SDI Productions

Investment Thesis

Zoom Video Communications, Inc. (NASDAQ:ZM) is a pretty self-explanatory company, given that the majority of us have interacted with its product in one way or another. I’ve recently looked into Zoom’s most recent 3Q22 results, and after my analysis, there seem to be a few fundamental flaws with its underlying business.

The primary concern seems to lie in the commodity nature of its core product as well as the increasingly competitive landscape. And without any clear competitive advantages, and yet a hefty amount is still being spent on S&M expenses, causing its margins to fall. Furthermore, they are also incurring massive amounts of SBC expenses, which in my view, are inflating its profitability, and worst of all, diluting shareholders.

Lack of Operating Efficiency, and Weak Sales Execution

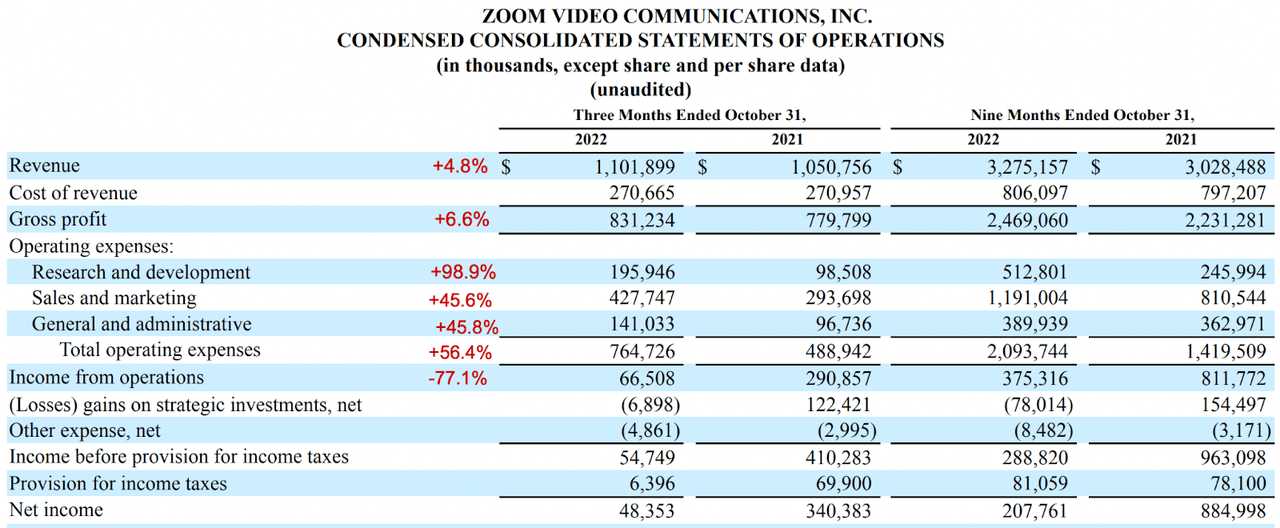

Zoom 3Q22 10-Q

Zoom 3Q23 revenue grew 4.8% Y/Y, and yet, the operating income declined by 77.1% Y/Y. This is driven by their increase in investments as their overall operating expenses grew by 56.4% Y/Y, indicating the lack of operating efficiency. Keep in mind that this is the 6th consecutive quarterly decline in revenue growth.

During the quarter, they added 5,600 new enterprise customers, and this was a decline from 10,700 in 3Q22, and 5,209 in 2Q23. Its sales and marketing expenses (“S&M”) grew by 45.6% Y/Y, and this disappointing revenue growth and net new enterprise customers further support the weak sales execution by the management team. I thought Zoom had done well to leverage the Covid tailwind to establish a brand presence, but it seems that it was not enough to mitigate the impact of the post-Covid normalization and increasing competition in the space, given the commodity nature of the product.

High Stock-Based Compensation Expense

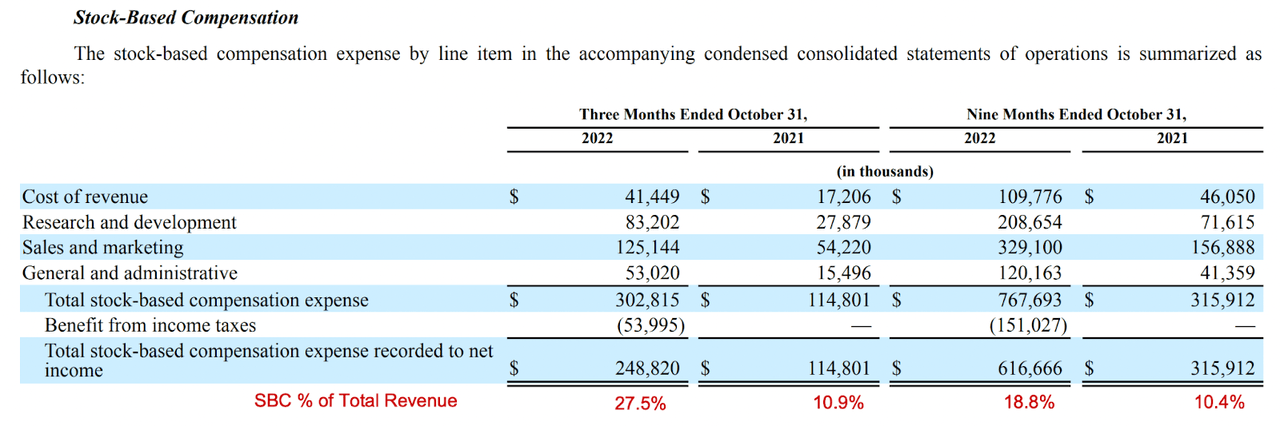

Zoom 10-Q

Another concern is Zoom’s increasing stock-based compensation (“SBC”) expense, which also makes up a hefty amount of its overall operating expenses. In 3Q22, its SBC make up 27.5% of its total revenue compared to 10.9% a year ago.

As SBC are expenses incurred to hire and retain employees, it should not be treated as a non-cash expense, and thus, investors should refrain from adding it back into their operating profit. This is also generally known as the non-GAAP operating profit or adjusted EBITDA. Doing so will only inflate Zoom’s profitability, which is not a true reflection of its margins. Thus, I prefer to look at its operating profit.

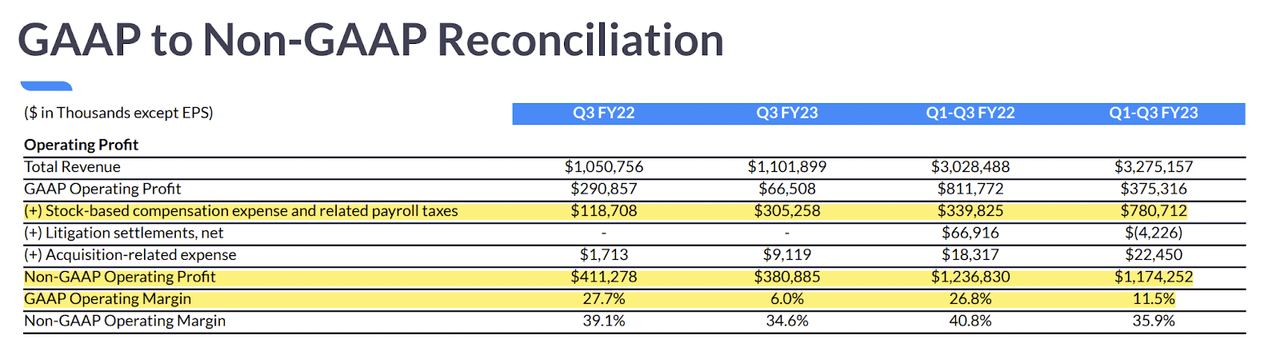

Zoom 3Q22 Presentation

Based on the table shown above, we see how Zoom had attempted to add back its SBC to attain the non-GAAP operating profit and margin, highly inflating its profitability. Not only does high SBC impact operating profit, but it also dilutes shareholders by issuing more shares.

Free Cash Flow After SBC

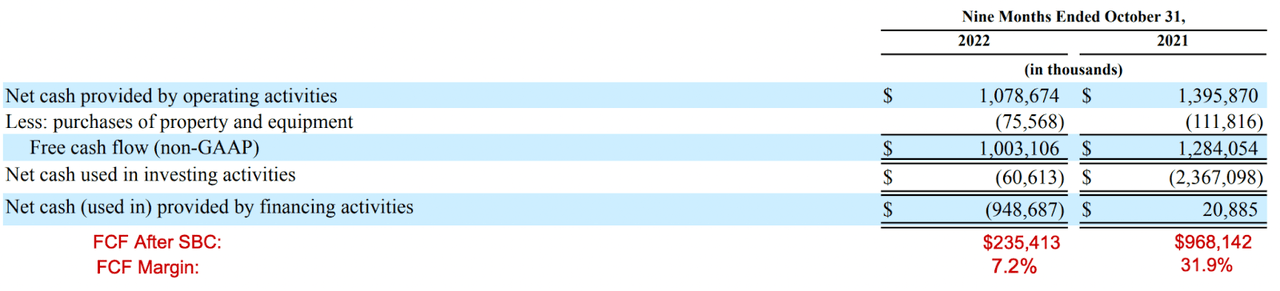

Zoom 3Q22 10-Q

I also attempted to exclude the SBC from its free cash flow (“FCF”), which gives me a year-to-date (“YTD”) FCF of $235 million, and an FCF margin of 7.2% as of 3Q22. This is a vast difference from its original FCF margin of 30.6%. This shows the impact of SBC on FCF, and like operating profit, investors should avoid excluding SBC from FCF.

Conclusion

There are a series of fundamental red flags as seen from its lack of operating efficiency, weak sales execution, declining profitability, and high SBC expense. Moving forward, the question is if investors can expect a reacceleration in growth rates and recovery in the margin, assuming that Zoom continues to reinvest into the business. That remains uncertain, although it has a strong balance sheet with no debt to sustain its operation. As of now, I’ll prefer to remain on the sidelines for Zoom Video Communications, Inc. unless there is a clear visibility of recovery.

What are your thoughts on the quarter? Let me know in the comment section below.

Be the first to comment