lindsay_imagery/E+ via Getty Images

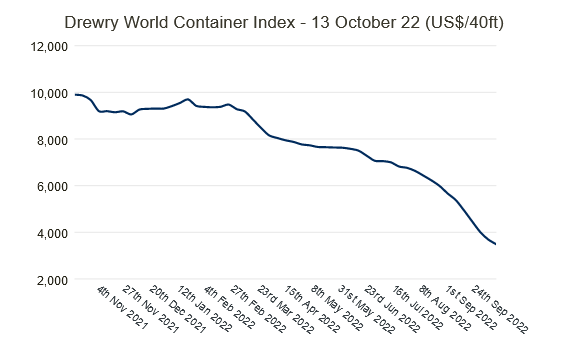

Freight Rates are rolling over

Since I published my last article on ZIM Integrated Shipping Services (NYSE:ZIM) the stock plunged by 62%. During the same time, global Container Freight Rates fell off a cliff. The WCI (World Container Index) fell from $ 8,000 per 40ft container (FEU) to $ 3,500 per FEU as of this week.

Drewry World Container Index (drewry.co.uk)

The FBX (Freightos Baltic Index) fell from $ 9,200 FEU to $ 3,500 per FEU during the same time.

Freightos Baltic Index (fbx.freightos.com)

How does this affect ZIM?

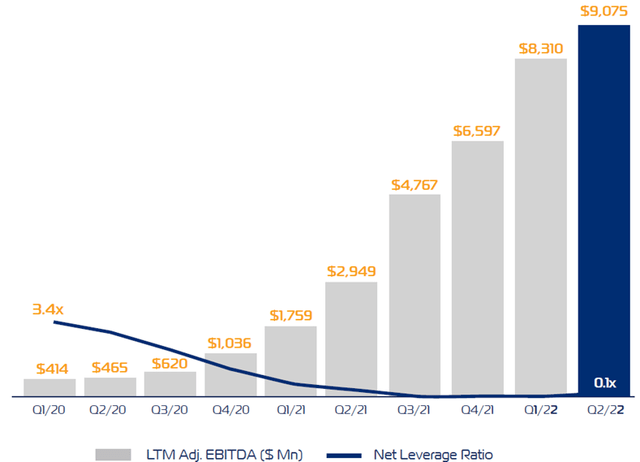

ZIM is a Container Liner that aggressively operates in the Container Shipping market. They are heavily exposed to swings in Container Freight Rates. Additionally, the vast majority of their 149 vessels are chartered in from Containership Lessors. The average Charter Rates went up parallel to Freight Rates. During the runup, ZIM profited from surging Freight Rates, but their Charters were still on contracts from previous times. The operating leverage created an insane spike in earnings during 2021 and 2022. ZIM went from barely breaking even in early 2020 to profit margins of 40-50% in late 2021 and early 2022. It’s pretty clear that we’ve seen the peak of earnings and margins during the first half of 2022.

Q2 2022 Investor Presentation (ZIM Investor Relations)

In the future, the operating leverage from which ZIM benefitted is not only going to disappear but is likely to reverse towards the negative. The new leases ZIM entered will increase their average cost per TEU progressively. Bunker rates remained somewhat sticky, and freight volumes are peaking. Given the macroeconomic circumstances (further reading: The Next Pivot Will Create A Fiat Crisis), I expect that volumes are the next shoe to drop because of demand destruction.

A qualitative argument: I work in a tax office in Germany and have direct connections to middle-class clients operating commercial businesses. Many of my relatives have their own businesses. Two of them have companies related to the housing sector (architect and electrician), and one is self-employed in the automobile business. I’m receiving red flags left and right: investors are bailing out, housing construction is weakening significantly because of cancellations, cosmetic repairs on cars are being postponed, and commercial businesses have too much inventory because they expected supply chain disruptions to last and ordered multiples of their usual stock in 2021 and early 2022 (maybe an additional explanation for the previous shipping craze). In times of surging energy costs, the average consumer will reduce unnecessary spending. Usually, that’s spending on things. A bad sign for the demand side of Container Shipping.

I believe ZIM will likely adjust their 2022 full-year guidance of adjusted EBIT of $ 6.3 – 6.7 billion downwards in the next quarterly report, as they assumed volume growth during 2022 and only a gradual decline of spot rates in H2 2022. Instead, we see crashing Freight Rates and likely a significant decline in shipping volumes in the near future.

The supply side is extremely worrying too. A total of 6.22 m TEU worth of vessels are now on order. That equates to an orderbook-to-fleet ratio of 25%. Most of the vessels will be delivered in 2023 and 2024. This makes for a perfect storm of exploding supply and decreasing demand in the next two years.

Regarding the dividend policy of ZIM: If I would manage a Liner company heavily exposed to Freight Rates, and I would see Freight Rates rapidly declining in orders of magnitude, which would seriously endanger my profitability in a year or so, I’d try to limit unnecessary spending. From a business side, it just doesn’t make sense to distribute 50% of net earnings as dividends while Freight Rates come down crashing. Therefore, I wouldn’t discard the possibility of a decrease in the variable dividends of ZIM. The “fixed” yield provides great article titles, though:

Seeking Alpha Title from April (seekingalpha.com)

Seeking Alpha Title from August (seekingalpha.com)

Seeking Alpha Title from October (seekingalpha.com)

Every couple of months, the “monster” dividend yield increased – amazing.

Jokes aside: Presently, ZIM is still operating a very profitable business, as Freight Rates remain nearly twice as high as their multi-year average. But the markets are forward-looking.

It’s always about the rate of change, not the nominal level.

Freight Rates will likely crash further from their still very elevated levels while freight volumes may decrease too. Meanwhile, Bunker rates remained somewhat sticky until now. A negative terminal rate for the business doesn’t seem unreasonable to me. I believe the markets are rational on ZIM price action. However, shorting ZIM after the intense selloff can be dangerous too. Especially if the proposed dividend yield for Q4/2022 really comes to fruition.

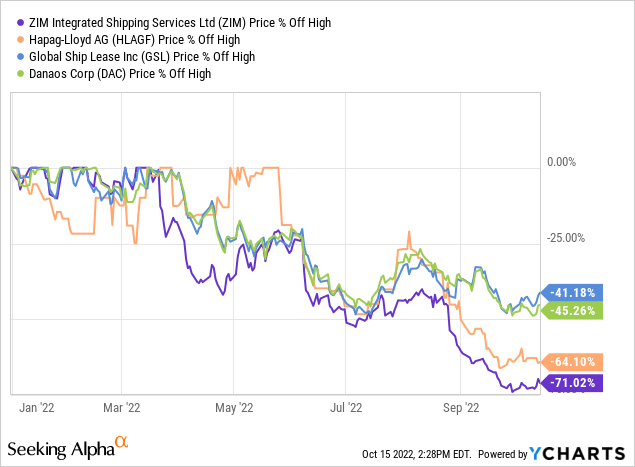

Right about Liners & wrong about Lessors

In retrospect, I was right about the breaking point of the Container Shipping cycle. My timing was somewhat lucky, as the craze could have gone on for a prolonged period of time. Instead of buying Liners, I suggested buying Containership Lessors, as many of the companies [e.g., Global Ship Lease (GSL), Danaos Corp. (DAC)] locked in extremely profitable leases for the next years. These are secured cashflows as the contracts are never renegotiated unless Liners face liquidity crises. Counterparty risk on these contracts remains low, as Liners (e.g. ZIM or MATX) printed cash during the acute supply chain disruptions and thus remain net-debt-free. Liners profited from sky-high freight rates, and now Lessors will profit from the pristine balance sheets of their counterparties.

What I got wrong was that I thought the market would discount the fact that many of the Containership Lessors were unaffected by the moves of the freight rate spot market. I also underestimated the significance of the macroeconomic trend and thought markets would differentiate, even during a liquidity crisis. Liners did sell off more than Lessors, but the pain of holding Lessors was severe too:

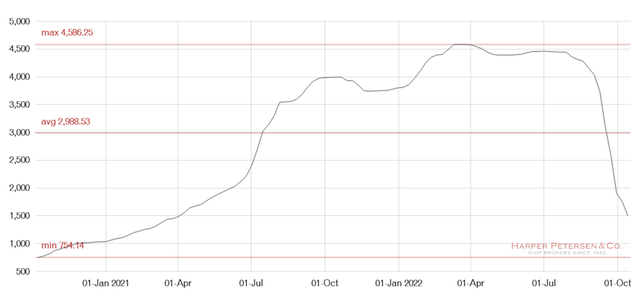

Markets priced in the significant chance of a severe recession in 2023. Furthermore, the Harpex Index (Containership Charter Rates) dropped sharply due to previously missing data points because of illiquid markets, and Lessors sold off massively.

Harpex Index (harperpetersen.com)

The Container Shipping Cycle

In my last article about ZIM, I introduced my conceptualization of the Container Shipping Cycle. After a brief explanation of my original idea, I’ll give an update on where I think the cycle moved after the recent crash of freight rates.

Phase 1: Market Uptick (Buy Liners)

During the first phase of the Container Shipping Cycle, the market is in a constant state of undersupply. Spot Rates have bottomed from their (usually multi-year or decade) downturn. Some form of catalyst provides meaningful upside for Freight Rates and Charter Rates. During this part of the cycle, you want exposure to Shipping Liners, as they provide meaningful operating leverage.

An uptick in rates already happened in 2019, and Covid was the major catalyst in 2020-2021 to propel Freight Rates and Charter Rates to never-seen-before levels. Lessor Companies fix their contracts for several years, and during Phase 1, only customer solvency improves for them. Cashflows take a while to rise. The ongoing charter contracts were agreed upon months or years ago with low Charter Rates. During Phase 1, Liners profit from the low costs of their previously chartered vessels and increasing Freight Rates. The result is a surge in margins and net profits. Shipping Liners are swimming in cash.

Phase 2: Market Peak (Buy Lessors, Sell Liners)

Liner Companies start earning record profits and usually rush to charter more vessels to increase the supply. This increases the newbuilds ordered significantly. Lessors start rolling their contracts, and meaningful cash flow gets secured by them. The cash inflows that Lessors experience are the outflows that Liners have to pay. Therefore, the operating leverage during Phase 1 slowly disappears for Liners. Earnings and Margins of Liners start to decrease as more and more charters are fixed.

At the late stage of phase 2, virtually all medium-term charters have been fixed with higher charter rates. Additionally, newbuilds are delivered, and the supply of Containerships meaningfully increases. Because of the additional supply, freight rates and charter rates start falling. Liner companies are hurt, due to their exposure in the spot market, while lessors earn secured cash flows.

Phase 3: Market Decline (Sell Lessors)

Huge costs due to high charter fixtures create pressure for Liners, and reduced credit ratings begin to burden the Lessors too. The oversupply of Containerships in the global market results in low Freight Rates and Charter Rates. The next downturn begins until the oversupply resolves.

The current state of the cycle

On April 2022, I believed that the Container Shipping Cycle was in the late stage of Phase 1. At that time, freight rates were near their all-time highs, but I thought there were signs of weakness. Charter Rates were holding up much better. But retrospectively, charter rates only held up because of an illiquid market. Looking back, I think my assessment of the state of the cycle was fair back then.

I believe we now entered Phase 2. The first newbuilds will hit the market soon, and Lessors started rolling most of their contracts. GSL and DAC have signed very profitable multi-year charters. Some of them are scheduled to commence between late 2023 and late 2024. That leaves significant time to collect secured cash flow during the next two years. GSL and DAC fixed the majority of their Charter Agreements until 2025-2027. Meanwhile, Liners are still printing money, but the markets begin discounting significant decreases in net profits because of expectations of further falling freight rates.

Macroeconomic headwinds

The current macroeconomic circumstances have more impact on stock prices than the Container Shipping Cycle itself. The market is pricing in future deglobalization, monetary tightening of Central Banks, a severe recession in 2023, and huge increases in energy and commodity prices. The resulting strong US-Dollar leads to falling asset prices. A high-beta sector such as container shipping will get hit hard by these factors, no matter what happens to the cash flow of individual companies. Because of the volatility of the sector, the implied risk is viewed as high. During a broad market selloff, the container shipping sector will likely underperform.

Because the macroeconomic circumstances have changed during the last couple of months, I reduced my exposure to the stock market significantly and raised my cash allocation in H1/2022. As I have explained in my last article, ‘The Next Pivot Will Create A Fiat Crisis’, there is no point in trying to front-run a potential pivot of Central banks. Personally, I will wait until the market breaks, the Central Banks pivot, and start their next round of monetary easing. Containership Lessors are likely on my future buying list. But the macroeconomic headwinds speak against exposure in such a high-beta sector.

Closing Thoughts

I view the Containership Liners as too risky for the potential upside. The macroeconomic headwinds and the state of the Container Shipping cycle speak against an investment in ZIM Integrated Shipping Services. Containership Lessors like Global Ship Lease, Danaos Corp., or Costamare Inc. (CMRE) remain intriguing investments because of their secure cash flows and high/stable dividend yields during the current state of the Container Shipping cycle.

The Containership lessors will be one of the investments I’ll possibly reenter if I see the current liquidity drought and demand destruction take a turn. The Container Shipping Cycle has progressed towards Phase 2, where Liners start to feel the pressure and Lessors enjoy stable cashflows, but the current macroeconomic environment keeps me from investing in any high-beta sector. I will update my views on the Container Shipping Cycle and the, in my regards more important, macroeconomic factors on Seeking Alpha when they change.

Be the first to comment