Cavan Images

Thesis

We believe that 23andMe Holding Co. (NASDAQ:NASDAQ:ME) as a standalone business faces numerous risks and the recent financial performance has raised serious questions about the viability of the company as a business. The company continues to burn through cash at an increasing rate, and management has been unclear on the company’s path to profitability and how its business will operate in a severe recession. However, we are recommending a “HOLD” as the company’s stock is nearly ~70% down from its SPAC merger price, and we find that there’s a possibility that the company may be acquired at some point.

Company Overview

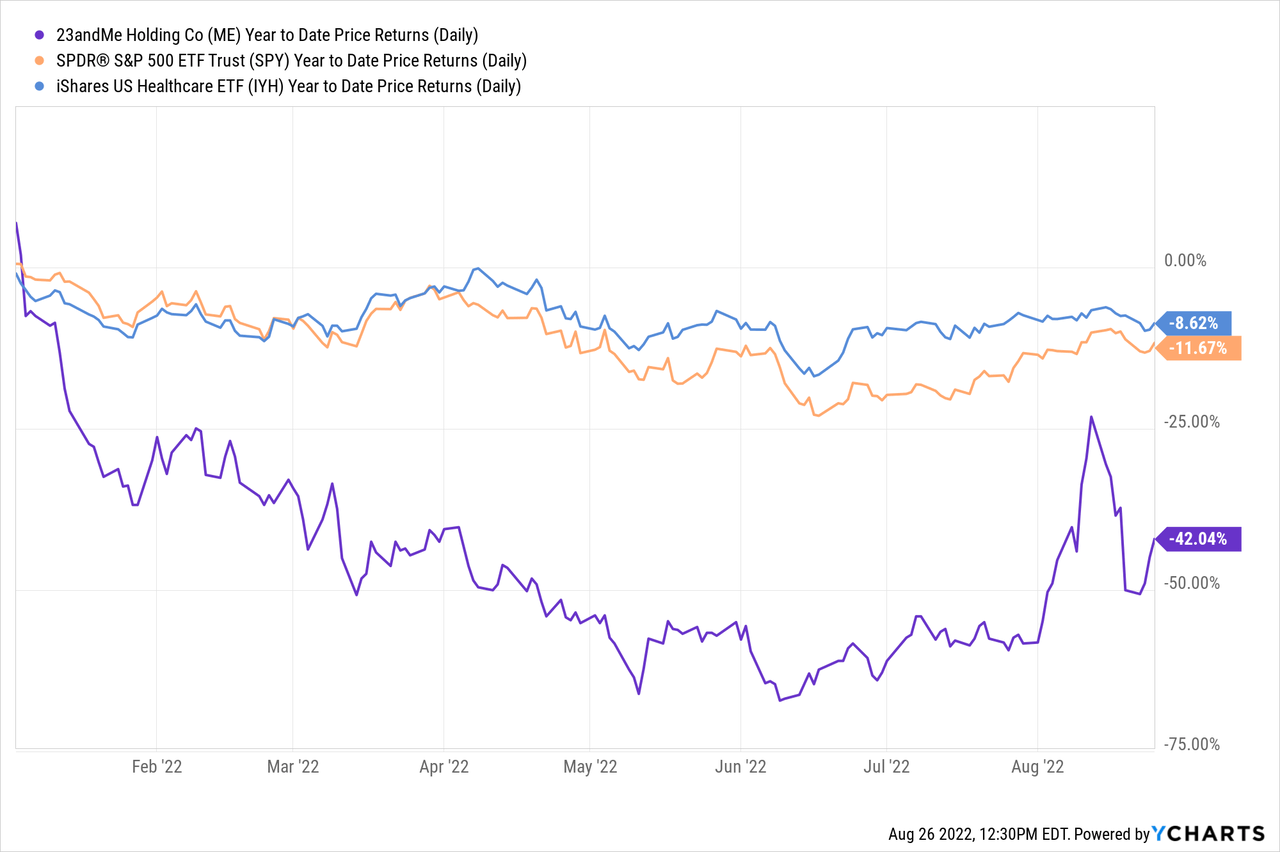

23andMe is a genomics and biotechnology company that provides health reports to consumers by analyzing their DNA. The company’s services include the analysis of one’s genome for ancestry breakdown, phenotypic traits, and assessment of health risks. 23andMe has been around since 2006, and the company has gathered the genomes of more than 1 million people. In 2021, 23andMe went public through a SPAC, raising nearly $600 million in the process. However, the company’s stock price has performed poorly in the recent months, and the stock price is down nearly -42% year-to-date. In the same time frame, S&P 500 returned -11.67% and iShares US Healthcare ETF (IYH) had slightly better YTD returns at -8.62%.

Burning Cash

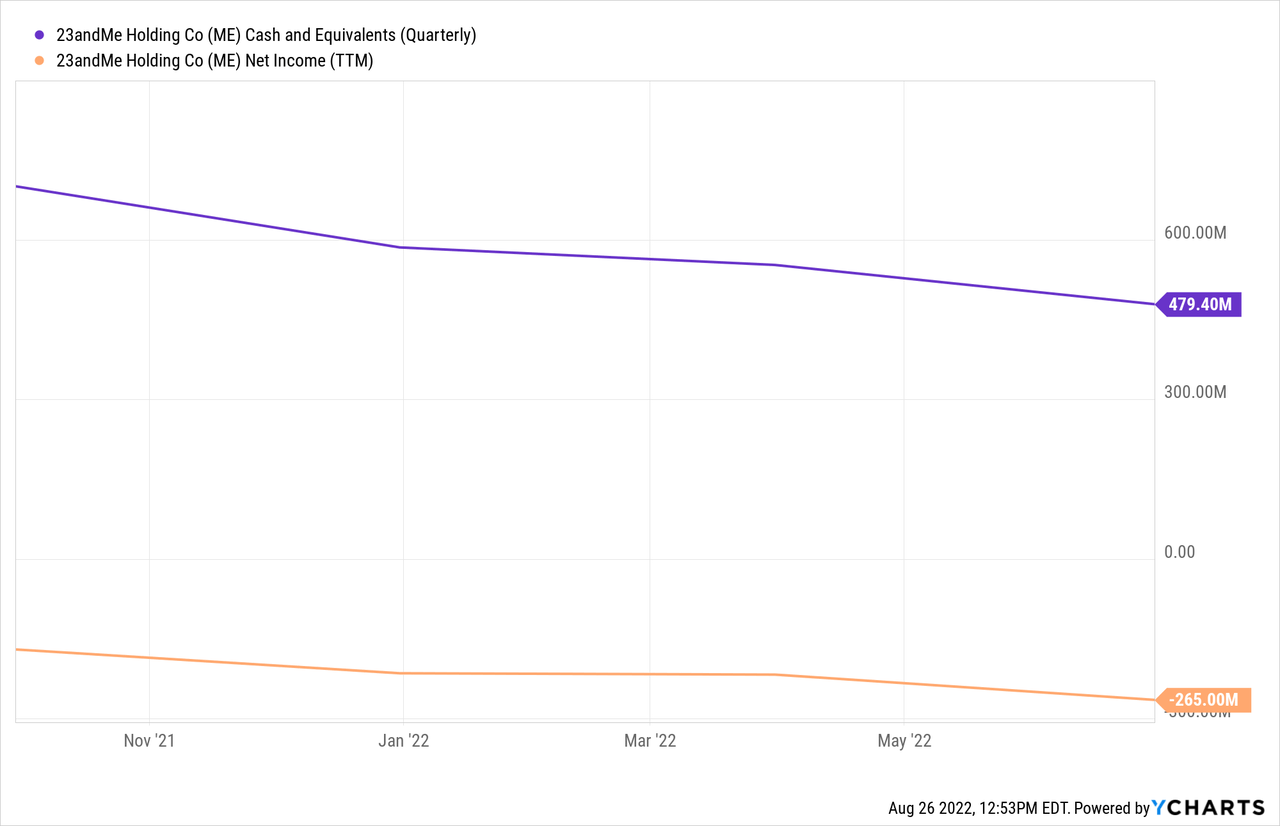

Despite the injection of new capital as a result of the SPAC merger, the company has been burning through cash. In the last reported quarter ending in June 30, 2022, the company reported a loss of $90 million compared to a revenue of $60 million in the same time frame. The company saw operating expenses balloon to $115 million (compared to $42 million in the same quarter last year), and resulted in the company losing more money than the revenue brought in.

This trend is not new, as in the preceding quarter ending in March 31, 2022, the company also reported a net loss of $70 million with a revenue of $100 million. The accelerating quarter-over-quarter decline in revenue along with an acceleration of losses is concerning. Furthermore, the cash burn can be visibly seen in the balance sheet, as cash and cash equivalents declined from $769 million in quarter ending June 30, 2021 to $480 million the same quarter this year. The continued cash burn is not sustainable and tightening capital markets will make it more difficult for 23andMe to continue on this trajectory.

Unclear Path to Profitability

Management has been unclear in the concrete steps to be taken for the business to be profitable. In earnings call and presentations, the company continues to emphasize “investments” in therapeutic business. However, we were not convinced by management’s response to question with regard to the path to profitability. An analyst asked 23andMe management during a recent earnings call, “Do you have enough cash on hand to become profitable?” The response by the CEO was:

So we disclosed at the end of the first quarter that we have $479 million in cash. And we also then reaffirmed our guidance on our adjusted EBITDA, which is our proxy for operating cash flow. And so when you look at that those two figures the range on adjusted EBITDA is $195 million to $215 million. If you kind of take the average of that and look at that cash balance, you can get a sense of what the runway is and it’s a reasonably good period of time it will give us the ability to execute a lot of things that Anne has talked about on the consumer side and that Kenneth is working on with our portfolio of therapeutics.

The company seems to be betting heavily on the consumer side and therapeutics side somehow contributing meaningfully to the top line and bottom line, though it remains unclear how they will get there. In addition, the economic slowdown is likely to negatively impact their prospects, and management clearly recognized this, describing the business as a “consumer discretionary” and stating that they “don’t have any experience in a deep recession” in the earnings call.

Potential Acquisition Target

One thing that keeps us from fully recommending against the stock is the potential for acquisition by a healthcare company or a private equity company. The amount of data that 23andMe has collected is immense, and such data may prove valuable for certain companies in either life sciences or pharmaceuticals. In 2020, Blackstone (NYSE:BX) group bought a company, Ancestry, for ~$4 billion as the business had a similar value proposition. Given that 23andMe now only has a market capitalization of ~$1.5 billion, it is not improbable to think the company might find a strategic buyer in the near-future.

Conclusion

23andMe has been a money losing investment since it went public through a SPAC in 2021. After more than a year has passed, we find that the company is still struggling, burning through cash in its reserves and reporting abysmal financial results with no end in sight. Management does not seem to have clear answers on how the ship will turn around, and the potential for a deeper recession raises additional questions about the company’s viability. We recommend investors to avoid the stock and take no positions in either direction as the uncertainty is too great.

Be the first to comment