DNY59

Only those who are caught unprepared for the storm can know the true face of the storm.”― Mehmet Murat ildan

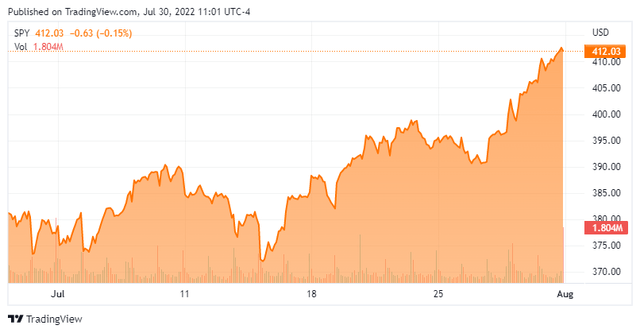

After an absolutely brutal first six months to open 2022, investors got a respite in July. All the major indices were nicely in the black for the month as July ended the month on a high note. The S&P 500 rose over four percent in the last trading week of the month led by the Energy and Utility sectors. The NASDAQ performed even better.

The rally occurred despite the Federal Reserve raising rates another 75 bps this week. Despite the aggressive monetary policy, inflation is far from under control. The PCE Inflation reading (one of the Fed’s favorite data points) jumped 6.8% in June. This was the largest increase since 1982.

So was July a dead cat bounce or the start of a sustained rally? It is much too early to tell in my opinion, but here are three predictions for the coming month of August:

Recession Clarity Gets Clearer:

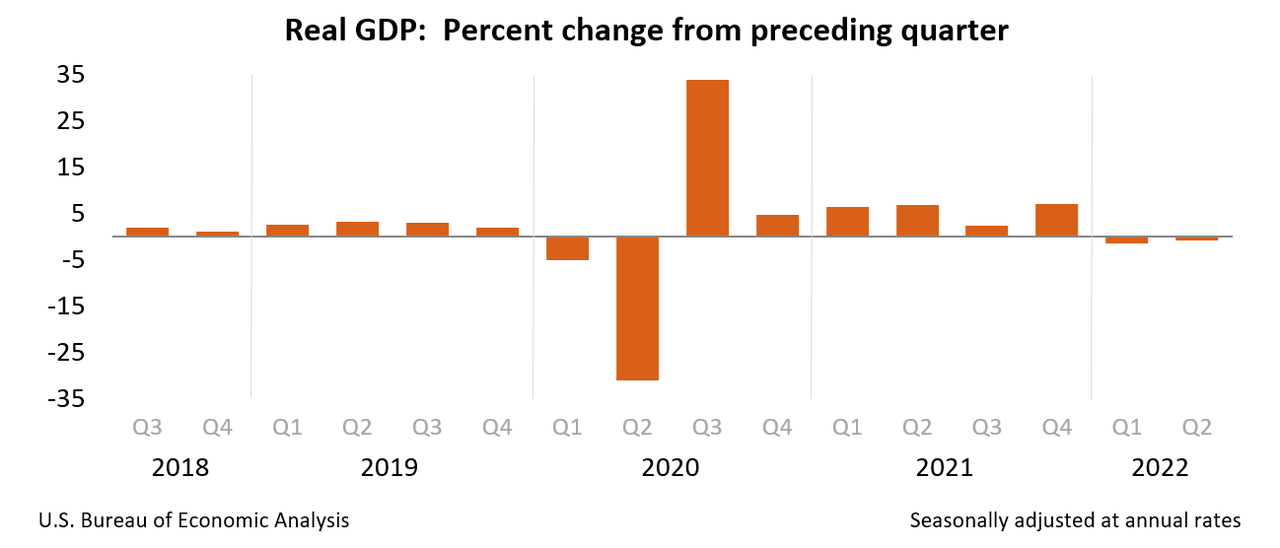

This week the preliminary reading of second quarter GDP came in at a negative .9%. This follows a contraction of 1.6% in the first quarter. Two straight quarters of declining GDP has always been deemed a recession historically. Despite this, there was much gaslighting by the administration, some economists, and a good portion of the media that we aren’t really in a “technical” recession despite these negative GDP readings.

U.S. Bureau of Economic Analysis

One can certainly understand the desire of the administration to spin these GDP readings as meaning something else than a recession. After all, the mid-terms are only months away and the current POTUS is racking up historically low approval ratings for someone just 18 months into the job. Some of the same sources were stating inflation was “temporary” and “transitionary” last year.

All of this is probably a moot point. Several recent polls show a majority of Americans believe the country is already in a recession. Since 1920 when the National Bureau of Economic Research (NBER) was founded, there have been 10 times the U.S. has had at least two straight quarters of economic contraction. All 10 of the events were eventually designated as recessions by the NBER. Some with a year lag.

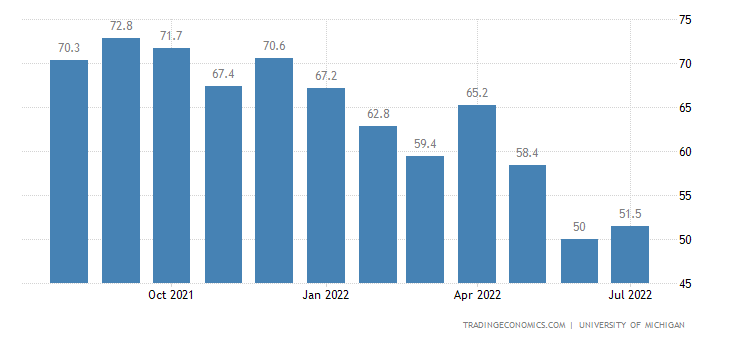

U of M Consumer Sentiment

With consumer sentiment near historical lows, the housing market slowing down significantly in the face of rising mortgage rates, vehicle sales posting double digit declines as well as a host of other recent economic readings; leads to the conclusion that “it is not different this time.” And these two straight negative GDP readings will eventually be classified as the recession they designate. My hope it is a shallow and short one. By the end of summer, the market view will be the economy is in a real recession.

Job Growth Will Start To Stall:

One of the main arguments the administration and others are making on why we are not in a recession is strong job growth. There are several problems with that view. First of all, job growth is a lagging economic indicator. Second, the jobs market is significantly weaker than it appears on the surface. While the headline 3.6% unemployment rate is indeed historically low, it is a big misleading. If the labor participation rate was at the same levels as before the pandemic, the unemployment rate would be 5.5%.

While states like Florida and Texas have fully recovered all of the jobs losses in their states from the pandemic, others like New York and California have not. The June Jobs Report showed 152 million jobs filled in the country. This is slightly below the 152.5 million level in February 2020. It also should be noted this does not account for population growth. If one factors that in, the U.S. are 2.6 million jobs below pre-pandemic levels.

Other than the mortgage industry where names like Rocket Companies (RKT) have announced significant layoffs, most sectors of the economy have avoided these sort of ‘workforce reductions‘ to this point. However, there was a notable uptick in companies like Microsoft (MSFT) stating they were either slowing or suspending job hiring plans. Amazon (AMZN) also disclosed on its earnings conference call that after relying on attrition to winnow its staff, Amazon now has about 100,000 fewer employees than in the previous quarter. By the end of the third quarter, I expect layoff announcements to increase significantly and by September or October, monthly job growth to slow substantially to under 200,000, approximately half of what it is currently.

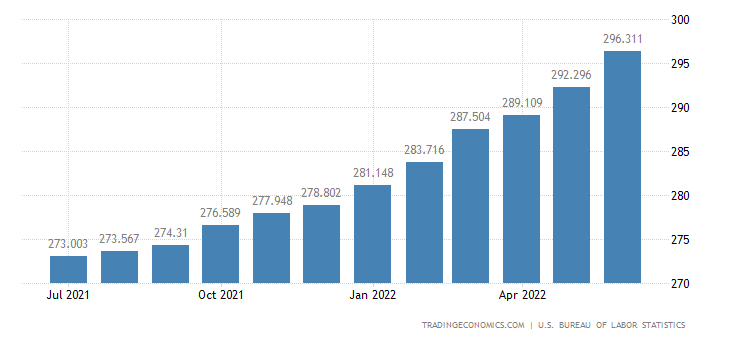

FRED

With consumer sentiment already right at historical lows and the average consumer losing more than four percent of their buying power over the past 12 months to inflation, I expect consumer spending to start to drop notably. This is especially true as the personal savings rate has dropped to under pre-pandemic levels. Given the consumer makes up roughly 70% of economic activity, it is hard to see a GDP rebound of any consequence in the third quarter.

There Will Be No Soft Landing:

The problem the economy has is activity has slowed or gone negative in 2022, and the Federal Reserve is just starting its monetary tightening efforts. Obviously, this week’s 75bps point hike will start to be felt throughout the economy in the weeks and months ahead. Another likely 50bps hike is likely on the way in September.

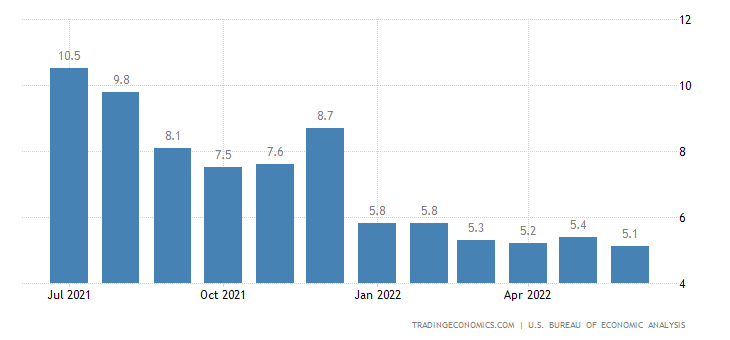

United States Consumer Price Index

It is rare for the central bank to be raising interest rates in the face of a clearly slowing economy, and one that is likely already in recession. However, with the last CPI reading north of nine percent and the PPI above 11%, the Federal Reserve has little choice at this point given surging prices. The fact is that Chairman Powell kept monetary policy too accommodative for too long given the massive amounts of the liquidity the central bank provided the economy during the pandemic as well as the roughly $7 trillion spent by Congress through various Covid-19 triggered relief efforts.

Unfortunately, we are now in the process of having to “pay the piper” for those excesses. The central bank can’t hit the “pause” button on monetary tightening until considerable progress is made on the inflation front. That seems unlikely until the country is significantly deeper in recession with the accompanying demand destruction that will help put the inflation genie back in her bottle.

Given this view, I see July as a nice relief rally but one that is unlikely to be the start of a sustained rebound. Another leg down in the market before the end of the summer seems the most likely scenario as recessionary headwinds increase. Therefore, I remain cautious on the markets here. Most of my open positions are within covered calls for the additional downside risk mitigation. I also am maintaining a 20% to 25% cash allocation in my portfolio as a cushion to act upon lower entry points in the months ahead.

You have to be willing to kiss the storm to taste the rain.”― Nitya Prakash

Be the first to comment