Funtap/iStock via Getty Images

Written by Nick Ackerman. A version of this article was published to members of Cash Builder Opportunities on September 24th, 2022.

We are seeing attractive valuations open up as pockets of the market are hitting fresh lows for 2022. Two business development company names on my watchlist have caught my attention. That would be WhiteHorse Finance (WHF) and PennantPark Floating Rate Capital (PFLT).

Both of these names have been on my watchlist for quite some time. They have been plunging along with the market, and some good valuations have been opening up. A BDC can trade at a discount or premium to its actual underlying net asset value. While they aren’t immune to drops in their NAV, the share price often overshoots the downside experienced in the NAV during these volatile periods.

On top of this, they have provided regular and steady dividends since their inception. That doesn’t mean they are guaranteed to going forward, but they are also in a situation where they can benefit from rising rates. That’s because the majority of the portfolios that they carry are floating-rate debt through loans, as is generally the case with BDCs.

WhiteHorse Finance

WHF is “an externally managed, non-diversified, closed-end management investment company that has elected to be treated as a business development company under the Investment Company Act of 1940.”

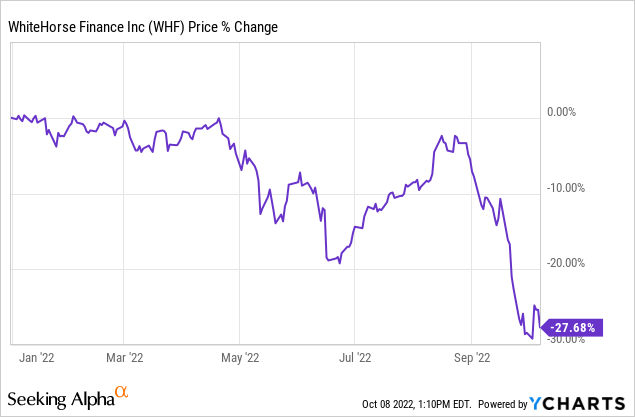

At this time, WHF has declined over 27% on a YTD basis. Most of this decline coming within the last few weeks. This was once again when the market realized that the Fed was likely to cause a recession. Of course, that was the fear heading into June also, but a soft inflation report shortly after that provided enough fuel to push the markets higher. We now know that the following inflation report was above expectations once again.

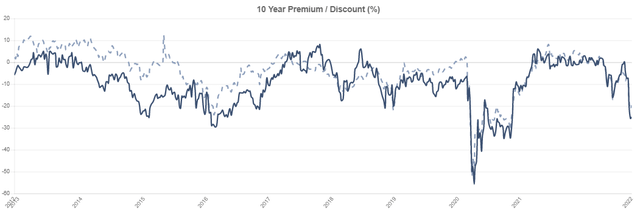

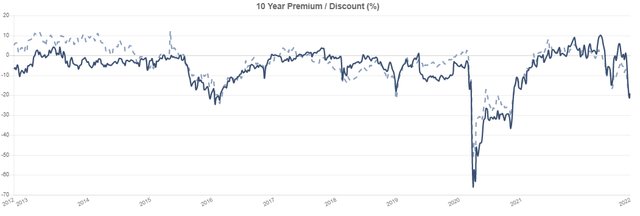

With that being said, here is what the discount/premium chart looks like for WHF. We can see that this is at the bottom of the range, except for 2020 and 2016, when these lows were breached. That doesn’t mean that WHF couldn’t further sell-off from here, but it is getting to a level that is looking quite enticing to start at least an initial position. The discount at this time is 25.02% based on the June 30th NAV of $14.95.

WHF Discount History (CEFData)

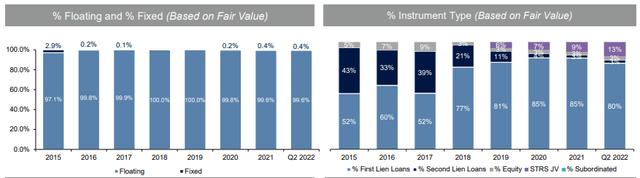

Their portfolio is set up for this environment as well. 99.6% of their portfolio is invested in floating-rate debt. This is comprised primarily of first-lien loans. They also have “STRS JV.” This is a joint venture with the Company and State Teachers Retirement Systems of Ohio. This is essentially a portion of their portfolio that is further invested in senior secured first and second-lien term loans. So, essentially, just more of what the rest of the portfolio is invested in.

Over the years, we can see that they’ve moved away from the heavier weighting in second-lien loans.

WHF Portfolio (WhiteHorse Finance)

At this point, the last two quarters showed 0% non-accruals. In Q2 2020, this spiked to 7.4% but came down rapidly. While 0% non-accruals would be great to see going forward, with a recession, this will likely come up at some point.

With interest rates rising, these floating-rate securities will start paying more to the BDC. At some point, rates could rise too rapidly, which would cause some damage. What point that starts to happen is really unknown at this time. This could especially be true when entering a recession because they lend to smaller companies that aren’t as financially stable. Getting hit with higher interest expenses and a possible slowdown in business could be a double-whammy for these companies. Which is more of why we’ve seen such sharp drops in BDCs lately, too.

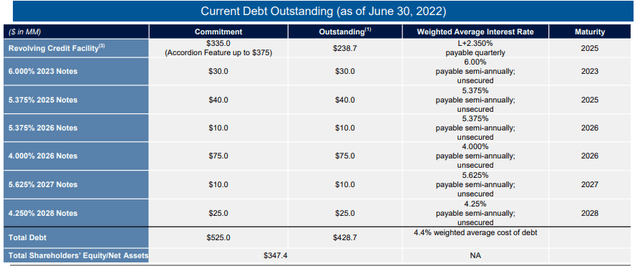

That aside, to help further support higher interest rates benefiting BDCs is the often fixed-rate portion of their debt. WHF has a large outstanding credit facility that is based on LIBOR plus 2.35%. However, they also have roughly the other half of their debt in Notes with various yields and maturities.

This sets up WHF in a position where most of its underlying holdings will start to pay more. At the same time, their interest expenses will be more sheltered from these rising rates.

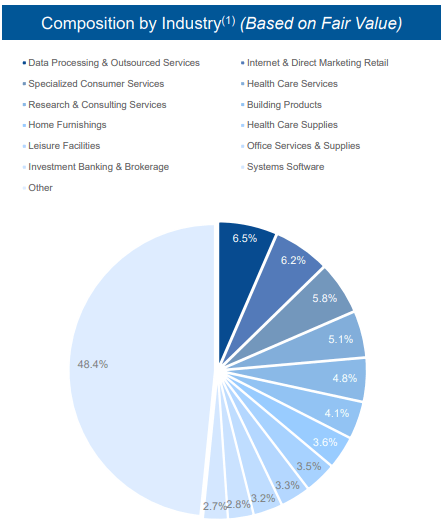

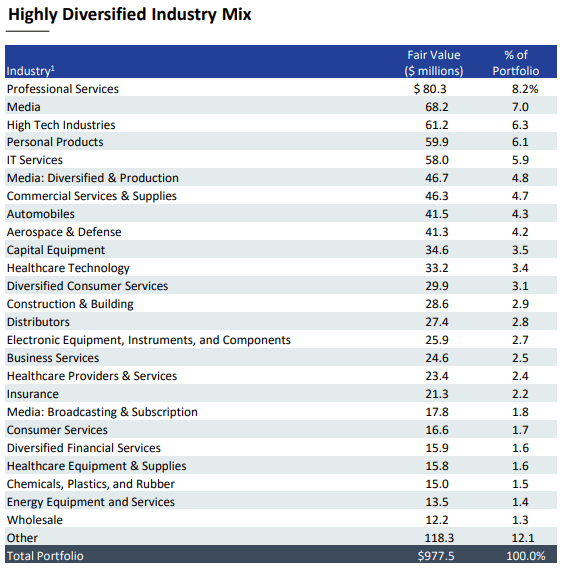

The fund is also invested in quite a diverse basket of industries. That’s despite the “non-diversified” label that they apply above. These various exposures can help during times of an economic slowdown. That’s because some industries will do better in different environments. As a simple example, healthcare services probably won’t get hit in a recession as badly relative to the home furnishings industry.

WHF Portfolio Industry (WhiteHorse)

Shifting over to a look at the dividend now. This BDC has paid a quarterly $0.355 since inception, with a few supplementals along the way.

WHF Dividend Coverage (WhiteHorse Finance)

The coverage has been missing more lately than hitting, but again, that’s where the rising rates can come in to help. The latest price plunge has pushed the BDC to yield 12.67%, where coverage has only had minor misses that could easily change.

PennantPark Floating Rate Capital

PFLT is also a “closed-end, externally managed, non-diversified investment company that has elected to be treated as a BDC under the 1940 Act.”

As we saw above for WHF, PFLT’s discount has widened out meaningfully lately. At 19%, it isn’t quite as deep as WHF. We also see that the discount is near the lower end for PFLT when looking at its history. We see the same notable 2020 and 2016 periods present lower discounts.

PFLT Discount History (CEFData)

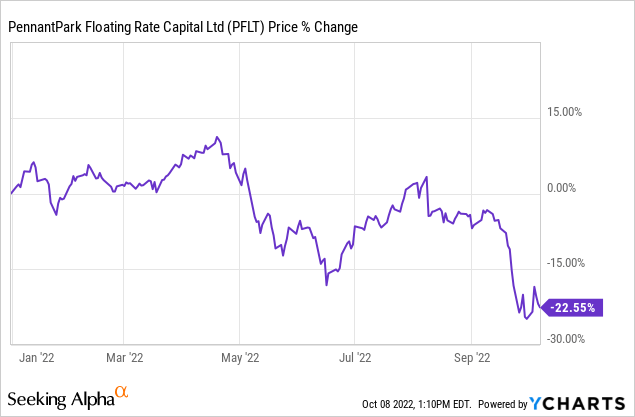

The drop in PFLT has been less severe relative to WHF.

They invest “in middle market companies located primarily in the U.S., with a proven management team, competitive market positions, strong cash flow, growth potential, and viable exit strategies.”

Worth noting is that they very recently upsized their credit facility from $300 to $366 million. That can be helpful during this environment when they have the flexibility to put some more capital to work. This credit facility has an interest rate of LIBOR plus 2.25%. In their last quarterly report, they had $259.3 million outstanding from their credit facility.

Additionally, in August, they issued new common shares through a secondary offering. That generally provides a short-term catalyst as the price slumps. We recently took advantage of that with shares of Trinity Capital (TRIN).

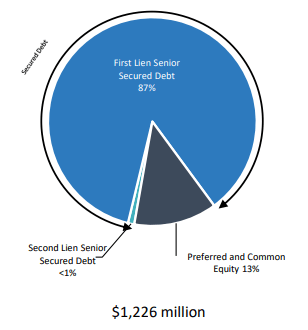

That said, they should be pretty flush with cash to deploy in their portfolio, which is largely first lien senior secured debt, similar to WHF. Though PFLT does have a meaningful exposure to preferred and common equity that can act as a kicker.

PFLT Portfolio (PennantPark)

100% of PFLT’s debt portfolio is floating rate. That being said, that leaves the floating rate portion shy of WHF. WHF has 99.6% of its entire portfolio in floating rate debt. That being said, they are similarly diversified in industry exposure.

PFLT Portfolio Industry (PennantPark)

In addition to the credit facility, they have $97 million in 2023 Notes at a rate of 4.3%. They also have $185 million in 2026 Notes paying 4.25%.

Then they also have $301.4 million in 2031 Asset-Backed Debt. This gets a bit more complicated because it is in different tranches at different rates itself.

(i) $78.5 million Class A-1 Senior Secured Floating Rate Loans maturing 2031, which bear interest at the three-month LIBOR plus 1.8%, (ii) $15.0 million Class A-2 Senior Secured Fixed Rate Notes due 2031, which bear interest at 3.7%, (iii) $14.0 million Class B-1 Senior Secured Floating Rate Notes due 2031, which bear interest at the threemonth LIBOR plus 2.9%, (iv) $16.0 million Class B-2 Senior Secured Fixed Rate Notes due 2031, which bear interest at 4.3%, (v) $19.0 million Class C‑1 Secured Deferrable Floating Rate Notes due 2031, which bear interest at the three-month LIBOR plus 4.0%, (vi) $8.0 million Class C-2 Secured Deferrable Fixed Rate Notes due 2031, which bear interest at 5.4%, and (vii) $18.0 million Class D Secured Deferrable Floating Rate Notes due 2031, which bear interest at the three-month LIBOR plus 4.8% and (b) the borrowing of $77.5 million Class A‑1 Senior Secured Floating Rate Loans due 2031, which bear interest at the three-month LIBOR plus 1.8%, under a credit agreement by and among the Securitization Issuers, as borrowers, various financial institutions, as lenders, and U.S. Bank National Association, as collateral agent and as loan agent

That means that PFLT is going to be similar to WHF. Not all their outstanding debt will be sheltered from higher interest rates. However, a portion of it will be, which is better than having all floating rate borrowings.

They had two portfolio companies in non-accrual status. That amounted to just 0.9% of the portfolio cost or 0.1% of the fair value of the portfolio. That was down from the 2.7% and 2.6% six months prior. That shows a similar trend to WHF, where the portfolios are not having significant underlying issues at this time.

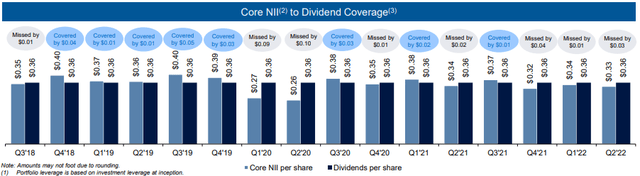

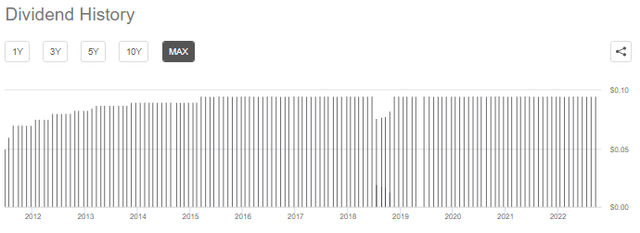

For the dividend, PFLT has been paying monthly, which can be more attractive for some investors. The latest $0.095 has been in place since early 2015. Before that, the BDC had only increased its dividend since its inception in 2011.

In 2018, the payouts were broken up differently, making it appear that they had been cut. This appears to be related to tax characterization reasons. For example, the September 2018 payout was split at $0.078 and $0.017, which still equals the $0.095 monthly payout. However, it was still the $1.14 in annual payouts that the $0.095 works out to.

With the price drop lately, the yield has been pushed up to 11.53%.

PFLT Dividend History (Seeking Alpha)

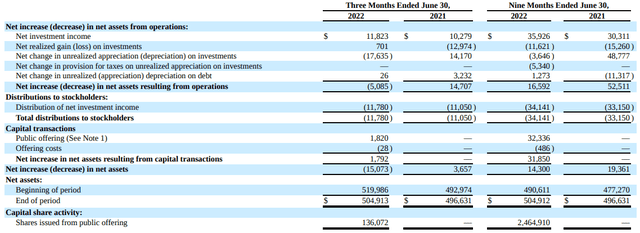

For the latest quarter and for the nine months ending June 30th, 2022, we can see that NII has covered the payout to investors.

PFLT Last Quarter Earnings (PennantPark)

Conclusion

WHF and PFLT are both presenting fairly attractive options in this volatile market. Both have run to some deep discounts and should benefit from higher interest rates. WHF is at a deeper discount, but its dividend coverage has been a bit shy lately. PFLT is at a slightly narrower discount but pays monthly and has been covering the payout from net investment income.

The current environment has some serious risks for BDCs that one should consider. They will be investing in smaller and less financially stable companies. That means they are more susceptible to soft economic periods. Thus, why we see these attractive valuations opening up in the first place. It could make sense to dollar-cost average, buying in smaller portions over the coming six to twelve months. That way, one can take advantage of potentially even lower lows from here.

Be the first to comment