John Lamb

Dear Friends & Partners,

Our investment returns are summarized in the table below:

|

Strategy |

Month |

YTD |

12 Months |

24 Months |

36 Months |

Inception |

|

LRT Global Opportunities |

-5.27% |

+14.15% |

+14.15% |

-13.98% |

-0.03% |

+18.94% |

| Results as of 12/31/2023. Periods longer than one year are annualized. All results are net of all fees and expenses. Past returns are no guarantee of future results. Please see the end of this letter for additional disclosures. |

December was a challenging month for our strategy, with our long holdings underperforming our hedges significantly amidst a broad market rally due to declining interest rates and the pricing in of a “soft landing” consensus.

In December, the spread on the Goldman Sachs “most shorted” vs. HF longs basket was over 25% – by some measures the most extreme such move in over ten years. Put simply, low-quality companies outperformed high-quality companies by an uncommonly large margin. As a result, December was a challenging month for most long-short / market-neutral funds strategies – ours included. In that context, however, the loss in December looks much better and I am happy overall with the performance of our strategy.

For the year, our returns trailed the overall stock market as measured by the S&P500 (SP500, SPX) but look very good when adjusting for the fact that our overall market exposure remained below 20% for most of the year. My goal going forward remains to compound capital in the low-20s annual return range, with low volatility and low correlation to the overall market. Most importantly, I want to limit drawdowns and avoid any “down years” going forward.

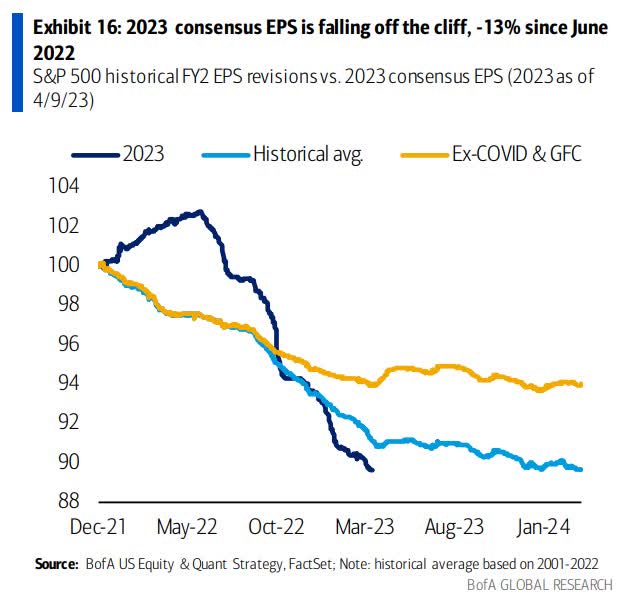

To that end, our investment strategy remains very defensively positioned. We don’t expect “market beta” to contribute much to investment returns in 2024. The market appears “priced for perfection” with limited room for multiple expansion or significant earnings growth. The trailing 12-month earnings of the S&P500 are 183.81, and analyst estimates call for a 13% growth in 2024 – double the historical average.

Typically, analysts’ earnings expectations get cut throughout the year, as can be seen in the chart below. But for the sake of argument, assume that the expectation for earnings growth is realized. Furthermore, assume a 10year Treasury yield of 4%, its current value, and an equity risk premium of 4% – its historical average. That gives you an estimated earnings level for 2024 of 207.71, and a justifiable market P/E of 12.5. This equates to 2,596 on the S&P5000 at the end of 2024.

As of today, the S&P500 is at 4,763, implying a drop of 45%. If you assume that the 10-year Treasury drops to 2% and the equity risk premium drops to 3%, that gives you a yearend target of 4,615 for the S&P500, a decline of 12.8%. What if you assume that the equity risk premium drops to 2.5%? Then the S&P500 downside is only 3.1%.

What if moreover, earnings grow 16.62% next year? Then the expected return on the S&P500 is 0%2.

What would it take for the S&P500 to deliver a 10% return next year? How about a 2% 10-year bond yield, a 2% equity risk premium, and a 14.03% growth in earnings? In other words: the 10-year bond yield would have to get cut in half, investors would have to become dramatically more enthusiastic about owning stocks, and corporate profits would have to grow at a rate more than double its historic average. In other words: the market is priced to perfection, and you must perform true mental gymnastics to expect the U.S. stock market to deliver any positive return this year. Could it happen? Of course. But that would mean a return to the mania of 2021 or late 1999 – hardly something one would endeavor to bet on.

I think it is clear from this simple analysis that the overall stock market does not offer a great “risk-reward” ratio for investors going forward. As a result, we remain defensive and carry low overall market exposure.

This defensive nature is already paying dividends in the first few days of 2024, and I believe that my patience and conservative investment approach will be rewarded in the months ahead. Our portfolio companies are firing on all cylinders, and I expect our strategy to deliver strong returns in the next twelve months, irrespective of the direction of the overall market.

As always, if you have any questions, please don’t hesitate to contact me. I appreciate all your ongoing support.

Lukasz Tomicki, Portfolio Manager LRT Capital

Be the first to comment