hapabapa

Thesis

Leading zero-trust cybersecurity leader Zscaler, Inc. (NASDAQ:ZS) stock remains more than 60% off its November highs, as it suffered another recent downgrade by the Street. The analysts were worried about a slowdown in enterprise IT spending, given the looming recession. We believe the concern is justified, given ZS’s embedded premium and aggressive growth estimates.

We updated investors in our previous article in May (Hold rating), encouraging them to wait for a sustained bottoming process before considering adding exposure. However, our preferred bear trap (indicating the market decisively denied further selling downside) price action didn’t form. Notwithstanding, we observed that ZS has been attempting to bottom constructively since May for two months.

Coupled with what we believe is a potential long-term bottom on the iShares Software ETF (IGV), ZS’s medium- and long-term bottom looks increasingly likely.

Consequently, we are ready to revise our rating from Hold to Speculative Buy. We also revise our medium-term price target (PT) to $200, implying a potential upside of about 38% (as of July 26’s close).

Management Remains Confident In Delivering Its $5B ARR Target

Given its sizeable growth premium (NTM FCF yield of 1.4%), management needs to convince investors that it has the confidence to continue executing well over the next few years to justify its valuation.

Therefore, it’s reassuring to investors that management has maintained its confidence in delivering its $5B ARR target at an investor conference in June. Management accentuated (edited):

The $5B market that we’ve got is based on our existing customer base. If they bought everything that we have for ZIA and ZPA, there’s a 6x opportunity of $1B ARR. So it’s significant just for ZIA and ZPA. We do have a 5-year plan, which is a detailed plan by product segment, geography, by channel related to where we expect things to be over the next five years. We also expect emerging products to be a significant portion of that. So we’ll see if they’ll grow at a faster pace than ZIA and ZPA. But our main products are still going to be ZIA and ZPA for a while because they’re so big and have so much momentum. (Zenith Live 2022)

But, Zscaler Needs To Execute With “Perfection”

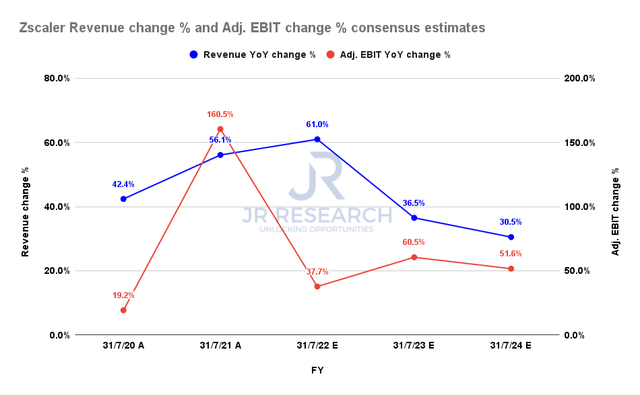

Zscaler revenue change % and adjusted EBIT change % consensus estimates (S&P Cap IQ)

Zscaler reported a TTM revenue of $970M in FQ3’22 (calendar quarter ended April). Therefore, we believe it behooves Zscaler to deliver a highly aggressive growth cadence to meet its projection.

Furthermore, the slowing revenue projection based on the consensus estimates (bullish) doesn’t augur well. However, we also observed that the company could continue gaining significant operating leverage that could underpin its valuation if it can continue executing robustly.

However, the Street downgraded the upside potential of ZS recently, given the worsening macro risks. Citi highlighted (edited):

Increasing odds of a global recession are becoming harder to ignore, and fundamental softness for the systems software names is now visibly manifesting in field work. – The Fly

BTIG also added fuel to the fire, downgrading ZS recently, citing its growth premium. It added (edited):

ZS shares are trading at more than 13 times enterprise value-to-sales, and though the company likely had a solid second-quarter, independent field checks downticked from prior quarters and lead us to believe sales cycles will elongate over the next 6-12 months. – Seeking Alpha

But, Price Action Suggests A Potential Long-Term Bottom For ZS

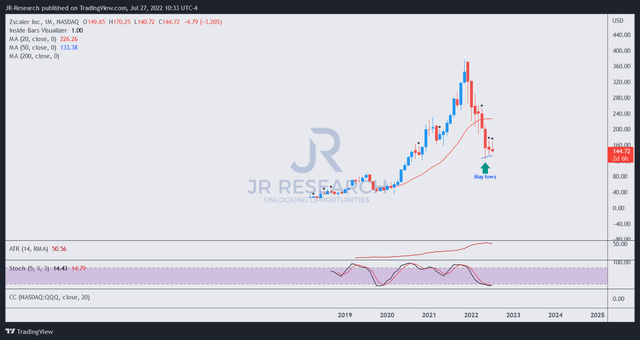

ZS price chart (monthly) (TradingView)

We observed that ZS had held its May lows resiliently over the past two months. Therefore, we believe its price action is constructive and looks increasingly likely to bottom on its long-term chart, which is potent.

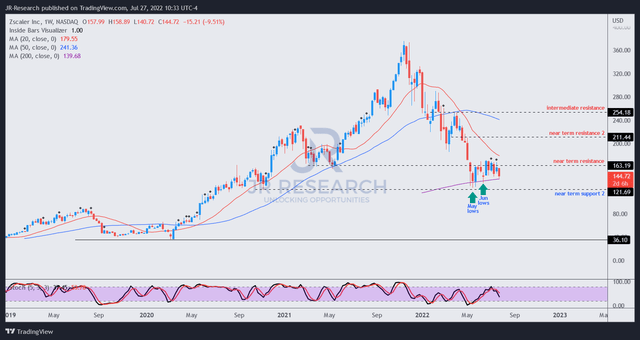

ZS price chart (weekly) (TradingView)

Poring into its medium-term chart, we can glean that ZS has been consolidating well along its 200-week moving average. It has also continued to absorb selling downside. Notwithstanding its near-term resistance ($163) has consistently denied further buying momentum.

However, if the consolidation continues (without breaking below May lows), we believe subsequent buying momentum should help ZS overcome its near-term resistance. Therefore, we believe its medium- and long-term bottoming signals look robust.

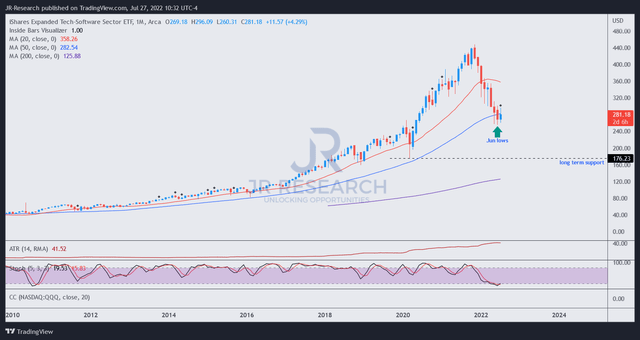

IGV price chart (monthly) (TradingView)

Also, our analysis of the IGV ETF’s long-term chart indicates a long-term bottoming process is forming. Therefore, it increases our confidence that ZS can sustain its current consolidation zone.

Is ZS Stock A Buy, Sell, Or Hold?

We revise our rating on ZS from Hold to Speculative Buy, with a medium-term PT of $200.

ZS has been bottoming well on its medium- and long-term charts, as further selling downside has been absorbed by dip buyers.

It’s also in line with the long-term bottom seen in the IGV ETF, which bodes well for a long-term bottom for the software group.

Be the first to comment