shapecharge/iStock via Getty Images

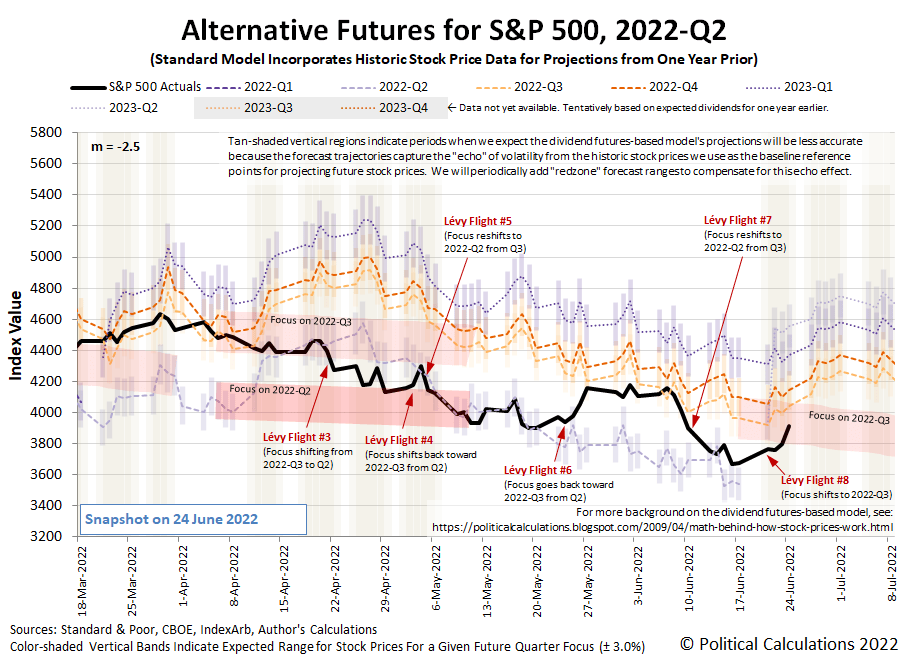

The trading week ending on Friday, 24 June 2022 ended with a bang for the S&P 500 (Index: SPX), which experienced its eighth Lévy flight event of the year. The index closed the week at 3,911.74, rising 3.06% just on Friday, 24 June 2022 alone and gaining 6.45% from the previous week’s close. The index is now 18.4% below its 3 January 2022 record peak, rising back above the 20% decline threshold that defines a bear market.

If you’re new to the concept of Lévy flights and how they apply to stock prices, here’s a quick primer. They are perhaps most easily understood as the outsized changes in stock prices that occur more frequently than would be predicted assuming the day-to-day variation in stock prices is described by a normal distribution from conventional statistics. Their variation is better described by the math for Lévy stable distributions, which have “fatter tails” than what you’ll see in the normal distribution’s bell curve.

In the dividend futures-based model we use to project the potential future trajectories of stock prices, these events can be seen occurring whenever investors shift their forward-looking time focus from one point of time in the future to another. In the past week, the alternative futures chart confirms investors fully shifted their forward time horizon to 2022-Q3 after having fully focused it on 2022-Q2 in the previous week.

Not that they had any choice. The expiration of 2022-Q2’s dividend futures contracts on 17 June 2022 represented the clock running out on the future of 2022-Q2. Its end meant investors had no choice but to shift their focus to a different point of time in the future, where they’ve fixed it on 2022-Q3. Again. For now.

From our perspective, the first half of 2022 has proven to be an exciting time. That’s because of the large difference between the potential trajectories of the S&P 500 for the alternative trajectories for 2022-Q2 and 2022-Q3, which are set by the expectations for changes in the rate of dividend growth for these two quarters. The cluster of volatility the stock market has experienced in the year to date has seen investors repeatedly shifting their forward-looking attention between these two quarters, producing an unusually high number of atypically large Lévy flight events in the process.

Those shifts have come as investors absorbed and responded to the random onset of new information throughout this period. We’ve tracked the market-moving news that has prompted those shifts throughout our S&P 500 chaos series during 2022. Here are the market-moving headlines we noted during the latest week that was.

Tuesday, 21 June 2022

- Signs and portents for the U.S. economy:

- Fed minions engage in wishful thinking, want bigger rate hike in July:

- China makes Russia its top oil supplier:

- BOJ minions in cahoots with government to prop up yen while keeping never-ending stimulus going:

- ECB minions worrying about what Europeans are feeling, think they should support the Euro, fear fragmentation, say there’s no free ECB lunch plan:

- Wall Street gains over 2% in broad rebound

Wednesday, 22 June 2022

- Signs and portents for the U.S. economy:

- Fed minions “strongly committed” to hiking interest rates to combat inflation:

- Bigger trouble developing in Canada, U.K.:

- Germany Finance Minister wants ECB minions to stop thinking and start doing something about inflation:

- Wall Street ends little changed after Powell remarks

Thursday, 23 June 2022

- Signs and portents for the U.S. economy:

- Fed minions claim fight against inflation won’t stop for recession, want bigger rate hikes:

- Bigger trouble developing in the Eurozone, U.K.:

- Other central banks acting to hike interest rates to combat inflation:

- S&P 500 ends higher, boosted by defensives, tech

Friday, 24 June 2022

- Signs and portents for the U.S. economy:

- Fed minions really determined to convince people they’ll do what it takes to break inflation, several decide to dump investments:

- BOJ minions becoming like deer in headlights for commitment to never-ending stimulus policies:

- ECB minions say they’re not worried about EU-member bond yield spreads:

- Wall Street posts big gains to end strong week

Data suggesting the U.S. economy is slowing more than expected is altering investor expectations for how the Federal Reserve will be setting interest rates to fight inflation. While the CME Group’s FedWatch Tool still projects half-point rate hikes for both July and September 2022 (2022-Q3), it now projects quarter-point rate hikes at six-week intervals after that through 2022-Q4 and 2023-Q1, topping out in a range between 3.50 and 3.75% in February 2023. More remarkably, the FedWatch tool is now projecting a quarter-point rate cut in June 2023 (2023-Q2), which is to say a response to a developing recession is now built into tool’s projections.

The Atlanta Fed’s GDPNow tool continued to forecast real GDP growth of 0.0% for the current quarter of 2022-Q2, unchanged from last week’s running assessment. In remarks delivered on 21 June 2022, current U.S. Treasury Secretary and former Chair of the Federal Reserve Janet Yellen indicated she uses “two quarters of negative growth as a good rule of thumb to indicate a recession”. Given the Atlanta Fed’s GDPNow tool’s projections, the U.S. economy may be on course to qualify as being in recession during the first two quarters of 2022 according to that rule of thumb. Not that there aren’t some positive developments that may help forestall such an outcome, which we’ll cover later this week.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment