VladK213

Sibanye Stillwater Limited (NYSE:SBSW) ADRs have been hit by a string of major one-off events, both bad luck and temporary in nature. The end result is earnings will sharply disappoint in calendar 2022, without negatively affecting long-term operations and upside for shareholders. Of course, investors are disappointed and have dumped shares this week. However, smart long-term thinkers may want to take a closer look, and buy the 50% Off Sale in shares compared to March.

On Wednesday, the company put an estimate on the income shortfall, with the stock quote dumping -8% on the trading session. Income is now expected to be at a level half of last year’s first six months from three factors. The biggest downer was a prolonged and painful strike at its South African gold mines between March 9 and June 13, slashing production by -77%. Second, flooding at its U.S. platinum group metal [PGM] operation in Montana curtailed production for seven weeks (-23% for first half ore processing vs. 2021). Severe flooding from rains and early mountain snow melt were to blame. Third, platinum group metals are down significantly from their high prices last year as the global economy weakens.

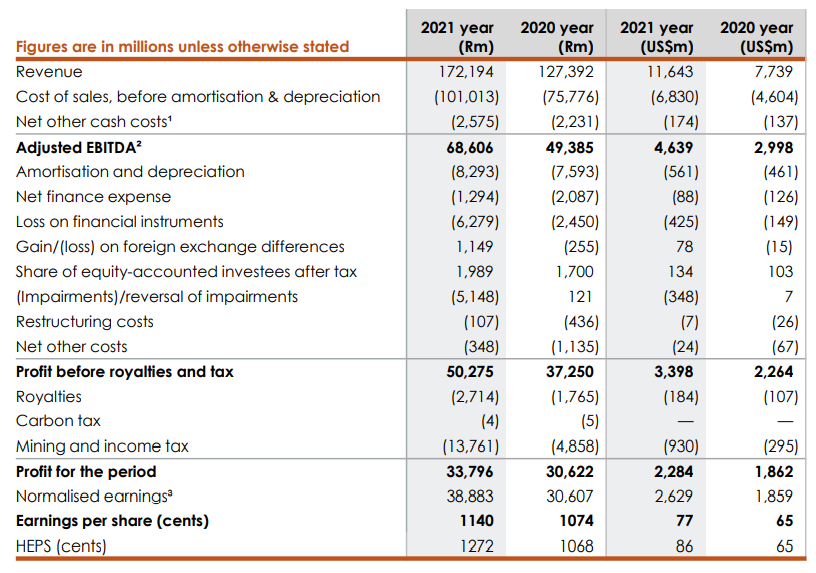

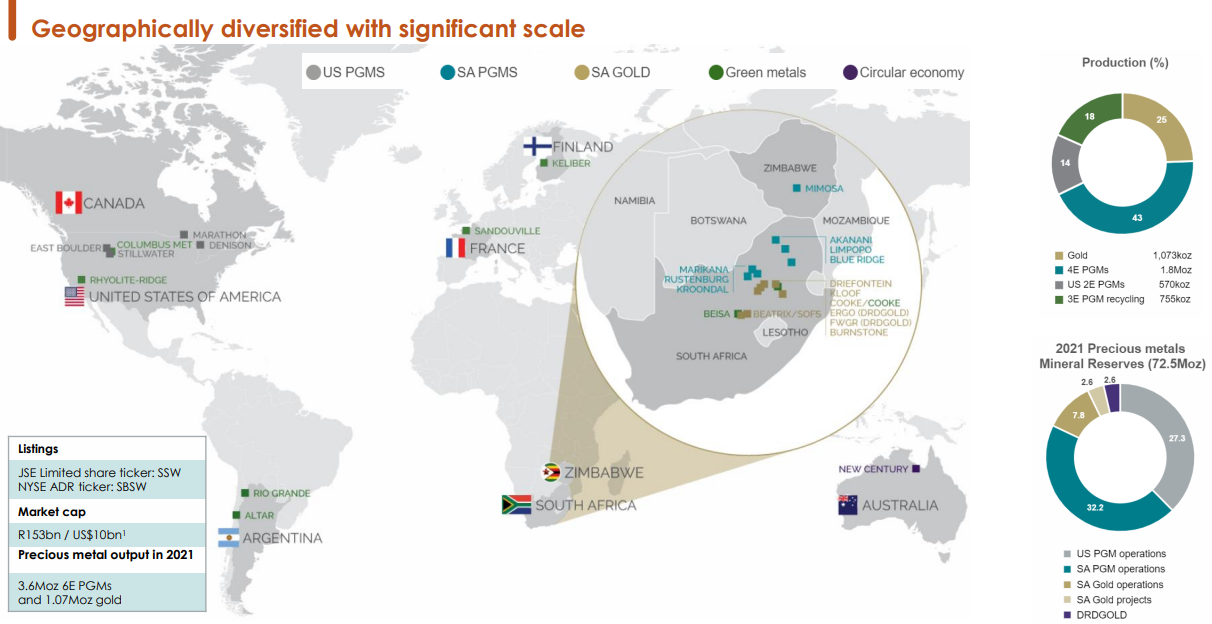

The bottom line is earnings per share for the six months to June 30th are projected at 4.02-4.47 rand (US$0.26-$0.29), compared to 8.43 rand in the prior-year period. On a trailing 12-month basis, including the first-half estimate, I come up with a current P/E of 5x [ADR EPS around $1.90 with a conversion rate of 4 regular shares listed in South Africa, or pink sheet ticker (OTCPK:SBYSF)] and a price to cash flow multiple closer to 3.5x, well under the valuation of major mining peers in the precious metals sector. The discount is the result of investor skittishness about the operating backdrop in South Africa (ranking as a less desirable mining jurisdiction with ever-changing tax rates, ownership rules, and labor issues), alongside an expectation that PGM prices have peaked. Nevertheless, I believe SBSW is worthy of consideration by investors with its holdings of decades of economic ore reserves, and a capital spending push into green energy metals like lithium outside of South Africa. Below is a financial statement review of sales and income for the 2021 fiscal year.

Company Presentation, May 2022

The balance sheet included US$4 billion in cash, receivables, and inventory vs. just $1.3 billion in debt and $4.5 billion in total liabilities at the end of December 2021 (the last official report available from the company). Overall, this setup is quite conservative for a capital-intensive mining concern, and will allow any jump in underlying commodity prices to flow directly to shareholder value.

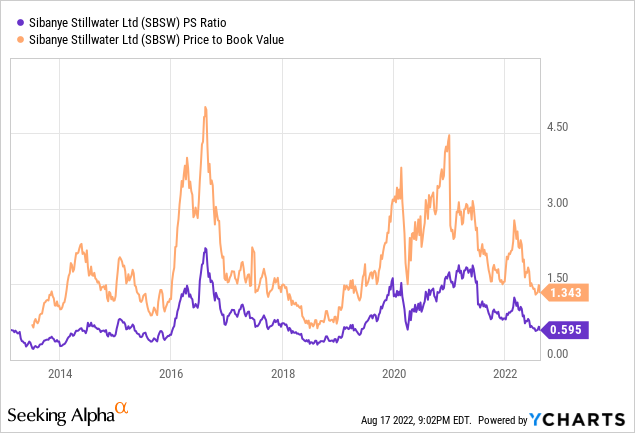

Using basic ratio analysis of normalized price to sales (excluding the strike and flooding issues), and trailing book value numbers, SBSW is trading under its average 9-year valuation at $10 per share, effectively sitting at its cheapest long-term setup since the middle of 2019.

YCharts, SBSW, Price to Trailing Sales and Book Value, 2013-Present

Gold, Platinum, Palladium, Rhodium

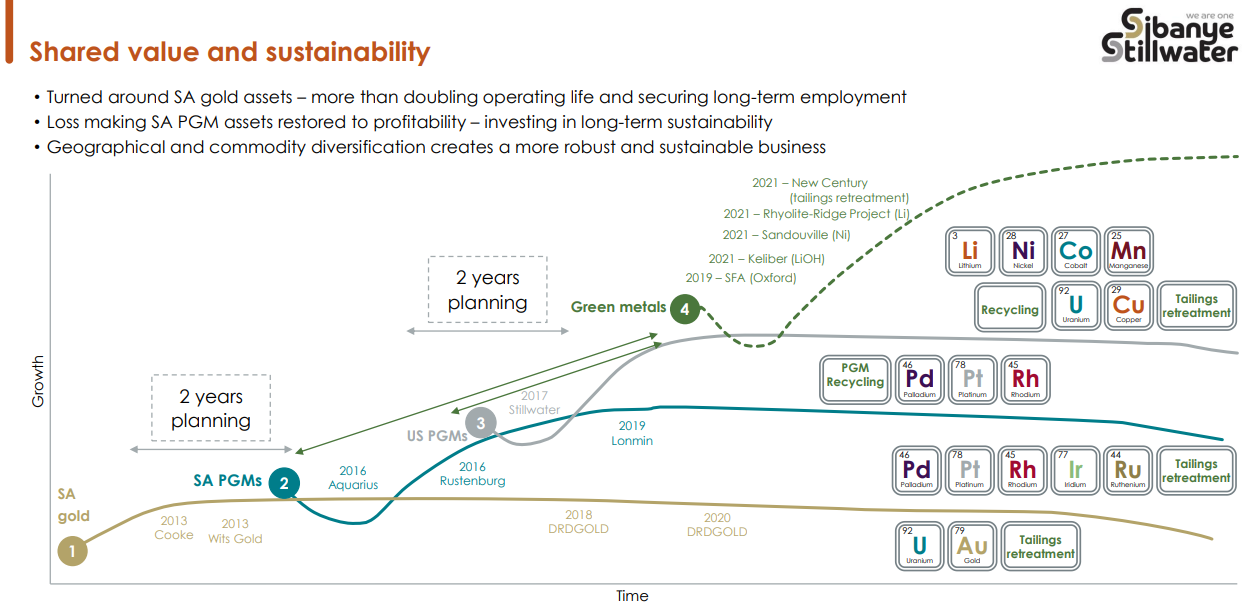

Sibanye Stillwater is one of the largest gold miners in the world, with difficult-to-find U.S. ownership availability for platinum group metal production outside of Russia. The good news for long-term investors is management has a terrific history of turning around problem-filled operations and reinvesting cash flows into accretive ideas. Below is a May company presentation slide highlighted past success at converting lemons into lemonade. My point is 2022’s operating mishaps and natural disaster bad luck are temporary headaches that can be conquered into 2023.

Company Presentation, May 2022

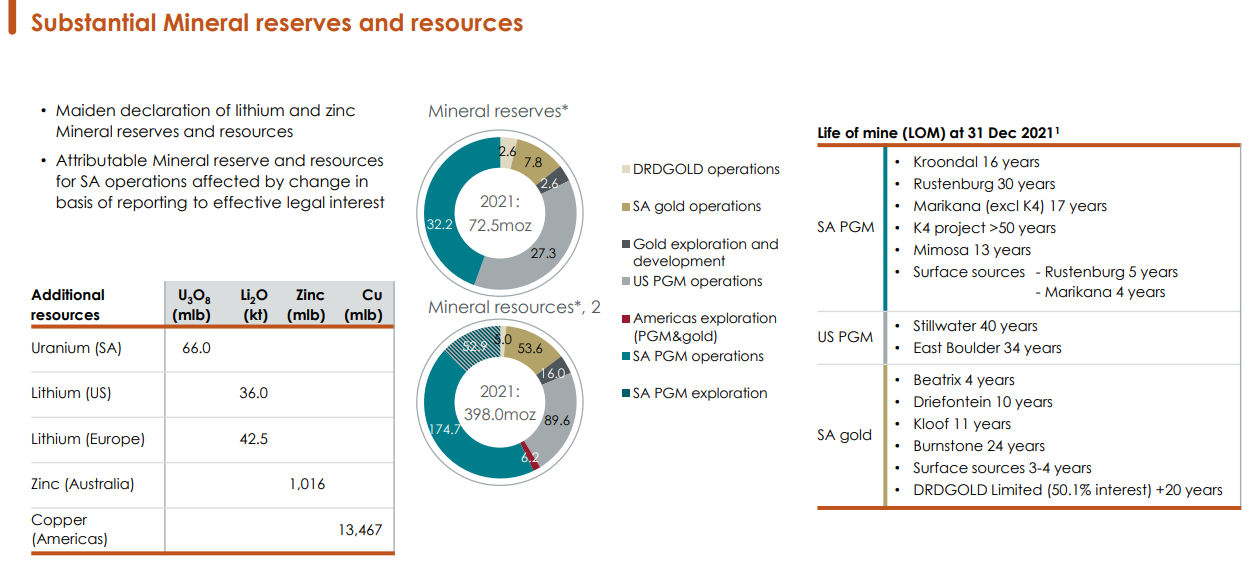

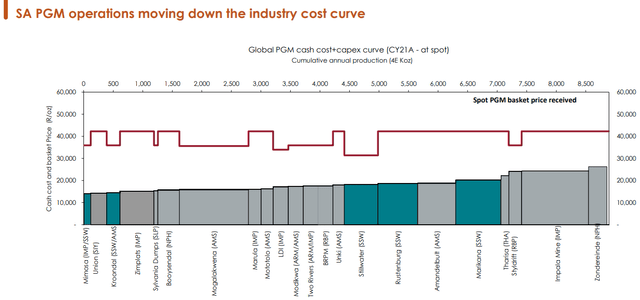

Below is a summary of reserves, a PGM industry production cost graph, and a worldwide map of owned resources and mines. The combination and diversification of metals mining exposure, with top-notch assets/resources on five continents, is truly unparalleled in the industry.

Company Presentation, May 2022 Company Presentation, May 2022 Company Presentation, May 2022

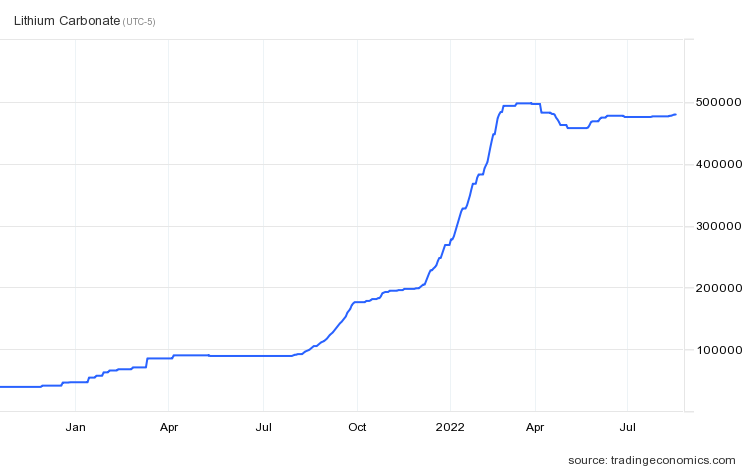

Expanding into Lithium

With extraordinary shortages of lithium (the lightest metal by weight with strong conductivity traits) expected for years to meet soaring electric vehicle [EV] battery demand, commodity prices are up +400% over the past 12 months and +900% over two years. Tesla‘s (TSLA) Elon Musk recently termed lithium miners as having a license to print money and profits.

tradingeconomics.com, Lithium Carbonate – China, 2 Years

During 2021, Sibanye Stillwater purchased 50% of the Rhyolite Ridge project in Nevada. This lithium-boron development could end up being the largest light-metal mining asset in the U.S., with some forecasting it may turn into a top global producer annually. Rhyolite Ridge is a joint venture with ioneer Ltd. (IONR), in a desirable location close to Tesla’s Gigafactory and near shipping ports in California. A 5-year deal to supply Ford (F) with lithium carbonate represents about 35% of expected production each year starting in 2025. Another contract was signed in June with South Korean battery maker Ecopro.

Sibanye has also increased its stake to 50.1% in Finland’s Keliber lithium project, and is trying to purchase more of the asset from minority holders to get closer to 80% ownership (20% is controlled by government agencies). The mine has an ambitious goal to be the first green-energy critical producer of the metal in Europe with output of 15,000 metric tons of lithium hydroxide per year by 2024.

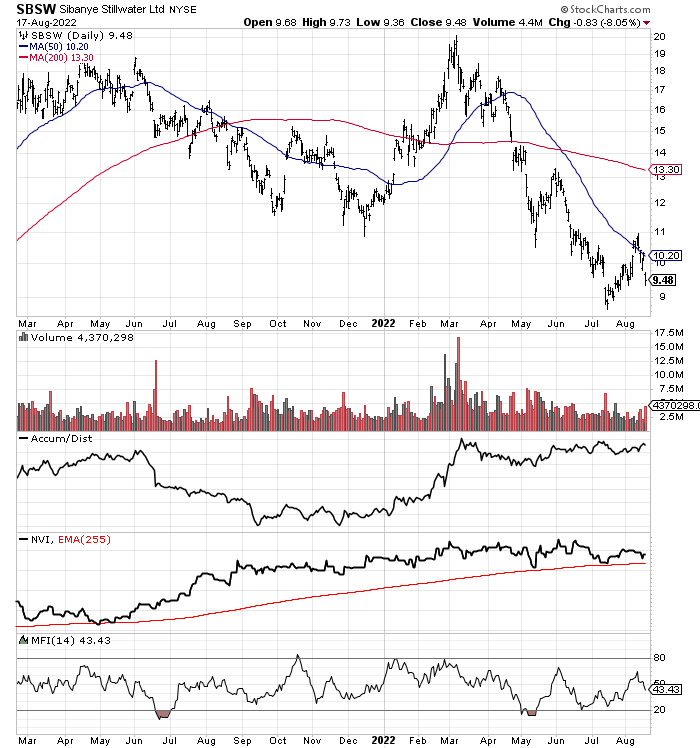

Technical Trading Chart

Looking at momentum trends, a reversal from selling to buying has yet to occur. But a number of similarities to late-November and December trading do exist, which marked a nice bottoming area for new accumulation. A price swing from $11 to $20 a share over four months into March was next.

On the 18-month chart below, some positives are clearly present. A flat Accumulation/Distribution Line and Negative Volume Index reading during 2022 indicate aggressive selling volumes have not been part of the selloff story in price. And, the 14-day Money Flow Index does not highlight extreme levels of selling and pessimism this week. Another bullish take on the latest price drop is it has not reached the 52-week low price of July under $9. In essence, the bad news report from the company has already been digested or discounted in price by investors. So, if price can turn higher and move above its 50-day moving average around $10.20 in coming weeks, a reversal in sentiment (and likely precious metals pricing) could become reality into 2023.

StockCharts.com, SBSW, 18 Months

Final Thoughts

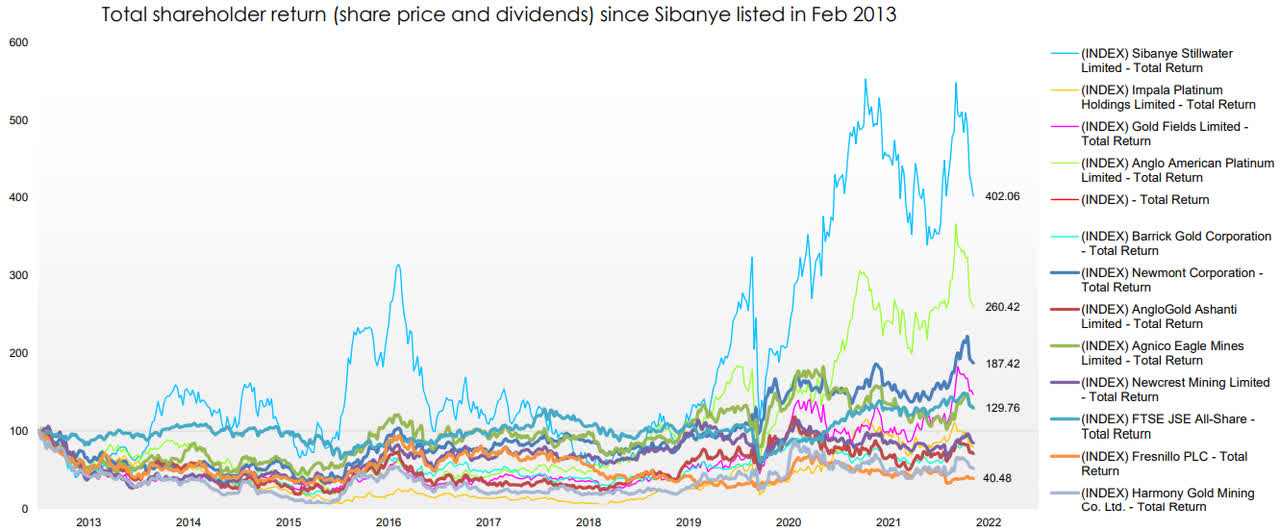

Sibanye Stillwater paid a 10% cash dividend last year and repurchased a large block of outstanding shares. The 2021 return of capital leader in the large-cap precious metals sector has also been the top total return gainer vs. peers and competitors since Sibanye was listed for trading in February 2013.

Company Presentation, May 2022

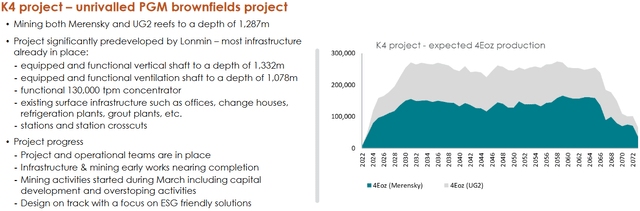

SBSW is developing lithium assets to soon become one of the world’s biggest producers of this important metal for rapidly expanding EV manufacturing goals around the planet. And, a new massive 50-year PGM project is moving into production during 2023-24, the K4 mine in South Africa.

Company Presentation, May 2022

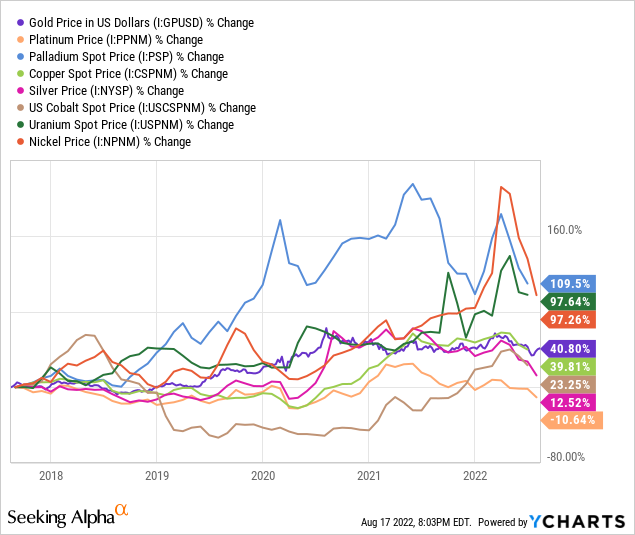

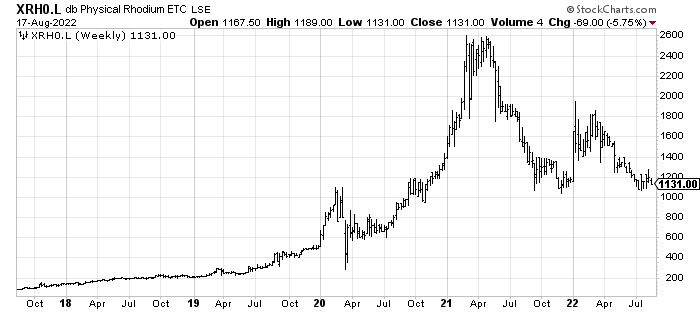

Basically, if you believe long-term money printing by central banks is increasingly out of control, and green energy growth is the future, Sibanye Stillwater is a unique choice to benefit from both trends. Gold, platinum, palladium, rhodium, lithium, copper, nickel, cobalt, silver, uranium and other metals are mined by the company. Below are 5-year price graphs for the metals produced by SBSW. Gains in price above +40% are common, with only the international platinum quote in U.S. dollars is lower. Rhodium is up +600% in London trading.

YCharts, Metals Pricing, 5 Years StockCharts.com, Physical Rhodium Fund, London

By far, the biggest long-term risks to an investment in Sibanye Stillwater are precious metal and green metal pricing and demand. For example, a severe recession would blow a sizable headwind at investors. However, any hint at renewed money printing by central banks could encourage speculators/hedge funds to load up on miners like SBSW to gain access to valuable hard assets with decades of resource leverage to paper currency devaluations.

If we are heading into severe recession, the share quote could decline further, maybe all the way down to book value closer to $7. However, during the next economic cycle with rising EV manufacturing trends, targeting all-time highs materially above $20 for SBSW seems to be quite reasonable, especially if few net long-term liabilities remain part of the investment equation.

I think the smartest accumulation plan may be to buy a small Sibanye Stillwater stake today, and cost average into additional shares over the next 3-6 months. That way a continuation of the Wall Street bear market and evolution of the economy into recession can be de-risked, while your long-term cost of an SBSW position is optimized.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Be the first to comment