porcorex/iStock via Getty Images

In my monthly series, 10 Dividend Growth Stocks, I rank a selection of Dividend Radar stocks and present the ten top-ranked stocks for further research and possible investment. Dividend Radar is a weekly automatically generated spreadsheet of dividend growth [DG] stocks with dividend increase streaks of five or more years.

I use a ranking system based on DVK Quality Snapshots, which employs five widely used quality indicators from independent sources to assess the quality of DG stocks. I apply different screens every month to highlight different aspects of dividend growth investing.

This month, I decided to present discounted stocks with high 5-year dividend growth rates [DGRs] and high 5-year trailing total returns [TTRs]. Every stock in this month’s list trades at least 10% below my risk-adjusted Buy Below prices.

Screening and Ranking

The latest Dividend Radar (dated July 15, 2022) contains 730 DG stocks. Of these, 326 pass my DGR screen, 289 pass my TTR screen, and 266 are discounted relative to my Buy Below price. Only nineteen stocks pass all my screens.

Here are this month’s screens:

- Dividend Growth: 5-year DGR ≥ 10%

- Performance: 5-year TTR ≥ 10%

- Valuation:

- Stocks trading below my FV estimate

- Stocks whose forward dividend yield exceeds the 5-year average dividend yield

- Stocks trading below my risk-adjusted Buy Below prices

I use a survey approach to estimate fair value [FV], collecting fair value estimates and price targets from several online sources such as Morningstar, Finbox, and Portfolio Insight. Additionally, I estimate fair value using each stock’s five-year average dividend yield. With up to 11 estimates and targets available, I ignore the outliers (the lowest and highest values) and use the average of the median and mean of the remaining values as my FV estimate.

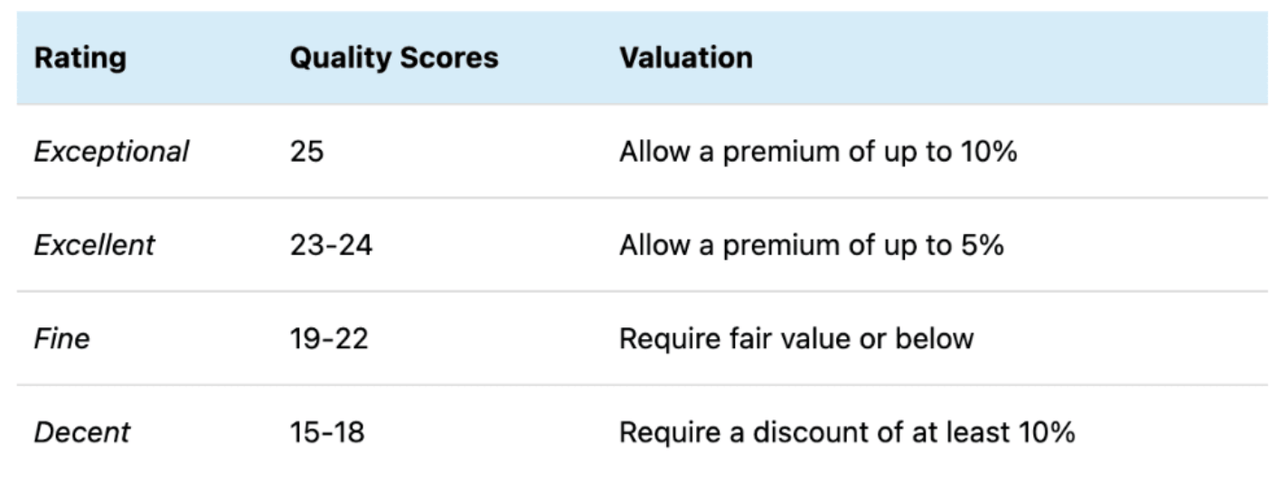

My risk-adjusted Buy Below prices allow premium valuations for the highest-quality stocks but require discounted valuations for lower-quality stocks:

Created by the author

My Buy Below prices recognize that the highest-quality stocks rarely trade at discounted valuations. As a dividend growth investor with a long-term investment horizon, I’m more interested in owning quality stocks than getting a bargain on lower-quality stocks.

To rank candidates, I use DVK Quality Snapshots to determine quality scores, sort them in descending by quality scores, and used the following tie-breaking metrics:

- SSD Dividend Safety Scores

- S&P Credit Ratings

- Dividend Yield

Each stock’s Rank is shown in the tables that follow.

Top 10 Dividend Growth Stocks for July

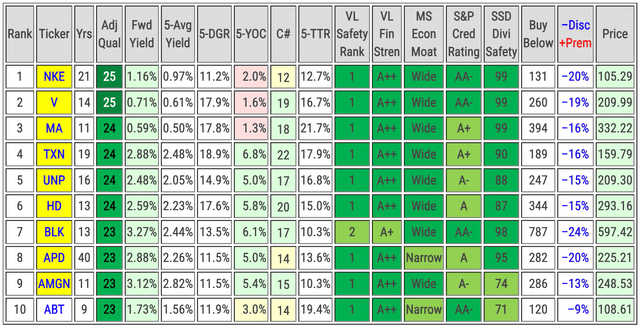

Here are this month’s ten top-ranked DG stocks in rank order:

I own all but one of these stocks in my DivGro portfolio.

The following company descriptions are my summary of company descriptions sourced from Finviz.

1. NIKE (NKE)

Founded in 1964 and headquartered in Beaverton, Oregon, NKE is engaged in the design, development, marketing, and selling of athletic footwear, apparel, equipment, and accessories. The company’s portfolio brands include NIKE, Jordan, Hurley, and Converse. NKE sells its products to retail accounts, through NIKE-owned retail stores and websites, and independent distributors and licensees.

2. Visa (V)

Headquartered in San Francisco, California, V operates as a payments technology company worldwide. The company facilitates commerce through the transfer of value and information among consumers, merchants, financial institutions, businesses, strategic partners, and government entities. V provides its services under the Visa, Visa Electron, Interlink, V PAY, and PLUS brands.

3. Mastercard (MA)

MA, a technology company, provides transaction processing and other payment-related products and services in the United States and internationally. The company offers payment solutions and services under the MasterCard, Maestro, and Cirrus brands. MA was founded in 1966 and is headquartered in Purchase, New York.

4. Texas Instruments (TXN)

TXN designs, manufactures, and sells semiconductors to electronics designers and manufacturers globally. The company operates in two segments, Analog and Embedded Processing. It markets and sells semiconductor products through a direct sales force and through distributors, as well as through its website. TXN was founded in 1930 and is headquartered in Dallas, Texas.

5. Union Pacific (UNP)

Omaha, Nebraska-based UNP operates the largest public railroad in North America, with 32,000 miles of track linking 23 states in the western two-thirds of the United States. UNP hauls coal, industrial products, intermodal containers, agricultural goods, chemicals, and automotive products. UNP owns a quarter of the Mexican railroad Ferromex. The company was founded in 1862.

6. Home Depot (HD)

Founded in 1978 and based in Atlanta, Georgia, HD is a home improvement retailer that sells an assortment of building materials, home improvement products, and lawn and garden products. HD provides installation, home maintenance, and professional service programs to do-it-yourself, do-it-for-me, and professional customers.

7. BlackRock (BLK)

BLK is an investment management company that provides a range of investment and risk management services to institutional and retail clients across the world. The company’s offerings include single and multi-asset class portfolios investing in equities, fixed income, alternatives, and money market instruments. BLK was founded in 1988 and is based in New York City.

8. Air Products and Chemicals (APD)

Founded in 1940 and headquartered in Allentown, Pennsylvania, APD produces atmospheric gases (such as oxygen and nitrogen), process gases (such as hydrogen and helium), and specialty gases, as well as the equipment for the production and processing of gases. APD also provides semiconductor materials, refinery hydrogen, natural gas liquefaction, and advanced coatings and adhesives.

9. Amgen (AMGN)

Based in Thousand Oaks, California, AMGN is a biotechnology company. The company discovers, develops, manufactures, and delivers human therapeutics worldwide. It offers products for the treatment of serious illnesses in the areas of oncology/hematology, cardiovascular disease, inflammation, bone health, nephrology, and neuroscience. AMGN was founded in 1980.

10. Abbott Laboratories (ABT)

ABT discovers, develops, manufactures, and sells health care products worldwide. The company also provides blood and flash glucose monitoring systems. The company operates in four segments: Established Pharmaceutical Products; Diagnostic Products; Nutritional Products; and Cardiovascular and Neuromodulation Products. ABT was founded in 1888 and is headquartered in Abbott Park, Illinois.

Please note that the top ten DG stocks are candidates for further analysis, not recommendations.

Key Metrics and Fair Value Estimates

Below, I present key metrics of interest to dividend growth investors, along with quality indicators and fair value estimates:

-

Yrs: years of consecutive dividend increases

-

Qual: DVK Quality Snapshots quality score

-

Fwd Yield: forward dividend yield for a recent share Price

-

5-Avg Yield: 5-year average dividend yield

-

5-DGR: 5-year compound annual growth rate of the dividend

-

5-YOC: the projected yield on cost after five years of investment

-

C#: Chowder Number, a popular metric for screening dividend growth stocks

-

5-TTR: 5-year compound trailing total returns

-

VL Safety Rank: Value Line‘s Safety Rank

-

VL Fin Stren: Value Line‘s Financial Strength ratings

-

MS Econ Moat: Morningstar‘s Economic Moat

-

S&P Cred Rating: S&P Global‘s Credit Ratings

-

SSD Divi Safety: Simply Safe Dividends‘ Dividend Safety Scores

-

Buy Below: my risk-adjusted buy below price

-

-Disc +Prem: discount or premium of the recent share Price to my Buy Below price

-

Price: recent share price

|

Color-coding

|

Created by the author from a personal spreadsheet

Commentary

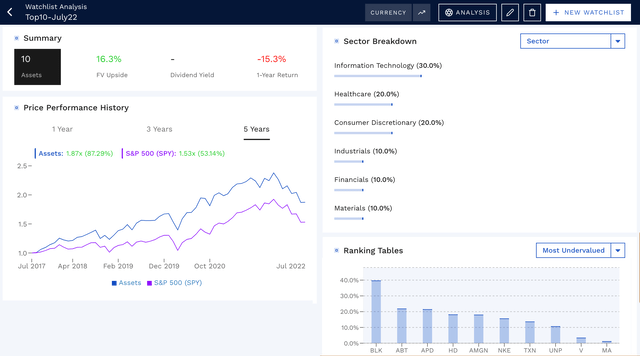

Here’s a comparative analysis of an equal-weighted portfolio of this month’s top ten DG stocks, courtesy of Finbox.com:

From a price-performance perspective, the portfolio would have outperformed the S&P 500 (as represented by the SPDR S&P 500 Trust ETF (SPY)) over the last five years, returning 82% versus SPY’s 53%.

According to Finbox.com, all the stocks have fair value upsides, with BLK (+40%), ABT (+22%), and APD (+21%) having the highest upsides of the ten top-ranked DG stocks for July.

TXN (18.9%), V (17.9%), MA (17.8%), and HD (17.6%) have the highest 5-year dividend growth rates and are strong candidates for growth-oriented investors.

MA (21.7%), ABT (19.4%), and TXN (17.9%) have the highest 5-year TTRs. All but two stocks (BLK, AMGN) outperformed SPY over the 5-year time frame:

BLK (3.27%), AMGN (3.12%), TXN (2.88%), and APD (2.88%) offer the highest forward yields and are strong candidates for income investors.

As for valuations, BLK (-24%), NKE (-20%), and APD (-20%) are discounted most relative to my Buy Below prices and are strong candidates for value investors.

Five stocks pass all five of my stock selection criteria for adding new positions to my DivGro portfolio:

- Stock Quality: Quality scores ≥ 19 (Exceptional, Excellent, or Fine ratings)

- Stock Valuation: Price ≤ Buy Below price (trades below my risk-adjusted Buy Below price)

- Growth Outlook: Green CDNs (likely to deliver annualized returns of 8%)

- Income Outlook: 5-year YoC ≥ 4.00% (likely to have high YoCs after 5 years of ownership)

- Dividend Safety: Dividend Safety Scores > 60 (dividends deemed Very Safe or Safe)

The stocks are AMGN, BLK, HD, TXN, and UNP.

I think these stocks offer the best opportunities to dividend growth investors right now.

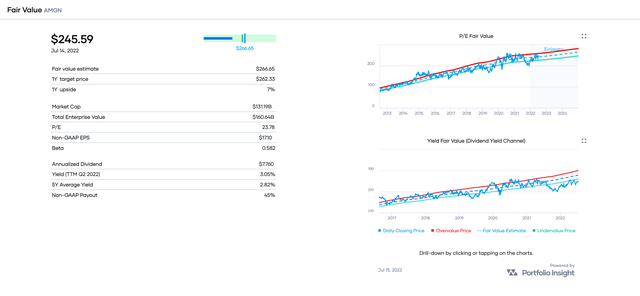

Amgen (AMGN)

AMGN is a Dividend Contender with a dividend increase streak of eleven consecutive years. The stock yields 3.12% at $249 and has a strong 5-year DGR of 11.5%.

With a Non-GAAP payout ratio of 45%, AMGN has room to continue paying and raising its dividend. AMGN’s dividend is Safe, given its Dividend Safety Score of 74 according to Simply Safe Dividends.

My AMGN position is overweight by about 55 shares, so I’m not interested in adding shares to my position right now. I determine ideal portfolio target weights using a flexible and dynamic system that supports my investment goals.

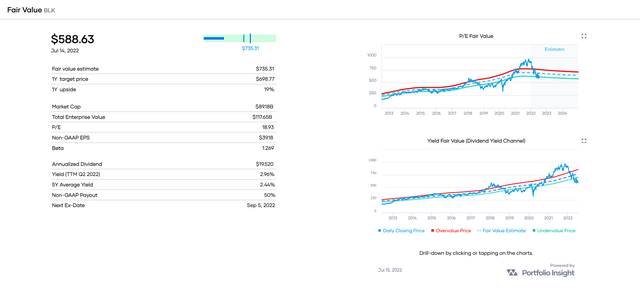

BlackRock (BLK)

BLK is a Dividend Contender with a dividend increase streak of thirteen consecutive years. The stock yields 3.27% at $597 and has a strong 5-year DGR of 13.5%.

With a Non-GAAP payout ratio of 50%, BLK has room to continue paying and raising its dividend. BLK’s dividend is Very Safe, given its Dividend Safety Score of 98 according to Simply Safe Dividends.

My BLK position is slightly overweight by about 9 shares, so I’m not interested in adding shares.

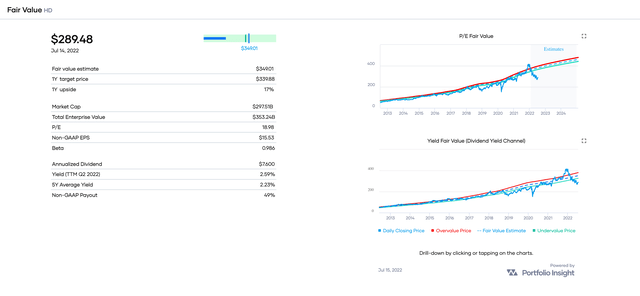

Home Depot (HD)

HD is a Dividend Contender with a dividend increase streak of thirteen consecutive years. The stock yields 2.59% at $293 and has an impressive 5-year DGR of 17.6%.

With a Non-GAAP payout ratio of 49%, HD has plenty of room to continue paying and raising its dividend. HD’s dividend is Very Safe, with a Dividend Safety Score of 87.

My HD position is overweight by about 47 shares, so I’m not interested in adding shares at this time.

Texas Instruments (TXN)

TXN is a Dividend Contender with a dividend increase streak of nineteen consecutive years. The stock yields 2.88% at $159.79 and has an impressive 5-year DGR of 18.9%.

With a Non-GAAP payout ratio of 54%, TXN has room to continue paying and raising its dividend. TXN’s dividend is deemed Very Safe by Simply Safe Dividends (Dividend Safety Score: 90).

My TXN position is a full position, and I’m not interested in adding shares.

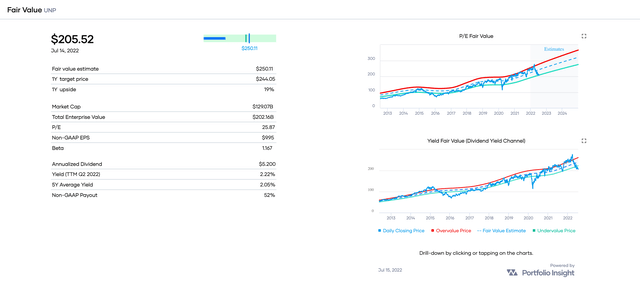

Union Pacific (UNP)

UNP is a Dividend Contender with a dividend increase streak of sixteen consecutive years. The stock yields 2.48% at $209 and has a strong 5-year DGR of 14.9%.

UNP has a Non-GAAP payout ratio of 52%, so the stock has plenty of room to continue paying and raising its dividend. UNP’s dividend is Very Safe, given its Dividend Safety Score of 88.

My UNP position is underweight by about 36 shares, so I’ll be looking to add some shares to my position soon.

Concluding Remarks

In this article, I ranked 19 discounted Dividend Radar stocks with high 5-year DGRs and high 5-year TTRs and presented the 10 top-ranked stocks for further research and possible investment.

I own all but one of the stocks in this month’s top 10. The stock I don’t own is ABT, which would interest me if it offered a somewhat higher yield.

I suggest first looking at AMGN, BLK, HD, TXN, and UNP, all stocks with compelling growth and income prospects and safe dividends.

Of these, my UNP position is the only underweight position, so I’ll be looking to add about 36 shares to turn it into a full position.

Based on your investment style, you may want to focus on the following stocks first:

- For income investors: AMGN and BLK

- For value investors: BLK, NKE, and APD

- For dividend growth-oriented investors: TXN, V, MA, and HD

- For very safe dividends: NKE, V, MA, and BLK

As always, I encourage readers to do their due diligence before buying any stocks I cover.

Thanks for reading, and take care, everybody!

Be the first to comment