alvarez/E+ via Getty Images

Capital Rotation

I am always looking for opportunities to rotate capital whenever the market presents an opportunity to do so. In the current environment, we have sold some of the high-cost energy investments and replenished cash holdings. It’s pretty uncommon that I liquidate a position altogether unless I believe the business model or potential investment thesis no longer makes sense.

A recent example of why we would eliminate a position can be seen with the sale of all Mesabi Trust (MSB) shares from our retiree Jane’s portfolio. The royalties of the Trust are in question because Cleveland-Cliffs (CLF) is going to idle all operations at Northshore Mining due to the “ridiculous royalty structure we have in place with the Mesabi Trust.” CLF is moving its production to another site altogether and they have not engaged in meaningful dialogue about the royalty structure which suggests a pretty bleak outlook for the trust in the near future.

As we sell these shares I usually peruse my watch lists to see if there are any stocks not currently held that would be worthwhile. This usually happens when the existing portfolio holdings appear fully valued or there is a full position associated with a particular investment.

Industrials On The Watchlist

The current environment has opened some doors for entry points in stocks that are near the 52-week-lows. In many cases, these stocks were near their 52-week-highs within the last six months.

The goal of this list is to have a brief review of the company and several of the metrics that we consider particularly important when investing in dividend-paying stocks.

Air Products and Chemicals – APD is one of those companies that was recently at its 52-week-high as recent as the beginning of January 2022. The drop in share price has been staggering and largely due to inflationary concerns which are especially important with APD running a large backlog. APD’s price targets were recently cut:

- BMO Capital – $383 down to $280 – Outperform reduced Market Perform

- Bank of America – $337 down to $285 – Neutral

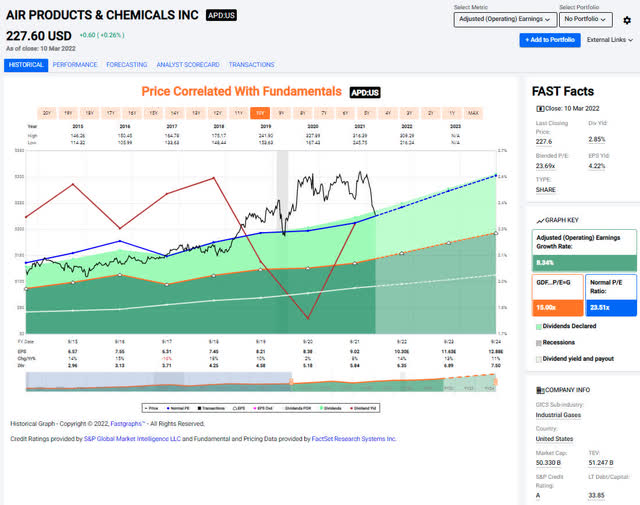

The good news is that even with these price target reductions the current share price is well-below these target prices and Fastgraphs shows us that shares are reasonably priced again using a 10-year P/E ratio average of 23.5X.

Fastgraphs – Air Products and Chemicals (Fastgraphs)

The red line on the image above represents the dividend yield (with percentages tied to the numbers on the right-hand side of the image). When investing in a dividend-paying stock I am always concerned about purchasing shares when the yield is too low. Purchasing shares at a low yield is one of the fastest ways to destroy value over the coming years because even the rapidly growing dividend will take years to get back to what I would refer to as a baseline or average yield.

The image below demonstrates this point for APD over a 10-year history. From the middle of 2020 through the end of 2021 the stock price was pushing an all-time-high which drove down the dividend yield well below 2%. I drew the red line to show that on average the dividend yield of 2.5% represents a reasonable entry point for APD and the current share price represents the best buying opportunity since the beginning of the pandemic in 2020.

Air Products and Chemicals – Dividend Yield (Seeking Alpha)

The current dividend yield with the recent dividend increase is closer to 2.84% which makes the shares even more attractive.

When we factor in APD’s 39 years of consecutive dividend increases and an average dividend growth rate of 12.63% (over the last five years) if further supports why buying shares is a compelling argument.

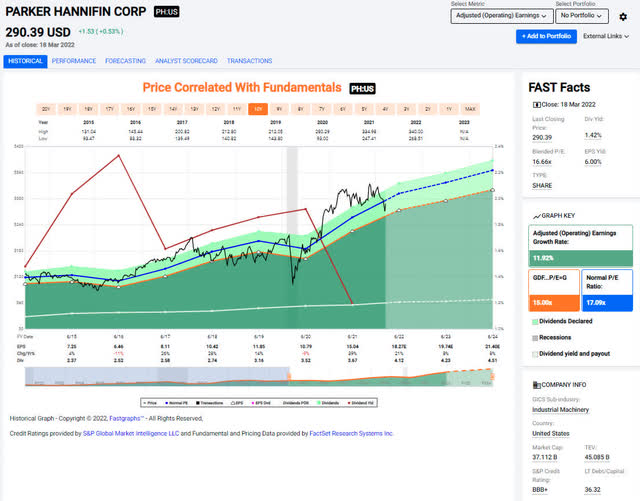

Parker-Hannifin – PH is another stock that has been on my radar for quite some time (my clients’ current position exploded after purchasing shares near their five-year-low. PH is a little different than my normal picks because its dividend yield is low when compared to other mature industrial stocks. PH is a mature business in the sense that it has been around for a long time, but its low dividend yield and rapidly growing earnings look more like a young company is growing rapidly. That has repositioned itself for growth which has pushed the dividend yield extremely low (especially when compared to the business model it was before).

Parker Hannifin Fastgraphs (Fastgraphs)

PH’s stock price is currently not that far off the all-time-high that was seen just a few months ago. The current payout ratio is under 25% and would be considered extremely safe which will undoubtedly lead to larger dividend increases in the future. The five-year dividend growth rate of just over 10% is very compelling especially when we consider that earnings are growing at a near double-digit pace and therefore can support this kind of rapid dividend growth.

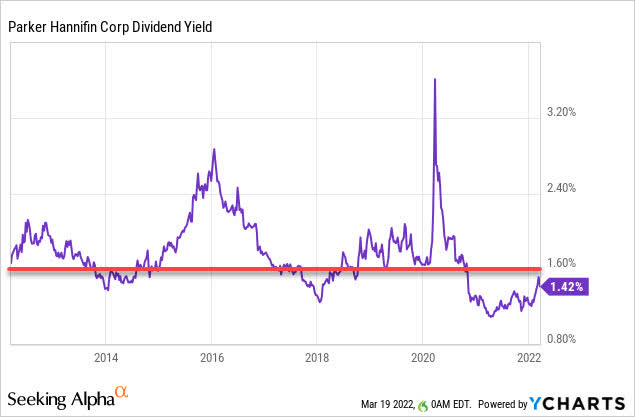

Parker Hannifin Dividend Yield (YCharts)

Over the last ten years, PH has really come with a dividend yield under 1.60%. If the company were to grow at a much slower rate, then the higher yield would be much more justified, but the reality is that PH’s fundamentals show the company is growing too quickly for the yield to be as high as it was just a few years ago.

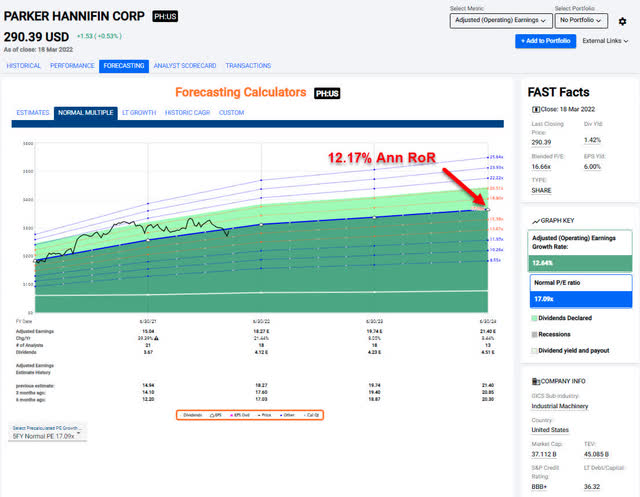

Even if we continue using the average P/E ratio of 17.09x we can see that Fastgraphs has the stock growing at an annualized rate of return just over 12%.

Parker Hannifin – Forecasting (Fastgraphs)

RPM International – RPM is the newest addition to my clients’ Taxable Account as shares recently bounced off their 52-week-low. I personally engage in a significant amount of home renovation work and can even say that I previously did a full gut job renovation on our previous residence. Some of the most common products that I come across are part of the RPM International portfolio.

RPM International Product Groups (RPM International Website)

I can easily recognize at least 50% of the brands in the lower left-hand quadrant.

RPM is currently benefiting from the increased demand for professional construction and the DIY Retail segment. With housing prices at record highs and the threat of interest rates going up, consumers are faced with the question as to whether or not they should sell and buy a new home or fix/improve the one they currently live in.

RPM is the conservative pick for those who are looking for modest growth (although it should be noted that 2022 appears to be a challenging year for earnings estimates). The current dividend growth streak has been active for 48 consecutive years and over the last five years, RPM has delivered a modest dividend growth rate of 6.3%. RPM also maintains a reasonable payout ratio of 43%. All of these factors combined suggest RPM is capable of some growth and modest dividend increases.

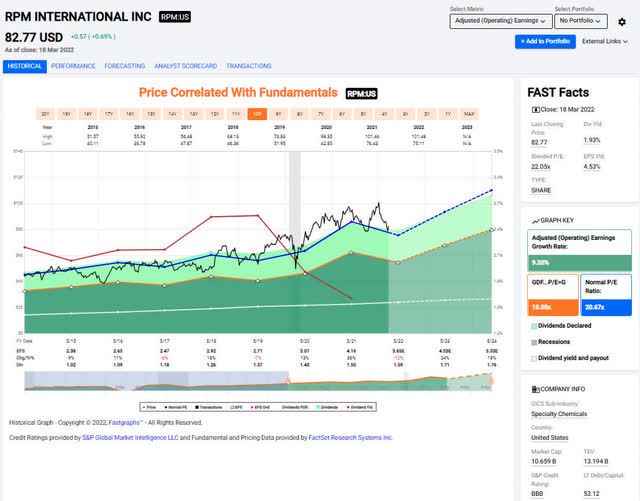

RPM International (Fastgraphs)

The image above provides a visual of the weakness that is projected in FY-2022. The good news is, that EPS is expected to increase significantly in FY-2023 and FY-2024. If the dividend growth figures on Fastgraphs are also accurate, we would expect to the see payout ratio drop to 33% by the end of 2024 even while still accounting for small to moderate dividend increases.

I believe that the current price is close to a good entry point (strongly encourage adding shares in the mid-to-upper $70) and the Dividend Yield chart shows that a shift occurred in 2019 to where the yield pushing 2% is often a ceiling whereas it used to be the floor for the lowest rate.

RPM International Dividend Yield (Seeking Alpha – RPM International)

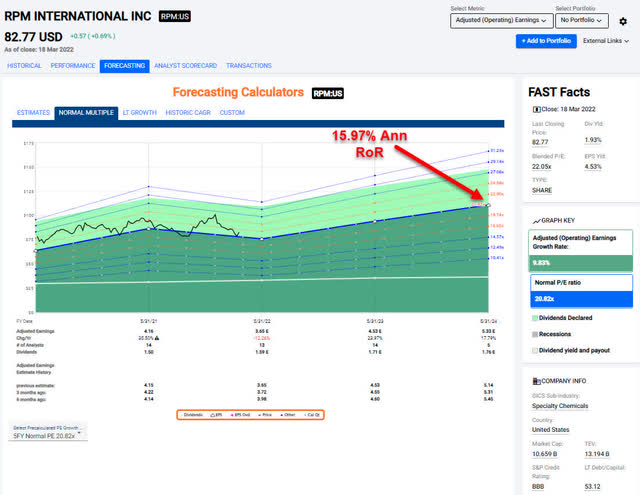

When we look at RPM’s forecasted growth with a 10-year P/E ratio average of 20.82x would result in almost 16% annualized returns over the next two years.

RPM International Forecast (Fastgraphs)

Conclusion

As always, you should always do your own due diligence because there are often external factors that could have a major impact on the information discussed in this article. For example, I have a couple of holdings that are already priced to perfection because they are in the process of a merger and/or acquisition.

The stocks above are mentioned because they are all currently on my Buy list (my clients’ and I both added or established a position in APD and RPM in the last week). Although we patiently wait for a better entry point in PH, I think that all three of the stocks mentioned have the potential to easily provide 10% Ann RoR over the next two years.

My clients John and Jane are long APD, PH, RPM

Be the first to comment