Octavian Lazar/iStock via Getty Images

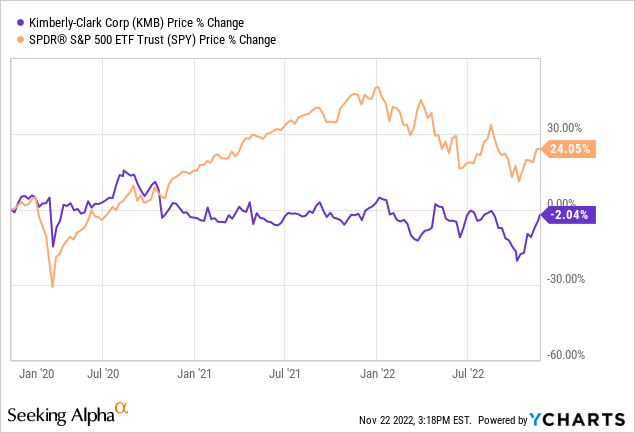

Kimberly-Clark Corporation (NYSE:KMB), together with its subsidiaries, manufactures and markets personal care and consumer tissue products worldwide. The company has performed exceptionally well during the beginning of the Covid-19 pandemic in 2020, as the demand for their products has skyrocketed. Since the second half of 2020, however, the stock price has remained relatively flat.

Today, we are going to elaborate on three reasons why we believe that the current price for KMB’s stock is not justified.

1.) Valuation

Gordon Growth Model

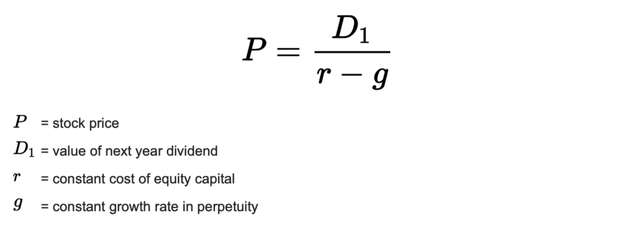

As many investors are investing in KMB’s stock for the dividend and dividend growth, we are going to use a dividend discount model to value the stock. Namely, the Gordon Growth Model, which is a single-stage dividend growth model. This model is often used to value the equity of dividend-paying firms. The following formula described the math behind the model:

The main assumption of this model is that the dividend grows indefinitely at a constant rate. Due to this criterion, the growth model is particularly appropriate for firms that are:

1.) Paying dividends

2.) In the mature growth phase

3.) Relatively insensitive to the business cycle

A strong track record of steadily increasing dividend payments at a stable growth rate could also serve as a practical criterion if the trend is expected to continue in the future.

We believe that KMB fulfills these requirements. First of all, the firm has a strong track record of returning value to its shareholders through dividend payments.

Dividend payments (Seeking Alpha)

The company has been paying dividends for the last 49 years, and they have even managed to increase these payments each year.

Also, KMB is a long-standing, well-established company without rapid growth prospects in the near future., therefore the assumption of being in the mature growth phase is also valid.

Firms in the consumer staples sector also tend to be less sensitive to business cycles than firms in the consumer discretionary, industrial or energy sectors.

For these reasons, we believe that KMB may be valued using the GGM.

To make a meaningful evaluation of the fair value of KMB’s stock, we have to make estimates about the input parameters for the model, namely the required rate of return and the dividend growth rate in perpetuity.

1. Required rate of return

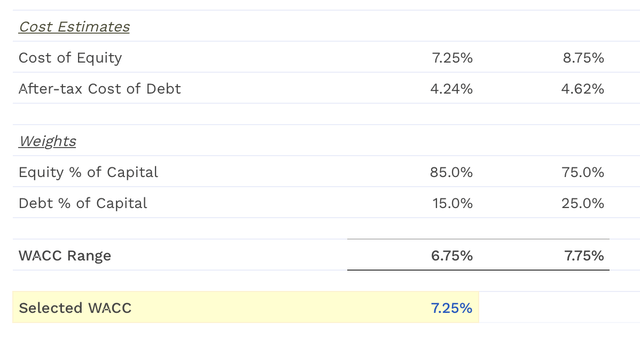

As a required rate of return, we usually prefer to use the weighted average cost of capital (WACC) of the firm.

KMB’s weighted average cost of capital is estimated to be 7.25%.

2. Perpetual growth rate

To define the growth rate, we have to take a look at the historic dividend growth rates of the firm and come up with a realistic range, which could be sustainable in perpetuity.

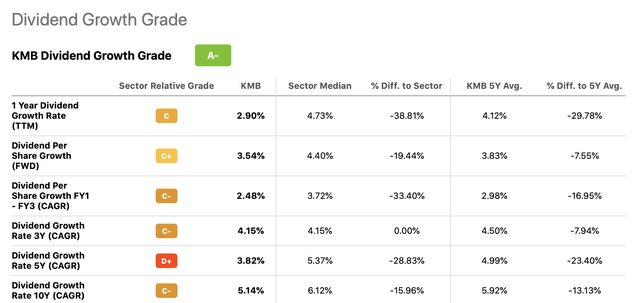

Dividend growth (Seeking Alpha)

Based on the table above, we believe that a range of 2% to 4% may be reasonable.

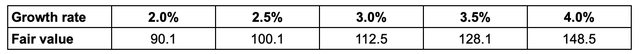

Plugging in these values to the GGM, we get the following set of results:

Fair value per share in USD (Author)

As the stock is currently trading around $135 per share, at the higher end of our range, we believe that the stock is not attractive enough from a valuation perspective based on its future dividends.

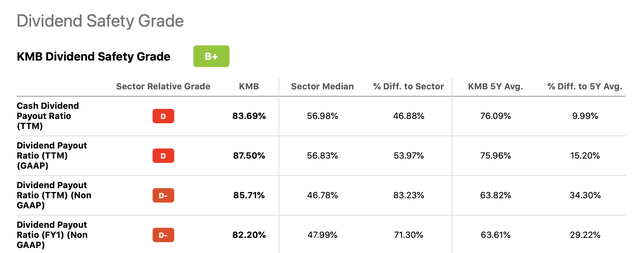

We also have to highlight that the current payout ratio is above 80%. These ratios are substantially above the sector median.

In case macroeconomic headwinds persist, KMB’s dividend may become unsustainable or will not grow at our assumed rates, causing our estimated fair values to be too high.

Price multiples

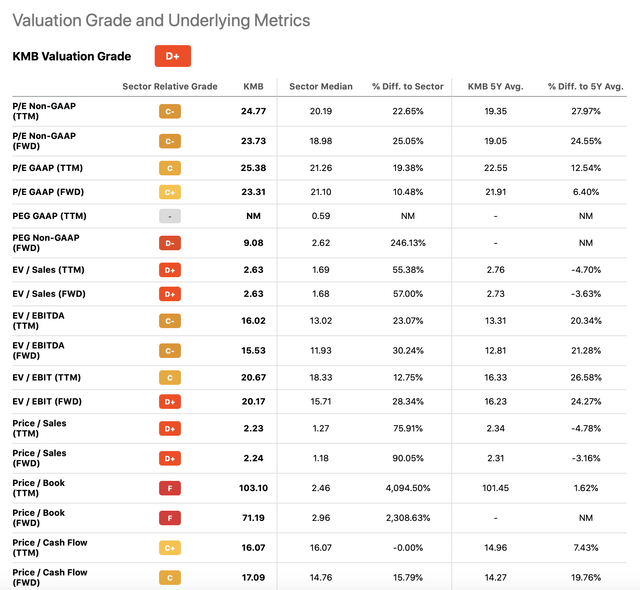

Price multiples are also indicating that KMB is trading at a premium compared to both the consumer staples sector median and its own 5Y averages.

Valuation metrics (Seeking Alpha)

Based on the price multiples, we would also like to see KMB’s stock to drop substantially, before we would consider starting a new position.

Sometimes, we recommend stocks, even when they are trading at a premium. But those stocks either have substantial moats, improving margins, or outstanding growth. We believe that KMB does not belong to any of these categories. Further, the macroeconomic headwinds are also creating challenges for KMB. And this takes us to our second point:

2.) Selected Q3 results

In this section, we will highlight selected information from the firm’s latest earnings report, which are signaling that the macroeconomic environment is negatively impacting KMB’s financial results.

Unfavorable FX environment

According to KMB’s latest 10-Q, about half of the total net sales are coming from outside of North America.

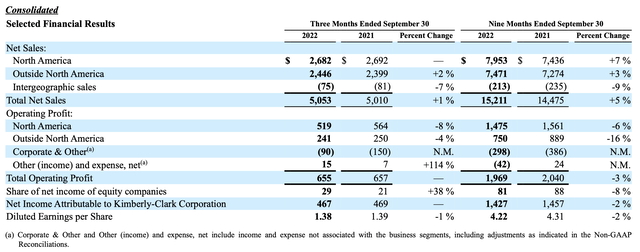

Selected financial results (KMB)

The relative strength of the USD compared to other currencies is negatively impacting these sales from outside of the U.S. In Q3, it had a negative 4% impact on net sales and a negative 2% impact on adjusted operating profit.

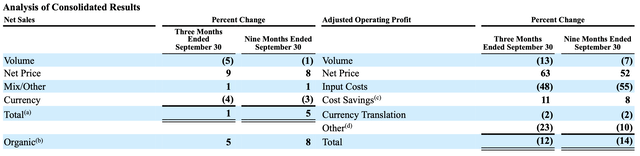

Analysis of consolidated results (KMB)

While in our opinion this headwind is temporary, in such an environment, we do not believe that the current valuation is justified.

Declining sales volume

In the last quarter, KMB’s net sales results were negatively impacted by as much as 5%. (See in the table above.) The demand has been declining across all business segments, but the largest decline has been recorded in the personal care segment.

At this point, we have to underline that KMB has been successful so far in offsetting this negative impact by pricing.

Net sales in the third quarter of $5.1 billion increased 1 percent compared to the year-ago period. Organic sales increased 5 percent as changes in net selling prices and product mix increased sales by 9 percent and 1 percent, respectively, while volumes declined 5 percent. Changes in foreign currency exchange rates reduced sales by 4 percent.

Again, we believe that this trend is also likely to be a temporary one. However, we would not like to pay 24 times earnings for such a stock, as long as the uncertainty with regards to the macroeconomic environment is not reduced.

To remember

KMB’s stock appears to be overvalued based on both its future dividends and on the traditional price multiples.

We believe that there are several macroeconomic headwinds, including the FX environment and the declining sales volume, that are negatively impacting KMB’s financial results right now. While these may be temporary in nature, in such an environment paying a premium for KMB’s stock is not justified.

For these reasons, we rate Kimberly-Clark Corporation stock as “sell.”

Be the first to comment