nicolas_

Ginkgo Bioworks (DNA) has entered into an agreement to acquire Zymergen (NASDAQ:ZY). While Zymergen shareholders are unlikely to be thrilled by the price, the company’s financial position gave them little option. Ginkgo continues to solidify their position as the leading synbio platform, but is richly valued based on current operating metrics. The all-stock deal gives Zymergen shareholders exposure to a company with better prospects, but also introduces valuation risk.

Zymergen

At the time of Zymergen’s IPO, the company appeared to be reaching an inflection point, with multiple products nearing commercialization. Zymergen’s narrative and valuation fell apart soon after though, when the company announced these products were not viable and that the CEO would be stepping down. Since then, Zymergen has been in a race to restructure costs and create revenue streams, in the hope of staving off bankruptcy. Given the company’s cost structure, balance sheet and the state of equity markets, an acquisition was probably the best hope for shareholders.

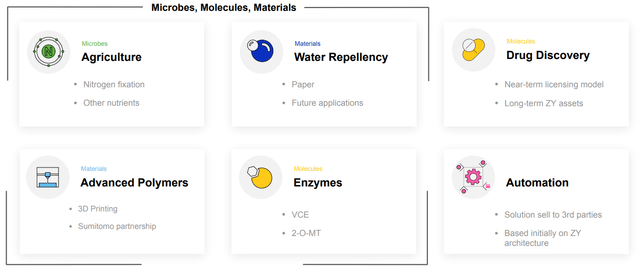

Figure 1: Zymergen Target Opportunities (source: Zymergen)

Automation & Tech Platform

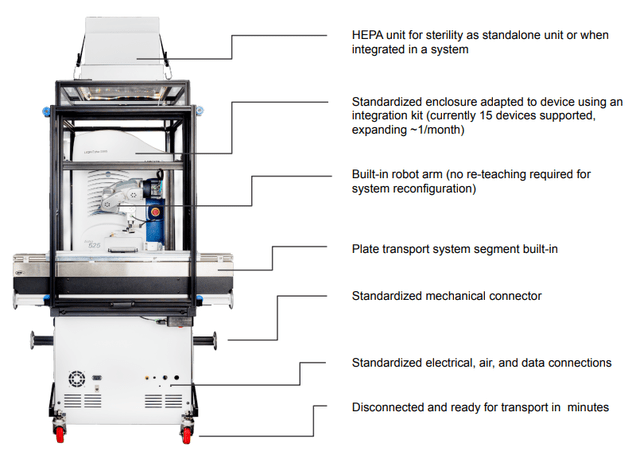

Zymergen had been in the process of offering modular automation systems to the market, to commercialize their lab expertise. In particular, Octant had purchased 11 of Zymergen’s Reconfigurable Automation Carts (RACs) to help scale their drug discovery platform. These RACs are designed to improve the throughput, efficiency, and reliability of lab operations and are controlled by Zymergen’s cloud software.

Zymergen previously stated that they had approximately 30 prospects, with a typical 10-RAC system costing between 1-2.5 million USD and requiring approximately 400,000 USD in annual software and support costs.

Figure 2: Zymergen RAC (source: Zymergen)

Advanced Materials

Zymergen have been developing materials, which they have bracketed under agriculture, water repellency, advanced polymers and enzymes.

Zymergen has a fairly mature nitrogen fixation program that uses engineered microbes to replace nitrogen fertilizers.

In their water repellency program, Zymergen have been exploring coated straws and recently demonstrated the successful conversion of their coated paper into an end product manufactured on a potential customer’s production line.

Within advanced polymers, Zymergen has announced a supply agreement with 3D4Makers to provide Polyimide for use in 3D printing. Polyimide is a high-strength polymer that is flame retardant, has excellent insulating properties and excellent thermal stability. The polymer will be offered to 3D4Maker’s customers for applications like aerospace, automotive, and transportation.

Zymergen has also developed mRNA enzymes (VCE and 2′-O-MT) for use in vaccines.

Drug Discovery

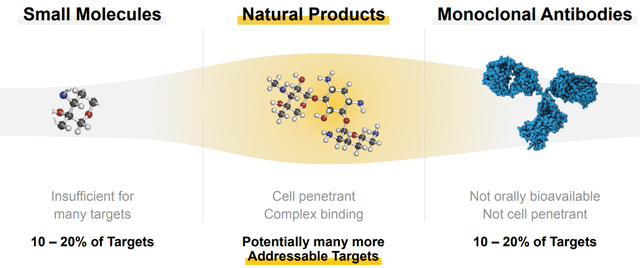

Zymergen is leveraging their metagenomic database to uncover natural molecules that inhibit targets of interest, with an initial focus on oncology. There are millions of novel bioactives from uncultured bacteria and fungi and Zymergen are computationally predicting the activity of these bioactives against human targets.

Figure 3: Therapeutic Classes and Potential Targets (source: Zymergen)

Ginkgo Acquisition

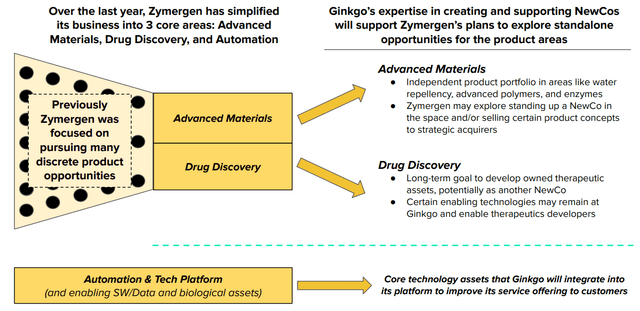

Ginkgo is acquiring Zymergen in an all-stock transaction that values Zymergen at approximately a 300 million USD market capitalization. The stated aim of the acquisition is to accelerate the development of Ginkgo’s platform. Ginkgo plan to integrate Zymergen’s automation, software, data science tools and biological assets. Zymergen’s core technical team will be retained, which will help Ginkgo to fulfill their hiring plans. Strategic alternatives will be considered for Zymergen’s Advanced Materials and Drug Discovery businesses. It is possible that these will be spun out and become Ginkgo customers, in a similar manner to companies like Joyn Bio and Motif Food Works.

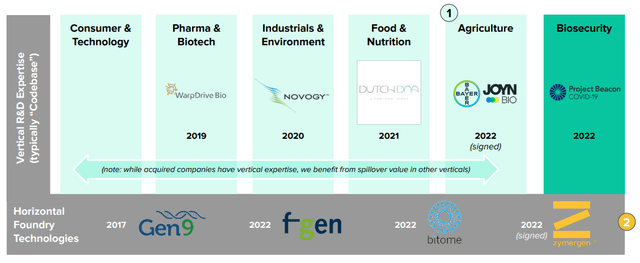

Ginkgo has been active in M&A in recent years, with acquisitions either building on the capabilities of their Foundries, or providing the necessary vertical expertise to attract customers and successfully bring products to market.

Figure 4: Ginkgo Acquisitions (source: Ginkgo Bioworks)

Ginkgo is doing the right thing by conducting countercyclical M&A, but it is unclear how much value Zymergen will add. Ginkgo’s appeal should be that they have singular capabilities, and acquiring competing synbio companies for their technology undermines this. Jason Kelly stated that approximately 70% of the deal’s value lies in Zymergen’s physical assets (foundry / automation). There could be significant issues integrating these assets into Ginkgo’s workflows, although Zymergen’s successful rollout of automation solutions at Octant has given Ginkgo confidence that this can be managed.

Figure 5: Ginkgo’s Plan for Zymergen’s Assets (source: Ginkgo Bioworks)

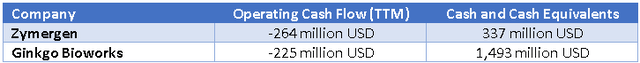

In its current state, Zymergen would significantly weaken Ginkgo’s financial position, and hence it is likely that there will be a large reduction in headcount. Zymergen had approximately 500 employees at the end of 2021 in comparison to Ginkgo’s 640 employees, but is not currently generating any meaningful revenue.

Table 1: Zymergen & Ginkgo Cash Flows (source: Created by author using data from company reports)

Zymergen will continue their internal cost-cutting initiatives, including headcount reductions and program rationalization. The Advanced Materials and Drug Discovery business are also likely to be spun off and further headcount reductions are likely after the acquisition as Ginkgo eliminates duplicated roles. Ginkgo has stated that the acquisition will not impact their long-term path to profitability, supporting the notion of deep cost-cutting.

Conclusion

While Zymergen shareholders are unlikely to be pleased by the acquisition price, they will receive exposure to a company with better prospects. The deal makes sense for Ginkgo as they gain Zymergen’s assets and employees at minimal cost. The deal also solidifies their position as the leading synbio platform and reduces competition in the market for lab services. Zymergen have several overlapping programs (VCE, nitrogen fixation) but Ginkgo appears to have limited interest in Zymergen’s product portfolio.

Be the first to comment