Tim Boyle

Introduction

In my search for a medical devices and healthcare company with a strong diabetes franchise, I came across Abbott Laboratories (NYSE:ABT). In my analysis published in August, I concluded that the stock is still somewhat expensive at $110, although it is down 20% from its all-time high and the speculation triggered by the company’s strong COVID-19 franchise may be largely over. This is also underscored by the abysmal – but expected – year-to-date performance of vaccine makers like Pfizer (PFE). The key aspects of my investment thesis on Abbott are:

- Abbott is the price leader in continuous glucose monitoring and insulin dosing – a fast-growing area.

- The company is broadly diversified across medical devices, diagnostic equipment, specialized nutrition, and pharmaceuticals – making earnings less volatile and dividend growth very reliable.

- The company can afford to grow through acquisitions, thanks to pandemic-related increases in free cash flow and strong cash on hand ($9 billion in cash, cash equivalents, and short-term investments at the end of the second quarter of 2022).

Abbott will report its third-quarter results on October 19 before the stock market opens. The stock is down about 10% since my last article and is trying to find support at $100. In this update, I share my opinion on the company’s upcoming earnings release and explain whether I think the stock is a buy at $100 using discounted cash flow analysis. For other approaches, such as a valuation based on multiples or a discussion of Abbott’s FAST Graphs chart, see my previous article.

What To Expect From Abbott On The SARS-CoV-2 Front?

In its second-quarter earnings press release, the company forecast full-year 2022 COVID-19 test revenue of $6.1 billion, while sales through June 2022 already amounted to $5.6 billion. In 2021, SARS-CoV-2 test-related revenue was $7.7 billion. So, while it’s only natural that revenues will decline as the pandemic ends, revenues of only $500 million in the second half of 2022 represent a very low bar to clear. Abbott management already took a more conservative stance on SARS-CoV-2 diagnostics sales in its first-quarter earnings release, forecasting 2022 sales of just $4.5 billion (-42% year-over-year), compared to $3.3 billion the company had already generated in that quarter.

Recent reports from the World Health Organization (WHO) that another wave of infection has begun are not particularly surprising given the seasonality of SARS-CoV-2, but nevertheless point to a resurgence in demand for rapid testing equipment in the coming winter season. In addition, a new and possibly more virulent strain, or one that leads to a more severe disease course, could lead to continued mass testing and correspondingly higher revenues for Abbott, which is a major supplier of SARS-CoV-2 polymerase chain reaction (PCR) test systems and the well-known lateral flow antigen tests. The emergence of new competitors appears increasingly unlikely, and the FDA sees sufficient testing capacity throughout the U.S., which is most likely true for the entire Western world. In this context, it should perhaps be mentioned that Roche (OTCQX:RHHBY, OTCQX:RHHBF) is currently beginning to distribute its latest antigen testing systems.

The recent decision to stop handing out free home tests, for example, suggests that governments are increasingly unwilling to continue spending large sums of money on a pandemic that WHO Director-General Tedros Adhanom Ghebreyesus believes may soon be over anyway.

However, an unexpected resurgence in SARS-CoV-2 diagnostics-related sales will have a major impact on Abbott’s earnings, underscored by the doubling of the Diagnostics segment’s operating margin from the long-term average of 20% in 2021. With an 18% revenue contribution, Abbott’s SARS-CoV-2 diagnostics business is certainly anything but small and therefore represents a significant buffer against other headwinds (see below).

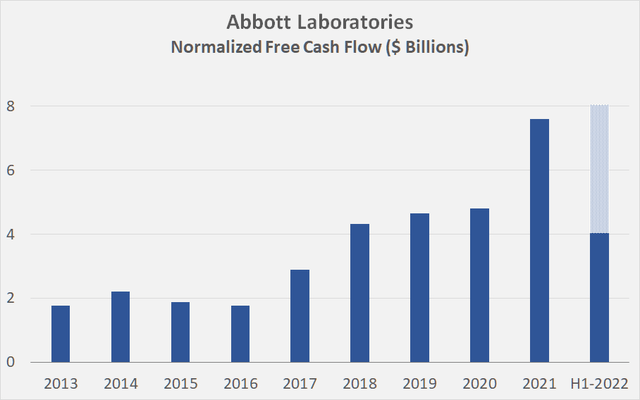

I see Abbott’s SARS-CoV-2 diagnostics segment as a plausible indirect growth driver going forward. The company has generated tremendous free cash flow (FCF), particularly in 2021 (Figure 1), even after adjusting for relatively rich share-based compensation (typically up to 8% of FCF) and normalization with respect to working capital movements ( those interested should read my detailed educational article). Note that Figure 1 only goes back to 2013, as cash flows from earlier years are not representative due to the spin-off of AbbVie (ABBV).

Figure 1: Abbott’s free cash flow, normalized with respect to working capital movements and adjusted for share-based compensation expenses (own work, based on the company’s 2015 to 2021 10-Ks, the second quarter 2022 10-Q, and own estimates)

At the end of the second quarter of 2022, Abbott had nearly $9 billion in cash, cash equivalents and short-term investments on its balance sheet.

Management are prudent capital allocators, having made some impressive and well-fitting acquisitions in the past, such as St. Jude Medical in 2017 and Alere in 2016. Given management’s acquisition skills, strong cash position, and generally conservative balance sheet (1.5 times net debt to three-year average normalized FCF), I can see Abbott increasingly growing through acquisitions, much like Pfizer (PFE), which has been generating an incredible amount of free cash flow thanks to Comirnaty. At the end of the second quarter of 2022, Pfizer was nearly debt-free when netting long- and short-term debt with cash, cash equivalents, and investments. Of course, growth through acquisition comes with execution risks – properly integrating acquired businesses is not always easy, nor is retaining talent in what is likely to be a completely different corporate culture.

How Will The Increasingly Strong Dollar Impact Abbott’s Q3 Earnings?

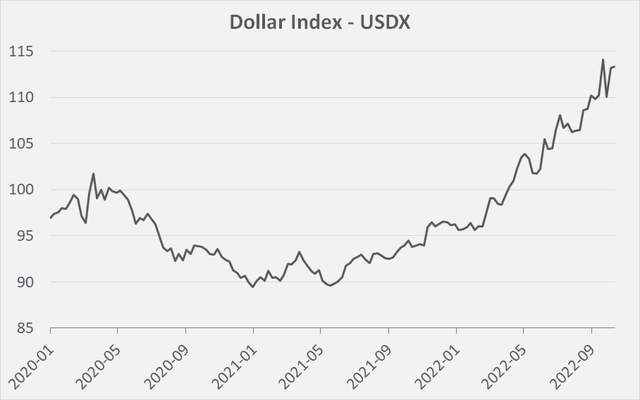

For various reasons not discussed here (I fully recommend the articles by Lyn Alden), the U.S. dollar has appreciated significantly since the beginning of 2021, as shown by the rising Dollar Index (USDX, Figure 2). The euro, Japanese yen, British pound, Canadian dollar, Swedish krona, and Swiss franc are all weighted in the index at different percentages, but the euro is the clear heavyweight in the USDX. Thus, the Dollar Index is a good measure of the strength of the U.S. dollar relative to major Western (and Japanese) currencies and the euro in particular.

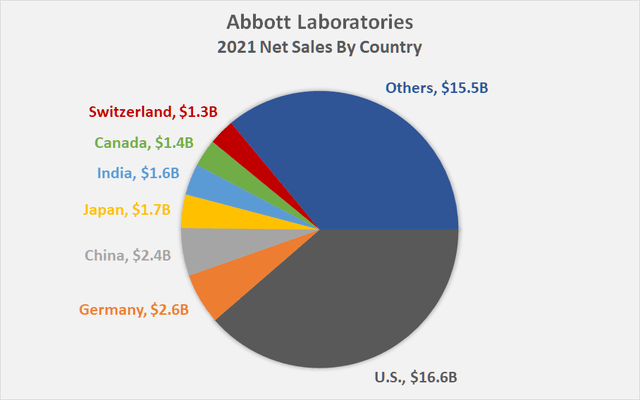

As an internationally diversified company, Abbott is naturally affected by a strong dollar in that its dollar-denominated earnings suffer at the corporate level. The geographic distribution of sales is shown in Figure 3, which indicates that Abbott generates about 61% of its sales in foreign currencies. Like most, if not all, large international companies, Abbott manages its foreign currency-denominated trade receivables and payables, as well as its international intercompany loans using forward exchange contracts, but its sales are nonetheless affected by the strong dollar.

Figure 2: Weekly closing level of the Dollar Index (own work, based on the data found on Yahoo Finance for ticker DX-Y.NYB) Figure 3: Abbott’s 2021 net sales by country (own work, based on the data found on p.74 of the company’s 2021 10-K)

In the second quarter of 2022, Abbott’s CFO pointed to a 4.2% year-over-year unfavorable impact from foreign exchange, more unfavorable than at the time of the first quarter earnings release. Nevertheless, the company raised its full-year adjusted earnings per share (EPS) guidance to at least $4.90 (+4.3% from previous guidance). Given that the dollar index rose 4.5% between Abbott’s first- and second-quarter earnings announcements and another 5.7% since the date of the second-quarter earnings announcement, investors should consider the possibility that management will narrow full-year earnings guidance at least close to the $4.90 per share floor noted in the second-quarter earnings press release.

In addition to the strong dollar, Abbott faces significant headwinds, such as recalls in its nutrition business, strong input cost inflation and increased freight costs (which have put even more pressure on Abbott since its first-quarter earnings call), and health care staffing issues. However, Abbott’s CEO expressed a fair amount of confidence when asked about the reasons for raising second-quarter guidance in light of these significant headwinds. The continued strength of Abbott’s base business, which the CEO expects to continue to grow in the high single digits over the longer term, and still strong (but in my opinion even conservatively guided) SARS-CoV-2 test device and material-related sales are the key factors helping to more than offset the above headwinds. Given, for example, the success of Abbott’s Libre Freestyle blood glucose monitoring system, I can share the CEO’s optimism.

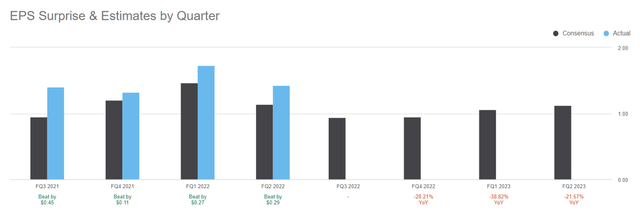

Taken together, I think that Abbott’s management did not issue such a significant guidance increase (which is the company’s second increase this year and came alongside a solid earnings beat, Figure 4) without reason. Management is rightly confident about the company’s growth prospects. It might happen that management has to narrow full-year guidance somewhat close to the previously announced $4.90 EPS floor due to the continued appreciation of the U.S. dollar, which was probably unexpected in July, but the likely underestimated sales of SARS-CoV-2-testing-related equipment and the strong base business make an earnings beat more likely than not.

Figure 4: Abbott’s EPS surprise and estimates by quarter (taken from ABT’s stock page on Seeking Alpha)

Why I Am Still Not Buying ABT Stock At This Level

Abbott shares might stage a rebound on Wednesday due to the more likely than not earnings beat, but of course depending on the market’s overall behavior (keep in mind the currently high volatility, VIX > 30). However, as a long-term investor, I remain on the sidelines waiting for a better price as I still think the stock is somewhat overvalued from a discounted cash flow (DCF) perspective (see below). The dividend yield is 1.8%, well above the five-year average of 1.6%, but it’s important to remember that this is a result of the strong share price appreciation in recent years. Abbott’s latest dividend increase of just 4.4% was also a bit of a disappointment. Longer term, I can see the company returning to stronger dividend growth, as the payout ratio is still very modest in terms of free cash flow (42% based on 2021 normalized FCF, 51% based on my base assumption for the DCF analysis below).

Much of Abbott’s revenue growth over the past two years has come from SARS-CoV-2-related diagnostic devices and material, and as a result, and due to the associated increase in profitability, the company generated significantly higher free cash flow in 2021 than in prior years. Abbott is also expected to benefit strongly from SARS-CoV-2 diagnostic devices and materials in 2022. However, in the longer term, demand for mass testing is expected to decline significantly and the associated cash flows will follow suit. However, with the excess cash generated over these years, Abbott should be able to fund acquisitions which should be cash flow-accretive upon proper business integration. As a result, Abbott’s baseline FCF, which forms the basis for the DCF analysis, is subject to significant uncertainty. For this analysis, I have averaged Abbott’s normalized four-year FCF, incorporating my own estimate for 2022 (see Figure 1). Because of the sensitivity of DCF analyses to the choice of a sustainable terminal growth rate and cost of equity, I am not a big fan of fixed assumptions, preferring DCF-based sensitivity analyses when determining the fair value of a company’s stock.

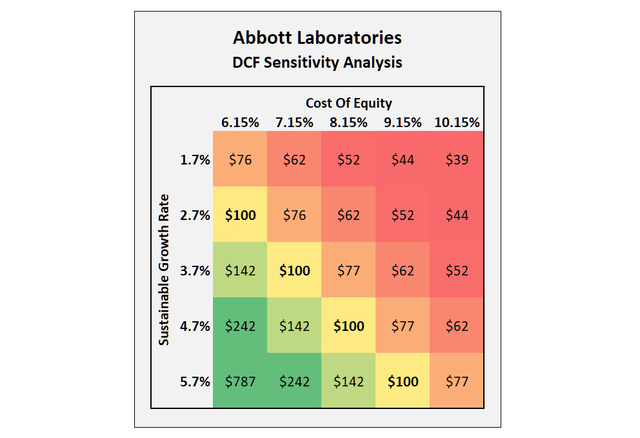

GuruFocus estimates Abbott’s current cost of equity at 8.15%, which is the midpoint of the fair value sensitivity analysis shown in Figure 5. FCF growth rates were chosen in 1% increments, starting at 1.7%. At a current price of $100, Abbott’s baseline FCF of $6.3 billion would have to grow at 4.7% per year in perpetuity to correspond a cost of equity of 8.15%. Accepting a growth rate of nearly 5% as sustainable is a bit of a stretch for a somewhat mature company, but it seems worth noting that Abbott grew its normalized free cash flow at a compound annual growth rate (CAGR) of 15% between 2013 and 2020, or 13% between 2013 and 2023 if the baseline FCF mentioned above is assumed for 2023. Between 2013 and 2020, Abbott’s revenue grew at a CAGR of 8.4%, suggesting that margin expansion was also responsible for the strong free cash flow growth.

For a company like Johnson & Johnson (JNJ) or Procter & Gamble (PG), I think a cost of equity of 8% is worthwhile, but for the company at hand, a discount rate of 9% or 10% seems more appropriate (after all, it has only a narrow economic moat, according to Morningstar). I could see paying about $80 for Abbott, as the combination of high growth rates and relatively modest cost of equity just does not appeal to me. The still fairly low dividend yield of less than 2% is another reason why I will continue to deploy my capital elsewhere for now. Nevertheless, Abbott remains on my watch list as I consider it to be a well-managed and highly diversified medical technology and healthcare company.

Figure 5: Discounted cash flow-based sensitivity analysis for ABT’s fair value (own work, based on the weighted-average shares outstanding during Q2 2022 and the 2019 to estimated 2022 four-year-average normalized free cash flow)

Key Takeaways

- Abbott has obviously guided conservatively in recent quarters and therefore delivered very solid earnings beats, despite substantial headwinds.

- During the second quarter earnings conference call, management raised EPS guidance again, well aware that the strength of the dollar is a major headwind for the internationally diversified medical device and healthcare company.

- The continuation of the strengthening of the dollar since the Q2 earnings call is unlikely to be baked into management’s guidance and should put a lid on earnings, all else being equal, as Abbott’s base business continues to grow at high single digit percentage rates organically.

- Still, the company’s (probably not entirely unintended) low guidance of just $500 million in SARS-CoV-2 diagnostics sales in 2H-2022 could result in another earnings beat.

- My DCF-based sensitivity analysis suggests that the shares are still somewhat expensive, and as a dyed-in-the-wool value investor, I am very careful not to overpay for my investments.

- The dividend yield is still below 2%, another reason why I see better value elsewhere from an income investor’s perspective.

Thank you very much for taking the time to read my article. In case of any questions or comments, I am very happy to hear from you in the comments section below.

Be the first to comment