Arpana Singh

(Note: This article was in the newsletter on October 7, 2022.)

Realty Income (NYSE:O) sailed through the coronavirus challenges. But at times there is just no pleasing Mr. Market. That knee-jerk “throw them all out” is in full swing in the REIT sector. That makes it an excellent time to pick up some great dividend income from industry leaders that rarely go on sale.

There has long been an expression that the stock market can be best represented as a store where no one is interested in the merchandise until it is marked up 50% to 200%. Individual investors can take full advantage of that market attitude.

Oftentimes institutional investors are unable to take advantage of the falling stock prices of market leaders like Realty Income because they have benchmarks to meet. Those goals are often too short term for them to buy bargains and then wait for those bargains to appreciate. Underperformance on Wall Street is often swiftly dealt with. Despite that swiftly dealt with, the over-attention paid to performance short term often allows long-term underperformance to persist. Individual investors are often free of professional constraints that make underperformance persist.

So, the current attitude that certain kinds of retail (if not all retail) is putting a group of REIT stocks on the “do not own list ever” for the time being. But the good news for individual investors is that well managed companies with strong balance sheets will come back into favor at some point.

Darn Good Yield

Realty Income has a yield that is heading towards the “danger zone” where the market has serious concerns about the maintainability of that yield. This is true even though this company has been maintaining and raising that dividend for a very long time.

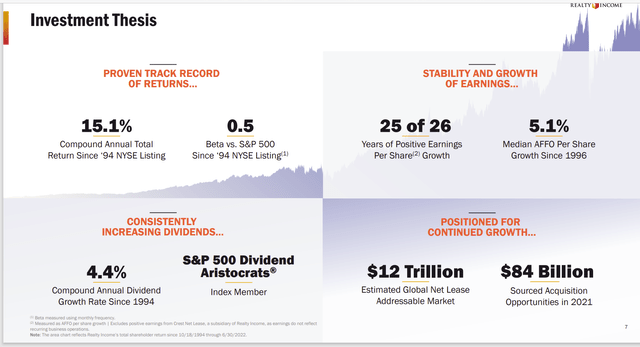

Realty Income Growth Summary (Realty Income Second Quarter 2022, Earnings Conference Call Slides)

The company obviously has a strategy that has proven to be relatively recession resistant in the past. There is absolutely no reason to believe it has changed. Yet you would not know that from the market reaction to the stock price. Right now, the consistency shown above is relatively less valuable compared to the fear that the winning streak will end.

Along with that dividend growth rate will come some stock price appreciation. Sooner or later (usually sooner) quality will matter. This company is poised to benefit from a return to quality that will happen. Besides the recovery potential, the combined (long-term) continuing return approaches 10% on a company with a sky-high debt rating and an earnings consistency that is seldom matched throughout the stock market. The performance here is on par with far safer investments like utilities than it is with other REIT’s.

Avoiding Losses

That steady progress noted above comes from avoiding losses. I believe management identifies the business risks and then minimizes them. This is in addition to the reduced financial risk from the very high financial strength ratings of the company debt. There is an old saying that losses count twice as much as profits. This management acts as though losses count far more, in my opinion.

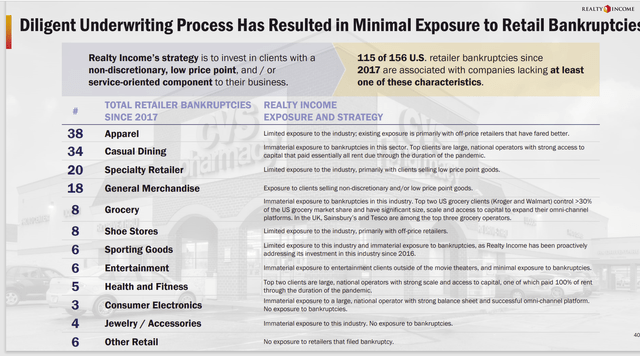

Realty Income Loss Avoidance Strategy (Realty Income Second Quarter 2022, Earnings Conference Call Slides)

This management has a detailed list of what to avoid. That importantly points towards what to make money on. The non-discretionary is the key to avoiding the effects of any cyclical business downturn. Another key item is low pricing points. If the business is a “must have” like food, and then is cheap as well, that retailer will outperform.

But the other thing is that this company is in the leasing business. There is a world of difference between clients that have a down year and clients that go into bankruptcy and liquidate. The company is clearly focused on avoiding the “not being able to pay” type situations.

As a business entity, this company wants customers that survive the bad times. Then a downturn matters little to the company prospects as the record shows. But Mr. Market often confuses a downturn with a fatal event. That clearly seems to be the case here despite a long record that indicates a far better performance from successfully avoiding clients with financial troubles.

Quality Matters

For as long as I have been investing, the market goes through cycles where nothing in an industry qualifies as a holding for the institutional investors. If it is out of favor, then they do not want that company in the portfolio under any circumstances.

Sooner or later, rational behavior returns to the extent that quality comes back into favor. That should be particularly true here given the dividend history and the company performance during fiscal year 2020 and 2021. Those were easily the most difficult years for much of the market in a very long time. If management can perform well during that time period, then management should breeze through any threatened recession that may not actually happen.

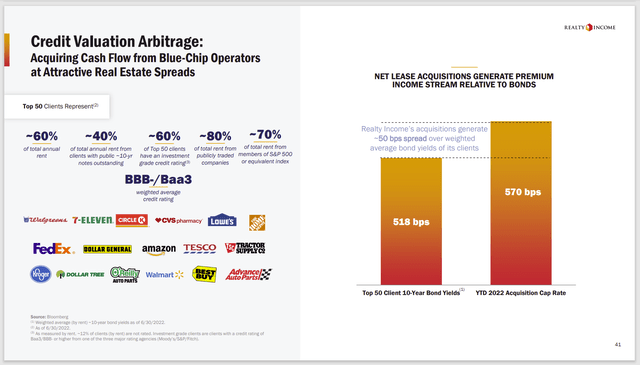

Realty Income Customer Financial Strength Profile (Realty Income Second Quarter 2022, Earnings Conference Call Slides)

The quality advantage is obvious from the average financial strength. These are companies that will be paying the bills through a recession. Any serious downturn that “hits hard” would likely result in a credit rating decline long before there is serious trouble.

The well diversified customer base shown above helps to keep credit surprises to a minimum. When that is combined with things like non-discretionary spending (where possible) and low pricing points, then it is easy to see how this company has raised dividends right through recessions. The fact that occupancy levels remain high during the whole business cycle is a foregone conclusion.

The Future

Right now, the market is “throwing out the baby with the bathwater”. Institutional Groupthink is a phenomenon that has been documented by those willing to combine economics and psychology for as long as I can remember. That combination has also been fought hard by economists ever since I took economics for my masters’ degree too. The best one can do is take advantage of the psychological market event by doing your due diligence and deciding whether or not you want the market panic to subside first or you are willing to average down (or just plain average over time).

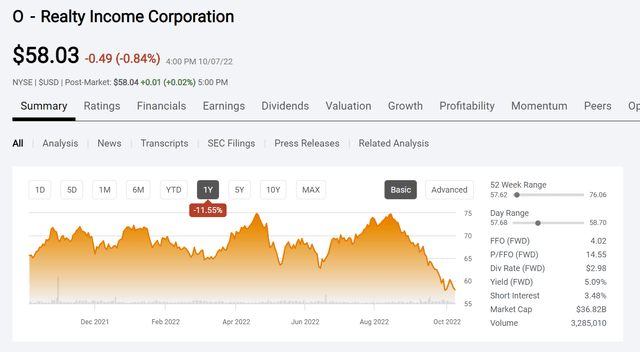

Realty Income Common Stock Price History And Key Valuation Measures (Seeking Alpha Website October 7, 2022)

That five percent dividend shown above is more than half of the average annual return that most investors report long term. The chart above indicates considerable recovery potential back to the old high prices previously reached.

Value

This is where the value argument comes in. As shown above, the P/FFO is 14.55. It has rarely been that low throughout the company’s history. This company has a consistency in financial results and dividend increases that has traditionally resulted in a considerable premium to the industry. That premium should again resume with the P/FFO ratio in the 17-20 range. That implies a minimal stock price recovery potential of at least 25% in addition to earnings growth and dividend increases. That recovery will likely be far more than that.

Similarly, the dividend yield is usually in the 3% range. It has now increased to 5% on all kinds of market worries. Through appreciation of the stock price, the dividend yield is likely return to a normal range.

I am always asked during times like these “why should the stock recover?”. The reason is that this management continually finds ways to grow the business. That business is continuing to grow despite the contractions of key measures like the P/FFO measure to historically bargain levels. This is a business that does well in good times and bad. That means that the stock is likely to go to the $76 shown above and probably higher until the business stops growing. A return to normal valuations is very likely to occur once a cyclical recovery gets underway. This company is in a position to be valued at a premium in the next business cycle.

Risks

A company like this has taken a lot of risks out of the business. Very few companies in any industry consistently post results similar to what is seen here.

Nonetheless, should that consistency fail in a material fashion, I would likely re-analyze my conclusion. It would most likely be caused by a failure to minimize all the risks shown in a previous slide earlier.

Similarly, a significant reduction in financial strength ratings or a significant change in dividend coverage would be another time I would possibly change my conviction.

Finally

Very few companies have the financial strength rating of this company in really any industry. Finances are extremely safe for those risk averse investors. The steadily rising dividend likewise takes a lot of downside risk out of the investment.

One of the things about a quality company like this is that when institutions panic to get out, about the only thing that happens is they come back in at a higher price to push the stock price higher. This has been documented by David Dreman in several of his books from studies that occurred over several decades.

Interestingly, when they do get back in, they often get back in at a higher price and push the stock price still higher.

As a contrarian, you want to be in before those institutions invariably return, and you probably want to get out if too many of them get in because you now see what happens to the stock price when they all want out.

Ironically, long-term investment risk is probably lower than usual for this safe stock at a time when Mr. Market is in full panic mode. Further long-term decline from the current price is far less likely (and less significant) than is a coming cyclical recovery. Instead, unusually large recovery results are available in addition to a generous dividend. That kind of combination rarely occurs. It is rare that additional risk at least temporarily will not offer sufficient greater risk adjusted returns (on average). Right now, that is the case. Then again, that is often the case during market downturns.

Editor’s Note: This article was submitted as part of Seeking Alpha’s best contrarian investment competition which runs through October 10. With cash prizes and a chance to chat with the CEO, this competition – open to all contributors – is not one you want to miss. Click here to find out more and submit your article today!

Be the first to comment