Vadym Pastukh

Zoom Video Communications (NASDAQ:ZM) was a pandemic darling, making investors who sold on the way up tremendous amounts of profits. ZM started 2020 trading around $68.72 and reached roughly $568.34 in October of 2020. Zoom became the acronym for virtual meetings even if another platform was being used. Let’s do a Zoom or set up a Zoom call became synonymous with the workplace environment, the same way people say, let’s grab an Uber or Google it. I wasn’t one of the fortunate investors who generated 5-10x returns from investing in ZM in 2020. Still, I have followed ZM closer during its downward spiral, looking for an opportunity to start a position. I am still interested in ZM as it has a strong balance sheet and isn’t part of the profitless tech trade. After reading through the earnings report, I think ZM has further to fall prior to the price stabilizing. There were many strong aspects of the quarter, but decelerating growth and lower Q3 guidance could send shares lower, creating a better entry point.

The market after-hours isn’t reacting well to Zoom’s lower guidance and revenue miss

Shares of ZM are trading down roughly -8% as the market isn’t digesting its earnings well. The main drivers are that growth is slowing, and ZM guided lower not just for Q3 2023 but for the full 2023 fiscal year. ZM’s Q3 revenue forecast is expected to come in between $1.095 billion and $1.100 billion vs. a consensus of $1.15B, while its non-GAAP diluted EPS is expected to be between $0.82 and $0.83 compared to $0.92 on the consensus estimates. For the full 2023 fiscal year, ZM was expected to generate $4.53 billion in revenue and is now guiding that its revenue will be between $4.385 billion and $4.395 billion. The consensus number for ZM’s full-year non-GAAP EPS was $3.82, and ZM guided for $3.66 – $3.69.

Steven Fiorillo, Seeking Alpha

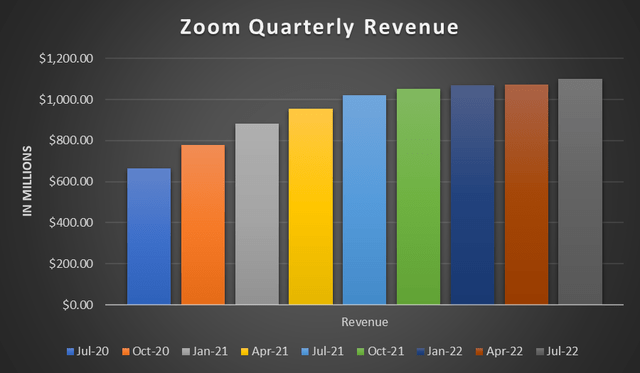

ZM’s growth is stalling out as were living in a post-pandemic environment where double-digit QoQ growth and 20% YoY growth just isn’t a reality. In the October 2020 quarter, ZM experienced 17.14% QoQ growth which fell to 2.87% in the October 2021 quarter. In the July 2021 quarter, ZM delivered 6.83% QoQ growth and 53.96% YoY revenue growth. Just 1 year later, ZM’s $1.1 billion of revenue in Q2 2023 had a growth rate of 2.4% QoQ and 7.64% YoY. In the July 2021 Quarter, ZM grew its revenue by $358 million YoY, and the 7.64% in YoY growth ZM just posted amounts to $78 million of additional revenue.

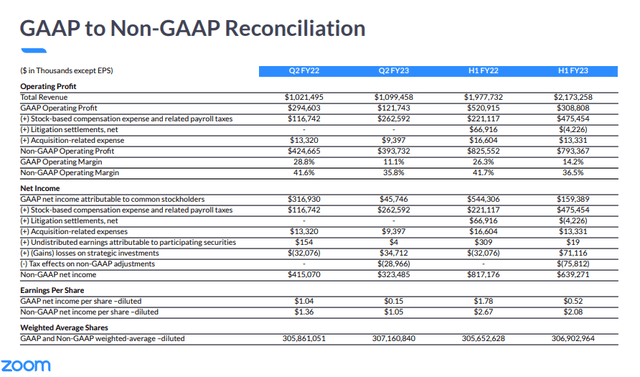

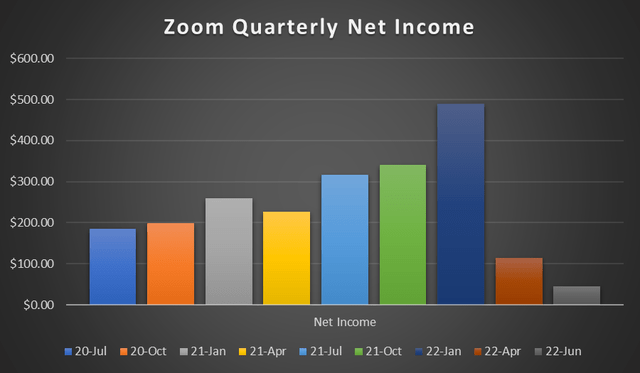

The next problem is that ZM’s profits have been deteriorating, even though revenue has increased. I care about GAAP net income, not non-GAAP, because of stock-based compensation. YoY ZM has more than doubled its SBC in the July quarter as it increased from $116.74 million to $262.59 million. The good thing is that ZM still made a profit, but shareholders are being diluted, and it is a cost that matters on the income statement. ZM went from having large profit margins that averaged 33.24% in the fiscal year 2022 to 10.58% in Q1 2023 and 4.16% in Q2 2023. In the July quarter of 2020, ZM’s profit margin was 27.99% (185.7m / 663.5m), and in the July quarter of 2021, its profit margin was 31.02% (316.9m / 1.02b). ZM’s profit margin dropped to 4.16% as its GAAP net income was $45.75 million.

Lowered guidance, decelerating revenue, and lower profit margins couldn’t have come at a worse time. Just last week Tyler Radke an analyst from Citi, downgraded ZM as he cited there were new hurdles to sustain growth. On Monday, the investment community learned that Tiger Global Management exited its position in ZM. One of the main headwinds for ZM is that video conferencing isn’t disruptive technology; it’s just gone mainstream. ZM has a great product, but so does Microsoft (MSFT) with Teams. For anyone who uses Microsoft Office, Teams interfaces perfectly with Office 365, the Outlook calendar, and the entire product suite. Alphabet (GOOGL) also has Google Meet, Discord has video conferencing software, and Cisco Systems (CSCO) has WebEx. My opinion is that the decelerating revenue growth is because there are multiple quality options and less of a need for video conferencing options compared to 2020.

There is certainly an opportunity for Zoom to accelerate its revenue growth

Nobody can take away ZM’s ability to execute. Overnight Zoom became a household name and critical for business infrastructure in 2020. ZM was able to scale, execute and deliver to meet demand. 2020 was a testament to ZM as a company and its technological infrastructure. ZM has a track record of delivering; now, they need to differentiate their revenue mix and build out their business segments.

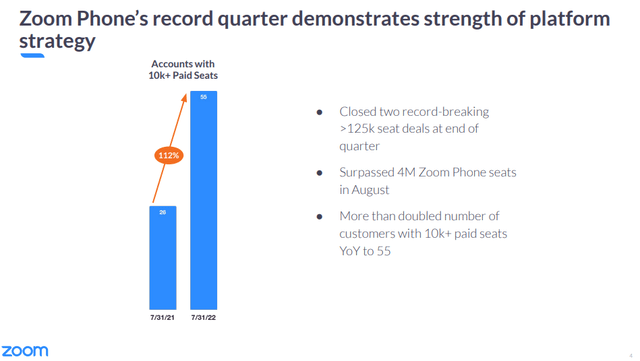

ZM has a large opportunity ahead of them in the Voice Over IP (VOIP) space. ZM has been building out its platform and incorporated Zoom Rooms and Zoom Phones. ZM’s customer count increased by 112% from 26 to 55 YoY for the number of customers with more than 10,000 paid “seats” or VOIP phones. In Q2, ZM onboarded their new largest customer twice with a global retailer then a global bank, each with more than 125,000 seats. In August, ZM had amassed over 4 million seats across its platform.

It’s 2022, but offices still have phones, and VOIP systems should eventually replace all traditional business phones. Many VOIP solutions offer an app that can be installed on a computer, tablet, or even a smartphone which can turn any device into your office phone. Communication is critical to business infrastructure, and a full VOIP package that can allow you to receive and make calls from any device no matter the location is critical in 2022. A VOIP platform sitting on top of ZM’s conferencing was a critical step as it enhanced the value of their product. Businesses were already used to ZM for conferencing; now, they are able to utilize it for their telecommunication needs; all they need is a device, cellular service, or access to the internet.

Building upon VOIP, ZM has delivered Zoom Contact Center and Zoom IQ for Sales. Their contact center is only 6 months old and has exceeded internal expectations having deals reach seat sizes not expected until next year. ZM has gained traction as one of the largest U.S healthcare systems, which was unnamed in ZM’s remarks, chose Zoom Meetings and Zoom Phone to support their 40,000 employees. UCLA expanded its relationship with ZM by adding 15,000 Zoom Phone licenses, and Warner Bros. Discovery (WBD) partnered with ZM for its global communications.

Phones and contact centers equals additional reoccurring revenue for ZM. ZM has a household name and can expand its contracted revenue with existing customers by closing deals for additional services. In Q2, ZM’s enterprise customers grew to 204,100, which is a large pool of existing relationships to convert into additional reoccurring revenue.

Zoom has a strong balance sheet, and there could be an argument that it’s undervalued compared to profitless technology companies

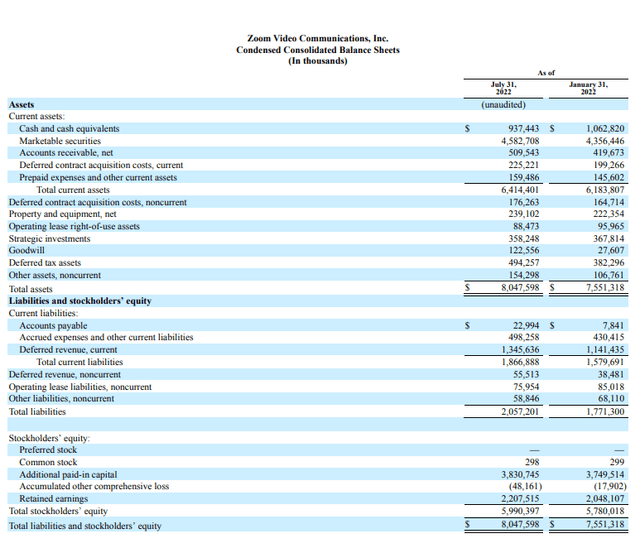

There is nothing not to like about ZM’s balance sheet. ZM’s balance sheet reminds me of a smaller version of Meta Platforms (META). ZM has $5.52 billion of cash on hand as its marketable securities are under current assets and can be easily liquidated. ZM has $8.05 billion in total assets with only $122.56 million in goodwill. ZM is debt free, and its $2.06 billion of total liabilities can be eliminated immediately as its fully covered by ZM’s cash position. ZM’s balance sheet is clean, unlevered, and gives the company options to maneuver in the future.

Zoom looks interesting from a valuation standpoint

Over the trailing twelve months, ZM has generated $1.29 billion in free cash flow (FCF), $4.3 billion in revenue, and has $5.99 billion of total equity on its balance sheet. ZM’s market cap has declined to $29.07 billion in after-hours trading. Snowflake (SNOW), which hasn’t reported its latest quarter yet, has a market cap of $48.97 billion while its TTM revenue is $1.41 billion, its TTM FCF is $255.7 million, and it has $5.49 billion of equity on the books. While SNOW generates FCF, it’s considered unprofitable because its net income is -$642.5 million.

From a valuation standpoint, ZM is trading at a P/S ratio of 6.77x, an FCF multiple of 22.47x, and has been given a 4.85x multiple on its equity. SNOW trades at a 34.66 P/S ratio, a 191.51x FCF multiple, and the market has placed an 8.97x multiple on its equity. The interesting thing is that some investors would argue that SNOW deserves to trade at these multiples due to its revenue growth, but the facts are that ZM did trade at lofty multiples when its revenue growth was off the charts, then its share price came back to reality. At this point in time, ZM is profitable, is still growing, and generates over $1 billion in FCF over a TTM period, yet it’s trading at a much cheaper valuation than SNOW.

I have no idea how low ZM will go, and it hasn’t seen these levels since February of 2020, pre-pandemic. Some would argue that the market isn’t rewarding ZM for any of its growth over the past 2.5 years and that it deserves to trade higher. I subscribe to the notion that the market is always correct, even if I don’t agree with it. If I had to speculate, I would think ZM will trade lower as stop losses and trading algorithms get triggered due to the -8% decline. I think ZM’s valuation looks attractive, but there is a chance ZM trades lower on concerns from slowing growth and increased competition. If shares somehow fall to $75, I would get very interested and may start a position.

Conclusion

The Q2 report wasn’t great and decelerating growth is shaking the market. Execution isn’t what’s being debated; whether ZM can get back to substantial revenue growth is. I think ZM has an opportunity ahead of it as a full unified communication platform with Zoom Phone could continue to win over large enterprise clients and small to midsize businesses, generating additional monthly reoccurring revenue. ZM has a great balance sheet and is trading at an interesting valuation. I think ZM will probably trade into the low $80s before it goes back up, and we could even see the $80 level breached. I would be looking to enter this around $75 if it gets there. I think ZM has both long-term valuation potential and could be a possible takeover target from CSCO or GOOGL to enhance their offerings to compete with Microsoft Teams.

Be the first to comment