monsitj

Written by Nick Ackerman. This article was originally published to members of Cash Builder Opportunities on July 6th, 2022.

There are several ways to grow your income over time. That is investing in dividend growth stocks that periodically raise their dividends. There are a good number of those companies in the U.S. that do this on an annual basis. (Hint: the two stocks we are discussing today are two of them that increase annually.)

Another way to build your income is to put new money into a stock. One of the ways to put fresh capital into stock is through a dividend reinvestment plan or DRIP. I often take all my dividends through cash and reinvest “manually” where I see the best opportunities. By turning on a DRIP, the investments will be working passively in the background without my intervention.

However, the market has been beaten down, and there are two stocks in particular that I want to start building up a large position. That would be 3M and STAG Industrial. Two completely different investments, but they are attractively valued, nonetheless.

They are also slower raisers for various reasons too. Turning the DRIP on for these shares means we can compound the income by increasing the number of shares owned.

3M Company (MMM)

MMM is quite a controversial stock right now. They have huge headwinds in the way of litigation. China is another issue as the CEO announced they see a $0.30/share hit from the China lockdowns.

As I write this, the news that they just reached an agreement on the PFAS issue with the Belgian government came through. They have agreed to pay €571 million. That seems sizeable but isn’t the worst thing they are looking at.

That’s where the hearing plug lawsuits come in. This is from former U.S. military members that have taken action against MMM for hearing loss or damage. I don’t want to come off as being cold because it is on a more touchy subject. I respect the military and believe they should have the best equipment to handle their job. A job that I could never do. On the other hand, the lawsuits have become a bit egregious regarding what they are ordered to pay.

In the latest case, the company was ordered to pay $77.5 million to a single military veteran. This will presumably be challenged and settled for less. However, we were looking at nearly 300,000 U.S. service members suing MMM. This is a number that has dwindled for various reasons. This will likely take years to resolve and many, many dollars to settle.

I want to reiterate that I believe the men and women in the U.S. service should be taken care of. It gets a bit trickier because they weren’t exactly MMM earplugs at first. They were made by Aearo Technologies, and 3M bought that company in 2008. Of course, 3M continued to sell them to the U.S. military through 2015.

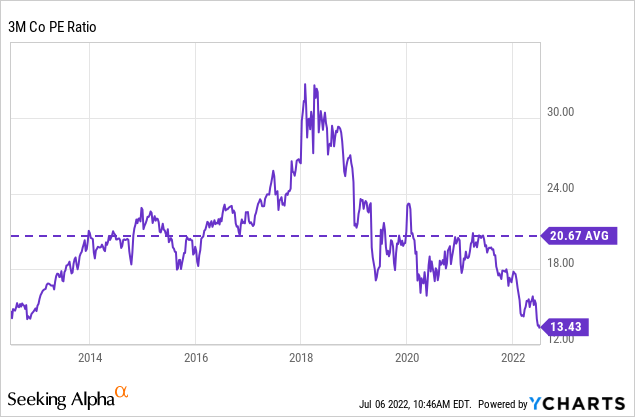

These unknowns of what the future outcomes might be, as well as a potential recession coming, have resulted in 3M to be pushed down to a forward P/E of 12.15. The average P/E ratio of the last decade had shares above 20.

Ycharts

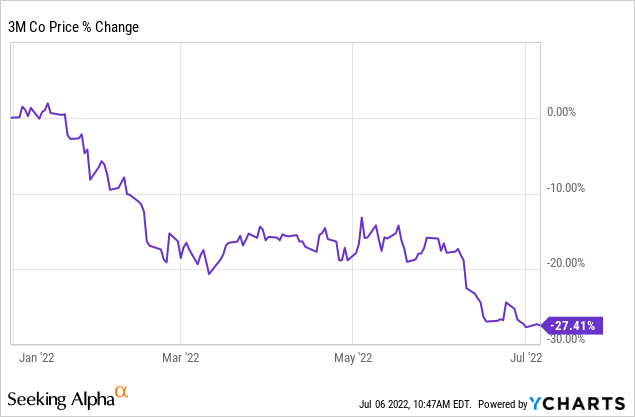

On a YTD basis, the stock has declined by over 27%. At the time of writing, shares are down nearly 37% from the 52-week high.

Ycharts

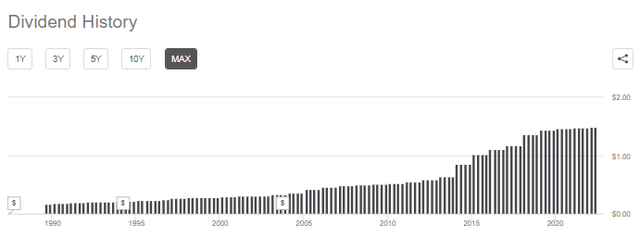

The latest declines have pushed the company’s yield to over 4.6%. MMM is likely to continue to be a slower dividend grower. It wasn’t a particularly fast dividend grower except through 2015 to around 2019 anyway. They’ve been conservative over many years, and that’s why they’ve been able to raise their dividend for 63 years straight.

MMM Dividend History (Seeking Alpha)

With around a 59.30% payout ratio, the stock doesn’t appear to be at risk of a cut. Even if a recession happens, they should be able to manage through. So many years of dividend growth means they are seriously committed to continuing to grow their dividend.

Through the next several years, it’ll likely continue to be the token $0.01 per quarter boost until the lawsuits are resolved. Therefore, turning the DRIP on will help boost that compounding and grow the income through that process.

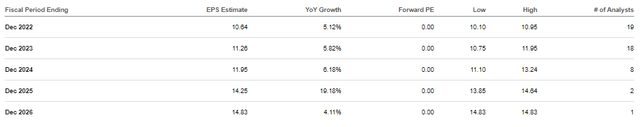

For what it’s worth, analysts expect 3M to continue to grow its earnings over the next five years.

3M EPS Growth Estimates (Seeking Alpha)

STAG Industrial (STAG)

This is another slower dividend grower. This is an industrial REIT that will be associated with the continued acceleration of e-commerce as that is expected to continue growing more and more.

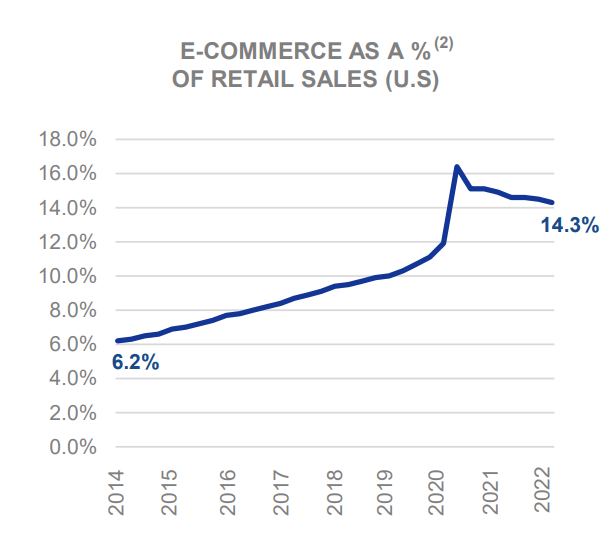

E-Commerce Trend (STAG Industrial)

They note that by 2030, they expect e-commerce to reach 30% of retail sales. In the above graph that they’ve provided in their investor relations slide, we can see a sharp spike in 2020. That’s obviously due to the pandemic and COVID lockdowns. While some of that has come back down, it seems to have accelerated and retained some of the increased demand. It has only trended down a bit since. It remains to be seen if this trend continues or if the trend of a higher portion of sales coming via e-commerce will resume.

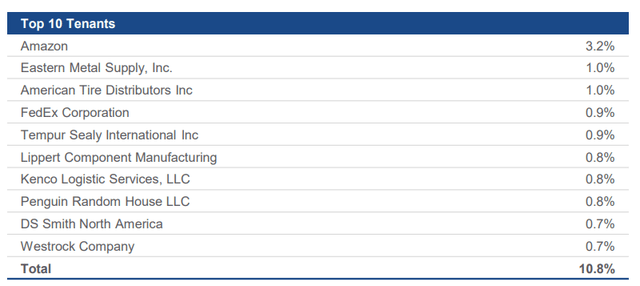

E-commerce is so important for STAG because they operate warehouses. Warehouses that are used by e-commerce companies and logistics companies. Their top tenants include big names such as Amazon (AMZN) and FedEx (FDX).

STAG Top Tenants (STAG Industrial)

AMZN is a large tenant for them, but they are also fairly diversified across the board. The top ten names represent only around 11% of their annual base rent.

STAG pays a monthly dividend, and that has its own perks. For one, we’ll be compounding a bit faster when we DRIP. It isn’t noticeable over shorter periods but can add up over the years. They haven’t missed a dividend payment in their 10 years. However, the growth here is slow and hardly noticeable on a dividend chart.

STAG Dividend History (Seeking Alpha)

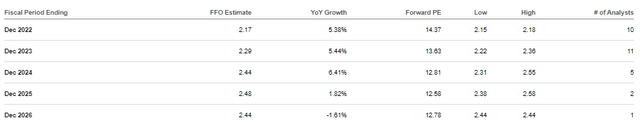

Helping to support that dividend to investors is the CAD payout ratio of 82.2% in the first quarter of 2022, as reported in their investor presentation. Additionally, analysts believe that their FFO should increase over the next four years.

STAG FFO Expectations (Seeking Alpha)

With earnings expected to accelerate a bit faster going forward, there is hope that the dividend growth will follow too. Over the last 5 years, it has had a CAGR of just 0.85%.

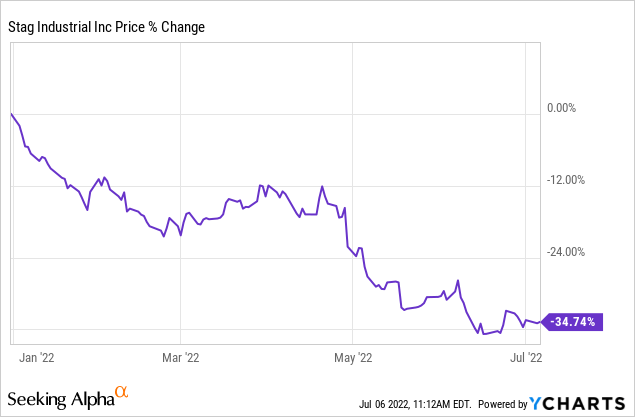

The forward P/FFO of the REIT has come down to 14.37. On a YTD basis, the price has fallen nearly 35%.

Ycharts

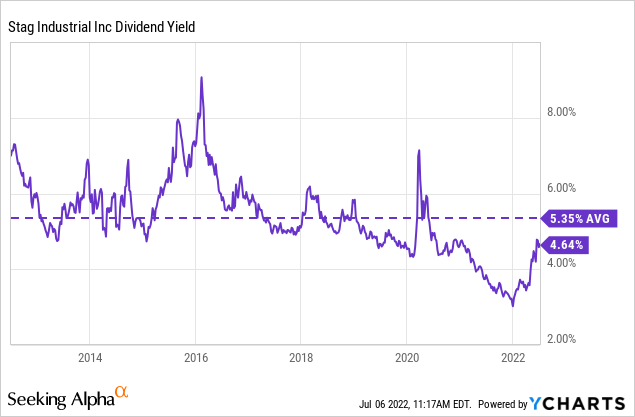

The latest decline has also pushed the REIT to trade closer to its decade-long average yield of 5.35%. While we aren’t there yet, we don’t necessarily have to be if the growth comes through and they start raising the payout more aggressively.

Ycharts

The main risk here, in my opinion, is that a slowdown could impact the REIT. That 5%+ growth might not materialize if we enter a recession and the need to build out or acquire new warehouses declines.

Conclusion

MMM and STAG aren’t risk-free investments, but they have come down meaningfully. They’ve come down even more than the broader markets and other names. Instead of fearing this, though, I’m going to take the opportunity to DRIP into these shares.

This way, I’ll add further exposure through a dollar-cost average method. STAG pays a monthly dividend, so the compounding in that name can happen a bit faster. For 3M, they might be quarterly, but they will likely stay lower for the next several years due to litigation headwinds.

Both are slower dividend growers. This will also be one way to boost up those payouts by putting this capital back to work where it’s coming from.

Be the first to comment