evgenyb/iStock via Getty Images

Investment Thesis

Mosaic (NYSE:MOS) has seen its share price fall meaningfully in the past few weeks.

Indeed, since my previous bullish analysis, there’s been ample mounting evidence that both potash and phosphate fertilizer prices will remain high.

What’s more, I make the argument that paying 5x this year’s free cash flows for Mosaic is a very attractive valuation.

Furthermore, recent data points from both Mosaic and Nutrien (NTR) together imply that Mosaic’s elevated free cash flow could last into early 2023.

Hence, I rate the stock a buy.

Mosaic’s Changing Dynamics

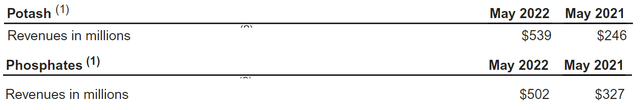

This time last year, Mosaic’s biggest segment was its Phosphate segment. The Phosphate segment was its biggest segment, with the Potash segment coming in a very close second place.

While Mosaic Fertilizantes, where Mosaic sells phosphate and potash-based crop nutrients in Brazil, comes in distant third place. In fact, one can think of Mosaic’s Fertilizant business as a low-margin distribution outlet. It adds a lot to revenues but doesn’t materially move the bottom line much.

Fast-forward to Q1 2022 and this changed. Mosaic’s Potash segment is now the biggest segment, and I believe that from Q2 and going further into the fall of 2022 and early 2023, I argue that Mosaic’s Potash segment will continue to be Mosaic’s biggest segment.

Simply put, I declare that Mosaic’s Potash segment will offer investors the most interesting dynamics.

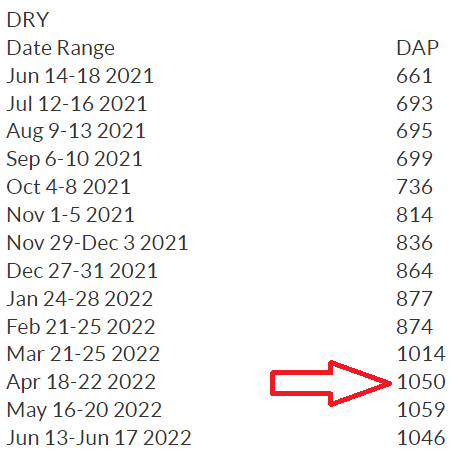

Along these lines, consider the figures above. What we see is increased evidence of the dynamics that we saw in Q1 2022.

We see Mosaic’s Potash segment outdistancing itself from its Phosphate segment, with Potash increasing by 119% y/y. That said, Mosaic’s Phosphate segment hasn’t been a pushover, with revenues increasing by 54% y/y.

Altogether, this reinforces that Q2 is going to report yet another sizzling quarter. For now, if we include Mosaic Fertilizantes sales, it appears likely that Q2 2022 will be up circa 100% y/y.

Now, this bear case that is weighing on the stock:

dtnpf.com

Above we see that fertilizer prices appear to have stopped increasing at their rapid ascent. Nonetheless, there are a few dynamics that we must keep in mind.

In the first instance, phosphate application is seasonal. It will climb during the spring, but it will then cool off once we get off its high-demand season.

While this would affect Mosaic’s Phosphate segment, it would have less impact, at least for now, on Mosaic’s Fertilizantes since Brazil’s application period for 2022 hasn’t yet arrived.

All that being said, I make the argument that investors shouldn’t only focus on the sequential phosphate price movement. The important consideration here is also to look at the numbers on a y/y basis too while being mindful that there will be some volatility along the way.

In sum, all the facts point to a very strong 2022 for Mosaic and fertilizer companies broadly.

Capital Return Profile, Favoring Repurchases

As a reminder, this is what Mosaic said during its Q1 2022 earnings call,

We continue to expect returning up to 75% of our free cash to shareholders through a combination of share repurchases and dividends.

Accordingly, we can see that Mosaic is committed to returning excess free cash flow to shareholders. That being said, Mosaic notes that it will repay its $550 million of long-term debt that reaches maturity in November.

This debt payment will get in the way of Mosaic meaningfully returning capital to shareholders. After all, Mosaic still carries approximately $3 billion of net debt.

Consequently, I believe that Mosaic will continue to pay out its razor-thin 1.3% dividend yield and keep its focus on share repurchases.

After all, with repurchases, Mosaic has more flexibility with when to deploy their excess free cash flow.

Mosaic has a $1 billion share repurchase program, this equates to a 5.9% capital return program at present market prices. When taken together with its dividend, investors are looking at slightly more than a 7.2% combined yield.

MOS Stock Valuation – Priced at 5x Free Cash Flow

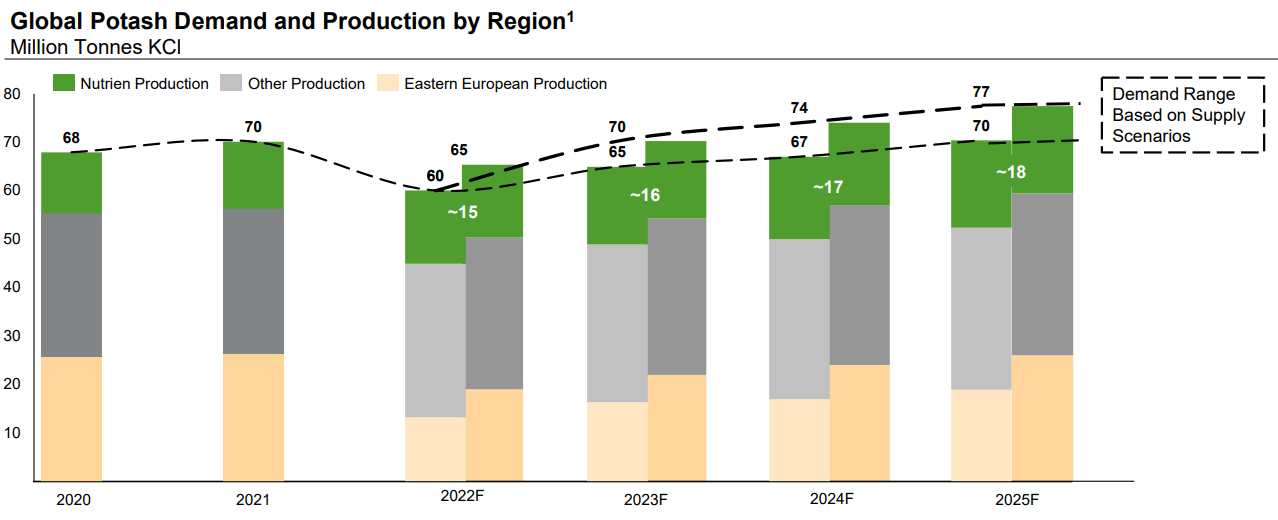

Last week, I covered Nutrien’s investor day here. Nutrien makes the argument that they expect fertilizer prices, particularly potash, to remain high into 2023.

You could make the argument that Nutrien would say that and that Nutrein is only pushing its own narrative.

While I obviously do not know as much as Nutrien about how the potash distribution channel is looking right now, what I do know is that there is starting to be increasing amounts of data that leads one to believe that these high potash and phosphate prices may not be falling off a cliff in 2022.

Indeed, note that the day before the Russian invasion, Mosaic was priced at $45 per share. Today, the share price is practically unchanged.

Nutrien’s Investor Day

What’s more, today we know a lot more. We now have more evidence that there’s going to be a pronounced shortfall in fertilizer in 2022 and its looking increasing likely an even bigger shortfall in 2023, see above.

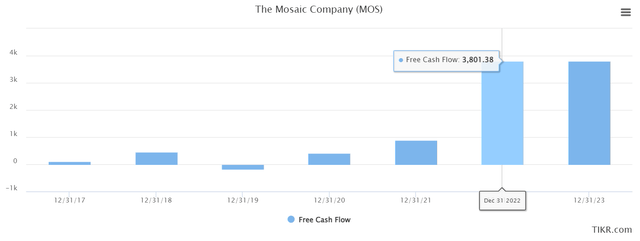

Moreover, some of these dynamics are starting to be reflected in analysts’ estimates, see below:

What you can see above is analysts are now estimating that Mosaic will have 2 years of elevated free cash flows.

Given that the business is priced at under 5x this year’s free cash flows, this means that shareholders only need 5 years of strong free cash flows for the business to pay for itself.

After that, the shareholders will get the remainder of Mosaic’s free cash flow until its terminal value for free.

The Bottom Line

There are a few dynamics at play. On the one hand, we’ve seen potash and phosphate fertilizer prices stop their rapid ascent. This has led investors to rapidly move to selling.

Indeed, as I noted above, Mosaic’s share price today is the same as it was before the Russian invasion, even though we now know that fertilizer prices have moved up substantially and Mosaic is going to have a very strong 2022.

We also now know something that we didn’t know before February, that Mosaic’s high free cash flows are very likely to remain elevated into 2023.

For all this, investors appear unwilling to pay 5x free cash flow. Hence, I rate this stock a buy.

Be the first to comment