AndreyKrav/iStock Editorial via Getty Images

Co-produced with Treading Softly

With 2022 well on its way, I wanted to take a moment among the madness to highlight two of my largest portfolio positions. These are positions I expect to treat me and other income investors extremely well.

Would I build a portfolio of just two holdings? No. How about five? Nope!

My long-term readers will know that I have carefully crafted my Income Method over decades of experience in the financial sector – as a commercial banker – as well as investing in the market. One of the rules within my Income Method is the Rule of 42, setting a target of a minimum of 42 positions in an income portfolio. This provides protection from any company crashing and cutting its dividend. So this being said, these two picks are two of the largest positions among my entire portfolio – they are not my entire portfolio by themselves.

I invest for income – reliable, stable, steady, recurring dividends. I like capital gains as much as the next person, but not at the risk of foregoing excellent income. In 2022, with the extra uncertainty and stress so many of us are facing. It’s nice to have a comforting fluffy bed of income to fall back into every night and sleep surrounded by the security it provides.

Doesn’t that sound nice? You can have it too!

Let’s dive in.

Pick #1: PFFA, Yield 8.2%

Virtus InfraCap U.S. Preferred Stock ETF (PFFA) is an ETF (exchange-traded fund) that has some features that make it more similar to a CEF (closed-end fund). Many ETFs operate formulaically; they have a pre-determined formula that informs what stocks are bought and sold. There is no human analyzing anything or making any decisions.

PFFA is different as it is a managed ETF, where management works to actively identify opportunities and makes decisions that might diverge from the index.

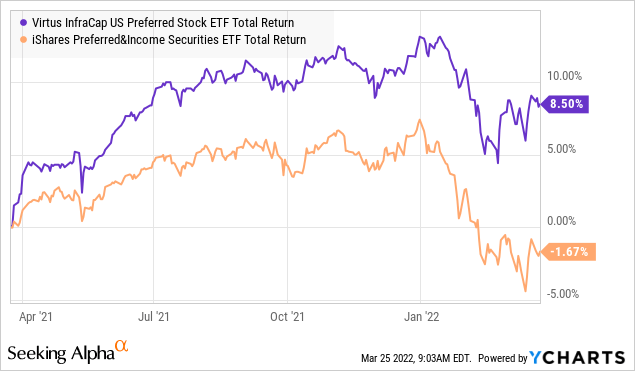

We can see that this active management, combined with the use of modest leverage, has made a huge difference for shareholders over the past year.

The recent spike up against the general downward trend in preferred was thanks to management identifying South Jersey Industries, Inc. 8.75% Equity Units (SJIV), a convertible investment that hit a home run with the announced acquisition by Infrastructure Investments Fund. PFFA was overweight SJIV as its largest single position, which is now up over 26% year-to-date.

These kinds of opportunities and decisions cannot be replicated by a passive formula. It requires human intelligence to recognize the value of the company, to recognize that it is materially undervalued and to decide to carry an overweight position.

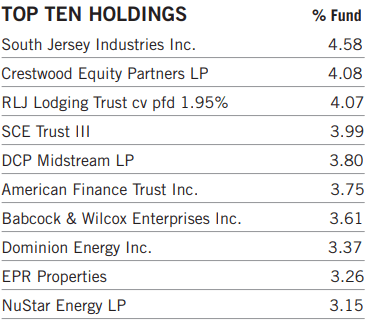

Among PFFA’s top ten, we see several holdings that are HDO favorites.

PFFA Quarterly Commentary

PFFA has had a bias towards exposure to convertible preferreds, “busted” convertibles that can’t be called, and high-yielding preferred. All of these have proven much more durable as the market fears rising interest rates.

PFFA’s investing style is strongly aligned with HDO, making it our “go to” ETF to expand our exposure to preferred shares.

Pick #2: ECC, Yield 12.5%

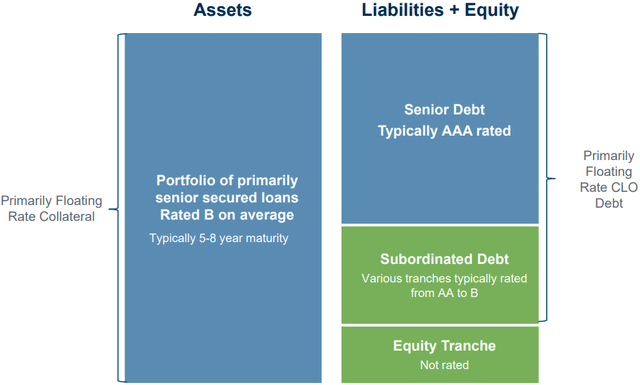

Eagle Point Credit Co, Inc. (ECC) is a CEF (closed-end fund) that invests in “CLO” equity – CLOs are collateralized loan obligations. These are bundles of senior secured loans that are then “securitized”. Investors can buy a tranche by seniority. The AAA tranches get paid first, and only after they are paid in full, do the junior tranches get paid. The “debt” tranches come with a pre-determined return. The “equity” tranche gets whatever is left. While it is called “equity”, it is backed by senior secured loans. The structure looks like this:

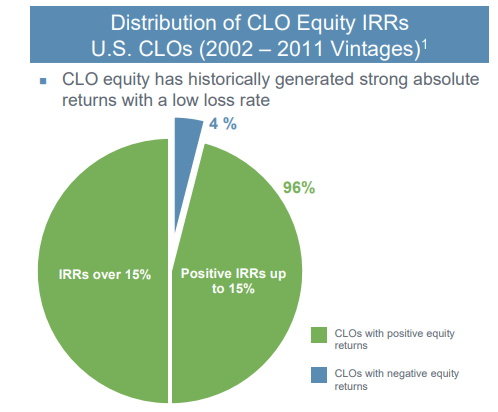

CLO equity has an excellent historical track record, with only 4% of “CLO 1.0” equity returns being negative.

ECC Investor Presentation-Q4

This despite the Great Financial Crisis causing a large spike in loan defaults. CLOs proved to be very resilient.

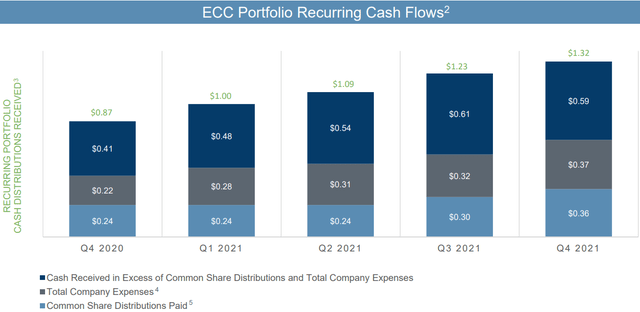

In 2020, ECC saw several CLOs it held have “redirection” provisions triggered. These provisions prepay senior tranches during times of difficulty. Cash that would have gone to pay the equity tranche, pays down the senior tranches instead. Note that the borrowers of the loans still have to make the same payments, so while it reduced cash flow in 2020, since default rates remained low these equity positions are paying more today.

ECC’s cash flows are now well above 2019 levels, which ranged from $1.02 to $1.13/quarter. ECC has been raising its dividend, only as taxable income has been high enough to force it to. The rest of the excess cash flow has been reinvested, taking advantage of the buying opportunity.

Fundamentally, ECC is in much better shape than it was pre-COVID. Cashflow is 30% higher per share, its NAV is 25% higher per/share than December 2019, and default rate expectations are much lower. Despite all this, ECC is trading at a lower price!

ECC provides a double-digit yield today, will likely be paying a special dividend in 2022, has excellent prospects for dividend growth and capital gains potential. It is rare to find all of that in one stock, and even rarer to find it with a 12% yield to start!

Dreamstime

Conclusion

By investing in excellent preferreds – via PFFA – and by investing in the belief that the U.S. economy will continue to strengthen – via ECC – we can generate high levels of immediate income. We are also the creditors to U.S. businesses. We’re not on the hook for the debt, we own the debt. This allows us to have a higher degree of security, while also enjoying great income. This way, the market takes care of your finances.

Imagine the free time you’ll have unlocked when you don’t need to worry about your finances. Money can be a tough topic to discuss, especially when you don’t have enough of it to cover your expenses. By changing how your portfolio is invested, you can squeeze even more income out of your portfolio.

Retirement, then, becomes more relaxing. You’ll have more flexibility. Want to snag that ice cream cone? Go for it. Want to dote on your grandbabies? You have the ability to do just that! Dream vacation to Italy and see the Colosseum? You can horde that extra income to pay for just that.

That’s income investing. That’s financial freedom. That is available to you. The choice is if you’ll take hold of it. Will you?

Be the first to comment