gremlin/iStock via Getty Images

I was recently reading a column by James K. Glassman in Kiplinger’s in which the author explained that investors should focus on the “Golden 6%” rule” – that is the 6% of stocks that “beat the Russell 3000 index” from 1983 to 2006.

Glassman was citing a research report that demonstrated the “lumpy distribution” of stocks over this period of time:

- 64% had lower returns that the Russel 3000 index

- 18.5% of stocks lost 75% of their value or more

- 6% of stocks beat the Russel 3000 by 500% or more

One of the authors of the report cited by Glassman, Cole Wilcox, said in his book, The Little Book of Trading that the so-called “Golden 6%” strategy would lead you to “own the LeBron Jameses, Kobe Bryants, and Dwight Howards of the world. There are many players in the NBA, but only a handful of difference makers.”

Glassman added, “investors should search for the Golden 6% among companies that have the chance to achieve spectacular business success.”

Within the REIT sector there are just a handful of companies that I’m comfortable including on the “own for decades” list. These companies must be proven performers with a long-track record of allocating capital wisely.

In addition to these all-important rear-view indicators, the company must also have solid balance sheet metrics such that it can continue to generate reliable and predictable earnings (or funds from operations).

Covid-19 was a great test for the REIT sector and while many companies were forced to cut dividends, these long-haulers on our list must have successfully navigated the pandemic by growing the dividend.

Although we would never recommend forgetting about your stocks for over a decade, we want to buy them as if we’re putting them into a time capsule for the grandchildren.

(Speaking of which, I’ll be a grandfather in just about three weeks myself.)

Keep in mind that this buy-and-hold mindset is designed for passive investors who aren’t concerned with short-term price fluctuations.

Of course, the most important part of the buy-and-hold strategy is that you need to buy the right REIT at the right price, and now what you’ve been waiting for…

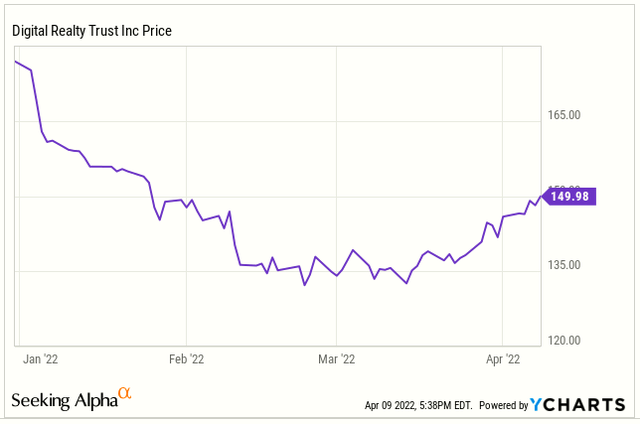

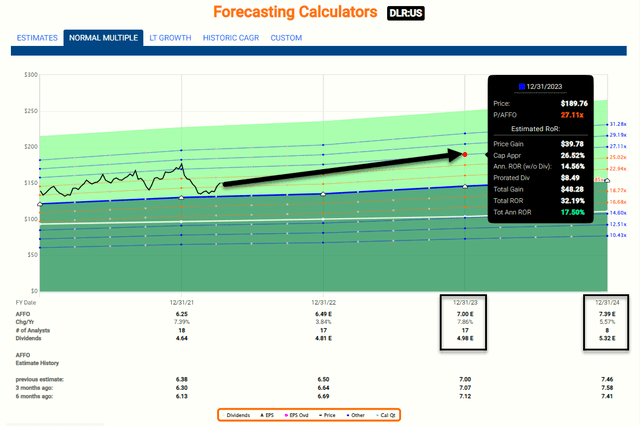

Digital Realty (DLR)

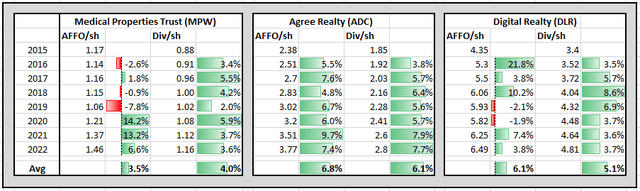

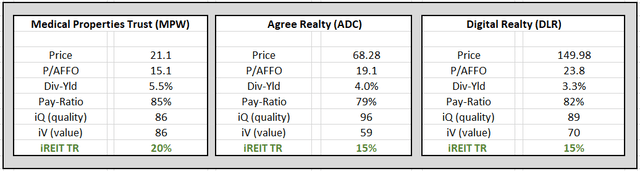

DLR is a data center REIT that owns 280 data centers in 26 Countries and 6 Continents. I have owned DLR since 2013 and shares have returned an average of 20% annually. As seen below, shares have sold off by ~15% YTD:

As I explained in a recent article,

[T]he long-term growth trends that drive demand for its cloud computing facilities cannot be attacked by inflation, Fed policy, or consumer spending trends. More importantly, with the world on the cusp of upgrading to 5G wireless communications technologies, demand for data storage will accelerate in the years to come.

The fact is that DLR’s wide moat advantages – scale and cost of capital – continue to drive earnings and dividend growth. DLR’s global dominance is validated by the company’s 10% CAGR in Core FFO per share since 2005 and its steady dividend growth (16 years in a row of increases).

iREIT provides DLR with a quality score of 89 which is due to the company’s investment grade ratings (BBB), earnings/dividend history (DLR has raised the dividend in every year since going public in 2004), and disciplined capital structure.

At year-end 2021 DLR’s leverage ratio was 6.1x, and fixed charge coverage was 5.4x. The company’s weighted average debt maturity is over 6 years, and its weighted average coupon is just over 2%. Around 99% of DLR’s debt is unsecured, providing the greatest flexibility for capital recycling.

Given the continued growth in cash flows and taxable income DLR continues to generate dividend growth. In early March the company declared a $1.22/share quarterly dividend, a 5.2% increase from prior dividend of $1.16.

Shares are now trading in our by zone and around 10% below our buy below target. The P/AFO is 23.7x, below the 4-year average of 22.0x. The dividend yield is now 3.3% and analysts forecast growth of 4% in 2022 and 8% in 2023. We forecast DLR to return 15%+ over the next 12 months.

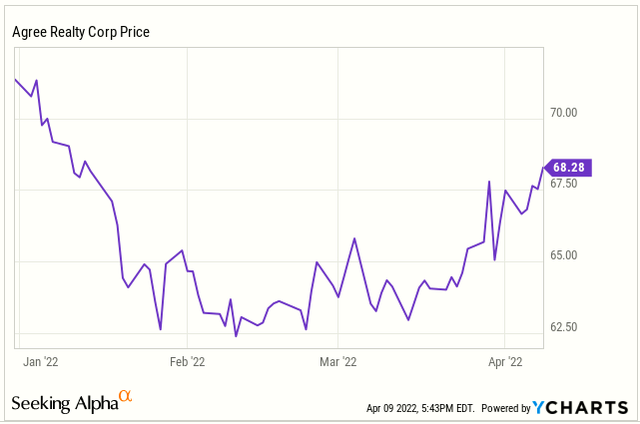

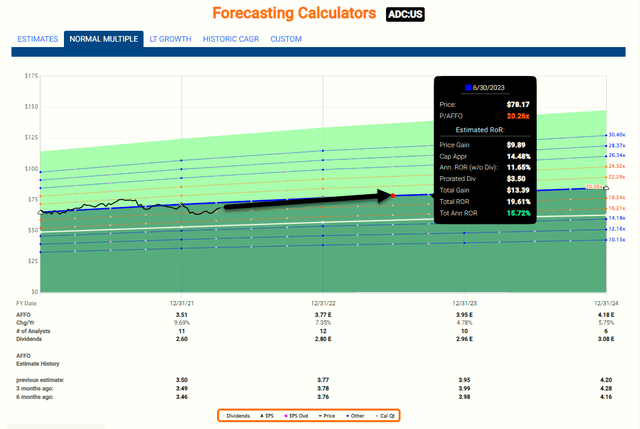

Agree Realty (ADC)

ADC is a net lease REIT that owns 1,404 properties in 47 states and was 99.5% leased (as of Q4-1). Top tenants include Walmart (6.6% of base rent), Tractor Supply (3.9%), and Dollar General (3.9%). As seen below, shares are +.80% YTD:

Less than 4% of ADC’s portfolio is made up of some of the more worrisome industries within their portfolio, such as the experiential gyms or theaters, which vastly underperformed in recent years.

ADC has clearly prioritized the most defensive cash flows, with large exposure to grocery stores, home improvement retailers, convenience stores, auto parts and service centers, and pharmacies…all segments of the retail space that should continue to perform even during an economic downturn.

At the end of 2021, 67% of ADC’s portfolio was made up of investment grade tenants and we’d be remiss not to mention that ADC offers investors unique exposure to ground leases (this is something that sets this company apart from its peers in the net lease space).

In December ADC amended its revolving credit facility by increasing the capacity from $500 million to $1 billion (includes an accordion option up to a total of $1.75 billion). As of Q4-21 ADC had over $1.4 billion in liquidity including cash on hand, a largely undrawn revolver and almost $520 million of net proceeds available (forward equity).

A few weeks ago Moody’s upgraded ADC to Baa1 from Baa2 with a stable outlook. The upgrade reflected ADC’s solid credit profile, supported by its low leveraged balance sheet and flexible capital structure with a resilient portfolio.

On April 1st, Morgan Stanley initiating coverage with an overweight rating and $75 price target. The analyst highlighter high quality tenants, with a focus on internet-resistant businesses, and a vertically integrated platform, as differentiating the company versus peers.

ADC’s CEO, Joey Agree, recently acquired an additional 1,560 shares in multiple transactions at prices ranging from $64.13 to $64.36. According to Yahoo Finance Joey now owns 482,898 shares valued at $32.9 million.

Today shares are trading at $68.28 with a P/AFFO of 18.9x (5-year average is 21.3x) and a dividend yield of 4.0%. Analysts forecast AFFO to grow by 7% in 2022 and iREIT forecasts shares to return around 15% over the next 12 months.

Medical Properties Trust (MPW)

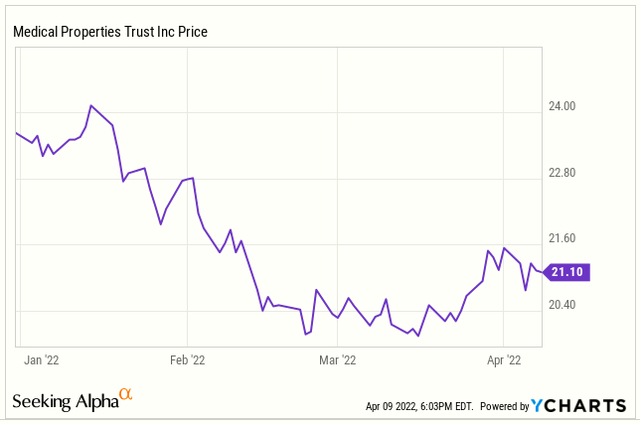

MPW is a healthcare REIT that focuses on essential mission-critical hospitals, that includes 438 properties (46,000 beds) in 9 Countries. As seen below, shares have fallen by ~11% YTD:

To be clear, I have not always been a fan of MPW, especially during the period in which the company did not grow its dividend (2010-2013), however, over the past seven years the pure-play hospital landlord has done a great job of scaling its business model and generating solid earnings growth (CAGR 3.5% since 2015).

MPW has over 50 operators in the portfolio, and although the company has outsized exposure to Steward (~19%) no Steward regional market represents more than 6% of the total portfolio and no single Steward property represents more than 2% of pro forma assets.

MPW’s credit rating is a notch below investment grade (or BB+) and has 6.4x debt to EBITDA (goal is 5x to 6x). Around 96% of MPW’s $11.28 billion debt is fixed, with interest rates between 2.5% and 5.25%.

MPW also utilizes JV’s to diversify its portfolio and take advantage of attractive and flexible capital. Pro forma for MPW’s expected JV proceeds is $1.3 billion that will repay the outstanding interim credit facilities with liquidity exceeding $1 billion in cash and revolver resources.

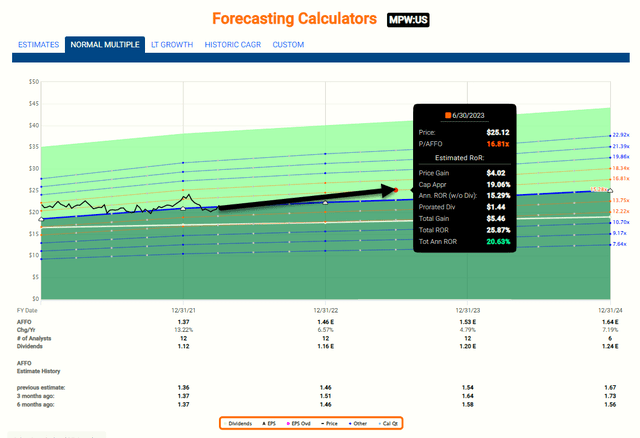

For Q4-21 MPW reported normalized FFO per diluted share and AFFO of $0.36, that continues the extraordinary double-digit year-over-year quarterly growth. On a full year basis, MPW’s normalized FFO was $1.75 and AFFO was $1.37, also representing the continuation of double-digit growth, a record virtually unmatched.

Over the past 10 full years, MPW has delivered normalized FFO and AFFO per share at compound annual growth rates in the mid-9s and mid-6s, respectively. The company recently boosted the dividend by around 4% (from $.28 per quarter to $.29 per quarter).

MPW shares are now trading at $21.109 with a P/AFFO of14.5x and dividend yield of 5.8%. Analysts are forecasting growth (‘AFFO’) of 7% in 2022 and we target shares to return 20% over 12 months.

In Closing…

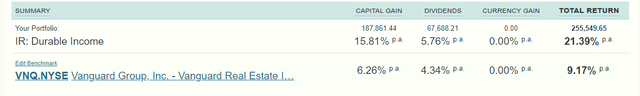

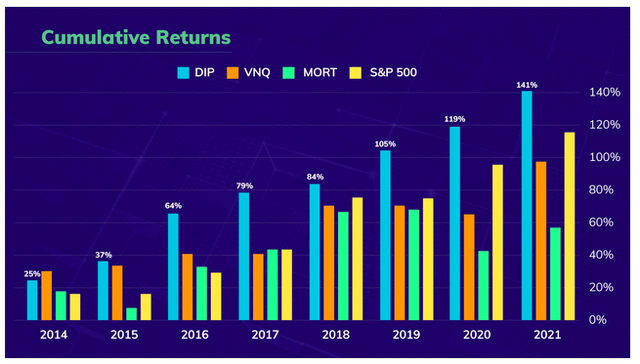

Most of our picks in the Durable Income Portfolio have been buy-and-hold picks. We rarely sell positions, except for trims that result from extreme valuation. This blueprint has worked well for us, as illustrated below:

This portfolio of around 40 REITs has generated annual returns of around 21% and we commenced the strategy in 2013. The average dividend yield in the portfolio is just over 5% so much of the return is comprised of price appreciation.

Given the diversification characteristics we seek to own beaten down REITs that offer the best risk-adjusted returns. We have found that market timing just does not work, so instead of focusing on being a high yield landlord, we adhere to the time-tested principles of value investing.

In fact, whenever we select a constituent for the portfolio, we screen it as with we will own for a decade or longer. The whole value proposition for REIT investing is to benefit from rental income growth, that drives earnings growth, that drives dividend growth.

The facts will never change: Bull markets make buy and hold look good, and bear markets make buy and hold look bad. The key to success is to always keep a keen eye on valuation and never forget about the margin of safety concept. As the legendary investor Benjamin Graham explained,

“The margin of safety is always dependent on the price paid. For any security, it will be large at one price, small at some higher price, nonexistent at some still higher price.”

Be the first to comment