ands456

There’s good management and then there’s bad management. And it can be pretty obvious to tell which is which.

Good management tends to:

- Be clear and honest about company expectations and results

- Promote a healthy workplace environment that encourages (not pressures) corporate goal achievements

- Understand not just the business but the industry it operates in and the economic environments it is dealing with and could/will deal with going forward

- Respect customers/clients and/or shareholders/investors

- Grow a company without jeopardizing its balance sheet

- Be engaged and engaging with the public.

Mind you, it’s not always obvious when a CEO or larger C-suite isn’t doing their jobs right. Some of them are very good at hiding their true actions and intentions.

Then again, some of them are just good at one thing: Being engaged and engaging with the public. In which case – sorry to be blunt, but… customers/clients and/or shareholders/investors have to blame themselves to some degree for any and all resulting failures.

And when the bad management in question doesn’t even do a good job of presenting a competent face to the world it wants to win? Then we really have to take responsibility for falling for their schemes.

Here’s looking at you, Sam Bankman-Fried (or is it Fraud?), also known as SBF.

That self-made, acronymized moniker should have been everyone’s first clue. Though hardly the only one.

Yet how many people still fell for his promises of fast profits amidst the fear of missing out?

Written Like a True Newb

Before I write another word, I fully realize I wrote about bad managers recently. But this time, I actually want to address it from another angle – companies that don’t treat their shareholders well.

It’s in response to a direct request from a reader, though admittedly one that came before the whole “SBF” scandal came to light. Sorry about the delay there, reader/requester. Hopefully better late than never though?

I have to admit that I am a bit happy I delayed the article. It means I get to reference a perfectly suited Yahoo Finance piece from right before Thanksgiving.

“SBF ‘charmed a lot of people’ – including himself: Leadership expert” starts like this:

“Embattled FTX Founder Sam Bankman-Fried (SBF) fell victim to one of the classic mistakes often made by a leader: He believed in his own schtick.

“And like most toppled leaders, the 30-year-old wunderkind – and a whole bunch of blind loyalists – is paying a high price for getting carried away.”

It then quotes Medtronic (MDT) CEO Bill George, who said:

“He got caught up with how great he was. And I don’t think he was ever there. I’ve not seen the performance at all. This is a young guy who really hasn’t created anything – and he charmed a lot of people.”

But should he have?

A more recent Vox article might think so. After reminding readers that “Bankman-Fried may have illegally taken about $10 billion in FTX customers’ funds for his trading firm, Alameda Research, whose future is also in peril” and that “Bankman-Fried [once worth an estimated $16 billion] is now worth close to nothing,” it claims that this:

“isn’t a typical story of… investor risk-taking; it didn’t crumble due to bad luck, but what now appears to be unsustainable layers of deception.”

Written like a true newb.

The Downside of “Luck”

It’s that claim that “investor risk-taking” centers around “luck” that has me shaking my head in disbelief. Some disgust, too, I’ll admit.

Intelligent investors don’t count on “luck” to make money. They’re not going to turn fortune down if she decides to smile on them, of course. But they know that luck is unreliable.

So they research companies instead. Thoroughly. Including whether they’re treating shareholders right… and can continue doing so.

In the case of SBF and FTX, as Bitcoin Magazine recently headlined, “The Warning Signs Were There: The Collapse of FTX Was Inevitable.”

“Every once in a while, the world is reminded of how easy it is for some people to get completely duped by a con man,” it begins. And it follows up with (emphasis supplied):

“The story of FTX… seemingly came out of nowhere in 2018/2019 and quickly rose to ‘prominence’ as one of the most respected exchanges in the world.

SBF was vaunted as a lovable autistic wunderkind who somehow, at the ripe old age of 25, figured out a way to take advantage of a price arbitrage opportunity that existed between Western and Asian bitcoin exchange rates that many institutional investors could not.

Pictures of Bankman-Fried pretending to sleep on a bean bag chair settled below his desk which included ten oversized monitors created a perception of legitimacy that gave every trading degen and crypto VC a hard-on. They were all on his side, as was most of the financial media.

At one point, the annoying uncle, Jim Cramer, claimed that he believed he was talking to the world’s first trillionaire during an interview with SBF.”

Some of that last bit makes me think of Adam Neumann from just three years ago. Clearly, nobody learned their lesson.

A Whole Lot of “Hows” That Should Have Been Asked

The author calls Sam Bankman-Fried “a bumbling idiot who didn’t really grasp the industry he was supposed to be a domain expert in.” Complete with examples, which brings me back to how a worthwhile leader understands:

“… not just the business but the industry it operates in and the economic environments it is dealing with and could/will deal with going forward.”

Interview after interview after personal detail showed SBF was not that guy. To quote Bitcoin Magazine’s Marty Bent again:

“This begs the question, if I, a lowly newsletter peddler, had good enough instincts to snuff this out, how in the world did some of the ‘most respected’ and seasoned cryptocurrency traders and venture capitalist funds who had been given the responsibility of managing other people’s money fall for this con man?

How did Sequoia put its stamp of approval on this company? How did the Ontario teacher’s pension fund manager okay the writing of a $95 million check to this company?

How did many venture funds in the space feel comfortable parking material amounts of their AUM [assets under management] on this exchange? How did none of these people ask rudimentary due diligence questions like: How do you monetize?

Can you show me the receipts of the arbitrage trade that made you rich? Where is all of this money coming from?”

Again, due diligence should have been done. And a serious amount of skepticism should have been applied to someone who thought he was worthy of his own acronym.

In other cases of company-specific “bad luck,” it’s not so blatant, I know. I’ll acknowledge FTX’s relative uniqueness in that regard.

But you can still usually see some warning signs that you and your money won’t be respected. Take these three real estate investment trusts (REITs), for example…

2 REITs on my Scrooge List

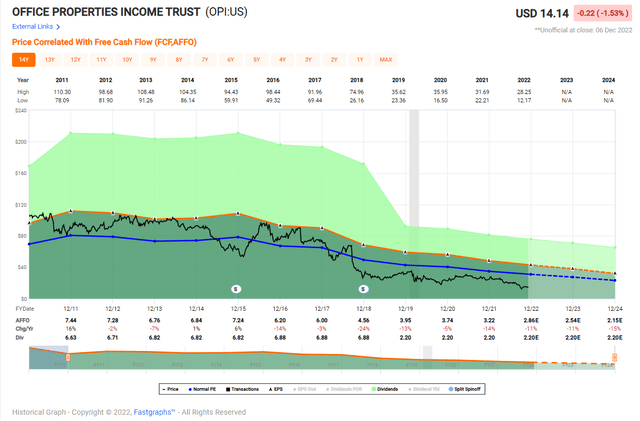

A picture is worth one thousand words:

That FAST Graphs above is for Office Properties Income Trust (OPI), an office REIT with a portfolio of 162 properties and over 21 million square feet.

As you can see, AFFO per share is on a downward spiral, and so is the price: shares have returned -35% YTD.

We just added OPI to our dividend alert tracker based upon the dangerous payout ratio of 78%, and it is expected to increase by over 100% in 2024. The dividend yield is now a whopping 15.5%. Did anyone say sucker yield?

I can sum up the negative news in just two words:

BAD MANAGEMENT

OPI is externally managed by The RMR Group Inc. (RMR). That’s also the manager to Diversified Healthcare Trust (DHC), Industrial Logistics Properties Trust (ILPT), and Service Properties Trust (SVC).

RMR also provides management and other services to other private and public companies, including Five Star Senior Living Inc. (or Five Star), TravelCenters of America Inc. (TA), and Sonesta International Hotels Corporation.

You may recall that, in my 2022 REIT Resolution article, I made it clear that I avoid most externally managed REITs, and with OPI there’s no exception. Keep in mind, OPI has no employees, so the REIT’s ability to achieve its business objectives depends on RMR.

In filings, you can easily see that OPI has conflicts of interest, and the management agreements are not negotiated at arm’s length. In addition, the agreements involve substantial penalties if terminated,

“…if we terminate a management agreement for convenience, or if RMR LLC terminates a management agreement with us for good reason, as defined in such agreement, we are obligated to pay RMR LLC a termination fee in an amount equal to the sum of the present values of the monthly future fees, as defined in the applicable agreement, payable to RMR LLC for the term that was remaining before such termination, which, depending on the time of termination, would be between 19 and 20 years.”

And…

“our management agreements with RMR LLC may discourage a change of control of us, including a change of control which might result in payment of a premium for our common shares.”

Keep in mind that RMR’s base management fee is tied to OPI’s share price performance. That consists of an annual fee equal to generally 50 bps multiplied by the lower of:

(1) OPI’s historical cost of real estate, or

(2) OPI’s total market capitalization.

Also, there is no incentive for RMR to complete any transaction that could reduce share price.

No way Jose!

No need to spend any more critical brain cells on this one, simply avoid at ALL costs.

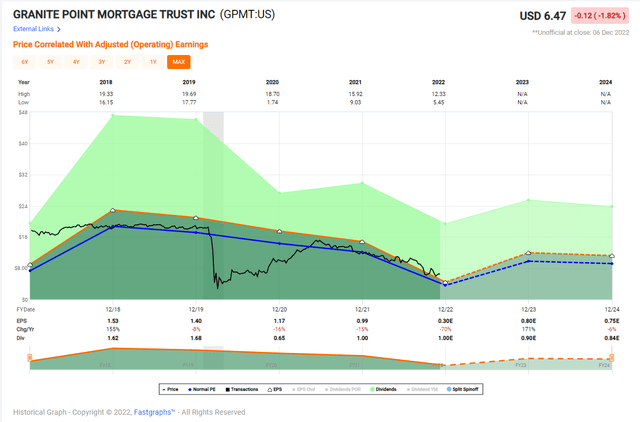

Granite Point Mortgage Trust Inc. (GPMT) is another REIT that’s worth Scrooging about.

As you can see above, EPS is declining, and in Q3-22 the $3.6 billion portfolio (97 loans with an average balance of $37 million) generated distributable earnings of just $.17/sh, versus a dividend of $.25/sh.

That poor performance is primarily related to an increase in credit loss reserves, which at quarter end totaled $85.6 million or $1.63 per common share.

At Q3-22, GPMT had four loans with a total principal balance of about $330 million that were on nonaccrual status. These assets impacted interest income by about $4 million ($0.08 per share during Q3).

From a historical context, GPMT has been a miserable dividend performer, cutting the dividend from $1.68/sh in 2019 to $.65/sh in 2020.

What’s most troubling with regard to GPMT is the current payout ratio and analysts forecast for 2023 ($.80 EPS) and 2024 ($.77 EPS).

Simply put, there’s a very good chance that GPMT will once again be forced to whack its dividend again, because the $.25/sh quarterly payout doesn’t seem sustainable.

I would not get too excited about the 15.5% dividend yield, plan for the worst.

(We’ll also be adding this one to our new Dividend Alert Tracker at iREIT on Alpha.)

We All Must Become More Like Scrooge

“Good management produce a good average market price, and bad management produce bad market prices.” Benjamin Graham

It pays to be skeptical of bad management and over the years I have learned to always verify the facts.

As many of you know, I interview C-suite executives almost daily and it’s important to not just trust the words of the CEO, but to always fact check.

In other words, I don’t get paid to be a REIT cheerleader, I get paid (by subscribers) to generate trusted research on a timely basis.

In fact, I firmly believe that I have more followers than anyone on the Seeking Alpha website because I have earned trust and respect.

I know I haven’t made 100% of my buy and sell calls over the years, but I have always adhered to sound investing principles, with an emphasis on protecting principal at ALL costs.

Happy REIT Investing!

Author’s note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: Written and distributed only to assist in research while providing a forum for second-level thinking.

Be the first to comment