes that the markets are already pricing Alerion fairly. Why?

- P/E ratio is much higher than renewable energy pure player. ERG (OTC:ERGZF) is currently trading at 30x compared to Alerion (>40x) – these two companies are very similar both with high % of wind production generation and are located mainly in Italy;

- Same conclusion on the EV/EBITDA valuation estimates;

- The dividend yield is also lower than peers (both pure renewable energy players but also integrated competitors such as Iberdrola (OTCPK:IBRRF) and Enel (OTCPK:ENLAY);

- Concerning point 3, Alerion needs to balance CAPEX growth with shareholder remuneration. Last April, the company’s board approved a dividend proposal of €0.44 per share. Thus, the company is yielding 1.16% versus ERG at 2.8%.

Having said that, there is an important execution risk to consider. We decide to rate Alerion with a neutral target, favoring the Iberdrola and Enel investment cases.

Two minor news to report in the period:

- Alerion has finally started its operation of a new wind power plant in the South of Italy in line with its 2025 plan;

- As we already commented on Euronext, Alerion was included in the European Nasdaq called Euronext Tech Leaders.

Be the first to comment