MicroStockHub/iStock via Getty Images

The market has recovered some in recent weeks thanks to encouraging inflation data and a resilient jobs market. Given that October CPI came in weaker than expected, it appears that the Federal Reserve’s rate-hiking efforts might finally be making some meaningful impact at reducing inflation. If this deceleration of inflation continues, it could enable the Federal Reserve to pivot away from interest rate hikes sometime by mid 2023, which in turn could be in time to still achieve a relatively “soft landing” for the broader economy and avoid massive jumps in unemployment and severe declines in consumer spending that would undoubtedly lead to a downward spiral of the economy.

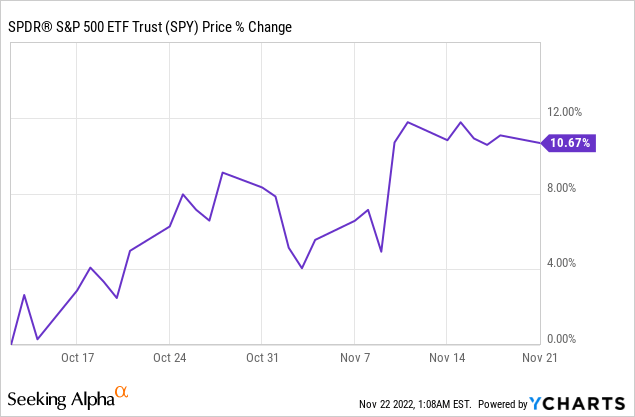

This encouraging news, has pushed the S&P 500 (SPY)(VOO) higher in recent weeks:

However, there are still come compelling bargains left in the high yield space. In this article, we share 3 of our top high yield picks that are on fire sale during the start of holiday shopping season and we also discuss 2 stocks that look cheap but we are avoiding.

2 Black Friday Bargains To Buy

At High Yield Investor, we are always looking for stocks that pay out high yields, appear to be deeply undervalued, and are well-run with management that has a considerable vested interest in generating attractive total returns for investors.

Two of our favorites of the moment are Energy Transfer (ET) and Algonquin Power & Utilities (AQN).

Both ET and AQN benefit from recession-resistant business models. As a very large energy midstream infrastructure business, ET enjoys significant diversification across geographies and energy commodities and generates fairly stable cash flows from long-term fixed-fee take-or-pay pipeline contracts. Only a small minority of the cash flows are considered commodity price sensitive.

As a ~70% regulated water, gas, and electricity utility and a ~30% renewable power generation business, AQN has an even more stable cash flow profile thanks to the long-term power purchase agreements attached to its renewable assets (including its large stake in Atlantica Sustainable Infrastructure (AY)) and the recession-proof regulated utilities businesses.

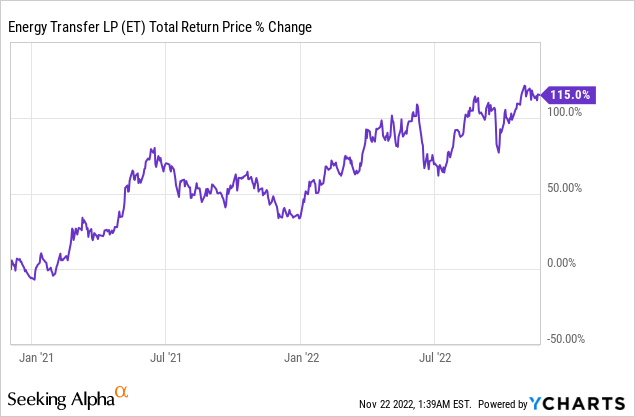

On top of that, both have investment grade balance sheets, and sky-high dividend/distribution yields. ET is likely going to be paying out a distribution of $1.22 per unit in 2023, giving it a ~10% forward yield, while AQN’s dividend yield is currently ~9.5%.

They both also trade at a steep valuation discount based on recent history. ET trades at a 7.68x EV/EBITDA multiple, well below its 5-year average of 8.91x and its P/DCF ratio if ~4.7x, which is obviously extremely low given the stability of the cash flow profile and relative strength of the balance sheet. Meanwhile, AQN trades at a 10.05 EV/EBITDA and a 10.54x price to normalized earnings ratio compared to its respective 5-year average multiples of 13.14x and 19.12x.

When combining the multiple expansion potential with the current yields at both ET and AQN, the total return potential is mouthwatering even before considering long-term growth prospects. As we have written about at length in past articles, ET is one of the most compelling high yield opportunities today because it remains dirt cheap despite firing on all cylinders.

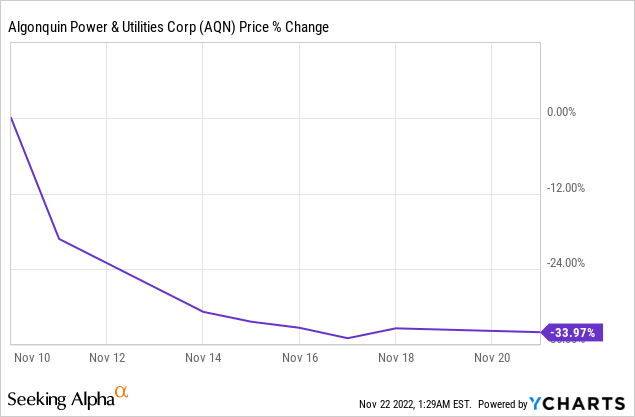

Meanwhile, AQN’s stock price has been pummeled lately on a disappointing downward revision in guidance and uncertainty about the company’s ability to fund its ambitious $12.4 billion growth spending plan in the coming years.

However, after recently interviewing the company and doing a detailed analysis for members of High Yield Investor, we have concluded that the dividend is unlikely to be cut and that the company has sufficient levers to pull in order to retain its investment grade credit rating as well. We believe that once management can clearly communicate this to the market at their upcoming Investor Day, the stock should shoot significantly higher. Adding to our confidence in the thesis is the fact that insiders recently loaded up on AQN stock to the tune of 1.7 million Canadian Dollars (including the CEO more than doubling his stake). If they knew that a dividend cut was a likely probability, they would not be pouring so much of their own money into the stock.

We bought ET back in early December of 2020 and it has been a big winner for us since then. We believe that further upside lies ahead.

Meanwhile, AQN has struggled mightily over that same time frame, offering us an opportunity to buy the dip and recently double down when our conviction was strengthened after speaking with the company.

2 Black Friday “Bargains” To Avoid

While we are always interested in a great bargain at High Yield Investor, we do not buy every stock that looks cheap on the block. Two stocks that we have been avoiding and plan to continue doing so are AT&T (T) and Lumen Technologies (LUMN).

Both are in the telecommunications industry and both are investing aggressively in fiber and other capital intensive projects right now despite generating little to no topline growth for all their efforts and expenses. Ultimately, we view both as money pits for the time being, no matter how cheap their stock prices look on the surface.

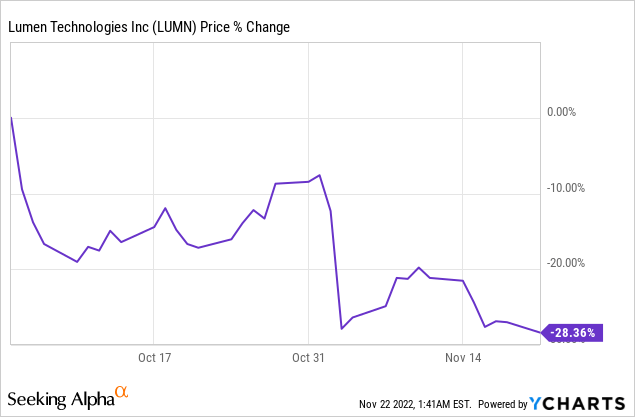

Fortunately, we sold a large tranche of our LUMN position back in May at a profit and then fully exited in early October at $8 per share. Shortly after that we warned investors on the public site that a dividend cut was likely imminent for Lumen Technologies, stating:

We recently contacted the company with a list of questions and in a recent note that we shared with members of High Yield Investor… we discussed our takeaways from that discussion… [LUMN] appears to be keeping the option open – if not outright planning – to cut the dividend… While we do think a dividend cut is already priced in, to some extent, it is still very possible that the stock will get hit further if the dividend gets slashed.

Thankfully we got out just in time as shortly thereafter the dividend was not only cut, but eliminated and the stock price has continued its seemingly irreversible descent:

Moving forward, while LUMN certainly looks extremely cheap, we are remaining out of the stock for several reasons. First and foremost, it no longer pays a dividend which is a requirement for us at High Yield Investor. Second, we do not trust that management will truly redirect the full savings from the eliminated dividend into buybacks, but instead will prioritize spending that money on “growth” investments that have as of yet to bear any real fruit. Third, management has repeatedly misled shareholders in the past about capital allocation priorities (such as the dividend) and has also repeatedly fallen short on achieving growth projections. While it is true that a new CEO has just taken over the reins of the company, until there is clear evidence that the company’s DNA has changed and it has truly become an under promise and over deliver type of company, LUMN will likely continue to destroy shareholder value, regardless of how cheap the stock price might look.

Meanwhile, T is a stock that we have been warning investors about for years. In fact, we warned investors ahead of their dividend freeze and eventual cut that the dividend was not nearly as safe as advertised. Meanwhile, on top of slashing its dividend, the company has destroyed shareholder value on a grand scale thanks to overleveraging the balance sheet in pursuit of ill-fated acquisitions such as DirectTV and ultimately massively underperforming the S&P 500 for years.

Despite its dividend cut and spinoff of the media assets along with a hefty pile of debt, the balance sheet is still too heavily leveraged, especially given the large CapEx spend that will be required to keep the core telecom business competitive in the future. Management even admitted at a recent investor conference that money for meaningful dividend growth and/or buybacks is pretty much not an option for the next several years:

we’re going to…get the balance sheet in order, as we get to 2.5x debt-to-EBITDA and ensure that by the end of 2025, we’re in a much better place in that regard…we’re using discretionary money to get the balance sheet back in order.

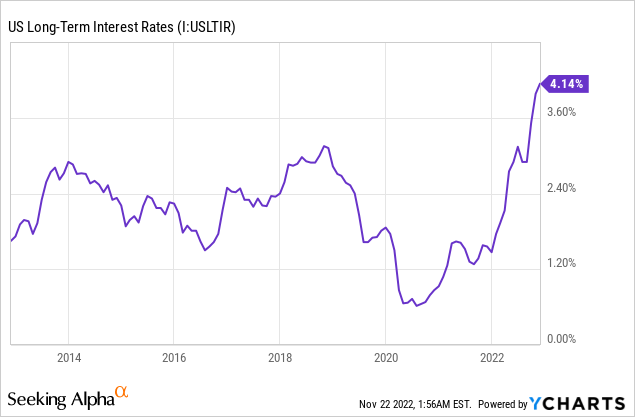

When you combine the anemic outlook for dividend growth and buybacks with the consensus analyst estimates that put revenue growth at a 0.2% CAGR through 2025, you place a heavy burden on multiple expansion potential and the dividend yield to drive shareholder total returns. The 5.9% current dividend yield is a pretty good start and we agree that this should be safe for quite some time to come. However, the valuation multiple is not at all exciting. T’s EV/EBITDA is currently 7.4x, which is at a premium to its 5 and 10 year averages. Meanwhile, interest rates are at the highest levels they have been over the past decade and will likely head a little bit higher from here as well.

As a result, we see little to no potential for meaningful multiple expansion moving forward, pretty much capping T’s annualized total return potential at ~6% over the next several years at least. With untrustworthy management and few catalysts to launch the stock higher, we see little to no reason to invest here.

Investor Takeaway

It’s a tough time to be an investor given all of the macroeconomic and geopolitical uncertainty in our world today. On top of that, there are numerous value traps like LUMN and T which constantly suck in investors searching for a compelling bargain that is too cheap to ignore only to get burned with perennial underperformance and deep dividend cuts.

Fortunately, however, compelling Black Friday bargains with asymmetrically positive risk-reward profiles are still out there. At High Yield Investor, we are aggressively searching for and buying these opportunities like ET and AQN while they still last as we believe that once the Federal Reserve pivots on its interest rate policy, these opportunities will vanish.

Be the first to comment