Klaus Vedfelt/DigitalVision via Getty Images

Intro & Thesis

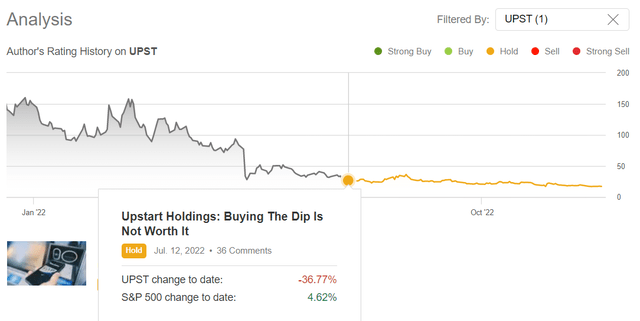

I wrote my first and only article on Upstart Holdings, Inc. (NASDAQ:UPST) exactly 5 months ago. In it, I strongly advised against buying a drawdown in the stock that had fallen 19% that day after its disappointing earnings report (at the time, the total YTD decline was over 80%).

As time has shown, I was right – after a few months, the stock continued its enchanting fall, although the S&P 500 (SPX) even recovered slightly:

Seeking Alpha, author’s profile, UPST

Today, I’d like to again warn of possible new lows in 2023 – all dip buyers should be aware of this and look at the broad macro picture that points to an abundance of credit card delinquencies next year. I expect this to negatively impact UPST, which still prices in a bright future that should happen shortly.

Why do I think so?

10 hours ago, as I write these lines, Reuters published an article saying that U.S. consumers will default on personal loan and credit card payments next year at the highest rate since 2010. The reporters cite projections from TransUnion, a major consumer credit rating agency, that the rise in delinquencies will follow a year in which consumers took out a lot of loans.

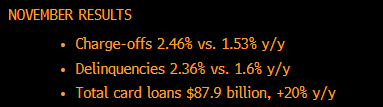

The negative real income of the U.S. population, eaten up by the still very high inflation (3.5 times above the 2% target), leads to the population having to borrow more and more, for which a higher interest rate than before has to be paid. This is already leading to an increase in defaults, as shown by the latest data for November:

Bloomberg Terminal, posted by Brian Sullivan

The housing market is a fairly important catalyst for the growth of the total number of delinquent borrowers, and the situation in this market is changing very quickly in a negative direction. For example, Black Knight (BKI) – a data and analytics firm serving the mortgage lending and servicing and real estate industries – writes in its recent study that 8% of 2022 mortgaged home purchases are now underwater. There are around 450,000 homebuyers who owe more than their house is worth as of the end of the 3rd quarter, and 60% of them [270,000] bought their homes in the first 9 months of 2022.

Digging deeper into the month’s data, Black Knight found that, while still relatively low among conforming loans, the early-payment default (EPD) rate – which captures mortgages that have become delinquent within six months of origination –– has risen among FHA loans for much of the past year to reach its highest level since 2009, excluding the months in the immediate wake of the pandemic.

Source: ZeroHedge [December 9, 2022].

How does all this affect Upstart Holdings?

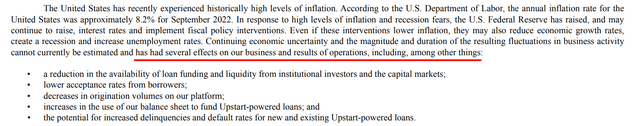

It’s all about the company’s business model. In essence, UPST relies on the willingness of banks [banking partners] to give loans – the more credit extended, the higher the company’s commission. The higher the risk of delinquencies seems to be, the more likely it is that bank partners will increase their provisions for NPLs and be more selective in issuing new loans to avoid further defaults – UPST will see an outflow of loan [basically its revenue] volume.

UPST’s recent 10-Q, author’s notes

As the number of delinquencies grows, the banking partners will monitor their risk management more carefully to maintain their own margins, so Upstart will feel a further decline in volumes.

So I expect that a decline in inflation in 2023 (perhaps even a return to the Fed’s 2% target) will have a positive impact on Upstart Holdings, but will still not be able to offset the headwinds of upcoming delinquencies.

However, the consensus opinion paints the current situation in positive colors.

For example, here is what JP Morgan analysts write in their December 10, 2022, report:

Interestingly, the relationship between delinquencies and unemployment pre-GFC was fairly similar to the pandemic, but for vastly different reasons. Unemployment spikes in the early ‘90s and 2000s were met with refinancing waves, which likely helped keep delinquencies low as borrowers could potentially refinance and lower their monthly payment. The early ‘80s showed rapid inflation and unemployment, paired with high mortgage rates, leaving borrowers even more locked-in to their mortgage than present day. Imagine looking to move with mortgage rates at 15-18%, up sharply from 9% a few years earlier. Delinquencies in the early ‘80s did rise eventually to 6% from 4% but were still significantly below unemployment levels. Borrowers were faced with a similar decision as today. Stay current on your mortgage, potentially face significantly higher payments elsewhere or downsize meaningfully. Regardless, we also have finely tuned delinquency workout programs today that should keep borrowers in their homes.

Source: JP Morgan, [December 10, 2022].

Also, Credit Agricole published a research paper on December 12, stating that lending standards have improved significantly compared to the pre-financial crisis period, meaning that foreclosures and delinquencies should be less common going forward:

Crédit Agricole CIB [December 12, 2022]![Crédit Agricole CIB [December 12, 2022]](https://static.seekingalpha.com/uploads/2022/12/14/49513514-16710792217159193.png)

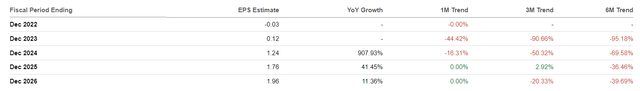

A rather optimistic view of investment banks allows their equity research analysts [who cover the fintech sector] to remain quite optimistic for UPST in the long run – I am talking about the 2-5 year outlook from here. Just look at these EPS consensus forecasts – despite 10 downward EPS/Revenue revisions in the last 90 days, analysts are forecasting a 5-fold increase and breakeven [of EPS figure] in FY2023 and then a 900%+ increase in FY2024. And this is against the backdrop of a high risk of a recession in mid-2023, which only the lazy do not write about. Why I share this view can be seen in my recent article “How To Position Your Portfolio For 2023.”

Seeking Alpha, Earnings Estimates, UPST

And yes, the most interesting thing is that these multiple increases in EPS, according to Seeking Alpha’s data, should be done against a backdrop of declining revenues:

Seeking Alpha, Earnings Estimates, UPST [author’s notes]![Seeking Alpha, Earnings Estimates, UPST [author's notes]](https://static.seekingalpha.com/uploads/2022/12/15/49513514-16710837333872101.png)

If you know approximately how the company can achieve this effect, let me know in the comments. I am sincerely interested.

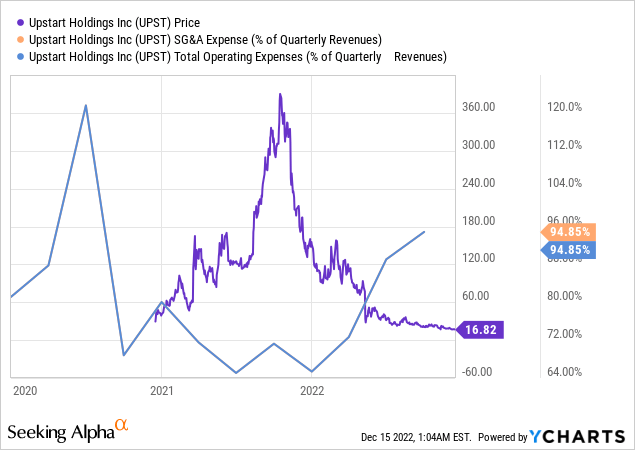

In the meantime, if we look at the latest 10-Q, we can see that even if we strip out the negative effect of interest income and fair value adjustments, core fee revenue was down 14.77% (YoY) in Q3 2022, while total operating expenses were a record 94.85% of total revenue for the past year (note that SG&A expenses below = total OPEX based on YCharts data). That’s well above the level when UPST IPOed in late 2020.

Final words

In all this, I see a mispricing of UPST, but definitely not in favor of the company. The quite optimistic forecasts of some investment banks regarding the “insignificance” of the extent of the arrears make long-term growth-oriented investors and some Wall Street analysts hope for a bright future for UPST; however, these hopes seem to be out of touch with reality, in my view – the company will most likely not be able to increase its earnings from negative -$0.03 per share in FY2022 to positive $0.12 in 2023, on a revenue decline of 6.27% in the same period.

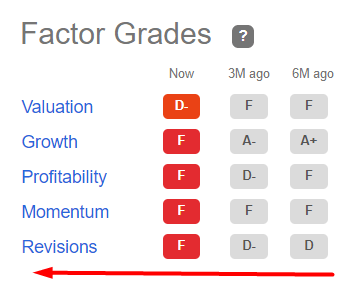

Despite the rather deplorable share price performance in the last 6 months (-51%), Upstart Holdings has only worsened in terms of the 5 grades that Seeking Alpha assigns based on its Quant system:

Seeking Alpha, UPST, author’s notes

I do not want to brag, but everything happened as I expected 5 months ago:

From my previous article on UPST, [July 12, 2022]![From my previous article on UPST, [July 12, 2022]](https://static.seekingalpha.com/uploads/2022/12/15/49513514-16710851602150924.png)

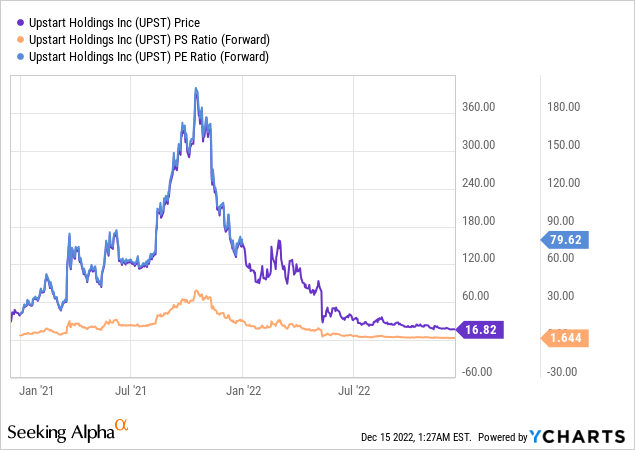

The company’s valuation has since deteriorated along with the stock price. However, since EPS forecasts are still very optimistic, I consider the 79 times price-to-earnings ratio a joke for which UPST’s stock price should apologize (in other words, it should go down).

But I agree that my updated “Sell” rating would be wrong in terms of timing.

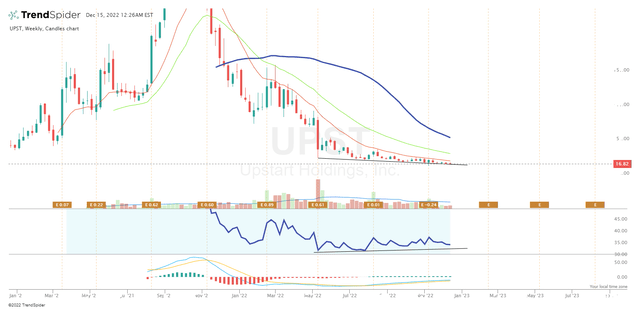

At the moment, UPST’s downward movement is gradually losing strength – we can see this from the RSI divergence formed (price lows down, RSI lows up):

TrendSpider, UPST, author’s notes

In addition, further positive news about falling inflation could give additional impetus to companies like UPST, as market participants believe that now is the time to go long in risky assets (which is a fallacy, if you ask my 2 cents).

In any case, I expect UPST to fall further, either due to additional earnings revisions or new negative earnings surprises that will inevitably lead to strong downside moves.

Thanks for reading!

Be the first to comment