grandriver/iStock via Getty Images

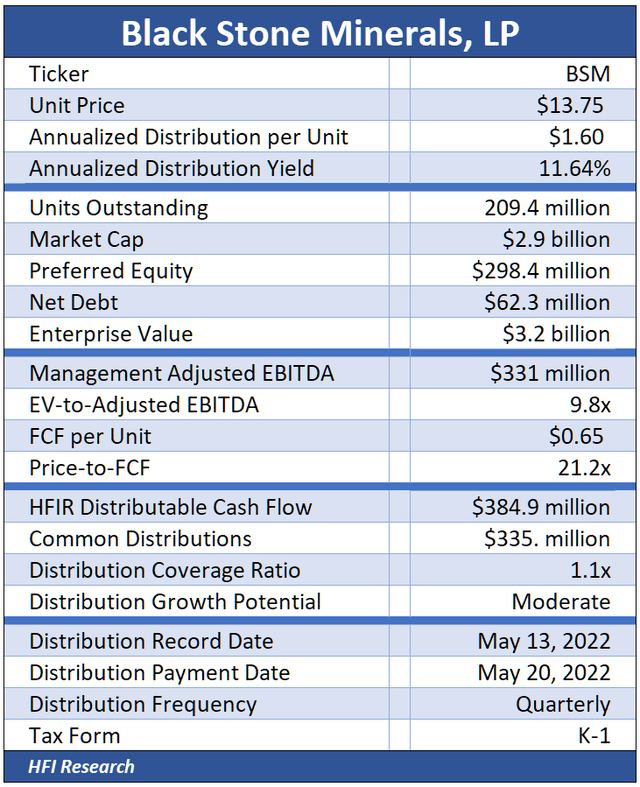

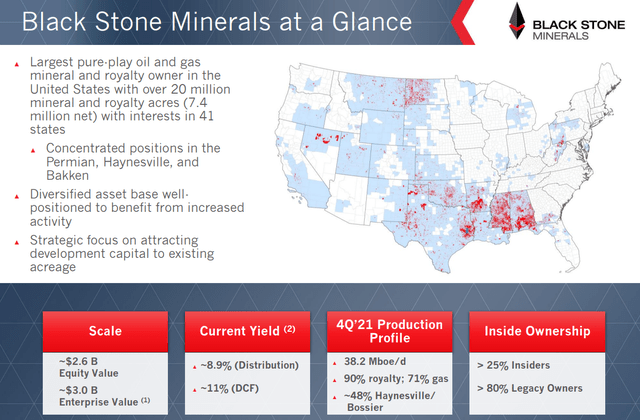

Black Stone Minerals, L.P. (NYSE:BSM) is the largest independent oil and gas mineral and royalty interest owner in the U.S. It owns an extensive portfolio of properties diversified by geography and E&P operator. Its volumes are weighted toward natural gas, though its revenues are more balanced between oil and gas. Its largest exposure is to the Haynesville in East Texas and Louisiana.

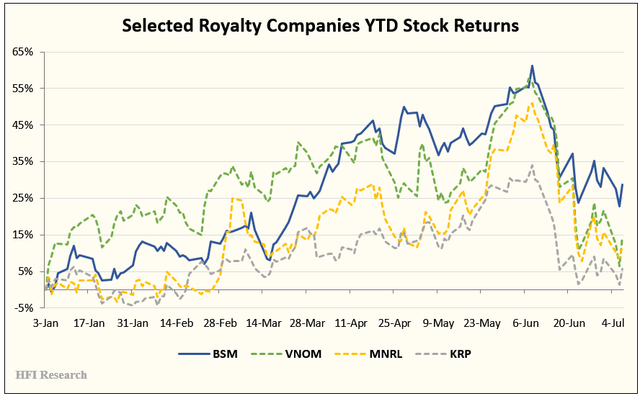

As longtime holders of BSM units, we’ve been impressed by how well they have held up during the energy sector’s recent selloff. The chart below compares BSM’s year-to-date performance against some of its peers.

Of the four equities in the chart, BSM is up 28.6%, while Viper Energy Partners (VNOM), Brigham Minerals (MNRL), and Kimbell Royalty Partners (KRP), are up 14.53%, 12.0%, and 5.7%, respectively.

BSM’s First-Quarter Results Underwhelm

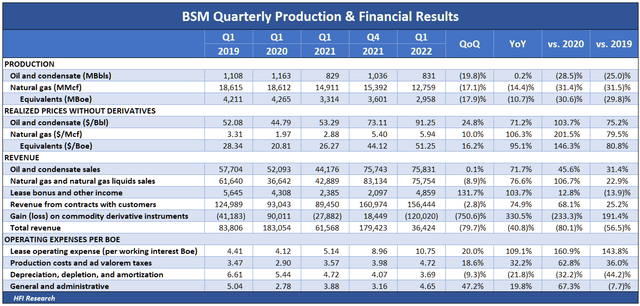

BSM’s performance is surprising in light of its disappointing first-quarter results. During the quarter, BSM’s production volumes fell 10.7% from the previous quarter and 17.9% from the previous year.

The poor operating performance caused BSM’s financial results to miss analyst expectations. The financial underperformance was partly attributable to the company’s longstanding policy of hedging a significant percentage of its production. In the first quarter, BSM hedged nearly 70% of its production at $3.12 per Mcf natural gas and $66.67 per barrel oil in a quarter when Henry Hub natural gas averaged $4.59, and WTI averaged $94.92.

The following table compares BSM’s first-quarter operating and financial performance with previous years’ first quarters. The weak production results stand out the most.

The Market Has This One Right

BSM’s poor first-quarter performance begs the question of why its units have held up so well versus its peers. We believe the market is correctly looking through the first quarter results and anticipates significant improvement over the coming quarters.

BSM’s first-quarter underperformance is likely to be temporary. Aside from its low-priced hedges, a large part of BSM’s underperformance in the first quarter was attributable to timing issues on the part of its E&P partners.

First, BSM’s partner in its Shelby Trough acreage, Aethon Energy, turned four of its six recently drilled wells to production shortly after the end of the first quarter. Those wells will improve results in the second quarter. Aethon also began drilling four additional wells in the play in the second quarter, which will add even more to volumes.

Second, production and revenues were also temporarily reduced by XTO Energy shutting in production as it resumed drilling operations on three wells on BSM’s acreage.

We see the reversal of these timing factors creating a tailwind for BSM over the rest of 2022.

BSM’s Second Quarter to Show Improvement

The production tailwind should cause BSM’s second-quarter results to come in significantly higher than both its first-quarter 2022 and fourth-quarter 2021 results. Higher production amid high commodity prices will showcase BSM’s robust cash flow generation and underscore that its $0.40 quarterly distribution is sustainable. We believe the fundamental improvement will drive an increase in BSM’s unit price.

Meanwhile, BSM’s balance sheet will remain in great shape. After a brutal 2020, when the company’s leverage forced it to sell attractive assets at the depths of the industry downturn, management has managed the balance sheet conservatively. BSM ended the first quarter with only $62.3 million of net debt and a rock-bottom 0.2-times leverage ratio. With debt so low, the company has little need for a financial safety cushion to cover its debt service obligations. It can therefore allocate all free cash flow available to equity owners toward distributions and repurchases. We expect management to opt for higher distributions, which we believe will occur over the next few years if commodity prices remain elevated, as we expect.

A Prudent Approach to Growth

Oil and gas minerals and royalties have been a seller’s market this year, with owners listing their properties for top dollar amid historically high commodity prices. BSM management views the current selling prices as being too high to consider making an acquisition. This is the kind of counter-cyclical behavior we look for in our investments. BSM was an aggressive buyer of low-priced properties when commodity prices were low from 2015 to 2021. Now, it’s abstaining from purchases when commodity prices are high.

Under today’s conditions, we’d prefer that BSM create value through harvesting its own acreage instead of through M&A. The opportunities to do so could be vast, as BSM has only leased 26% of its acreage. High commodity prices make the remaining 74% of unleased acreage more economic to develop, so the company can focus on finding operating partners for its undeveloped acreage.

BSM Valuation

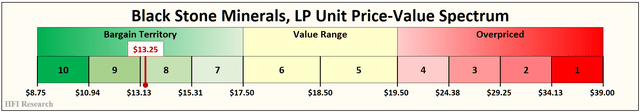

We value BSM units in the range of $17.50 to $19.50. Our price target is the midpoint of the range, or $18.50. The units would have to appreciate by 35.8% to reach our price target.

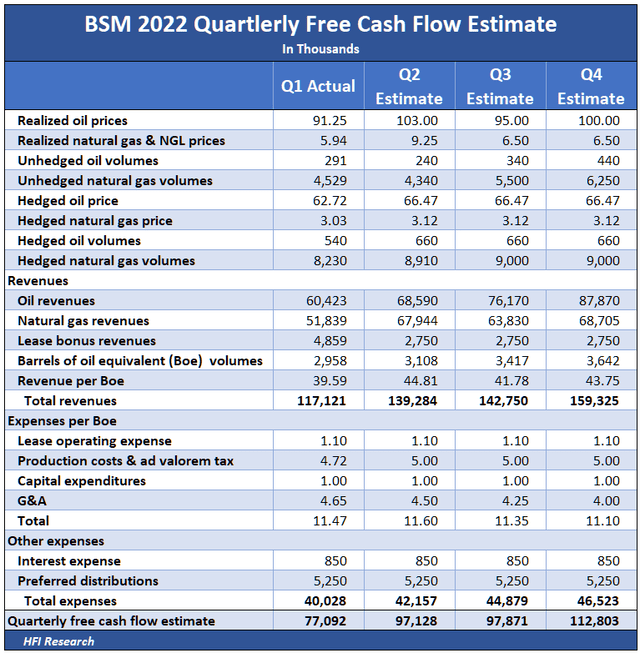

We value the units through a free cash flow multiple approach. We estimated full-year 2022 free cash flow for BSM’s unhedged production by assuming it realizes $95 per barrel of oil in the third quarter and $100 per barrel in the fourth quarter, and that it realizes $6.50 per Mcf of combined natural gas and NGLs in those quarters. We also assume oil and natural gas volumes grow each quarter from their depressed first-quarter levels. The table below details our estimates.

For full-year 2022, we estimate that BSM will generate $384.9 million of free cash flow. This is well in excess of the approximately $335 million the company will pay out to common unitholders through its $1.60 annual distribution. That distribution on the current price equates to an 11.6% yield, which we believe is safe.

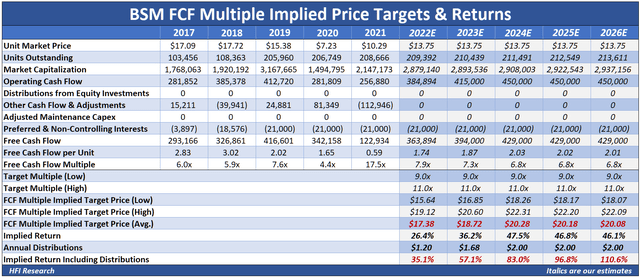

Our free cash flow multiple valuation assumes that oil prices remain above $85 per barrel and natural gas prices above $4.00 per Mcf. The higher prices enable BSM to increase its cash flow by 7.5% in 2023 and 2024. Distributions increase to $2.00 annually by 2024.

Our valuation implies the units are worth $17.38 in 2022, at which price they would sport a 9.2% yield. With distributions factored in, we estimate 35.1% upside from the current price. Our implied total return increases to 110.6% over the next five years.

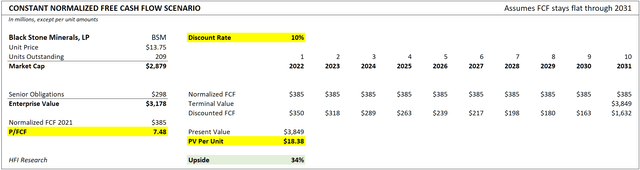

Our discounted cash flow valuation assumes that our $384.9 million free cash flow estimate remains flat through 2031. It values the units at $18.38, which implies 34% upside from the current price.

Valuation Upside

Given our bullish macro energy commodity outlook over the next five years, we believe there is more upside than downside to our BSM valuation. For one, we expect management to focus on driving increased production on its unleased acreage. Incremental production won’t be subject to BSM’s low-priced hedges, so it can increase cash flows by realizing today’s higher prices.

One example is BSM’s recent agreements with several operators to drill wells in its massive Austin Chalk acreage. Initial well results over the past few quarters have demonstrated that new completion technology can improve production rates and increase reserves compared to the older Austin Chalk wells. If BSM ramps up its Austin Chalk acreage, it could significantly boost the company’s cash flows.

There is also potential upside to our valuation if oil and natural gas prices stay high over the next few years. If so, BSM’s old hedges struck at lower prices will roll off while management layers on new hedges at higher prices. This can provide a huge boost to cash flows relative to 2022 levels. However, given the company’s hedge book, any such increase won’t occur until 2024 and beyond.

As for downside risks, a fall in commodity prices is by far the most significant. We believe the oil market will be in a structural supply deficit for at least the next few years and that oil prices will remain elevated to incentivize supply and reduce demand. However, if commodity prices were to fall below $85 per barrel oil and $4.00 per Mcf natural gas and stay there for more than a few months, BSM will probably cut its distribution. However, at the current unit price, we believe any such cut would result in a still-high yield. The quarterly distribution would have to decline by more than one-third-from today’s $0.40 to $0.26-to result in a 7.5% distribution yield on BSM’s current unit price.

Conclusion

BSM is one of the best ways for investors to benefit from bullish fundamental energy market conditions. We believe the company’s well-covered distribution, low operational risk, low capital requirements, and cash flow growth prospects make the units a Buy for their income and capital appreciation prospects.

Be the first to comment