alvarez

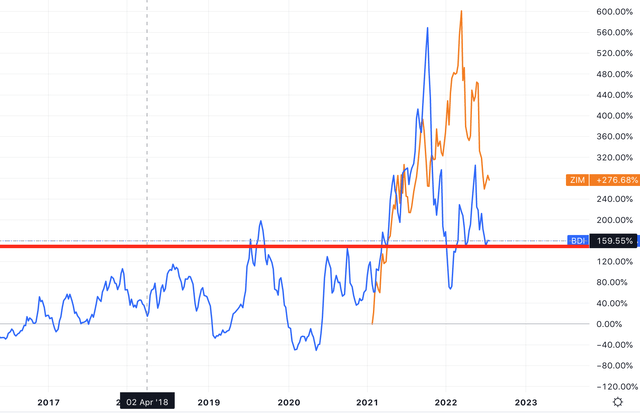

ZIM Integrated Shipping (NYSE:ZIM) is a global cargo shipping company, which was founded back in 1945 but didn’t IPO until January 2021. Since going public, the company has taken investors on a tremendous voyage. Its stock price has increased by over 320% and its dividend has increased substantially from “just” 20% to now over 40% which is huge. These sort of numbers are what investors dream of. However, before we get too excited, let’s remember ZIM has benefited massively from the spike in shipping costs which arose from a sleeping economy being reopened in 2021. The shipping industry is cyclical; we know this and thus must assess the risk-reward accordingly. In my last post on ZIM, I discovered a pattern between the Baltic Dry Index (a benchmark for the price of moving the major raw materials by the ocean) and ZIM’s share price, which of course makes sense. But I also took things one step further and identified a pattern between the Baltic Dry Index (Blue line) peak and ZIM’s Stock (orange line) price peak of approximately five to six months.

Zim Share price (orange) and Baltic Dry Index (blue) (created by author Ben Motivation 2 Invest)

I then extrapolated out this predictive delay to find the “bottom” for ZIM’s stock price as it was falling at the time. I quoted in my past post;

“The bottom for ZIM’s share price should be sometime in July and it does seem to have found possible support recently”

It turned out this prediction was correct; the stock price found support in July and has since popped by ~18% from the start of that month. Now of course, I don’t consider myself a market wizard just yet, so let’s dive into the company’s recent financial report, the monster dividend and the valuation.

Second Quarter Results

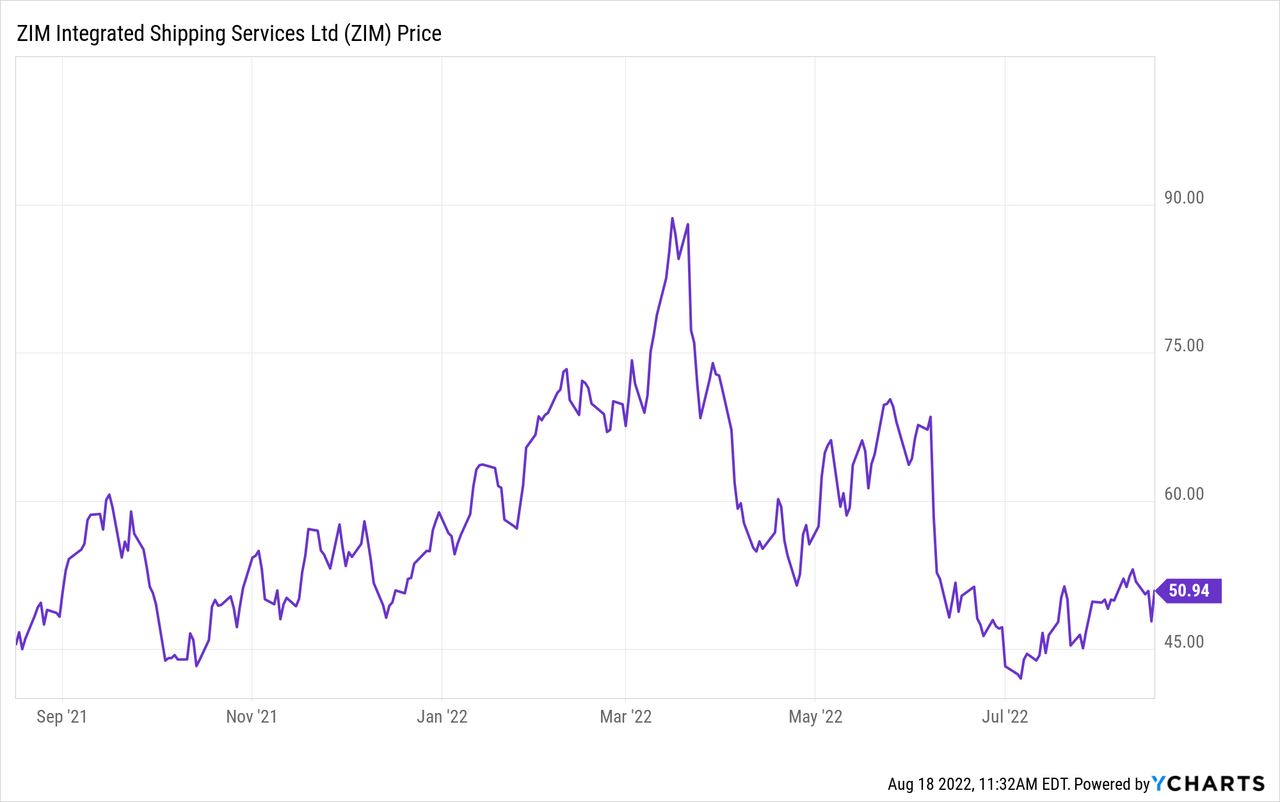

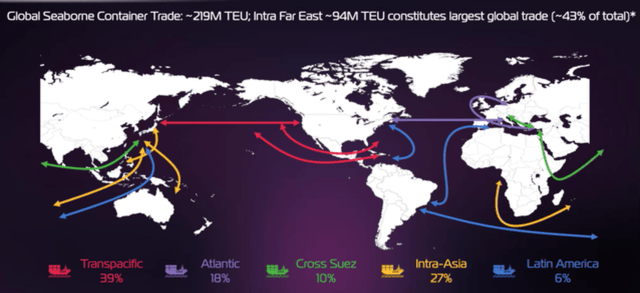

ZIM announced its financial results for the second quarter of 2022. Revenues were $3.43 billion, which increased by a rapid 50% year over year, but missed analyst estimates by $278 million which was not a great sign. Its average freight rate per TEU was $3,596, in the second quarter which increased by a blistering 54% year over year. As mentioned in the introduction this boost in shipping rates was driven by the supply and demand imbalance. However, as I noted in my previous post, a McKinsey study indicated that there isn’t a lack of ships but rather a lack of “available” ships due to port congestion. The same study also indicated that shipping rates are expected to “Normalize” but still be above pre-pandemic levels, the question is by how much.

ZIM Routes (Investor Presentation 2022)

The good news for ZIM is that they have an asset light charted capacity model, in which its 137 vessels can be flexibly managed and rented on contract at various prices. Management is also confident in its ability to opportunistically source extra capacity as needed from the second hand market. Importers tend to prefer less volatility and thus this gives ZIM the opportunity to “lock in” high contract prices, which should help to prevent some downside volatility moving forward. The company’s “global niche” approach to shipping routes should also help with diversification from changing rates on mainstream shipping routes.

Net income was $1.34 billion in the second quarter up a rapid 50% year over year. Adjusted EBITDA was also a strong $2.10 billion, up a blistering 57% year over year. Earnings Per Share [EPS] were $11.07 per share which again missed analyst expectations by $2.18 per share.

I believe ZIM’s financial results were tremendous overall; it’s just Wall street was expecting them to be even more tremendous.

Carried volume was 856 thousand TEUs (Twenty Foot equivalent unit) (a shipping container metric), this declined by 7% year over year. This is an interesting point to notice as remember when freight rates finally correct, volume will be the main growth driver. This recent decline in shipping volume is a worrying sign in my eyes and something many investors have overlooked. Many analysts are forecasting a recession or even a period of “Stagflation” which results from a high inflation, low economic growth environment. Low economic activity means companies are buying less goods and thus shipping volume and then rates (supply/demand) also tend to fall.

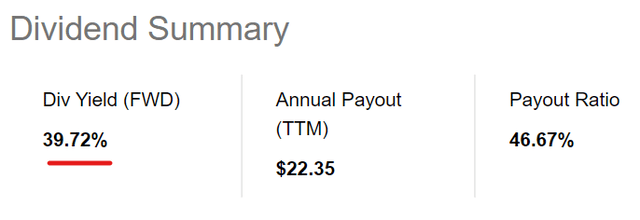

Shipping a 40% Dividend??

ZIM’s management is extremely generous with its dividend pay-outs to shareholders and have recently hiked it higher, here are the full details below.

According to Eli Glickman, ZIM President & CEO;

Due to our conviction in ZIM’s ability to earn sustainable long-term profits, we are increasing our quarterly dividend payout from 20% to 30% of quarterly net income, allowing shareholders to benefit from our strong results even more directly on a quarterly basis.

He then goes onto say;

We maintain our dividend policy, according to which shareholders may receive up to 50% of annual earnings.

In the second quarter ZIM’s board declared a cash dividend of $571 million or ~30% in the second quarter plus a one-time catch up of 10% from Q1 net income (totalling 40%). This dividend will be on September 8, 2022 to holders of ZIM ordinary shares as of August 29, 2022.

Google Finance has ZIM’s Dividend Yield at ~43% and Seeking Alpha has its Forward Dividend Yield at 39.72%.

ZIM’s management is not just generous in its return of cash to shareholders, they don’t really have many other options. Usually management has three choices with its cash, Invest, pay down debt or return to shareholders. ZIM already has a strong balance sheet with a total cash and cash equivalents position of $3.93 billion, up $121 million from the prior quarter. While its Net Debt was just $630 million, which gives a net leverage ratio of 0.1x. But things get even better, when we dive “under the hood” we see that ZIM includes its lease liabilities for ships as debt when really that may not be considered debt in negative sense. Its loans outstanding were just $160 million which is really the company’s true debt.

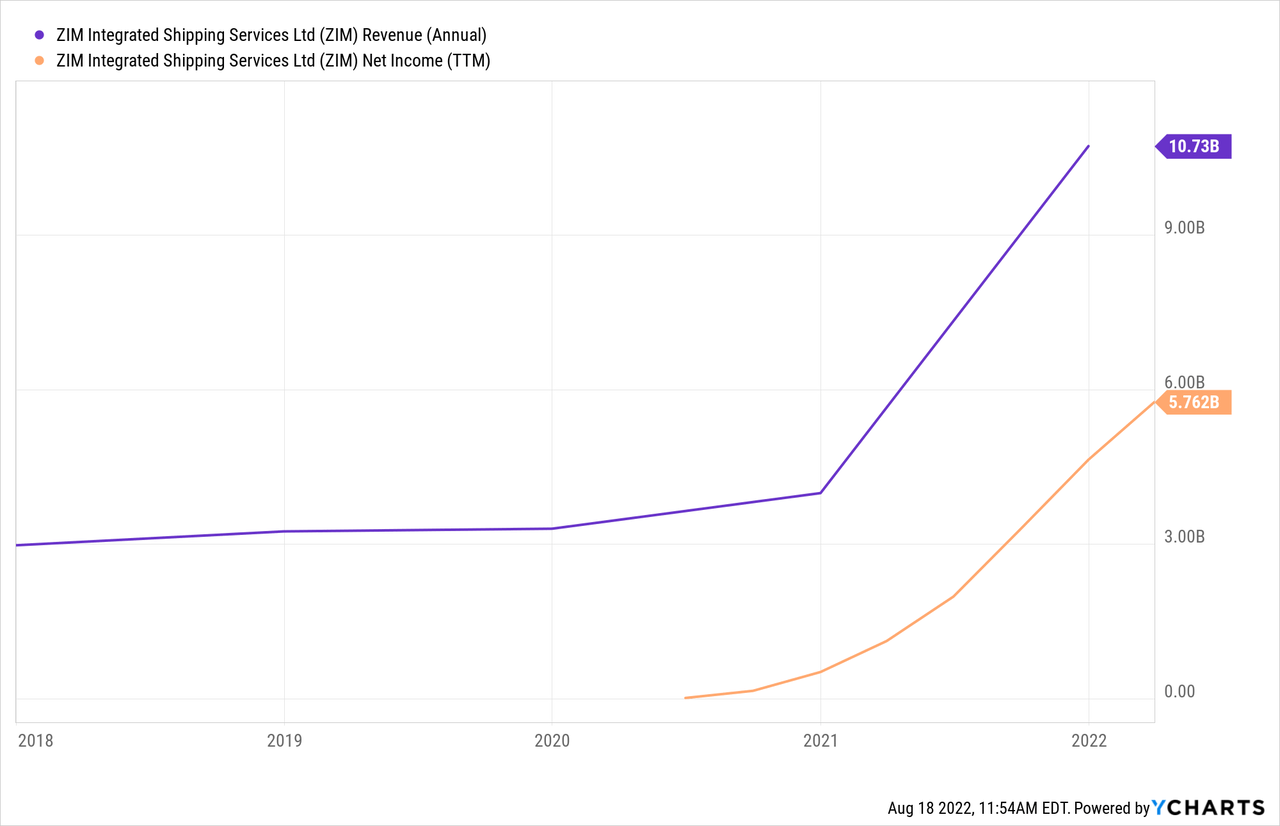

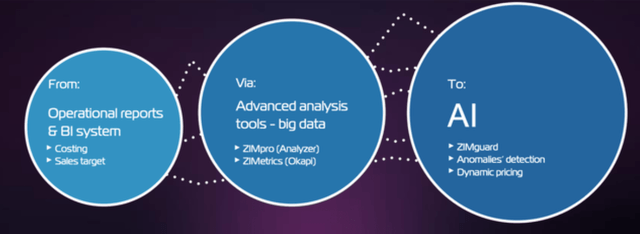

Investments into Technology

The second thing ZIM can do with cash is to invest it into technology, which is what they have done in a Venture Capital style. ZIM’s management is extremely forward thinking when it comes to technology, which is a rarity in the antiquated shipping industry. For example, in late July ZIM invested $6 million in Data Consulting Group (DSG) a leader in Artificial Intelligence solutions for Governance. On August 1st, ZIM announced a $5 million Series B financing round in Sodyo Ltd., a developer of innovative scanning technology. According to the CEO of ZIM, [Proof of Concepts] “demonstrate the potential this technology has to become the new global standard for scanning technology”. On August 11th ZIM also announced a $5.5 million investment into Hoopo, a leading provider of asset and fleet visibility solutions. This enables businesses to track real time inventory, equipment and operations through real-time data and analytics.

ZIM AI (Investor Presentation 2022)

I believe ZIM’s investments and focus on technology could give this company a competitive advantage against other shipping companies which are not so forward thinking.

Valuation?

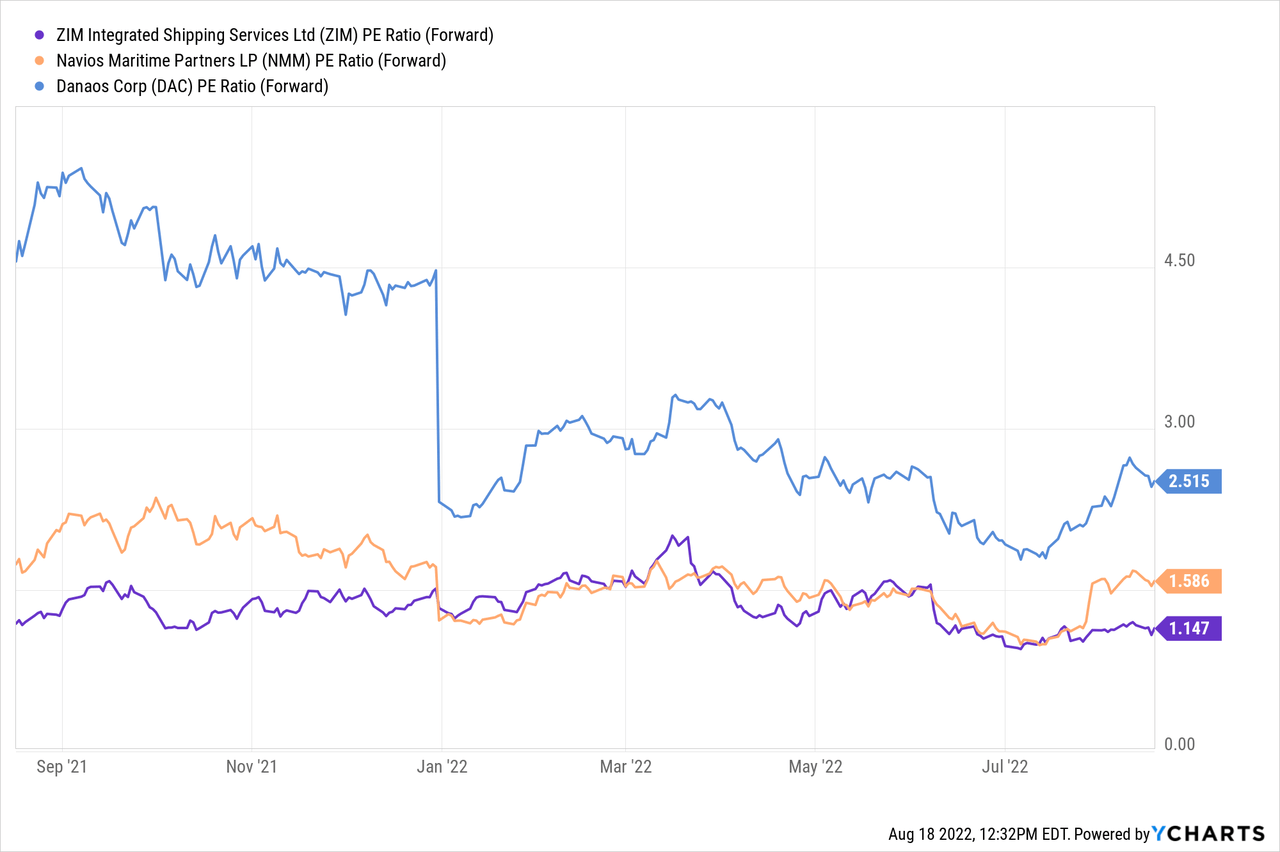

ZIM is trading at a very low forward P/E ratio of just 1.15, which is cheaper than historic levels. In addition, the stock trades at a cheaper P/E ratio than industry peers such as Navios Maritime Partners L.P. (NMM) which trades at a P/E (forward) Ratio = 1.59 and Danaos (DAC) which trades at a P/E (forward) Ratio = 2.515, at the time of writing.

Risks?

As mentioned previously the shipping industry is notoriously cyclical and thus what goes up must come down. As shipping prices normalize expect cash flows to fall for ZIM. The recent inflation numbers show inflation had dipped to “just” 8.5% in July which is less than the 9.1% generated in the prior month. According to a recent study by the IMF, Global shipping costs are linked to increasing inflation. Therefore we could reason that lower inflation means lower shipping costs, but this depends upon the rules of causality. Bank of America has slashed its price target for ZIM to $40/share on weak demand.

Has the Ship Sailed?

ZIM is a tremendous company which has benefited massively from the global rise in shipping costs. Management is forward thinking, flexible and executing well. The stock pays a monster dividend and is still undervalued relative to past multiples and competitors. The only risk is the expected decline in global shipping rates at least within the next year as economic demand is forecasted to be muted.

Be the first to comment