Michael Edwards/iStock via Getty Images

By Rob Isbitts.

Summary

The Fed’s November 2nd policy meeting was not a surprise in any tangible respect. They raised rates by 0.75% for the fourth time this year, moving interest levels off of the 13-year “sugar high” that has convinced a generation of investors that double-digit stock returns are a birthright, and that leverage was the investor’s version of a favorite toy. The further we get into 2022, the more this reality should be setting in for investors.

The good news is that investing hard-earned capital is not impossible in this environment. It just requires some evolution of one’s investing mindset. And, while this article can’t cover all of the different ways that can be pursued, the key point is to acknowledge the reality, and start the pursuit.

This is a better way to approach a continued bear market for stocks and bonds than some combination of hope and misunderstood financial market history, which is what I fear many investors are doing this year. The latest actions and words from the Fed simply means that their priorities are as clear as ever. Equity investors are not the favored child anymore. And they probably won’t be for a while.

Background

The U.S. Federal Reserve Board kept rates too low for too long. There was ample opportunity to lift rates and keep them in, say, the 2% area as far back as the middle of last decade. But each time, the Fed did the right thing for stock market investors. That juiced stock prices, valuations, home prices, bond prices, and most significantly at this point, investor confidence. Chairman Jerome Powell is finding that it is hard to reverse that process.

Key Points

And that is why the Fed continues to provide as clear a signal as they can, even if the stock market has a love-hate relationship with listening. You see, the Fed’s top priority continues to be to avoid having sustained high levels of inflation ruin the financial lives of the vast majority of U.S. households. Even though it will likely cause a period of elevated job losses and other forms of “pain” as Powell himself has said, it is better than the alternative. Sustained high inflation is THE enemy of consumers. It kills their real income, and in turn, their long-term confidence. The Fed doesn’t want that, and neither should any citizen stock market investor.

The Fed is concerned about things like this.

THIS is who the Fed is trying to help most (CNBC.com)

As they say, the stock market has spent much of 2022 taking its medicine. The message to equity investors from the Fed has been unwavering all year: “You’re not so special. We have to prioritize consumers and workers, not stock market investors.”

This is why the sharp rallies we have had all year continue to “bear market bounces” until they are not. And, so far, the course has not changed. By my count, there have been 11 different cases of “could be the S&P 500 stock market bottom” moments in 2022. So far, none have lasted. In addition, the bond market has been screwed up in a big way. Sure, prices have fallen to a degree most investors are shocked to see. But more than that, liquidity is drying up, even in the U.S. Treasury market. Of all the risks to equity markets the rest of this year and in 2023, that might be the biggest.

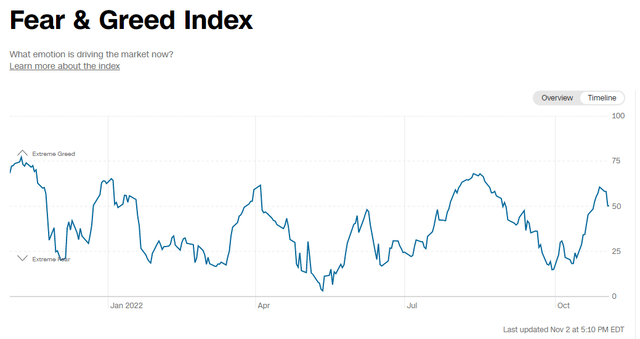

CNN Fear and Greed Index: rolling over again? (cnn.com)

On The Other Hand

Based on my own informal observations of consumer and investor sentiment this year, there is still a very strong contingent of investors that assume that the Fed will “pivot” – that is, comfort the market with the belief that they will return to doing things that favor the equity market’s return to the glory days of 2010-2021.

While there’s always a chance that the Fed will blink, and start guiding investors toward a stoppage of rate hikes, and an eventual reversal of 2022’s activity, I don’t think that’s very likely. Because while the stock market continues to waffle between fear and greed as shown here, this is not 2016, 2018 or 2020 (though it is an even year). This is when the punch bowl at the party finally disappears. Or, to be chronologically accurate, it vanished months ago.

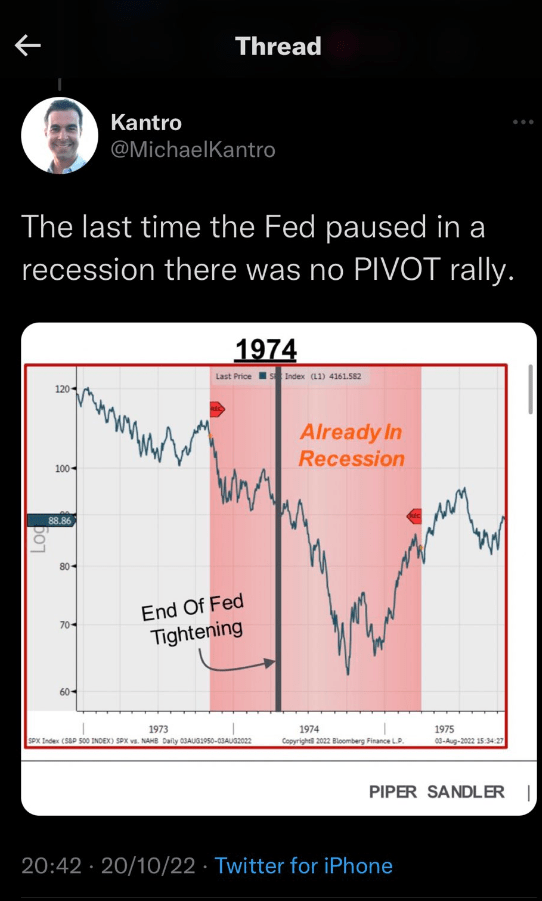

This recent post by Piper Sandler’s Michael Kantrowitz shows that in the infrequent history of periods like 2022 (i.e. when stocks and bonds were falling together and inflation was spiking), that pivot might create some immediate market happiness. But those Fed actions will ultimately be seen for what they are: a bigger risk that whatever they have already done may not work out well.

Pivot = end of bear market? Don’t count on it. (Piper Sandler – posted on Twitter by Michael Kantrowitz, CFA, Chief Investment Strategist, Head of Portfolio Strategies)

You see, it takes several quarters for a slew of rate hikes to work through the system. Back in 1974, perhaps investors had a bit more patience than they ever would in today’s Fed-obsessed, fast-money climate. After all, back then most people were not active investors.

Conclusion

And really, that’s my point. Today, while investing and trading stocks have gone mainstream, the vast majority of consumers and families do not live off of their investment portfolio. So the Fed has made their choice. They are going to prioritize helping consumers, workers, families. Since investors have the freedom to choose how they deploy their accumulated wealth, the Fed is essentially saying “we did it your way for over a decade, and gave you everything you ever asked for. Now, we have a different priority.”

Investors should stop rooting for the stock market to go up. Instead, they should embrace a more contemporary approach to managing money. The stock-bond paradigm is broken, but that doesn’t mean giving up. Instead, the current climate favors those who learn how to be more “tactical,” essentially renting more of their investments than owning them. In other words, recognize that in bear markets for stocks and bonds at the same time, you are more likely to make, say 10% in a few months than 100% over four years. We’ll return to a more bullish period eventually.

In the meantime, return of capital is the priority. You take return “on” your capital in smaller bites, over smaller time periods. My team and I have and will cover a wide variety of investment styles and exposures, so this strategy article will not “name names.” But that information is now pretty easy to find on Seeking Alpha.

Embrace the new reality of investing in 2022, and likely in 2023 as well. Secular changes in interest rates, and the inflation threat that accompanies it, don’t come around very often. But when they do, the worst thing to do is what I fear many investors are still doing: counting on the Fed to bail them out. Because even if that ultimately does come to pass, the latest message from that 109-year old institution is as loud and clear as ever: stock market investors, you are now on your own.

Be the first to comment