FinkAvenue/iStock Editorial via Getty Images

Spotify Technology S.A. (NYSE:SPOT) is one of the biggest brands in the world, ranking number 66 on Interbrand’s Best Global Brands. It’s also growing rapidly; doubling revenue since 2018 while remaining free cash flow (“FCF”) positive. Despite that, the stock is down 36% since going public more than four years ago.

Here are three reasons why SPOT is poised to do well in the long-term.

Spotify is cheap today

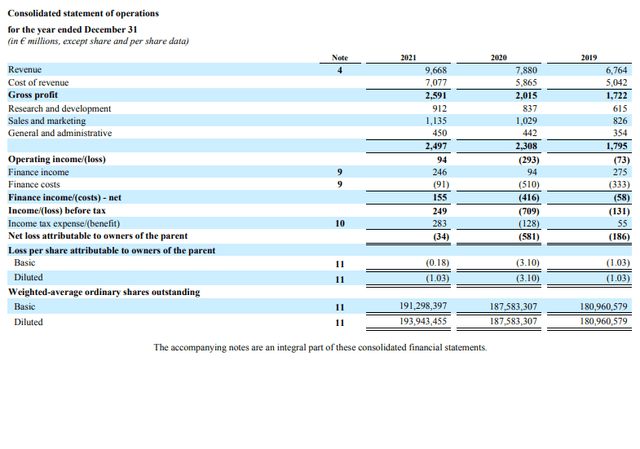

Investors should take a closer look at Spotify’s financials (Spotify)

The 2021 annual report shows that the company reported a loss of $34 million based on GAAP accounting. My view is that the number doesn’t reflect the economic performance of the company. I am strongly in the camp of capitalizing both marketing and R&D. They are currently expensed as incurred based on the view that R&D and marketing can’t guarantee future economic benefit and so can’t be considered investments. But no investment can guarantee that in my opinion. Here is Spotify’s CFO Paul Vogel on the company’s decision to grow the advertising business backing that view

When we decided to grow our advertising business outside the US, we had a clearly defined model for the revenue uplift and the costs associated to achieve our goals. And in the short-term, this cost hits our operating expenses before we see the revenue uplift. However, we see this investment, mostly in headcount, as driving LTV (lifetime value) improvements. And on a more traditional financial return basis, we expect to generate a strong double digit ROI from this investment over the next 3 years

I personally prefer to look at this spending as a reinvestment of profits, and then evaluate management’s success in re-investing those sums. Spotify is cheap if you evaluate it based on this approach.

Removing marketing and R&D expenses can give us a hint of what the company’s profits look like. Adding them back to pre-tax income of $249 million would yield $2.3 billion pre-tax, slap a 25% tax rate (taxes are a very complicated topic, but this rate is more of a by-the-book rate), and you get $1.7 billion in net income or 11x earnings.

So Spotify can decide against increasing headcount and make $1.7 billion today, but management chose to make those investments to increase that $1.7 billion in the future by solidifying their competitive position and value proposition to customers.

The other important development is that capitalizing R&D has now become a law. Under the law, companies can capitalize R&D over 5 or 15 years.

Let’s assume Spotify can capitalize all R&D over 5 years since that is more tax-efficient. Their expenses would decline by $730 million, bringing net profit to $696 million. The company would be selling for 27x earnings. Note that taxes in 2021 saw an additional expense of $241 million in recognition of deferred tax, so normalized earnings are more like $937 million (21x earnings). In both cases its a reasonable price compared to the 30-year U.S. Gov. bond trading at 32x.

Lack of differentiation is a plus

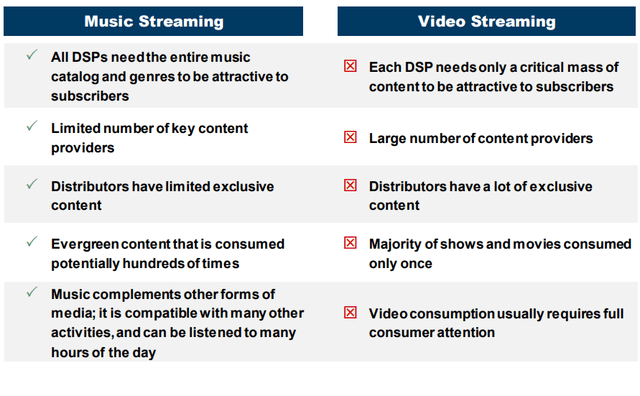

Music streaming gives Spotify big advantages Vs. video (Pershing Square Tontine)

This slide is from Pershing Square during an event they held to announce their acquisition of a stake in Universal Music Group. The comparison reveals an important advantage for Spotify; unlike streaming video, music streamers need to have all the content catalogue. That means that audio streamers don’t have to spend billions of dollars to differentiate their content catalogue. This has been an area of focus for investors in video streamers like Netflix and The Walt Disney Company (DIS). It also means that Apple Inc. (AAPL) and Amazon.com Inc. (AMZN) can’t use their billions to come for Spotify like they are doing with Roku Inc. (ROKU). Everything the customer wants is controlled by the music publishers, and they have an interest in the ubiquity of content.

The only way to beat Spotify is to offer a better user experience. Big tech can’t outspend them because the content is available to everyone, they can’t buy music publishers because it will be blocked by regulators, and they can’t offer a cheaper product because Spotify is already free.

Spotify is the YouTube of Audio

The only real issue for Spotify is they are powerless against the three major music labels, and that’s where the two-sided marketplace comes in. While the power of the music labels/publishers stave-off the threat of big tech for Spotify, it represents a drag on the company’s gross margins. Mark Mahaney noted that the company’s low gross margin is

“the single biggest factor behind Spotify’s share price underperformance, we believe.”

Instead of taking on the music industry, Spotify is trying to turn this challenge into an advantage. The company realized that having all those artists on its platform presents it with an opportunity to build a SaaS-like business for its creators. So the company will absorb the margin dilution from the publishers, and make-up for it by charging the content-creators for tools that helps promote their work. Here is the company’s Global Head of Music Product Charlie Hellman:

These marketplace businesses have been the primary factor in growing our music gross margins. And given the strong growth rates, this revenue will continue to be the primary driving force to help us further improve those margins.

Spotify also encourages all artists to upload their music or podcast to the platform. There are a few steps that makes it hard for the absolute novices to get on the platform, but in essence the company is turning its app into a more mature, premium YouTube for Audio.

It seems to be working too. Here is CFO Paul Vogel sharing some of the results:

In 2018, our Marketplace contribution to gross profit was only €20 million. In 2021, it grew to more than €160 million, 8 times the size in just 4 years. We expect that number to increase another 30% or more in 2022.

So the focus on Spotify’s MAUs is important, but just as important is the 50,000 creators who generated more than $10,000 on the platform in 2021. The future of Spotify will rely on how much it grows that side of their marketplace just as much as it grows users and their engagement.

Risks

This article established that differentiation based on the content catalogue is not possible and that lowering price as a means of competition is also ineffective given Spotify is free. What has been difficult for me to determine is the existence of barriers to entry; why can’t another company in the future create an audio user experience better than Spotify’s? Why can’t the business commoditized since there is no differentiation?

One potential answer might be the marketplace business, given it creates a two-sided network for the company. The longer the runway Spotify has with that business, the more difficult it will be for future companies to compete with it given it will require economies of scale. Investors should keep an eye on potential entrants not into the music-streaming side, but into the SaaS-like business Spotify is building for content creators.

Conclusion

Spotify is at the very least reasonably-priced based on 2021 earnings. The business has two characteristics that make it difficult to undermine by its competitors, but the barriers to entry are unclear at this point. Investors should keep an eye on the marketplace business, as it is potentially a game-changer for Spotify.

Be the first to comment