Olivier Le Moal/iStock via Getty Images

By Rob Isbitts

Summary

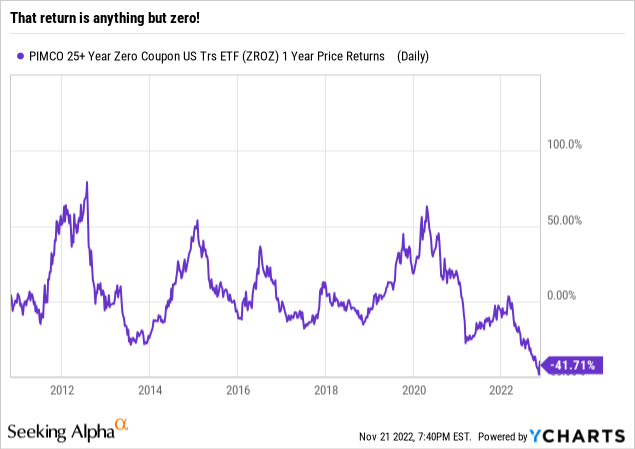

PIMCO 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund (NYSEARCA:ZROZ) is an ETF that might just be setting up to be a solid winner. Just not immediately. As rates move toward the ultimate top of their range for this interest rate cycle, owning Zero-Coupon bonds with long maturities can be attractive for investors who see falling rates as akin to owning growth stocks: price appreciation is the goal, not income. ZROZ is rated Hold for now, only because we still see potential for long-term rates to move higher. But you could say this one is getting loose in the investing bullpen, and could enter the game in the foreseeable future.

Strategy

ZROZ is run by bond giant PIMCO. It aims to profit from the total return on the longest-term U.S. Treasury Bonds whose coupon payments are “stripped out,” otherwise known as Zero Coupon Bonds. The fund does make quarterly distributions of cash, but those are not interest payments. It distributes any profits from selling bonds prior to maturity.

Proprietary ETF Grades

-

Offense/Defense: Offense

-

Segment: Bonds & Cash

-

Sub-Segment: Treasury Bonds

-

Correlation (vs. S&P 500): Low

-

Expected Volatility (vs. S&P 500): Moderate

Holding Analysis

This ETF holds two dozen different bonds, all of which are issued sans a coupon payment. These so-called Zero-Coupon Bonds make it so that the investor does not receive a cash “coupon” return, but rather earns money by a combination of price change and “accretion” of interest as the bond approaches maturity. That maturity is a very long time away in this case. Bonds in this portfolio mature between the years 2047 and 2052, the very long end of the Treasury yield curve.

Strengths

Long-term bonds have a lot of “juice” in them, since their prices can whip around on any significant news coming from the fixed income markets. Their long time to maturity makes them behave more like stocks than traditional bonds, at least when volatility is concerned. However, there are times when stocks do not provide much return, but falling interest rates on long bonds do. That makes ETFs like ZROZ an intriguing potential source of profits, as a stock alternative.

The fund is also quite liquid. While it “only” has about $500mm in AUM, it trades quite actively, over $40mm worth in the average day.

Weaknesses

These bonds are a long way from home, so to speak. We suspect one owns ZROZ because they aim to sit on the position and wait to cash in the bonds at full maturity value in 2-3 decades. That wouldn’t happen anyway, since the fund aims to maintain that 25-30 year maturity posture. So, any volatility from rising rates can lead to significant losses in a fund like ZROZ. Witness the 40% decline in this ETF so far this year. Not like traditional bond investing at all.

Opportunities

The above chart is about the best evidence we can show that ZROZ can not only take away wealth as it did this year. It can pack a heck of punch when long Treasury rates sink, as they did multiple times during the past decade. This graph shows that on multiple occasions, ZROZ posted a 1-year return of more than 50%. These are price returns, so it excludes the aforementioned profit distributions that may have occurred. Bottom-line: this ETF merits a place on our list of funds to consider once we determine that rates are heading significantly lower, at least for a while.

Threats

This is not our parents’ bond market. As such, the potential for a false breakout in bond prices, spurred on by a market desperate for a “Fed pivot” that doesn’t occur or otherwise disappoints, can trap investors into thinking the bond price cycle has turned. Bear markets tend to get cheaper, not simply “bottom” which everyone expects them to.

Proprietary Technical Ratings

-

Short-Term Rating (next 3 months): Hold

-

Long-Term Rating (next 12 months): Hold

Conclusions

ETF Quality Opinion

ZROZ makes our short list for whenever its “go-time” to buy long-term Treasuries for price appreciation. We do not think that time is right now, but we will acknowledge it is getting closer, for tactical usage, if not for buy-and-hold purposes.

ETF Investment Opinion

ZROZ is a Hold for now. If you have suffered through this year’s 40% drubbing, you have likely already made that decision. There will be a shining opportunity here, since the credit markets will, in our view, remain secondary consideration to U.S. Treasuries for quite some time.

Be the first to comment