double_p

Stocks meandered most of the day before finishing modestly lower in advance of a tsunami of earnings and economic data this week. After the close, Walmart announced its earnings for the quarter ending in July would fall short of estimates, which is weighing on this morning’s open. The company blamed food price inflation on consumers’ ability to spend on goods like apparel. This is similar to what we heard from Target a month ago. I suspect this says as much about a shift in spending preferences and bloated inventories as it does about consumers cutting back due to higher prices.

Finviz

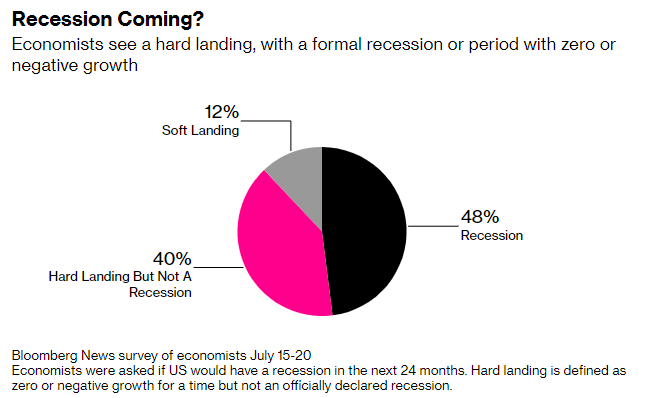

We should see an end to the debate about whether the U.S. economy is in recession on Thursday when the Commerce Department reports GDP for the second quarter. Economist Nouriel Roubini asserted that the US faces a deep recession as rates rise and the economy is weighed down by high debt loads, and he calls those who are forecasting a shallow downturn, if one at all, “delusional.” Well then, call me delusional, as I’m still in the soft landing camp. Not only do I see growth in the second quarter, but I think there will be an upward revision to the first-quarter contraction when the initial estimate is updated later this week.

Bloomberg

It is difficult to calculate a contraction in economic activity during the second quarter when industrial production rose at a 6.2% annual rate, the unemployment rate declined, and we added approximately 375,000 jobs per month. The math simply does not add up. Granted, auto sales declined sharply, but that was mostly due to supply issues. Outside of autos, inflation-adjusted retail sales rose during the quarter, so overall consumer spending should contribute to growth. Capital investment appears to have grown at a stronger rate and should also add to growth. The one sector of the economy that will undoubtedly be a drag on growth is housing, but it only accounts for approximately 5% of overall GDP. Government spending, trade, and inventory investment are likely to be modest drags after the outsized negative impact all three had on growth during the first quarter. Therefore, we should see a growth rate of less than 1%, but it is not a negative number. If you know where to look, the market is saying the same thing.

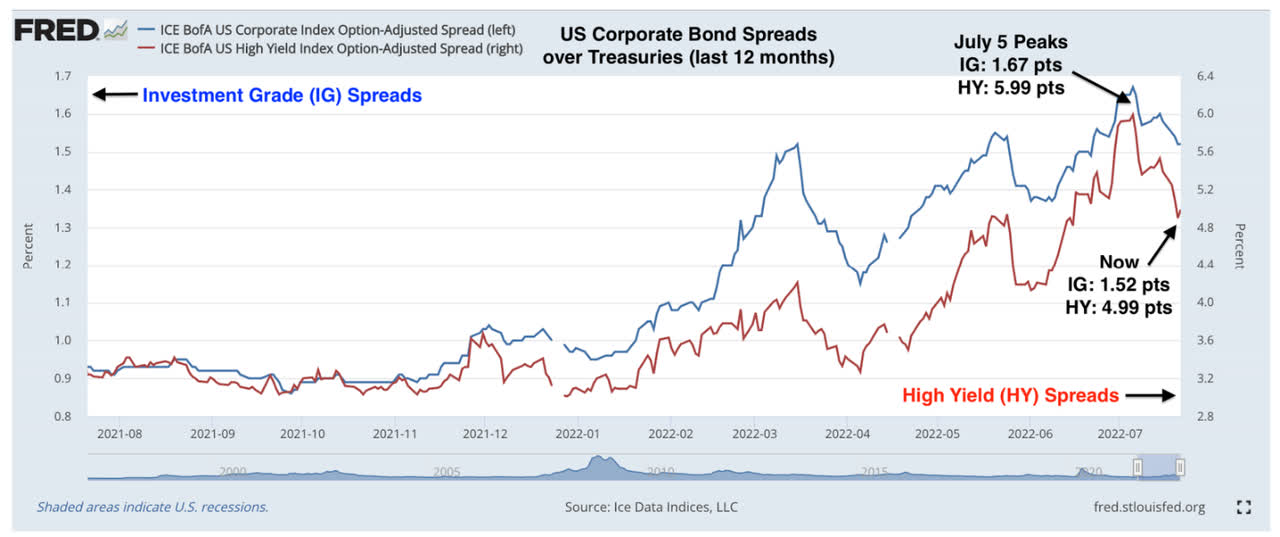

The bond market has always been more sensitive to economic developments than the stock market, which is why it is important to watch credit spreads at turning points. The credit spread I am talking about is the difference in borrowing costs between the federal government (guaranteed) and corporations. The spread between Treasury yields (gov’t borrowing costs) and the yield on high-quality corporate bonds, otherwise known as investment grade, stood at a peak of 1.67% in early July. The spread between Treasuries and lower-quality company bonds, otherwise known as high yield or junk, stood at 5.99%. As you can see from the chart below provided by DataTrek, the spreads for both investment grade and high-yield bonds have fallen meaningfully since the early July peaks.

DataTrek

If the economy were falling into recession, we would be seeing the exact opposite, as lenders demand a higher rate of return in the market to account for the increased risks associated with a recession. It looks like spreads peaked shortly after the S&P 500 hit its low for the year. The narrowing of credit spreads suggests that recession concerns are starting to abate. We will have our answer on Thursday.

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Be the first to comment