SaskiaAcht/iStock via Getty Images

Income investors currently face some key risks stemming from the geopolitically and economically tumultuous environment. Three challenges in particular come to mind:

1. Soaring inflation and supply chain headwinds that are hurting many high-yielding dividend stocks

2. An inverting yield curve that signals we may be in store for a recession. If we were to go into a recession, many high yielding stocks – already facing razor-thin dividend coverage and/or dealing with overleveraged balance sheets – might have to deeply cut their dividends, likely sending share prices plunging and income investors left holding the bag without principal or income.

3. Due to burdensome dividend payouts in an age of exploding innovation, many high yielding stocks are unable to sufficiently reinvest in their businesses, essentially starving themselves for capital. This makes them highly vulnerable to an eroding competitive position at the hands of innovative and aggressively investing competitors.

In this article we dig into these three important warnings to help income investors navigate the current environment and then also offer a few top picks in light of these warnings.

#1. Soaring Inflation & Supply Chain Issues

It is no secret by now that inflation is raging and supply chain backlogs are eating into corporate profits and sending end-user prices soaring. These issues have been exacerbated further by the war in Ukraine and the accompanying sanctions placed on Russia by most of the developed economies of the world.

In earnings call after earnings call for consumer and industrial goods producers the story is the same: profit margins are being hit and management teams are trying to pass on costs to consumers with increased pricing. However, there is always a lag and it is impossible to project how high inflation will soar moving forward, so even these pricing increases are guesses at best. It is safe to assume that as long as these headwinds persist, industrial and consumer goods companies like 3M (MMM), Leggett & Platt (LEG), and Caterpillar (CAT) will continue to take a hit. On the other hand, each of these businesses enjoys strong brand power, so they should be able to pass on price increases pretty well, minimizing some of the headwinds.

Still, not every company in these sectors is so well positioned, so investors should take extra care to ensure that – if they do decide to invest in these sectors – the company has strong enough brand power to be able to pass on price increases. Otherwise, they are likely to see profitability completely and potentially irreparably evaporate.

#2. Rising Recession Risk

Another big risk is the potential for a recession to set in. While stagflation (low growth and high inflation) is the scenario that six in 10 fund managers expect to play out, the yield curve just inverted.

Historically, this has proven to be a signal of an impending recession (typically within six months to two years). While it is no guarantee that a recession is in fact coming, it does mean that the conditions are such that we could see one. On top of that, many assets remain at bubble-like valuations, including the housing market as per recent Dallas Federal Reserve comments. If mortgage rates continue to rise in response to runaway inflation and overwhelming demand for housing, it could lead to a housing bubble pop.

Furthermore, major stock indexes like the S&P 500 and Nasdaq remain near historical highs both in terms of absolute levels and valuations. This is largely the result of the massively popular passive index investing trend that has taken hold over the past decade, where retail investors poured savings into large low-cost S&P 500 (SPY)(VOO) and Nasdaq (QQQ) ETFs. On top of that, cryptocurrencies like Bitcoin (BTC-USD) and Ethereum (ETH-USD) and even high-growth unprofitable companies found in ETFs like Ark Invest’s flagship Innovation ETF (ARKK) remain at rich valuations despite recently experiencing a sharp pullback.

If we see a major crash across various asset classes in combination with high consumer price inflation and rising interest rates, we could certainly find ourselves in another recession or even depression. This poses a particular risk for the high yield investor, because he has typically structured his portfolio to be dependent on income so that in the event of market turbulence he can ride out the storm while living off of income. This enables him to sleep (and eat) well instead of fretting about the lack of market appreciation to fund his retirement.

While market turbulence is not a problem for him, a major and protracted economic contraction would be, as many high yield stocks are also dealing with razor thin dividend coverage and/or a heavily leveraged balance sheet. This means that in the event of a major economic stressor, these companies would very likely have to right-size (i.e., deeply cut) their dividends, sending their share price tumbling and leaving income investors without income nor principal in the midst of a fierce recession or even depression.

As a result, it is essential that in the current environment high yield investors focus on businesses with sound balance sheets, strong dividend coverage, and/or a somewhat recession-resistant business model. Some of our favorites that check all these boxes can be found in the midstream sector, including Kinder Morgan (KMI), Enbridge (ENB), and Energy Transfer (ET).

#3. Disruption Risk

The third big warning that high yield investors must heed in the current environment is the threat of disruption. While it is great that high yield companies are typically generating significant profits to support their fat dividends and most likely have pretty stable – even “boring” – business models, it is easy for investors (and management teams) to get complacently “fat and happy” on current profits and dividends, assuming that they will continue forever.

Meanwhile, thanks to an explosion of disruptive technologies across the economic spectrum and a surge in entrepreneurial spirit facilitated by increasing interconnectedness and the rapid dissemination of knowledge across the globe via the internet, fewer and fewer industries are considered disruption proof. As a result, if a company is not constantly innovating or at least aggressively implementing cutting edge technologies into their business, it is at risk of falling behind. However, the challenge with high yielding stocks is that so much of their capital is being committed to paying dividends that they have less resources on hand to reinvest in innovating/upgrading the business’ technology and capabilities.

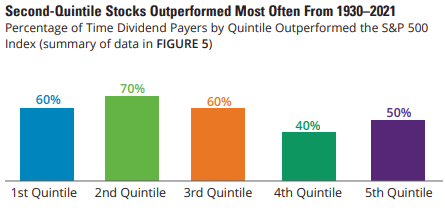

While high payout ratios are often a blessing to shareholders (as they force management teams to be highly disciplined in how they allocate capital), they can also be a curse if they get too high to the point of starving the business of much needed capital. This is also evident in the following chart which shows that high yield stocks have a track record of outperformance, but the highest yielding stocks typically underperform the high but not highest yielding stocks:

High Yield Stocks Outperform (Hartford Funds)

As a result, the high yield investor should carefully examine his investments to ensure that a large percentage of the companies in their portfolio is positioning itself and its dividend – through the nature/state of its industry, management strategy, and capital allocation practices – to survive and thrive through the age of rapidly accelerating innovation and disruption.

Some high yield stocks that we think are particularly well positioned to weather disruptive forces include Hanesbrands (HBI) (which is doubling down on its Full Potential Plan that includes aggressive investments in e-commerce capabilities), Lumen Technologies (LUMN) (which is investing aggressively in assets which are poised to benefit from the 4th Industrial Revolution), and Enterprise Products Partners (EPD) (which is investing in renewable fuels and other green energy technologies alongside its core hydrocarbons infrastructure business).

Investor Takeaway

Between soaring inflation, supply chain headwinds, geopolitical uncertainty, an inverted yield curve and rising threats of recession and economic crashes, and accelerating innovation and disruption, high yield investing is arguably more difficult than ever.

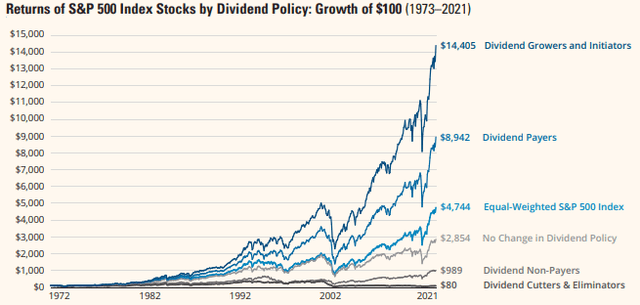

Nevertheless, for prudent investors, the rewards remain just as great as they have historically been:

Dividend Stocks Outperform (Hartford Funds)

At High Yield Investor, we have been able to more than double the performance of the S&P 500 since inception by investing in dividend stocks on a value basis. Moving forward, we expect to continue doing so by investing in some of the picks mentioned in this article that are well positioned to weather these present challenges.

Be the first to comment