SeventyFour

Today I’m taking another look at Global Self Storage (NASDAQ:SELF) in an effort to update my last article on the company. In that article, I had concluded that Global Self Storage is a small-cap storage REIT with relatively low leverage and an attractive dividend. However, I also concluded that its performance was questionable, in relation to its peers. So, how does the company look today?

A glimpse into Q2 2022 results

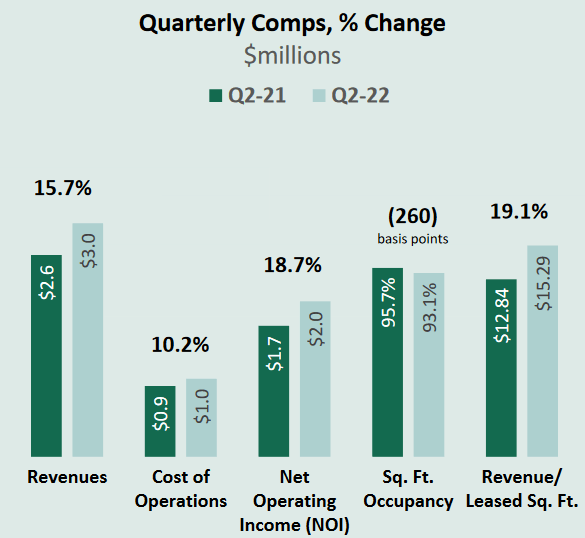

The company reported significant increases in every REIT – related metric for the second quarter of 2022. Adjusted FFO increased by 42% on a quarterly basis, reaching $0.11 per share. Total revenues increased by $3 million, which stands for a 15.7% increase on a quarterly basis. Based on these results, the company announced the increase of its quarterly dividend by 11.5%, reaching $0.0725 per common share. This figure stands for a 5.1% annualized dividend yield and represents a safe 66% dividend payout ratio. Finally, overall occupancy rate landed at 93.1%, while at the end of 2021 was 94.2% and at the end of Q1 2022, it was at 95.7%.

Same Store QoQ comparison (Global Self Storage September 2022 Investor Presentation)

One of the very impressive milestones of the company is that they managed to grow their FY 2021 FFO figure by nearly 60%, outperforming all of their peers by far. Given that the self-storage market is expected to grow by 2% per annum in the following years and also the fact that Global Self Storage is a small cap, growing REIT, it would be reasonable to say that such performance could be repeated in the future.

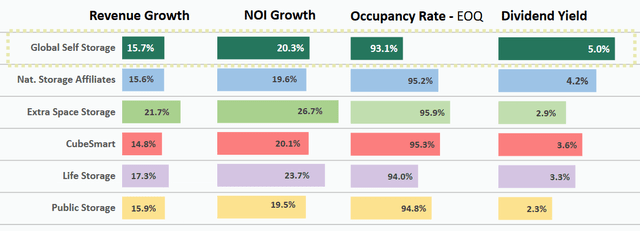

However, if we look at the bigger picture, the company is underperforming relative to its peers. As we can see in the graph presented below, during the first half of 2022, the company’s revenue growth was at the lower half of the peer group, while they showed the lowest occupancy rate among their peers. In terms of NOI growth, things look better, but I would expect better performance from a smaller REIT. Finally, the company is paying a higher dividend yield than all of its peers, which at today’s share price, reaches 5.1%.

Global Self Storage vs its peers, 1H 2022 (Global Self Storage September 2022 Investor Presentation)

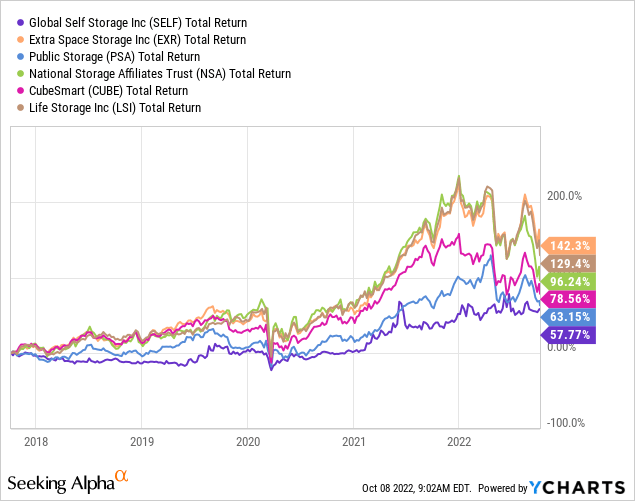

This is also reflected in the total return of the peer group, as it is shown in the graph presented below. We can see that Global Self Storage has significantly underperformed its peers, during the last 5 years, providing its shareholders with nearly 58% total return, while Extra Space Storage (EXR) reached more than two times this figure.

Valuation considerations

The company is now trading just above 15 times its forward FFO, which is one of the lowest valuation multiple among its peers. On the contrary, Extra Space Storage, which as I wrote before, outperformed all of its peers, is trading at the highest valuation multiple, which shows the trust of investors.

| P/FFO (FWD) | |

| SELF | 15.14 |

| PSA | 18.38 |

| NSA | 14.42 |

| CUBE | 15.95 |

| LSI | 16.99 |

| EXR | 20.29 |

Source: Data from SA Premium, table created by the author

The average P/FFO [FWD] multiple within the peer group is 16.9x, so the question that arises is this: Can Global Self Storage’s share price rise to $6.37/share in order for the forward P/FFO ratio to reach the peer average? The answer is more likely yes. This is not one of the times that the market is exaggerating in its valuations. The current valuation discrepancy, always in my opinion, has its roots in the historical underperformance of the company, relative to its peers.

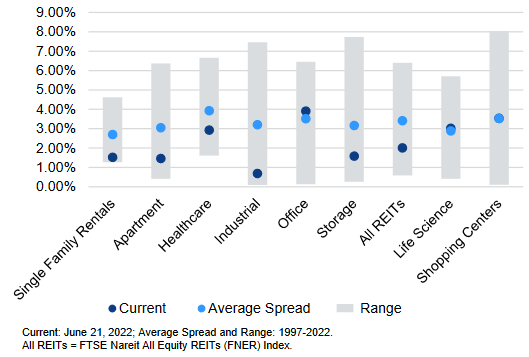

However, at $5.71 per share, given the number of common shares outstanding at the end of Q2 2022, and an annualized NOI projection of $7.5 million, the company is valued at a 12% cap rate. On the other hand, Extra Space Storage is currently valued at an optimistic cap rate of 4.8%. In other words, the company is trading at a very steep discount relative to its peers. This conclusion is further validated by the following graph.

REIT implied cap rate spread vs 10 Yr Treasury (Center Square Real Estate, The REIT Cap Rate Perspective)

According to Center Square research, the historical average cap rate spread between storage REITs and 10 – year treasuries is at approximately 3.1%, while the current (June 21st, 2022) spread is at 1.8%. The 10 – year treasury rate at that time was 3.1%. So, now that this figure is at 3.9%, we would expect a storage REIT average cap rate of 7%.

This implies two things: Firstly, extremely low cap rates cannot satisfy investors’ return requirements at this point. Secondly, it shows that Global Self storage is trading at a 40% discount to its asset class.

Conclusions

There’s a reason for everything and usually, such valuation discrepancies are happening for a reason. Although I am inclined to accept the factor of mismanagement, it does not justify for such a steep discount. On top of that, the company is offering the highest dividend yield among its peers, which is also quite safe by its produced FFO figures. Another point of skepticism would be the decreasing occupancy rates. Every single same store, except for one, showed reduced occupancy rates at the end of Q2 2022, as compared to the end of Q2 2021. That’s why I’m willing to remain on the sidelines for now, and see what happens when the Q3 results are announced. Folks currently holding shares in this company are in a good position to benefit from the nice and safe dividend and some potential price appreciation. But I wouldn’t initiate a new position in this company at this moment.

Be the first to comment