Daniel Wright/iStock Editorial via Getty Images

None of ZIM Integrated Shipping Services’ (NYSE:ZIM) exceptionally good financial figures fit the conclusions most of us know how to make, making it hard to decide between either extreme. It is probably the most written about company in its sector on SA and most of those article are very negative.

As a container shipping company it is also in a sector that for some reason is treated as if cursed by a market convinced that the world economy has nowhere to go except to the ocean floor. Sector big boy Maersk (OTCPK:AMKAF) recently reported that its “exceptional results” were driven by a continued rise in ocean freight rates, but said it was clear that these have peaked and will begin to normalize in the fourth quarter.

There is no doubt that much of the world is in troubled waters with much of Europe in or near recession and China’s growth engine has put on slow speed astern by Covid lockdowns.

Those things are not new having been around for at least a year during which time ZIM has done well. That use of the word “normalise” by Maersk and ZIM’s latest figures suggest it will continue to do so even if the very important one of Europe continues to decline.

Normalize means precisely that and not the crash priced in by the market. Maersk’s PE is only 1.28. ZIM’s is 0.5. By comparison, poorly performing air and land freight carrier FedEx (FDX) has a PE of 12.84! Market out of balance or getting things right?! The answer is a no-brainer, except for some.

Part of the reason ZIM should continue to do well is its differentiator. The use of the word integrated in ZIM’s full name – ZIM Integrated Shipping Services Ltd. – tells part of the difference between it and many other shipping companies. That integration is enabled by the use of advanced technology that put ZIM into a niche occupied by few plus it keeps them closely integrated with customers in a near partnership arrangement; a closed loop. And many of those customers choose ZIM to reliably transport their higher end products and perishables.

In addition to those competitive advantages, which enable ZIM to maximise profits, container shipping is a growth market. About 90% of global trade is carried at some point by ships, with seaborne trade up nearly threefold in the 30 years to 2020. Much of that is in containers. During the pandemic downturn, when others were cutting back, ZIM expanded and gained market share.

Apart from those competitive advantages ZIM is also protected by being part of a non-competitive cartel that could prevent freight rates falling too far if any economic downturn gets bad.

I shall say more about that cartel and the world economic outlook later but first will say more about ZIM and its financials.

ZIM Integrated Shipping Services

The market symbol/ticker is conveniently ZIM and that makes it easy for investors to remember and for me in writing this article.

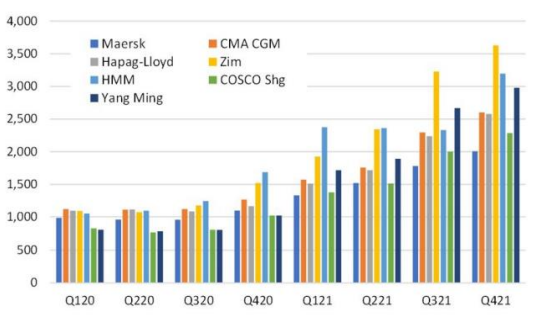

ZIM is an Israeli based shipping company established in 1945 and transformed in recent years under new management into a container only shipping company. It had its IPO on the NYSE last year (Jan 2021) and was one of the best performing IPOs that year on the back of super financial results following the transformation. Their average revenue per TEU (a 20-foot container to us laymen) by quarter from 2020-2022 left competitor’s ships in its wake…

ZIM

According to marine digital data, ZIM now has the world’s 10th largest liner fleet, with less than an eighth the capacity of the largest one, Maersk.

It has an asset light model that is a non balance sheet asset in bad business conditions because its fleet is almost entirely chartered in. Ninety four percent of ZIM’s vessels are chartered. The company has also expanded its car carrying activities to diversify its operations.

Chartering means some profit is transferred to the companies the ships are chartered from but ZIM has no costs for their upkeep and crews in an economic downturn when they might not need to renew the charter contracts.

It owns the containers those ships carry and those containers carry key parts of ZIM’s advanced technology. All its containers are fitted with sensors that means they can be traced while at sea or on land.

The Revelator revealed that around 3,000 were lost in the Pacific in one recent winter. They are untraceable but ZIM’s technology could trace theirs. At any given time, there are around 30 million shipping containers moving around the globe on ships, trucks and trains. With sensors built into the containers ZIM’s are traceable at all points from supplier to user even after they have been offloaded from ships onto trucks and trains. Those sensors feedback precise location details to a remote inland monitoring centre thus keeping all in a closed loop. In temperature controlled containers other sensors can feedback information so that any problems can be detected and rectified before the contents – such as fresh food – get damaged. That keeps insurance premiums lower and ZIM can earn extra money from operating remote monitoring and control services.

It should be pointed out that Israel is a world leader in new technologies and ahead of the US. ZIM has made recent investments to further their technology leadership in the shipping sector.

While sea transportation moves at a very low speed of 13 knots on average, ZIM decided to make a strategic decision under new management to jump on the technology wagon and lead a revolution that would bring about change. Until three years ago, it was almost impossible to find digital practices, high-end technologies and focus on customer experience in the world of cargo transportation. ZIM was among the first to realise that the world was changing drastically, and that a focused, customer-centric approach was a must to continue to lead in the industry.

The major challenge ZIM faced was enhancing customer experience and looking beyond operational service to adopt a more holistic approach where the customer’s needs are at the centre. That has become a ZIM differentiator and attracts customers shipping higher value added products.

More can be found about ZIM on their website. I would like to detail a bit more here about the financials behind that huge dividend.

Here are the full results for the third quarter and first nine months of 2022 recently published on 16 November, 2022.

Highlights from that are:

- Recorded Q3 2022 Net Income of $1.17 Billion; Continued to Deliver Very Strong Operating Margins

- Delivered Record Results for the First Nine Months of 2022, including Net Income of $4.2 Billion

- Revised 2022 Full Year Guidance: Expect to Generate Adjusted EBITDA1 of $7.4-$7.7 Billion and Adjusted EBIT of $6.0-$6.3 Billion

- Declared Q3 2022 Dividend of Approximately $354 million, or $2.95 per Share, Representing 30% of Q3 2022 Net Income

Stock market reaction to those super results? Share price down 10.8% in the following couple of days. ZIM shares have been pummelled, falling 54% in the past 12 months despite producing record results and being positioned for a very ok 2023.

I know of no other company of similar size with such good results that has been cursed with such investor contempt. That is magnified by lack of knowledge or lack of acceptance of the global conditions and opportunities ZIM has in the coming “normalised” cartel times.

Global outlook for ZIM

This contains many points, including the influence of the…

Cartel

Monopolies are resisted but, similarly, cartels can control prices.

These companies have formed three global alliances-groups of ocean carrier companies that work together-that now control 80% of global container ship capacity and control 95% of the critical East-West trade lines. Despite the US being a major shipping point there is not a US company among them.

ZIM is a member of two of them.

shippingandfreightresource.com

Since the beginning of the pandemic, these ocean carrier companies have been dramatically increasing shipping costs through rate increases and fees.

They increased spot rates for freight shipping between Asia and the United States by 100% since January 2020, and increased rates for freight shipping between the United States and Asia by over 1,000% over the same period.

Equally they can stop rates falling too far. All they need to do is take some ships out of service in a number proportionate to their fleet size thus reducing supply to match lower levels of demand. Some of the ships are very old anyway and downturns are a good time to send those to the scrapyards.

It is especially interesting to note that large Chinese shipping companies are members and they will not do the normal Chinese thing and cut prices. The absence of US companies also widens the ever growing political ocean between the US and China, the latter being possibly of more importance to world trade than the US.

China

China is lifting its one size fits all Covid shutdown policy and I doubt that will return given the size of under reported people protests that even the autocratic leader there is starting to listen to. That is reflected in new confidence among investors…

Bloomberg

President Biden’s first meeting with President Xi at the Group of 20 summit has been hailed a success that should improve China-US relations. That should further improve the situation for US companies that reap a meaningful percentage of revenues from China.

And while an American Chamber of Commerce survey showed a collapse in optimism, only a fifth of the 307 companies surveyed were decreasing their investment in China compared with 2021, while 30 per cent were increasing it.

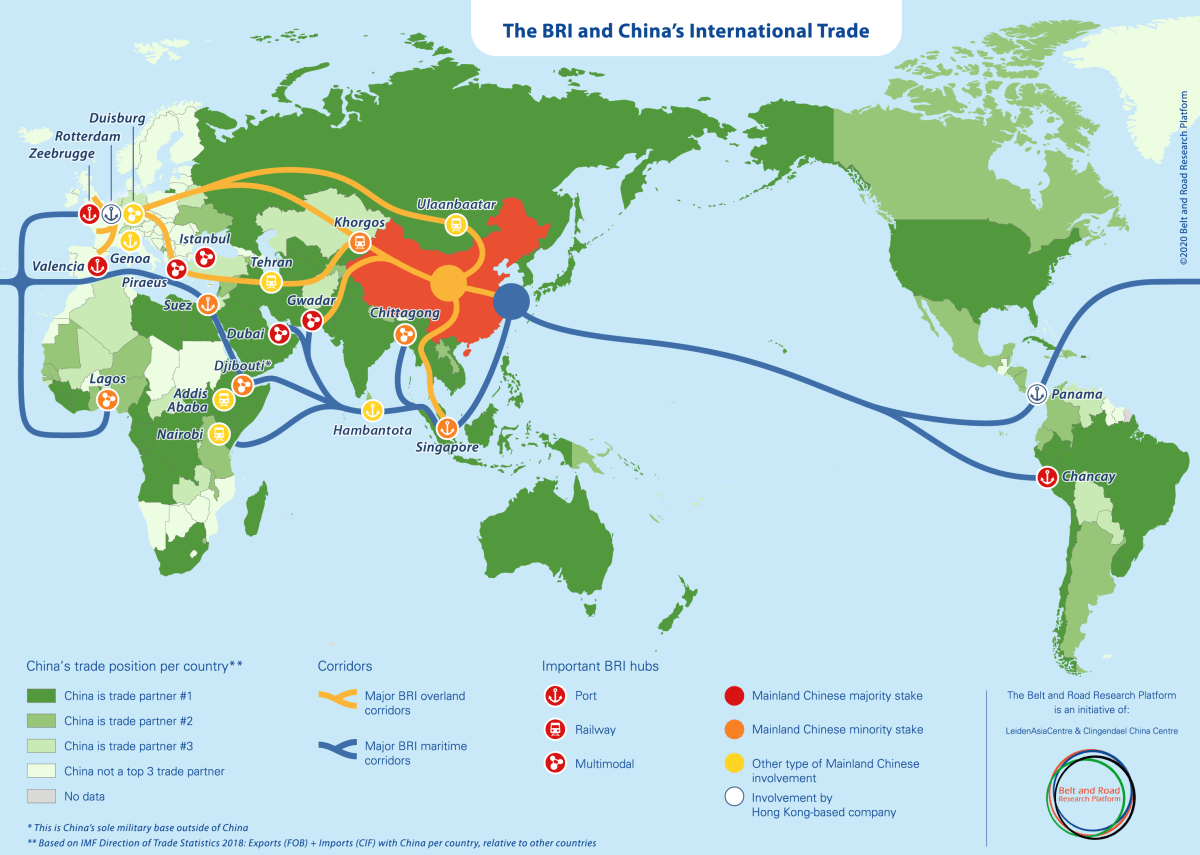

US China trade is important but China is taking things much further. Its Belt and Road Initiative is focused on energy, infrastructure, and transportation. To put its scope into perspective, the potential overall investment is estimated at about $1.4 trillion – a scale never seen before and at least seven times larger, measured in today’s dollars than the Marshall Plan, the US initiative that rebuilt Europe after World War II.

Much of trade today is travelling in containers.

Belt & Road Research Platform

The orange lines show the new Eurasia Land Bridge. The blue ones are the Maritime Silk Road.

China today is thus crucial to sea container shippers. Now China is the world’s largest exporter by value; mainland China exported US$3.026 trillion worth of goods around the globe in 2021. That dollar amount reflects a 33.2% gain since 2017 and a 16.8% acceleration from 2020 to 2021. The value of China’s total exports represents 14.1% of overall global exports (based on the world’s total of $21.513 trillion for 2021).

It is the world’s second-largest importer. The US is the largest importer and is China’s biggest customer despite trade wars.

China and Israel aim to sign a free-trade agreement by the end of 2022 in a breakthrough that would give Beijing its first deal in the Middle East. ZIM is an Israeli company so could benefit from increased trade.

Also, world trade routes have changed.

Latin America has long been seen as a US domain, but the largest economy there, Brazil, now does more trade with China…

| Main Customers (% of Exports) | 2020 |

| China | 32.4% |

| United States | 10.3% |

| Argentina | 4.1% |

| Netherlands | 3.2% |

| Canada | 2.0% |

| See More Countries | 48.0% |

| Main Suppliers (% of Imports) | 2020 |

| China | 22.1% |

| United States | 17.9% |

| Germany | 5.8% |

| Argentina | 4.9% |

| South Korea | 2.8% |

| See More Countries | 46.5% |

Source: Comtrade

Many of China’s textile makers have shifted to lower-cost countries in Africa and to Vietnam. New Chinese-built railways in Africa link countries to Chinese-built seaports, allowing them to export goods for the first time and import more with the wealth created. That has opened new sea trade routes.

A Chinese company owns the largest port facility on the Panama Canal that provides a major link for east/west trade, including to and from Europe and US west coast ports.

What a lot of those bearish ZIM articles on SA overlook is the fact that CEO Eli Glickman is one of the best in the industry. Among the decisions he has made include the expansion into New Zealand and the intra-Asia routes. New Zealand might be a tiny country but it exports more dairy products, lamb and venison than any other country and is among the leading exporters of beef, kiwifruit, apples and seafood. Most of those things travel in high margin temperature controlled containers.

Europe

Much of Europe is in or near recession. Britain shows signs of becoming a failed state as it was in the 1970s when it needed an IMF bailout. Even if things do not get that bad the economy is in a sad state but several mainland European countries will ensure things keep moving. The EU is taking a middle path with China and is not taking part in the trade war talk of the US.

If car sales are an indicator then those have shown some recovery from losses between January and July this year. The European Automobile Manufacturers’ Association (ACEA), said that European Union passenger car registrations rose 12.2% in October, the third consecutive month of growth this year. In September, car registrations were up 9.6%.

Four EU markets saw good gains: Germany up 16.8%, Italy up 14.6% and Spain up 11.7%. The French market saw a more modest growth, up 5.5%. Sales are still below pre-pandemic levels but this improvement, if maintained, will show through also in container shipping volumes.

My tiny home country in the centre of Europe but not in the EU – Switzerland – is a major exporter of many things from farm machinery through pharmaceuticals to watches and things are mostly going ok here; inflation is now 3.3% and slowing, GDP growth to June 2022 was 2.8% and unemployment is 1.9%.

The U.S.

All we hear of is doom and gloom but labour markets are tight, as they are in most European countries. All important consumer spending in the US is strong and air travel this Thanksgiving should add to that.

The crash there has been mostly in housing – a very important part of the economy – and in tech stocks. Tech stocks like Netflix (NFLX), Meta (META) and Microsoft (MSFT) are not big shipping container company customers!

Companies that are – such as Caterpillar (CAT) and John Deere (DE) – are doing very well globally as shown in their latest results.

Adding the above points together confirms my conclusion that…

ZIM Should Be A Holy Grail For Dividend Investors

In concluding the recent results report the CEO said:

“Driven by macroeconomic and geopolitical uncertainties, the near-term outlook for container shipping has shifted and the normalization in freight rates has begun. Based on our current market expectations, we now forecast 2022 adjusted EBITDA of between $7.4 billion to $7.7 billion and adjusted EBIT of between $6.0 billion to $6.3 billion, and note that both will once again represent full-year records” and…

“The proactive steps we have taken over the past two years, combined with our balance sheet strength, have transformed ZIM and significantly enhanced our resilience both commercially and operationally, to best position our Company for the ‘new normal.’ As we remain committed to our global niche strategy focused on attractive trades, we have opened several new services during this time, improving our port coverage to better serve our customers and making our commercial presence more resilient and diversified. We have identified growth engines complementary to our container shipping activities, such as our car carrier activities and digital freight forwarding subsidiary. We have also secured competitive and cost effective newbuild capacity to support our commercial strategy and advance our and our customers’ ESG agenda.”

Cash flow is good so dividends get paid from that and not from debt. Even if the profits halve in 2023 then assuming the payout of 30% of those remains then dividend investors can still expect a payment of around $5 per share.

I invest mainly for capital gain because I do not pay tax on that but do on dividends. ZIM’s PE of 0.5 only has to get to that of Maersk’s 1.28 and the stock price will go up 156%. If it gets to the level of poorly performing FedEx at 12.84 then I become a rather rich and happy guy.

Prior to that I shall enjoy the next dividend payment and if others want that too they should buy in before the next ex-dividend date of November 29.

Be the first to comment