SHansche

The biggest hope to buying ZIM Integrated Shipping Services Ltd. (NYSE:ZIM) at slightly above $22 now is a large true-up dividend for 2022. Most investors probably aren’t appreciating how much EPS estimates have fallen since the last quarterly report, based on falling charter rates. My investment thesis remains Neutral on the stock at best, with fears of a market correction sending container shipping rates below pre-covid levels.

Disappearing Dividend

Due to container charter rates collapsing, ZIM will feel a rolling impact from the lower rates. As customers come off contracts, the company will either have to sign new charters at much lower rates or let ship leases end. Either way, profits will disappear and dividends will become near nonexistent.

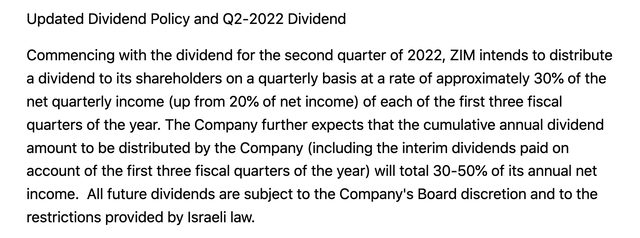

Earlier this year, the BoD initiated a new dividend policy with a 30% quarter dividend payout ratio, followed by the option to true-up the payout to 50%. Last year, ZIM had a mixed quarterly dividend payout policy followed a by true-up to a 50% payout for the year, leading to a $17 dividend for the Q4 true-up.

Source: ZIM Q2’22 earnings release

On the Q3’22 earnings call, CEO Xavier Destriau suggested the true-up dividend of up to 20% isn’t a done deal:

So today, this quarter, we continue to be true to our words and announced this 30% dividend payout. I think when it comes to what may be the discussion on the decision of the company, in March when we release our full year financial statement.

It’s a little bit too much premature today to opine as to where we will land the consideration that will be taken at the time will be obviously how did we close the year, but also as importantly, what do we think the outlook is ahead of us, and there is lot of unknown data at this point, which again I think make us say that it’s a little bit too early –too premature to opine on what might be the year two payment next year.

ZIM has paid the following dividends in 2022:

- Q1’22A – $2.85 (20%)

- Q2’22A – $4.75 (30% + 10% Q1 one-time catch up)

- Q3’22A – $2.95 (30%)

- Q4’22E – $0.75 (30%)

The true-up dividend potential is enormous, especially with the stock at just $22. A full true-up to 50% would entail a Q4’22 dividend of $0.75 and a true-up dividend of $7.53 leading to a very large dividend payment of $8.28. ZIM would pay out $1.0 billion in the process.

With the limited cash flows forecast for Q4, ZIM would watch the current cash balance of $4.45 billion dip significantly. The BoD might choose to hold onto the cash.

Rolling Impact

The problem with ZIM is that the company currently has high charter rates that are appealing, but the container shipping company is forced into altering rates to keep long-term customers happy. CEO Xavier Destriau was clear on the earnings call that slashing contract rates was in the best interest of keeping customers over the long term:

And we normally contract 50% of our volume with a long-term contract and remain close to the spot market for the other 50%.

But more importantly, from our customer perspective, the demand was not there, and the volume was not there. So, we had to leave with this new reality and engage with our customers. Those customers are not customer for one year, for one season, they are recurring customers. We have a long-term relationship, and we intend to continue to have a long-term relationship.

So clearly, the — as the spread between the contract rate in terms of dollar per TEU and the spot was increasing, we had to sit down and agree and revisit the pricing for those customers.

In essence, ZIM was already exposed to spot rates with 50% of ships and even the long-term contracts are being adjusted down to match the direction of the spot rates. The container shipping company currently has 149 vessels leased, with an average contract duration of 27.4 months.

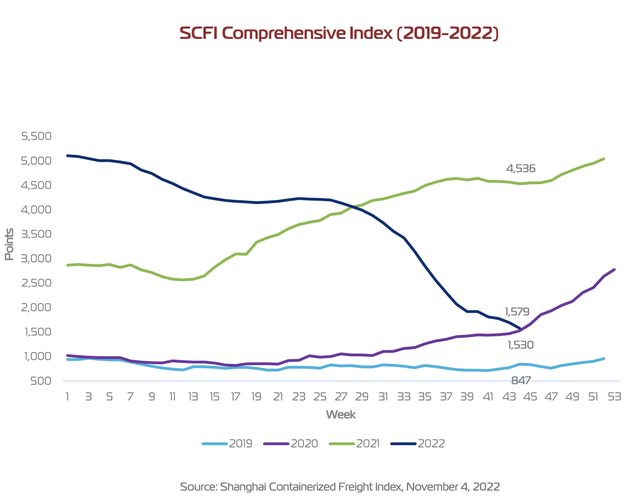

As the SCFI index continues to fall towards pre-covid levels with a forecast to hit the 1,000 level in December from 1,579 level when reporting Q3’22 earnings, investors should expect a further reduction in expectations for ZIM. The company shared a chart where the SCFI index hadn’t even crashed below 2020 levels yet.

Source: ZIM Q3’22 presentation

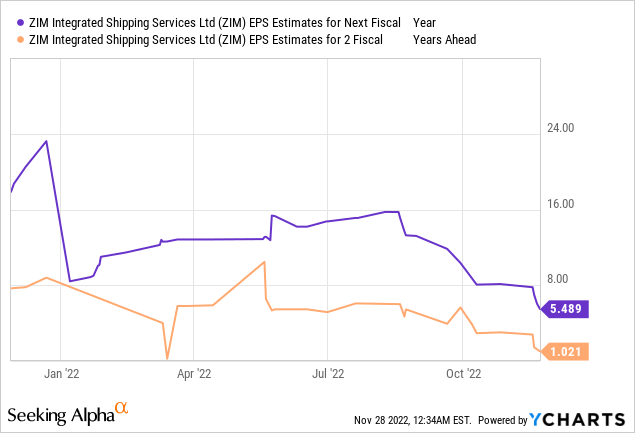

Corresponding with the substantial container shipping market weakness in the last few weeks, analysts have substantially cut earnings expectations going forward. The current forecast is for 2024 EPS to dip towards only $1.

Important to note, the low-end analyst has ZIM only producing a 2023 EPS of $1.33 with a 2024 target for a loss of $2.15. Such an earnings profile for the next couple of years not only eliminates the dividend, but also likely reduces the desire for the BoD to pay a very large true-up dividend in March/April, when the Q4 dividend is normally announced.

The company does have a solid balance sheet with the cash balance at $4.5 billion and the only debt at $4.7 billion tied mainly to ship leases, though this amount has nearly doubled in the last year.

Takeaway

The key investor takeaway is that ZIM has no appeal here, with limited dividend payouts over the next couple of years. The container ship market is headed towards a disastrous couple of years as a large amount of newbuilds hit the market while demand slumps.

An investor might get a large true-up dividend for 2022, but the stock will slump in relation to the payout and dividends will disappear going forward.

Be the first to comment