AsiaVision/E+ via Getty Images

Elevator Pitch

I rate ZTO Express (Cayman) Inc.’s (NYSE:ZTO) [2057:HK] shares as a Hold. ZTO refers to itself as “a leading express delivery company in China” and “one of the largest” worldwide on its corporate website.

ZTO Express’ recent Q2 2022 financial performance was excellent, but the market still expects the company’s top line growth to decelerate for the next three years. The negatives associated with weak economic growth should offset the positives relating to market share gains for ZTO in the near future. In that respect, I think that a Hold investment rating for ZTO is fair.

Robust Top Line And Bottom Line Growth For Q2 2022

ZTO Express delivered a very strong set of financial results for the second quarter of 2022, as highlighted in its most recent quarterly earnings press release published on August 17, 2022, after the market closed.

Revenue for ZTO increased by +18.2% YoY to RMB8,657 million for Q2 2022, and this implied that ZTO Express’ YoY top line expansion has accelerated compared to a lower +14.4% YoY revenue growth recorded in Q2 2021.

The company’s strong revenue growth for Q2 2022 was driven by both price increases and higher volumes. Specifically, ZTO Express’ parcel volume and delivery ASP (Average Selling Price) grew by +7.5% YoY and +10.5% YoY, respectively in the recent quarter.

Non-GAAP net profit for ZTO Express surged by +38% YoY from RMB1,272 million in Q2 2021 to RMB1,759 million in Q2 2022. Besides benefiting from a significant increase in its revenue, ZTO’s bottom line grew substantially as a result of better profit margins.

ZTO’s gross profit margin expanded by +2.6 percentage points from 22.8% in the second quarter of 2021 to 25.4% in the most recent quarter. The company explained at its Q2 2022 analyst briefing on August 17, 2022, that its ability to “sustain the price that was increased from the past year” and the fact that “the competitive environment is stabilizing” helped it to deliver an improvement in profitability at the gross profit level in Q2.

The company’s operating margin also increased by +300 basis points from 19.9% in Q2 2021 to 22.9% for Q2 2022, as ZTO Express managed its costs well. This is evidenced by a decline in the company’s selling, general & administrative or SG&A expenses-to-revenue ratio from 5.4% in the quarter a year ago to 5.3% in the second quarter of this year.

Positive On Market Share Gains

The key positive takeaway from ZTO Express’ most recent second-quarter financial results is that the company is grabbing market share from its competitors.

ZTO revealed in its Q2 2022 results media release that its share of the express delivery market in Mainland China with regards to parcel volume rose from 21% in Q1 2022 to 23% in the recent quarter. It is critical that ZTO Express grows its market share for two key reasons. The first key reason is that express delivery is a high fixed-cost business for which economies of scale matters. The second key reason is that bargaining power with customers and suppliers is also a function of size.

Looking forward, ZTO Express has guided at its recent Q2 2022 results briefing that the company is “in a very good position to reach 30% or even 40% of the overall market in the next five to 10 years.” ZTO’s long-term market share expectations don’t seem farfetched, if one examines short-term and long-term historical trends.

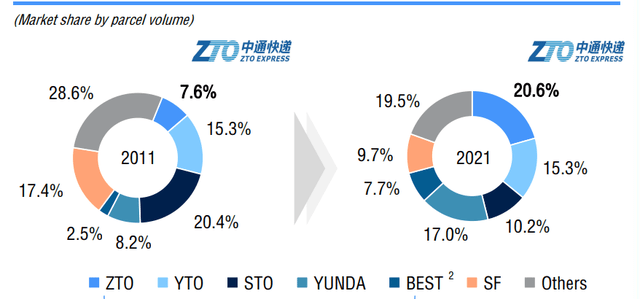

In its Q2 2022 earnings presentation slides, ZTO highlighted that its market share has increased every year between 2017 and 2021. Specifically, ZTO Express’ share of the China express delivery market grew from 15.5% to 20.6% over this period. A decade ago, ZTO’s market share was much lower at 7.6% in 2011.

Industry consolidation is a key driver of share gains for ZTO Express and its larger peers.

A Comparison Of The China Express Delivery Market’s Competitive Landscape In 2011 And 2021

ZTO’s Q2 2022 Earnings Presentation

As highlighted in the chart above, the combined market share of the smaller players (apart from the six largest players including ZTO) in the Chinese express delivery market has contracted from 28.6% in 2011 to 19.5% in 2021. There is still lots of room for ZTO and its bigger rivals to take more market share away from the sub-scale and smaller competitors in the foreseeable future.

Concerns About Weak Economic Environment In China

According to a August 5, 2022, South China Morning Post article, China’s premier Li Keqiang was quoted as saying at a business forum that the country “can ‘live with’ slightly lower GDP growth if inflation stays below 3.5 per cent.” This can be probably interpreted as a signal of China acknowledging that economic conditions in the country aren’t good. Earlier, Reuters also reported on July 28, 2022, that “China omits mention of GDP growth goal” at the country’s Politburo meeting.

The weak economic environment will be naturally negative for an economically-sensitive industry such as parcel delivery.

According to the sell-side’s consensus financial projections obtained from S&P Capital IQ, the analysts are expecting ZTO Express’ top line growth to slow from +20.6% in FY 2021 to +19.2%, +17.8%, and +15.5% for FY 2022, FY 2023 and FY 2024, respectively. In other words, market share gains can’t fully offset the expected decline in parcel volume resulting from economic weakness, suggesting that revenue growth deceleration for ZTO in the near future is inevitable.

Concluding Thoughts

ZTO Express’ shares are rated as a Hold. The company has the potential to expand its share of the Chinese express delivery market from 23% now to as high as 30%-40% in the next decade. On the flip side, ZTO will be still affected by slower economic growth in China, as indicated by consensus numbers pointing to a moderation in revenue growth.

Be the first to comment