Dragoljub Bankovic/iStock via Getty Images

MannKind Corporation Has Good Growth Prospects Amid Disappointing Biotech Industry

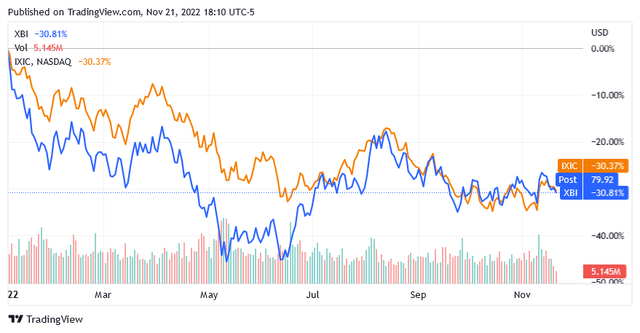

Year-to-date, biotech stocks have plummeted, as illustrated in the chart below, in which the SPDR S&P Biotech ETF (XBI) — a proxy index for the biotech sector — has slightly underperformed the US stock market — represented by the NASDAQ Composite (^IXIC) and lost 30.81%.

seekingalpha/symbol/COMP.IND

Nonetheless, there are good stocks in the biotech stock sector that will rebound quickly once the market breaks through this widespread bearish sentiment.

One such stock could be MannKind Corporation, a biotech developer of next-generation diabetes products. These products have good growth prospects in a global market that is expected to grow very rapidly.

The Role of MannKind Corporation in the Biotechnology Industry

Headquartered in Westlake Village, California, MannKind Corporation (NASDAQ:MNKD) is a biotechnology developer of innovative therapeutic products and devices through which the company aims to address the serious unmet medical needs of patients affected by endocrine and rare pulmonary diseases.

MannKind Corporation is also involved in the commercialization of these products and devices.

MannKind Corporation technologies consist of dry powder formulations and inhalation devices aimed at reducing the symptoms and other consequences of diabetes, pulmonary arterial hypertension [PAH] and non-tuberculous mycobacterial [NTM] lung disease through the convenient and rapid delivery of the ingredient deep into the lungs.

Thus, the drug can act locally or enter the bloodstream.

The Portfolio of MannKind Corporation

MannKind Corporation’s portfolio includes the following products, devices, and activities:

- Afrezza is an inhalable insulin that helps adult diabetics better control their blood sugar levels.

- V-Go is an attachable disposable daily insulin device that allows blood glucose measurement and can be worn independently of daily lifestyle. The V-Go device was acquired by MannKind Corporation from Zealand Pharma A/S (OTCPK:ZLDPF) for $10 million. Under the terms of the agreement, announced on May 17, 2022, MannKind Corporation is obligated to pay Zealand Pharma A/S certain milestones based on sales and certain inventory-related costs.

- Collaborations and services.

- Royalties from Tyvaso DPI, an inhalation powder. Tyvaso DPI is a prescription drug used in adults to treat PAH.

Diabetes is a disease that causes the body to either produce inadequate levels of insulin or not use insulin properly. In both cases, the condition causes an abnormally high amount of blood sugar to remain in the patient’s bloodstream. Over time, the condition can cause major health problems in the patient, affecting the cardiovascular, visual, or nephrological systems. The most common symptom of diabetes is fatigue, which also occurs in patients who are treating their disease.

Pulmonary arterial hypertension: people with pulmonary hypertension have high blood pressure in the pulmonary arteries or the heart arteries on the right side.

Some common causes of pulmonary hypertension can be congenital myocardial diseases, but also diseases of the coronary arteries or liver diseases. Other conditions that predispose to the disease include high blood pressure, clots of blood in the lungs, and chronic lung diseases such as emphysema. Pulmonary arterial hypertension can also have a genetic cause. If left untreated, the disease can lead to serious complications, including heart failure.

From The Third Quarter of 2022

During the third quarter of 2022, MannKind Corporation reported total revenue of $32.8 million, reflecting a year-over-year growth of 47.7% compared to $22.2 million for the third quarter of 2021.

Afrezza accounted for 33% of total net revenue for Q3 2022, V-Go for 16.5%, while revenue from collaborations and services accounted for 31.5% and royalties for 19%.

Afrezza’s net revenue for the third quarter of 2022 was $9.8 million, an increase of 11% year-on-year thanks to higher pricing coupled with an increase in the demand from patients.

The company sold V-Go devices in the third quarter and had net sales of $5.4 million.

Collaboration and services revenue declined 17% year over year to $10.3 million driven by the completion of research and development services related to MannKind Corporation’s collaboration with United Therapeutics Corporation (UTHR).

Royalties related to the launch of Tyvaso DPI totaled $6.2 million.

In the third quarter of 2022, Afrezza’s gross margin was 81% of total sales, more than 1.3 times higher than in the same quarter of 2021.

V-Go’s gross margin was 46% of total sales.

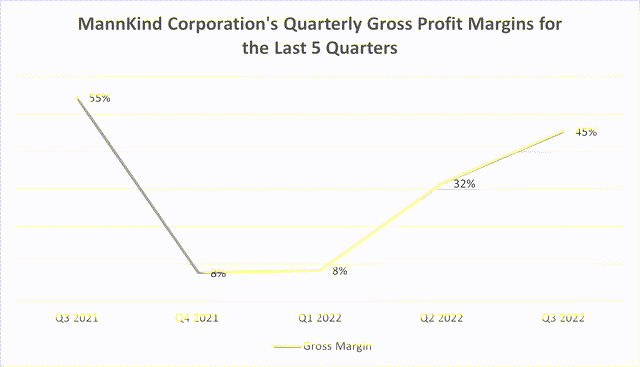

Overall, the company reported a gross profit margin of 45% of total sales showing a strong recovery compared to recent quarters.

seekingalpha/symbol/MNKD/income-statement

The company had total expenses of $42.4 million, a significant year-over-year increase of 47.3% due to higher personnel expenses in addition to V-Go-related promotional efforts. Total expenses were also impacted by costs related to stock-based compensation and the production of Tyvaso DPI. Thus, the impact of overall operating expenses resulted in a deterioration in net loss per share to $0.06 in the third quarter of 2022 compared to a net loss of $0.02 per share in the same quarter of 2021.

MannKind Corporation is still reporting negative net income, but it’s on track to turn positive, and shareholders likely won’t have to wait long given rising sales.

These have gained momentum that should continue as a result of favorable global market conditions analysts are predicting for the businesses of MannKind Corporation and other healthcare providers.

A shift from a net loss to positive earnings could potentially be reflected in a sharp rise in MannKind Corporation’s stock price.

Global Market Outlook

MannKind Corporation’s products seem to have a very promising future considering what analysts think about this market and their predictions about its possible development.

Diabetes therapy and drug delivery devices such as those from MannKind Corporation are next-generation diabetic products aimed at significantly improving the quality of life for diabetics.

While these innovative technologies help the diabetic to keep blood sugar levels under control, they come with minimal discomfort as they are not as invasive as the more traditional ones and are therefore not painful.

In addition, the process of calculating the correct dose of insulin to inhale or take orally is simple. However, this does not mean that these innovative products are less effective than traditional ones. On the contrary, they help reduce the risk of complications of the disease.

The practicality of using these technologies and the expected increase in global healthcare spending will favor the growth of this market over the next several years, according to analysts from ResearchAndMarkets.com.

These analysts also project that the global market for next-generation diabetes therapy and drug delivery devices will grow at more than 14% per year over the next 8 years and reach $28 billion in 2030. In 2020, the global market had an estimated value of $7.01 billion.

MannKind Corporation is making its way into a market with other major healthcare companies such as Abbott Laboratories (ABT), Medtronic plc (MDT), Sanofi (SNY), Eli Lilly and Company (LLY) and Johnson & Johnson (JNJ).

However, what will make a significant contribution to the global growth of the diabetes therapy and drug delivery devices market will be the expected significant increase in the cases of people with diabetes in the coming years.

According to the International Diabetes Federation [IDF], the total number of adult diabetics will increase from 537 million in 2021 to 643 million in 2030 and then continue to grow to 783 million in 2045.

Analyst Sales and Earnings Estimates

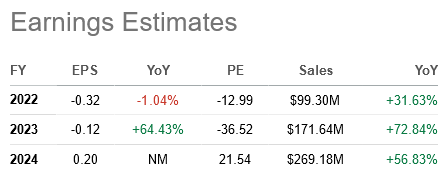

Analysts are expecting a positive turnaround in MannKind Corporation’s bottom line in 2024. If this happens, it could provide a boost for a big rally in the stock price.

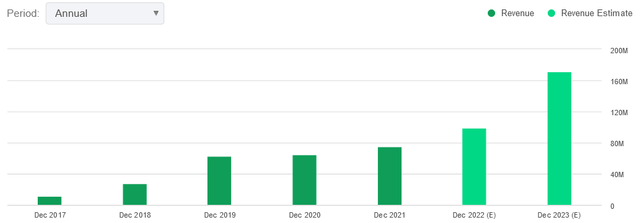

Analysts expect sales to grow 31.63% year-on-year to $99.3 million in 2022 and 72.84% to $171.64 million in 2023.

seekingalpha/symbol/MNKD

Analysts expect the net loss to improve in 2023, diminishing by 64.43% year-on-year, and expect net earnings per share of $0.20 in 2024.

seekingalpha/symbol/MNKD

The Stock Price Could Get Cheaper

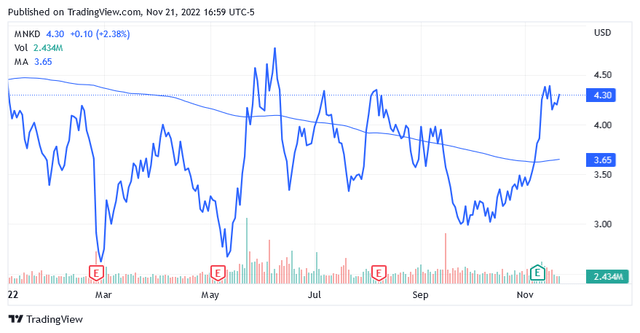

At the close of regular hours on November 21, shares were trading at $4.30 per unit for a market cap of $1.11 billion and a 52-week range of $2.49 to $4.88.

seekingalpha/symbol/MNKD

Given the strong upside potential, the stock does not look expensive right now, although the share price has broken out of the long-term trend of the 200-day simple moving average of $4.30 and is now well above it.

More recently, the stock price may have been driven by the third-quarter 2022 financial results.

But there is a possibility that the share price could retrace to the lower levels seen in October, creating an opportunity to take advantage of a cheaper entry point to buy shares in this biotech developer with amazing growth prospects. If enthusiasm for third-quarter 2022 results wanes, the stock price could drop a bit.

An investment in MannKind Corporation is not free from the risk that future growth will be missed or that its present value will be adversely affected by a higher discount rate resulting from increases in interest rates.

Analyst Recommendation and Price Target

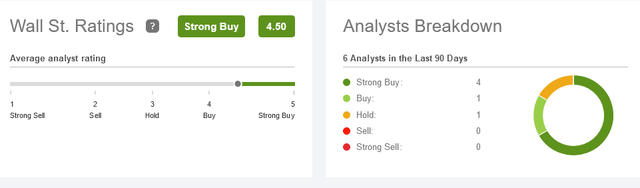

On Wall Street, the stock has 4 Strong Buy ratings, a Buy rating, and a Hold rating, resulting in a medium Strong Buy rating.

seekingalpha/symbol/MNKD/ratings/sell-side-ratings

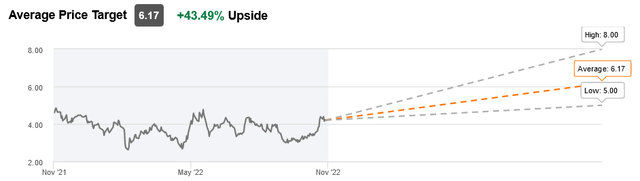

The stock has an average price target of $6.17, which translates to a 43.49% upside potential.

seekingalpha/symbol/MNKD/ratings/sell-side-ratings

Conclusion

MannKind Corporation is engaged in diabetes therapies and drug delivery devices. Despite competition from large healthcare companies, the global market also offers good growth prospects for MannKind.

The company is growing in sales and a positive net income is expected for 2024. The stock offers growth potential, but also a considerable risk.

Be the first to comment