TokenPhoto/E+ via Getty Images

Nickel cobalt

There’s no doubt that nickel demand is going to rise in the years to come, so too cobalt. They’re both required in the batteries for the electric vehicle revolution. That they’re often found in the same ores means that nickel cobalt projects should be in fashion these days and they are.

So, great, if we’ve got a nickel cobalt project that looks ready to go – or at least ready to develop to the next stage – then that looks interesting, obviously.

We might temper this excitement a little bit with the knowledge that those $100,000 a ton numbers for nickel a couple of weeks back were in fact technical issues on the London Metals Exchange. A short squeeze rather than any real indicator of future nickel pricing.

On the other hand, who knows what’s going to happen to Russian supplies of both metals given events over Ukraine? A project that looks like it might work at current pricing should at least spark our interest.

Ardea Resources (OTCPK: ARRRF)

Ardea has an interesting such project at Kalgoorlie. This is in Australia, so it’s a stable economic and legal environment. Something that other possible sources such as DR Congo don’t boast so much about.

We should note that this is at a fairly early stage of development. Advanced stage exploration that is. They claim the largest Ni-Co resource in the developed world. But this is still resource, they’re some way from mining as yet.

The finances of the company reflect this. The company now runs at about a $200 million market capitalization and that’s up from more like $50 million just a few weeks back. We might usefully call this a microcap that just had a burst in the stock price.

Of course, having ridden a 300% rise would have been nice. That rise seems to have been sparked by this:

The award of Major Project Status recognizes the national and strategic significance of the Kalgoorlie Nickel Project (KNP) to the Australian economy and the Eastern Goldfields of Western Australia. • MPS provides Ardea access to the Major Projects Facilitation Agency for intergovernmental coordination of project support and approvals.

In and of itself that doesn’t mean very much but it does ease the path toward development. You get a bit more attention from the bureaucracy as you attempt to gain the varied licenses required.

Finances

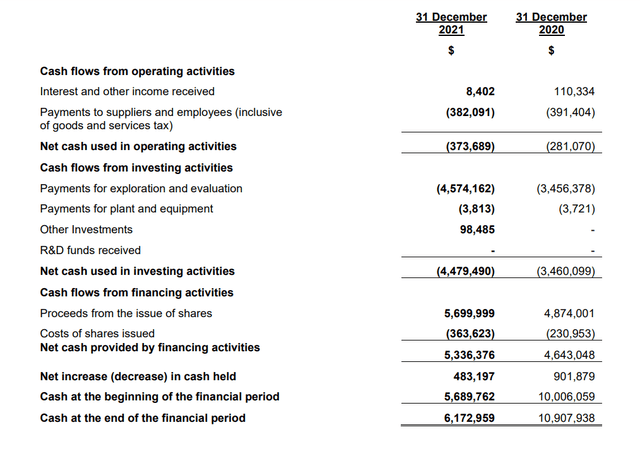

Ardea finances (Ardea Resources)

There’s nothing particularly interesting or different in these numbers. These are just what small scale and junior miner accounts look like. They’re spending money on the proving of the resource, the money comes from issuance of stock. This stage of any such project simply is a capital sink.

The amount of money spent – both that has been and is being – is small in respect of the size of the resource but that’s just happenstance.

That the company is currently small – that $200 million or so – does mean that any capital raise to actually develop the deposit is going to be highly dilutive. But again, that’s normal at this sort of stage.

We’ve not got any detailed plans for that development simply because we’re at too early a stage here. So, too, there’s no real valuation of the deposit, nor outlining of the costs of mining and processing. These are all things to be nailed down in this next stage of research and development. So, we’ve no details on net present values given costs and all that.

Actually, we’re not certain that this is even economic, given that we’ve not got those detailed numbers. But we’d probably assume that it is given the size of the deposit and the claims of mineralization.

So, my problems

I’ve two problems here with this. The first is pretty trivial. That 300% price jump off the bank of major project status looks overdone to me. Sure, it could be worth that but really? But that’s a short-term trading point.

The other one is perhaps still trivial. Or perhaps it speaks to something deeper. You make up your minds on whether I’m being trivial here or pedantic.

Sc is expected to be produced as a by-product of the Ni and Co. mining and processing at Goongarrie.

- Scandium ((Sc)) is used in aluminium-scandium alloys for high strength, light weight aerospace industry components and for sports equipment such as bicycle frames, fishing rods, golf iron shafts and baseball bats.

- Scandium iodide is used in mercury vapor lamps, which are used to replicate sunlight in studios for the film and television industry.

REEs are likely to be produced as a by-product of the Ni and Co. mining and processing at Goongarrie.

- Rare-earth elements (REEs) are used as components in high technology devices, including smart phones, digital cameras, computer hard disks, fluorescent and light-emitting-diode (LED) lights, flat screen televisions, computer monitors, and electronic displays.

Now I have a bit of a bugbear about scandium. As I’ve mentioned with Niocorp more than once. And for those who don’t know I used to be the wholesaler for 50% or more of the world’s scandium. This is my tiny little corner of the world where I’m the expert.

And, well, that looks like someone’s just copied a bit out of Wikipedia. Or from somewhere at least. Yes, Scandium Iodide is used in a certain form of light bulb, they have been used to recreate daylight for filming. It’s wider than that though, a whole class of halide, or metal iodide, bulbs use it. They’re on the way out, being replaced by LEDs. The usage is also tiny. Even back a few years it didn’t go much above 100kg a year.

I mean I know this stuff, I was the person handling it. GE, Phillips and Osram all got their scandium iodide through my hands. For a couple of years I supplied the Japanese as well, the only people using it and not me were the Chinese. It was a tiny, tiny, market. Just not the sort of thing that you’d be expecting a nickel miner to be thinking about.

Sure, there is Sc in there. It can be extracted – the Sumitomo plant in the Philippines does so. But the use as iodide seems trivial – and that worries me. Because it makes me think they’re just throwing what looks cool at their case, not thinking through whether it’s relevant or not.

The same is true, to a lesser extent, of the rare earths. Sure, there are REs in there. It’s possible to extract them. But the sort of concentrate you get would be worth $1,000 to $2,000 (one to two thousand dollars only) per ton. It’s just not a material consideration.

Additionally, significant Rare Earth Element (REE) and Rare Metal (RM) grades were indicated within the historic nickel-cobalt laterite mineralization, including: • WERC0371: 12m at 1.70% nickel, 0.151% cobalt, 28g/t scandium from 20m with; o 0.244% Total Rare Earth Oxide (TREO) includes neodymium (Nd), praseodymium (Pr), lanthanum (La), cerium o 1.320% Total Rare Metal Oxide (TRMO) Includes titanium (Ti), yttrium , zircon (Zr), niobium (Nb), hafnium , tantalum and tungsten • VKPRC0112: 4m at 1.66% nickel, 0.102% cobalt, 40g/t scandium from 29m with; o 0.1297% TREO o 0.7193% TRMO

Oh, come on. Rare Metal Oxides? There’s no way that Zr, Hf, Ti, W and so on will be extracted in any meaningful or price relevant manner. That’s like claiming that your back garden contains helium – sure it does but it’s not a relevant consideration about where you plant the onions.

And:

3.39kt scandium, from just Goongarrie deposits

But Sc is 15 tons a year, tops, for the world. Having 3,000 tons and more in your deposit is an irrelevance. A 200 year supply for the world from the one mine means that the selling price is going to be near zero.

My view

I don’t doubt there’s nickel and cobalt there. There’s more work to be done to show that it’s economic – that’s why the company isn’t claiming it is as yet.

But when they start talking about the bits – scandium, rare earths, some of the other trace elements – that really are my expertise they’re saying things that either don’t make sense or just aren’t relevant.

So I’m hesitant about everything else they say of course. Hey, perhaps this is just me but there we are.

The investor view

I’ve no doubt that this share – which is, really, a microcap which has only just risen above that level of market capitalization – will be a fun ride. Which direction it’s going to go in from here I’d not like to hazard a guess. But where I’m checking what they say against my own specific technical expertise I’m not impressed.

At best, to my mind, this is something to regard as a bet on other investors’ views of it. Is it in fashion or not? Whether we think that’s because there’s just not enough information there to judge it on the fundamentals, or if people share my concerns about some of the details being announced.

Seriously, someone who says they think they might gain revenue from the hafnium content* in the gangue really does need to be looked at with a very jaundiced eye.

Yes, I know I’m being picky. But some of the details here read like the baseball commentator querying whether they’ll kick on the fourth down. The sort of thing that brings into question everything else he’s just said.

*Because the hafnium is extraordinarily hard to separate from the zirconium and it’s impossible to make a profit doing so unless you’re trying to make nuclear grade Zr in the first place. Also, all zircon is 2-4% Hf anyway.

Be the first to comment