Morsa Images/DigitalVision via Getty Images

Investment thesis

Zoom’s (NASDAQ:ZM) shares have been declining for over a year. They’re now down over 80% from their peak. The market is pessimistic about work-from-home stocks. But I see long-term growth potential for Zoom. The company is shifting its focus to enterprise customers. There is also potential for new services to drive strong incremental revenue. I think shares are fairly valued, even if I would prefer a larger margin of safety.

Focusing on the enterprise

Zoom was one of the key beneficiaries of the lockdowns and quarantines of the past few years. However, as we move out of the pandemic, the company’s platform is being used less and less. Zoom’s revenue growth rate is slowing. The company reported a topline increase of just 12% year over year.

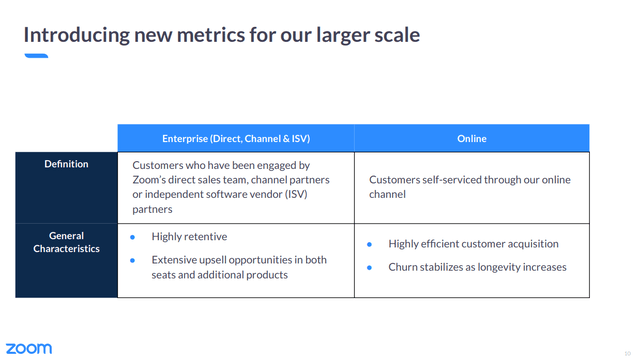

In response, Zoom has shifted its focus to its enterprise customers. The company defines this segment as customers directly engaged by their sales teams and partners.

Last quarter, enterprise revenue grew by 30% year over year. The segment had a strong net dollar expansion rate of 123%. At the end of last year, the company projected 20% growth for its enterprise segment. This offset flattish estimated growth in their self-service segment.

Customers from the enterprise segment are more reliable. Management reports that an increasing number of clients are committing to multi-year contracts. These long-term contracts will ensure more consistent recurring revenue. This stabilizes Zoom’s topline and makes their results more stable over time.

Zoom’s enterprise offerings are also less vulnerable to a video conferencing pullback. At a recent conference, the company’s CFO explained why.

Enterprise retention rates have remained very, very strong. And that’s because even though usage is coming down slightly in terms of minutes usage, people aren’t going to the office every single day of the week. And so they need those new licenses. If they’re working outside of the office even one day a week, they still need those licenses and that’s what we’re seeing.

Video conferencing services are integrated into our workflows. It doesn’t matter if Zoom usage declines. What matters is that the software is used enough for customers to continue paying. So far, it seems like that’s been the case.

Businesses have been increasingly cautious about spending, especially those in the technology sector. Video conferencing services are a cheap alternative to business travel. This may drive continued usage of Zoom’s services. The company has offerings focused on events, conferences, and webinars.

New products create an opportunity for growth

Zoom has been expanding its offerings. The company crossed the three million user mark for its cloud PBX system during the last quarter. More recently, the company added a CCaaS product and an offering for sales teams. I think there’s a huge opportunity to add incremental revenue from existing customers.

Zoom is an industry leader in the video conferencing space. Their software compares favorably to its competitors. This creates a strong install base for the company to sell services into. Businesses are usually more willing to buy from vendors they have a positive working relationship with.

There are also some economies of scale here. Zoom’s products can all run on the same cost structure. New offerings can use existing infrastructure and sales resources. This drives extra revenue growth without increasing operating costs by as much. Zoom can be competitive on both pricing and quality with this strategy.

All this reduces the impact a recession may have on the company. In fact, Zoom may benefit from a consolidation in IT spending. Their core product is the market leader in video communications software. Clients are less likely to cut spending on a key communications platform. Instead, they may buy Zoom’s other offerings.

There’s some execution risk here, as most of these products are still in their early stages. The overwhelming majority of Zoom’s revenue comes from its core service. On their latest earnings call, management gave more details on this revenue breakdown:

In terms of when I expect any of those [non-Zoom meetings] products, I think on a combined basis, we do see the combination of those products exceeding 10% of revenue today. We’ve always committed that as soon as each — any individual product gets to 10%, of course, we’ll start disclosing that. I think that’s likely — not likely to happen in FY23, but probably in FY24, FY25, you’ll start to see some of those product lines coming into their own and producing at least 10% of revenue.

The company is diversifying, but it’s still highly dependent on its core offering. A lot of their newer products also have established competitors. I believe Zoom can grab market share, but it’ll be a while before we see more concrete results. I think this uncertainty will make the stock more volatile through the rest of the year.

Zoom is creating solid free cash flow

Zoom has generated strong free cash flow over the past few years. During the last twelve months, the company reported $1.52 billion in FCF. The business converted 36% of its revenue to free cash flow. This is very impressive for a company trying to rapidly expand its operations.

In the long term, the business expects to convert 100% or more of their non-GAAP operating profit to free cash flow. I believe this stream of cash should reduce the uncertainty around the company’s core business model.

Stock-based compensation is one of the main reasons why free cash flow is so much higher than net income. During the last year, the company paid out 28% of operating expenses in shares. However, a lot of this expense is likely driven by hiring trends. The company added many employees during periods when their share prices were high. While SBC is a real, reoccurring expense, this rate is likely to come down over the long term.

During the last quarter, the company’s shares outstanding only increased by 1% year over year. Based on the company’s guidance, diluted weighted average shares outstanding are expected to increase by only 1% this fiscal year. The company’s SBC expenses are high. But the company seems to be doing a good job of keeping dilution under control.

The valuation is now reasonable

Zoom’s valuation has come down significantly since the peak of the pandemic. At one point, shares traded at a triple-digit EV/sales multiple. Now, the company trades at a more reasonable 5.7 times forward EV/sales. The business has a strong cash position, with $5.7 billion in cash and fixed income products.

Shares are trading at about 17 times EV/FCF. I think this is a fair valuation for a company that forecasts solid double-digit topline growth. Management sees a potential increase in the rate of topline growth near the end of the year. This is an opportunity for additional upside.

Final verdict

Zoom has had a rough year, and the next potential inflection point is still months away. I still see solid opportunities for expansion. The company is generating strong free cash flow. There’s solid operating leverage in their business model.

I think the business is reasonably valued relative to its potential for growth. I believe shares would be a clearer buy if they dropped into the $80 or $90 range. I think this is still a good opportunity for GARP investors with a higher risk tolerance.

Be the first to comment