mphillips007/iStock via Getty Images

As most of my followers know, I normally don’t recommend double-digit yielding REITs because typically they underperform and because they’re just flat out risky.

Over the last twelve years or so (as long as I’ve been writing on Seeking Alpha) I’ve seen many high yielding REITs get demolished.

It’s always fascinating to see how the allure of chasing high yielding stocks creates such an appetite for getting rich quick.

This has played out time and time again, even during the Great Depression, in the book, If You Must Speculate Learn The Rules, Frank Williams explains,

We are all gamblers at heart. We cannot be blamed for wanting to get the best things in life in the quickest possible way. This is the spirit of America. The stock market seems to offer the most rapid road to fortune.

Of course, we know that Crypto and NFTs were not around in during the Great Depression, but Williams was certainly right about this,

The creed of the new speculator is: “I want to make a lot of money on little capital in a short time without working for it.” This is just as impossible in Wall Street as it is in any other place.

I’m thankful for my 100,000 or so followers here on Seeking Alpha who have entrusted me to steer them to safety, recognizing that there is no way to get rich owning high-yielding stocks, once again citing Williams,

The quick profits are just froth. They arouse a fever in the blood and don’t last. The worst thing that can happen to a new speculator is to make a lot of quick money on his first trade.

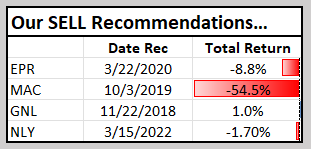

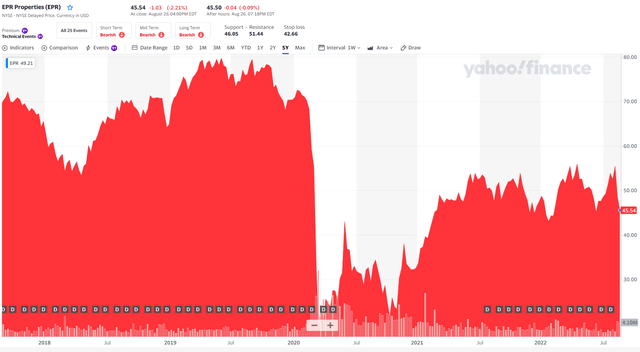

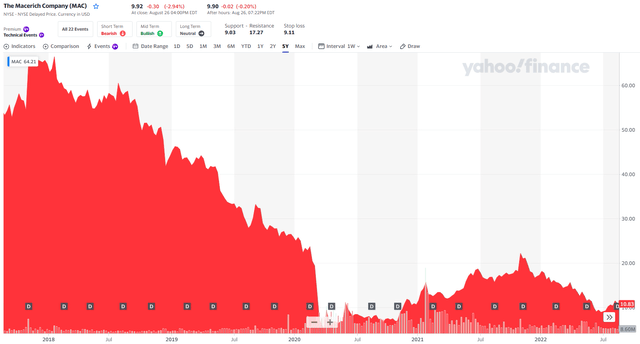

Back in 2020 I watched many investors gobbling up shares in EPR Properties (EPR) and Macerich (MAC), yet I was firm in my conviction that these stocks should be avoided.

Here’s what I said regarding EPR:

..we implore that conservative income investors look at EPR’s 33% yield dividend yield with distrust. At the end of the day, a dividend yield is only as good as its safety and in EPR’s case, we could certainly not sleep well at night owning shares of this company. One last time, please avoid being a high yield REIT investor. Focus on quality!

Here’s what I said about MAC:

…the dividend to net CFFO payout ratio has exceeded 100% of those 16 rolling 4Q periods. This means MAC management has no cash to put toward cash flow from investing (‘CFFI’) or investing activities, which is where things start getting interesting…

Just to highlight the risks of chasing yield, I’ll provide one more example, in which I provided a harbinger for yield chasing back in 2018. Here’s what I said about Global Net Lease (GNL):

Don’t be fooled, GNL looks like an amazing opportunity, but the company’s cost of capital will ultimately turn this high-yielding play into an “Emperor with no clothes” scenario. Or as Warren Buffett recounts, “Only when the tide goes out do you discover who’s been swimming naked.” Maintain SELL.

That’s a lot of red ink. These 3 REITs were all enticing high yielding picks, yet their stakeholders have experienced tremendous agony as losses have mounted. As Frank Williams explained,

Making money in the stock market depends largely on the speculator’s ability to obey certain common-sense rules.

As I informed members at iREIT on Alpha, I plan to put together a special report titled “The Common Sense Guide to High Yield Investing” in which I will explain the pros and cons for investing in high yielding securities. I’ll hereby say that:

A person has no right to speculate in securities unless he is in an assured position

In other words,

Men and women certainly should not speculate until they have paid the landlord, the butcher, and the tailor. They should have no doctor’s bills or insurance premiums overdue.

In other words, I’m now recommencing two of my highest yielding picks, but readers should recognize that they are speculative, and you should always maintain adequate diversification.

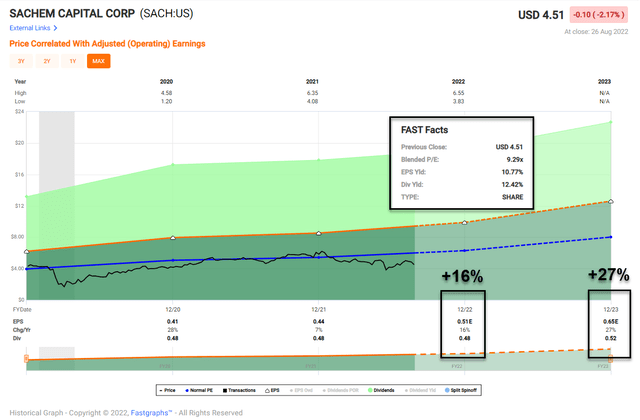

Sachem Capital (SACH): Yielding 12.4%

SACH is a commercial mREIT with loans that are secured by first-lien mortgages. They have a conservative maximum 70% loan-to-value ratio, and all loans require personal guarantees by the principals of the borrowers.

The key driver for SACH’s business model is residential housing demand, which continues to outpace current supply. The past decade of under-development led to an aging housing stock where the median house is about 40 years old.

SACH’s historical primary market (in Connecticut) has especially benefited from several pandemic trends:

- Movement out of dense urban locations, including New York City, to suburban neighborhoods

- Increased demand for larger, more spacious housing that can better accommodate the work-from-home movement

- Lower interest rates improving mortgage affordability for home purchasers.

Better yet, SACH can close quickly, as more flexibility in structuring loans leads to enhanced customer retention. It can actually close some loans in five days, whereas many competitors can take 3-6 months.

That’s because it centers more due diligence around collateral value rather than property cash flows or borrower’s credit. And this combination of speed and flexibility enables it to adapt to new market conditions.

That doesn’t mean it isn’t willing to take on other projects though. SACH’s latest initiative is to focus on larger-sized loans with financially stable, experienced developers.

SACH’s expertise in “hard-money lending” and extensive knowledge in their operating markets provide investors strong growth potential.

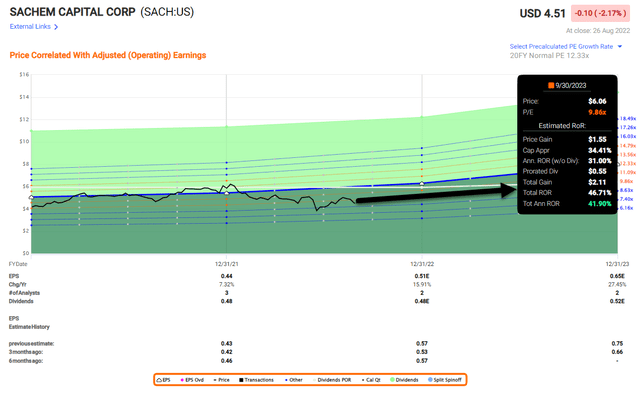

SACH recently (July) declared a quarterly dividend of $0.14 per share, a16.7% increase from prior dividend of $0.12, translating to an annual distribution of $.48 per share.

In 2021 the company generated $.44 per share (109% payout ratio) which is one of the reasons we label this as a speculative pick. However, in Q2-22 SACH generated EPS of $.16 per share which makes the dividend much safer (payout ratio of 88%).

As viewed above, analysts are forecasting SACH to grow EPS by 16% on 2002 and 27% om 2023. While we know SACH is a small cap ($173 mm market cap) and there are just three analysts providing estimates, we recognize the potential for this diamond in the rough. Recently I spoke with the Chief Credit Officer, Bill Haydon, and he explained,

…we have some inbound deal flow there. That’s pushed up some of our demand. We’ve increased our diligence as a result. So we feel like we need to be a little bit more discriminating because of that type of inbound deal flow.

So we’ll increase market share as a result of that. There is also a countervailing force that’s going on, where frequency of transfers will start to slow.

He added,

…our portfolio is pumping out in interest about close to about $50 million a year. So the return going forward is probably going to be very sustainable.

We consider SACH a rare bird, in which we can collect 12% income with the potential to generate strong total returns of 30% or higher. Of course, we spend a lot of time researching these smaller cap names because of the limited research provided by analysts.

Chicago Atlantic (REFI): Yielding 12.3%

REFI is another commercial mREIT that focuses on cannabis lending.

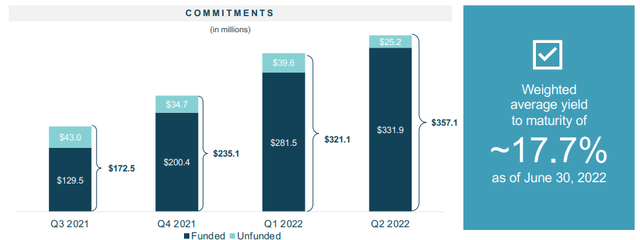

The company listed shares (on Nasdaq) on December 2021and as of Q2-22 the total loan commitments were approximately $357.1 million ($331.9 million funded, $25.2 million unfunded) across 22 portfolio companies. REFI’s portfolio’s weighted average yield to maturity was approximately 17.7%.

I recently caught up with the management team and they told me:

We focus on the limited license states or east of the Mississippi. We really hone in on great operators with proven track records, obviously in the cannabis space, but even just as important, outside of the cannabis space. Because this is a nascent industry, so it’s very rare that you’re going to have five plus years of track record to go off of.

They added,

…we really like vertically integrated operators. That is really our focus. Obviously, that mitigates any of the commodity price risk because commodity prices are much faster moving and will adjust to the market really fast. Obviously retail will adjust, but slower. So if you have your own vertical, you’re able to really capture a bigger piece of the margin and it’s a mitigator of risk.

Keep in mind, REFI is different from equity REITs such as Innovative Industrial (IIPR) or NewLake Capital (OTCQX:NLCP), as REFI’s management team told me,

As a lender, we have the ability to actually get stock pledges of the operating entities that hold the licenses they’re buying. In event of default, we could force our will, if necessary, and step into the shoes of the operator, which I think is a little harder to do on the equity REIT side because of the lack of having the stock pledges in place.

Since inception REGI has closed $1.4 billion of transactions that includes 46 loans. The company has over $850 mm in near-term loans (the pipeline) under evaluation right now and the gross portfolio yield is 17.7%.

In Q2-22 REFI generated total interest income of approximately $11.9 million with total expenses of ~$2.9 million (before provision for current expected credit losses).

Net Income was approximately $7.5 million, or $0.42 per weighted average diluted common share and Adjusted Distributable Earnings were ~$8.8 million, or $0.50 per weighted average diluted common share.

REFI had borrowed $45 million on its $65 million secured credit facility, resulting in a leverage ratio (debt to book value) of approximately 16.8%. Subsequent to quarter end, REFI drew an additional $8 million on the facility, leaving $12.0 million of capacity. The management team told me,

We have no leverage other than the 65 million. It is highly unusual to be a mortgage REIT at that level of leverage. We have a first-in-class team able to work out any of the loans that we have in case that becomes an issue.

And on top of that, I think if you’re comparing us to other mortgage REITs. We’re at a 60% loan-to-value where other mortgage REITs are trying to be at the 90% loan-to-value.

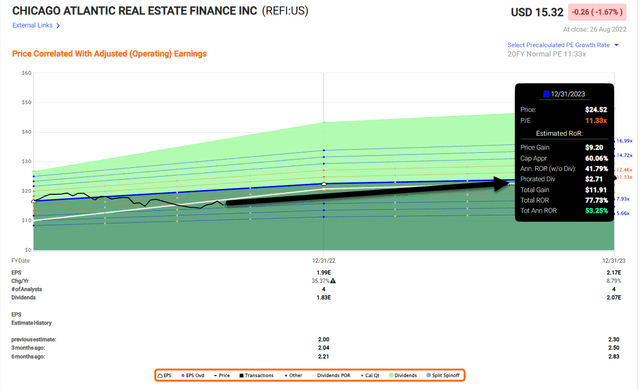

In June REFI declared a $.47 quarterly dividend, a 17.5% increase from the prior dividend of $0.40 per share. That translates into a current yield of 12.3%.

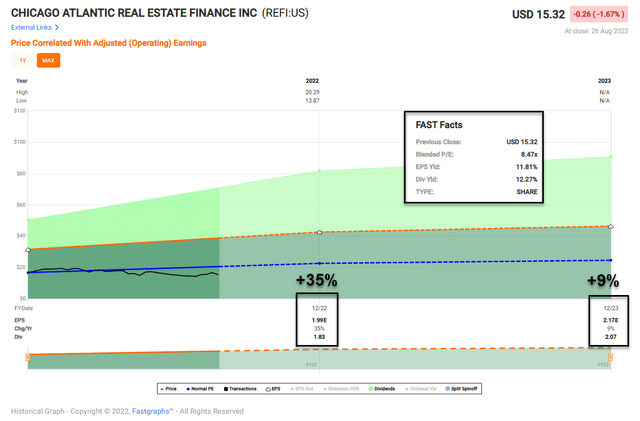

Once again, like SACH is a small cap REIT (and REFI is externally managed), which means there’s a small analyst base providing estimates. As viewed above, analysts (4) are providing estimated EPS of +35% in 2022 and +9% in 2023.

REFI is trading at 8.5x P/EPS which makes this an extremely cheap REIT, and the double-digit 12.3% dividend yield is enticing. We also like the “limited license” focus which certainly mitigates risk (like we’re seeing now with IIPR’s default with Kings Garden in California).

Thus, REFI (like SACH) is offering a mouthwatering 12%+ yield with solid total return prospects.

In Closing…

Frank Williams knew a thing or two about adversity, as a Wall Street writer in the 1920’s he witnessed the good times and bad.

Similarly, I went through the Great Recession with a new mindset, to avoid speculation, and to focus on principal preservation.

I’ll leave you with a few of The Golden Rules expressed by Mr. Williams:

Don’t speculate unless you have plenty of time to think about it.

Look out for the buying fever; it is a dangerous disease…

Use your mistakes as object-lessons – the person who makes the same mistake twice deserves no sympathy.

Don’t let emotion or prejudice warp your judgement. Base your operations on facts.

Let me be perfectly clear, these two picks are speculative and before pulling the trigger make sure that you have “paid the landlord, the butcher, and the tailor. They should have no doctor’s bills or insurance premiums overdue.”

iREIT

All the best!

Be the first to comment