dimid_86/iStock via Getty Images

Investment Thesis

Cutera Inc. (NASDAQ:CUTR) shares have gained in value by 39% this week, reaching a price of $68 at the time of writing, after the medical aesthetics company’s announcement that the FDA has cleared its AviClear device to treat Mild, Moderate and Severe Acne.

According to a press release:

In addition to reducing existing acne, clinical trials show that future breakout episodes are shorter, less intense, and more infrequent following the AviClear procedure. Further, acne clearance results continue to improve over time, demonstrating the long-term efficacy of this novel treatment. Importantly, no pain mitigation was utilized or required by any clinical study participant.

I am generally a fan of medical aesthetics companies as investment opportunities (I recommended Cutera to my marketplace subscribers 3 weeks’ ago) as I have often found them to be profitable businesses capable of driving recurring revenues, with high barriers to entry, due to the expertise required to develop and administer treatments, and the generally strong demand for such treatments.

In past notes for Seeking Alpha I have recommended Sensus Healthcare (SRTS), whose scar removal technology and equipment business is thriving again after pandemic pressures, including the enforced lockdown period, devastated its sales, and Soliton, whose Rapid Acoustic Pulse (“RAP”) tattoo removal technology was being expanded into cellulite and scar removal, as buy opportunities.

Since my notes, Sensus stock has risen in value by >150%, and Soliton has been acquired by AbbVie (ABBV), at a ~90% premium to traded price. On the other hand, Venus Concept (VERO), which leases medical aesthetics devices to clients around the world, has not enjoyed the same success, and its share are -37% since my last note in July last year, unable to shake off debt problems, and COVID affected sales, illustrating that not every medical aesthetics business is a straightforward “buy” opportunity.

If you are not currently long Cutera, would it be a good idea to invest now? Generally I would caution against investing after a share price spike, since the initial enthusiasm tends to fade after the initial buying spree pushes the stock price up. Now that its market cap has risen >$1bn, Cutera is entering uncharted territory, and scrutiny of its business model and adherence to guidance will inevitably increase.

As such, I will stop short of giving Cutera an outright “buy” recommendation, but in the rest of this analysis, I will provide several reasons why an investor prepared to embrace a higher level of risk might consider the company to be a high conviction buy.

Company Overview

Cutera is a medical aesthetics specialist with a focus on laser solutions that has been around a long time, its IPO having completed all the way back in 2004. Hair removal, fat reduction, muscle sculpting, tattoo removal and skin rejuvenation are some of the many services the company provides via a suite of technologically innovative products.

Cutera’s systems sales account for the bulk of its revenues, and the company wowed analysts recently with a strong set of Q421 and FY21 earnings results. Cutera earned $231m revenues across the year, up 57% year-on-year, although it was only narrowly profitable, with net income of $2.1m, or $0.11 per share.

For FY22, Cutera is forecasting $255 million to $260 million in revenues, and has promised to enter new markets such as acne treatment – a promise which it has already delivered – to augment a range of products that management suggests in a recent investor presentation compare favorably to competitors.

Cutera’s share price was devastated by the beginning of the pandemic in March 2020, when the lockdown period meant that its clients were scarcely able to use their equipment, due to the cancellation of elective surgeries, but quickly recovered and hit a high of $54 in August last year.

The current market cap of $1.23bn is ~5x forward sales, which seems relatively cheap, and in general, Cutera’s share price has been resilient, although there appears to have been a tricky period in 2018 when the board elected to dismiss CEO James Reinstein, commenting at the time:

We are dissatisfied with the company’s operational results and stock price performance in 2018. While we appreciate Mr. Reinstein’s efforts over the past two years, it’s time to seek new leadership at Cutera.”

More Cutera-throat, than Cute, perhaps, but it does seem to imply that Cutera is a business run for its shareholders, and that only outperformance will satisfy.

Reasons The Uptrend Can Continue

Cutera’s guidance for FY22 does not include any revenue from AviClear, but some analysts have been quick to raise their price targets for the stock on the back of the FDA’s approval, although the ceiling appears to be ~$70, which is the current price.

Without its additional spending on AviClear, however, Cutera’s Chief Financial Officer Rohan Seth pointed out on the Q421 earnings call that:

It’s worth noting that our EBITDA excluding the investments we made during the year to support the upcoming commercialization of our acne products would have been $8.9 million in Q4 and $30.2 million for full year 2021.

There will be further investments in AviClear – presumably related to launch and marketing – in 2022, Seth added, in the range of $15 – $20m, meaning EBITDA for the year will be unlikely to exceed $20m, but the CFO also added that “it’s our belief that we will earn a very strong return on these investments on behalf of our shareholders.”

Cutera management did not speculate on just how big the opportunity could be, but a slide from a recent investor presentation suggests that this is an 8.5m patient opportunity, with 9,600 dermatologists and 7,800 dermatology practices in the US alone.

Cutera uses a field sales team to drive product sales, and increase utilization of products, and obviously, post lockdown, this has become a far more useful resource, and much less of a drain on finances.

Balance sheet strength is another positive, with the current cash position of ~$165m being the strongest in the company’s history, which ought to mean that there are no dilutive fundraisings this year.

And another plus point is that Cutera grew revenues substantially in all 3 of its geographic territories – North America accounted for 48% of revenues, and grew by 61%, Japan accounted for 31%, and grew by 62%, whilst the rest of the world revenues grew by 41%, and accounted for 21% of revenues.

Conclusion – An Already Impressive Business Just Secured A Major Win & There Is All To Play For In A Post Pandemic Environment

Back in early 2020, the pandemic induced market sell-off dropped Cutera’s share price from ~$36, to <$10, and it is tempting to wonder what might have been had it not been for COVID, as prior to that, Cutera had managed to double its share price after the late 2018 low.

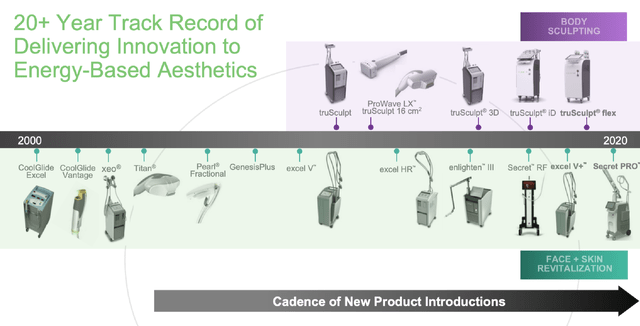

It strikes me that there has never been much wrong with Cutera’s business model – the company grew revenues in every year between 2012 to 2019, from $77.3m, to $182m, and whilst it was unprofitable in more years than it was profitable, growth was clearly the objective, and product development, as the slide below illustrates.

Cutera product development – last 20 years (investor presentation)

The fact that Cutera’s share price recovered as rapidly as it did means the aesthetics business passed an acid test, whilst many other companies faced a much longer and more tortuous path to restoring BAU performance.

There had not been much sign of stagnant sales at the company, but clearly the successful approval of AviClear has been foremost in management’s mind, and now that that hurdle has been cleared, and with cash plentiful, the strategy may shift towards profitability, which will be good news for investors, although bolt-on M&A could depress the valuation in the short term.

Interestingly, the medical aesthetics industry is not overly competitive, my research suggests, due to barriers to entry – Cutera lists its competitors (in its 2021 10K submission) as AbbVie (ABBV) Bausch Health (BHC), Vieve, Soliton, InMode (INMD) and Korea based Lutronic.

Bausch and AbbVie are both giants, and it is tempting to wonder if Cutera could become an acquisition target itself, although I suspect that the opposite may be true, and they will represent fierce competition, which is probably Cutera’s biggest challenge going forward, since it has grown large enough to be potentially bothersome to these deep pocketed rivals.

I think the gap between these enterprises and Cutera may be large enough for the latter to be able to enjoy a period of unrestricted growth, however, in a market freer from pandemic pressures, and therefore I would not be surprised to see the company’s valuation continue to grow in 2022, with revenues from AviClear beefing up revenues, particularly in the latter half of the year.

As mentioned in my intro, the sensible play in relation to Cutera may be to maintain a watching brief, and take advantage of a mini-selloff in the shares due to profit taking, or bearish signals from the wider market i.e. inflation and interest rate issues.

With that said, however, when medical device companies get on a roll, the upside can last for a long period of time, especially when earnings begin to outperform. Analysts clearly had not got too far ahead of themselves in relation to Cutera, and seem to have been taken by surprise by the sudden share price upside.

Now we will see how a promising product performs in a potentially lucrative market, and there may be further surprises to the upside to come, in my view. I would put the cap at a market valuation of $1.5bn in 2022, which implies maximum 25% upside, but that may be conservative if the AviClear launch goes well and I would urge investors interested in the medical aesthetics sector to watch this space.

Be the first to comment