Editor’s note: Seeking Alpha is proud to welcome HIT Investments as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Thierry Dosogne

ZIM (NYSE:ZIM) is a leader in the integrated shipping services space and is currently trading at a deep discount to their estimated fair value. They have multiple tailwinds, minimal risk, and an advantageous business model that should drive their share price higher over the next year.

Tailwind 1 – Pent Up Selling Pressure Due to Subside

The first tailwind for ZIM is centered around the exodus of their legacy shareholders. ZIM restructured in 2014 and Israel Corp ownership was reduced down to 32% and $1.4B of debt was exchanged for 68% equity. It wasn’t until 7 years later that ZIM went public in a poorly executed offering where they could sell a few of their shares. The IPO only raised $204mm (7% of 12/31/20 total assets) and ZIM was already close to a net cash position on the balance sheet thus this raise appears to be a way for shareholders to liquidate their positions and lock profits rather than increase cash for ZIM’s future plans. This later became more clear as the share lockup period subsided and the selling pressure commenced. Danaos (DAC), Kenon Holdings (KEN), Deutsche Bank (DB), and KSAC were the largest shareholders pre-IPO and have since sold over 32 million shares: Kenon 7M shares, Danaos 4M, Deutsche Bank 15M, and KSAC 5M. This selling pressure is unsustainable due to them starting to run out of shares. KSAC and Deutsche Bank have sold out completely and Danaos and Kenon Holdings have sold off 44% and 21% of their shares respectively (according to their latest quarterly reports).

Tailwind 2 – Unknown to Known

ZIM has been a publicly traded company for less than 2 years and is still proving out their transformational shipping vision. Eli Glickman the CEO who joined ZIM in 2017 set out on a mission to transform ZIM from an antiquated shipper delivering one container to another to an integrated, asset light, customer focused, technological and environmental leader. It is also worth noting Mr. Glickman is vested and convicted not only in his words but also in his actions as he owns 1.4% of ZIM’s outstanding shares.

As Mr. Glickman and ZIM continue to execute the ZIM story will continue to be more well-known and accepted across the investor community. The results are already starting to shine through on the operating flexibility, partnerships forged, premiums earned and technological investments made.

Tailwind 3 – Flexibility

To better manage the fluctuations of the shipping business cycle, ZIM has adopted an asset-light model and charter’s individual ships for 1-5 years. This allows them to expand, contract, and adjust to demand and new regulations more efficiently than their peers.

For example on January 1, 2023, a new set of environmental regulations will come into effect that may force their peers ships into early retirement and or to operate at a slower speed. The Carbon Intensity Indicator (CII) and Energy Efficiency Existing Ship Index (EEXI) estimate the TEU capacity in containerships to be reduced by around 17% in 2023. These environmentally friendly initiatives become more restrictive as time goes on and ZIM’s short term charters allow them to adapt their fleet to the changing regulations.

The flexibility of charters also allows ZIM to adjust their fleet to meet customers’ changing demands. This has resulted in them growing from 87 to 149 vessels in 1.5 years and the recent leasing of more car carriers.

I view the chartering business model as a strength in the long term but it may be holding ZIM’s current valuation back in the short term. I say this because the typical shipping commentary when freight rates increase as they had done in the past couple years revolves around chartering rates increasing as well. The belief being that when freight rates go up so do charter rates (which is true) but chartering is not the shippers primary expense, cargo handling is. Cargo handling makes up almost 50% of the costs, followed by fuel costs of 15-30% then followed by charter costs at 10-15%.

Tailwind 4 – Technology Improvements Focus

This leads us into more of how ZIM continues to differentiate with their asset light shipping model. Instead of focusing on ship ownership, they are focused on cargo handling. This can be seen in their ingenious method of R&D. Rather than doing their research solely in house they have invested in small and passionate teams (startups) of which are building solutions to many of the cargo handling operations biggest expenses. For instance ZIM owns a percentage of Hoopo which is focused on tracking solutions without the need for power (container tracking), Sodyo a scanning technology business (container scanning), Data Science Consulting Group an AI tool (to enhance operations and profitability), and Wave BL a blockchain solution to send receive and digitally sign documents (replaces the courier with technology). There isn’t a better and more efficient way to stay at the cutting edge in my opinion than owning and partnering with the people creating and building the future.

Tailwind 5 – Customers and Partnerships

I believe ZIM uses their technological edge, asset light model and overall forward-thinking vision to attract meaningful win-win relationships with their customers and historical competitors. For example, ZIM partnered with one of the largest world retailers, Alibaba (BABA). Alibaba now uses a service from ZIM Logistics China that integrates into Alibaba’s software and allows their customers to purchase sea freight seamlessly through ZIM.

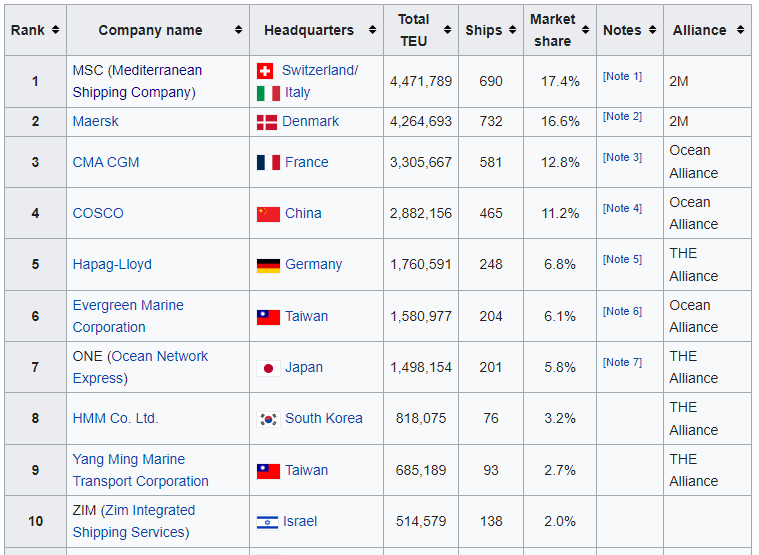

In combination with connecting directly with Alibaba’s customers ZIM can offer more shipping options than their 2% market share implies due to their partnership with Maersk (OTCPK:AMKBY) and MSC (the 2M alliance). The 2M alliance makes ZIM part of the largest TEU alliance in the world.

TEU by Company (Wikipedia)

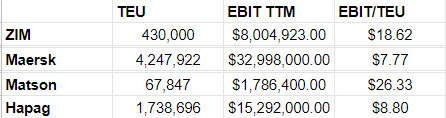

Proof is In The Premium

ZIM’s tailwinds I mentioned above: technology, flexibility and partnerships are all in support of providing a premium shipping service to their customers. So if ZIM is executing their vision, we should be able to start to see the premium service come through in higher comparative margins. To test the customer premium I compared the $’s of revenue earned by the number of Twenty Foot Equivalent Units (TEU‘s) owned/chartered. To do this I took the total TEUs from the publicly traded shipping companies and divided them by their EBIT. The three companies I found and compared to ZIM were Maersk, Matson, and Hapag. ZIM came out ahead of Maersk and Hapag (OTCPK:HPGLY) but was less than Matson (MATX). That was initially concerning to my narrative but Matson’s premium is explained by their monopoly protection from the Jones Act. So if we compare ZIM to its publicly traded peers that compete in the open market their services earned a 2x premium in terms of EBIT/TEU. The results are in the chart below.

HIT Capital EBIT/TEU (HIT Capital)

Industry Tailwinds

On top of what appears to be ZIM’s long term and company specific tailwinds there are a few potential industry tailwinds that do not seem to be included in most shipping estimates. International Longshore and Warehouse Union (ILWU), which represents more than 22,000 West Coast port workers, and about 70 employers of the Pacific Maritime Association (PMA) has been working without a contract since July 1, 2022. If there is a strike, freight rates will increase due to port congestion regardless of global recession fears. If the strike doesn’t happen, there may be a bottom to freight rates in the near future because of the alliances across the container shipping space. In the last shipping downturn each shipper competed with each other all the way to bankruptcy but with the new alliances they are partners working together. This allows them to utilize their ships more efficiently and creates a better business across the sector for those in an alliance like ZIM.

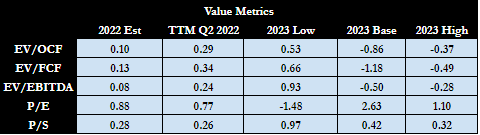

Tailwinds + Safe and Cheap = Strong Buy

To go along with the tailwinds, ZIM is trading at a steep discount to the market and their peers. I calculated ZIM’s EV/FCF, EV/OCF, EV/EBITDA, P/E, and P/S metrics below using their trailing 12-month costs, 2022 earnings estimates, TTM earnings and for 2023 I used historical costs and estimated a reduction in revenue due to freight rates declining from their TTM by 74%, 41% and 24%. The percent decline is based on a 2023 FBX Global Freight Index averaging 1500, 3500 and 4500. All of which are below the current FBX Global Freight rate of 4600 today. ZIM’s price is so cheap that the EV is negative in two of the three scenarios due to their cash heavy balance sheet.

ZIM Value Metrics (HIT Capital)

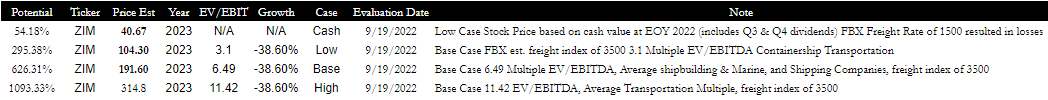

ZIM’s Estimated Stock Price Target

At the lowest freight rate of 1500, ZIM is unprofitable but since their current stock price is valued at less than their expected EOY cash balance (excluding leasing obligations), of which they can release as customer demand falls, and that they are able to earn a premium as compared to their peers, I feel their risk of operating and staying in the red is minimal. Thus I put ZIM’s low stock price estimate at their EOY cash value of $41. ZIM’s base and high case stock price estimate is based on a 41% revenue reduction or an estimated FBX Freight Index of 3500 and ZIM regressing back to their sector and industry EV/EBITDA multiples ranging from 3 to 11. This brings my 2023 stock price target to $40 at a low and $314 at the high, an increase of 50% to 1000% in comparison to the price of $27 seen today.

HIT Capital Stock Price Estimates (HIT Capital)

Conclusion

In conclusion ZIM appears to be a solid and well-run business, with a strong balance sheet, trading at a deep discount. The risk vs reward profile points to ZIM being a great opportunity to buy and high risk to shorting when the freight rates equalize or increase.

Be the first to comment