shaunl

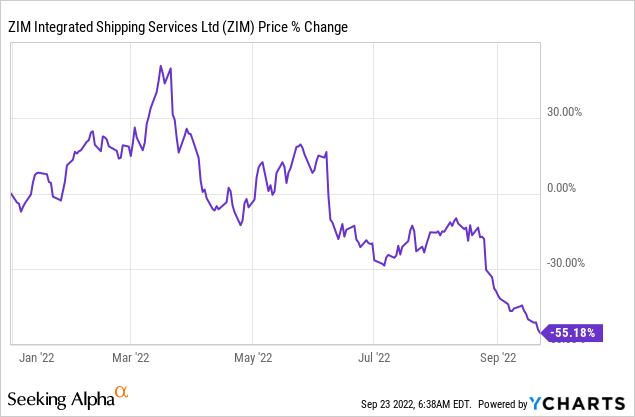

Shares of ZIM Integrated Shipping Services (NYSE:ZIM) have dropped to a new 1-year low yesterday due to growing concerns of a global economic downturn that would likely lead to a significantly lower profit baseline for cargo shipping companies. Although ZIM Integrated currently gets a lot of attention due to its 80% dividend yield, I don’t see this yield as sustainable in a market-driven lower by rapidly declining shipping rates and a potential decrease in container volume during a global recession. Additionally, shares of ZIM Integrated are cheap only because of unsustainably high shipping rates. A continual decline in shipping rates is likely to result in further profit and valuation pressure for ZIM Integrated!

The global economy is heading for trouble and freight rates are collapsing

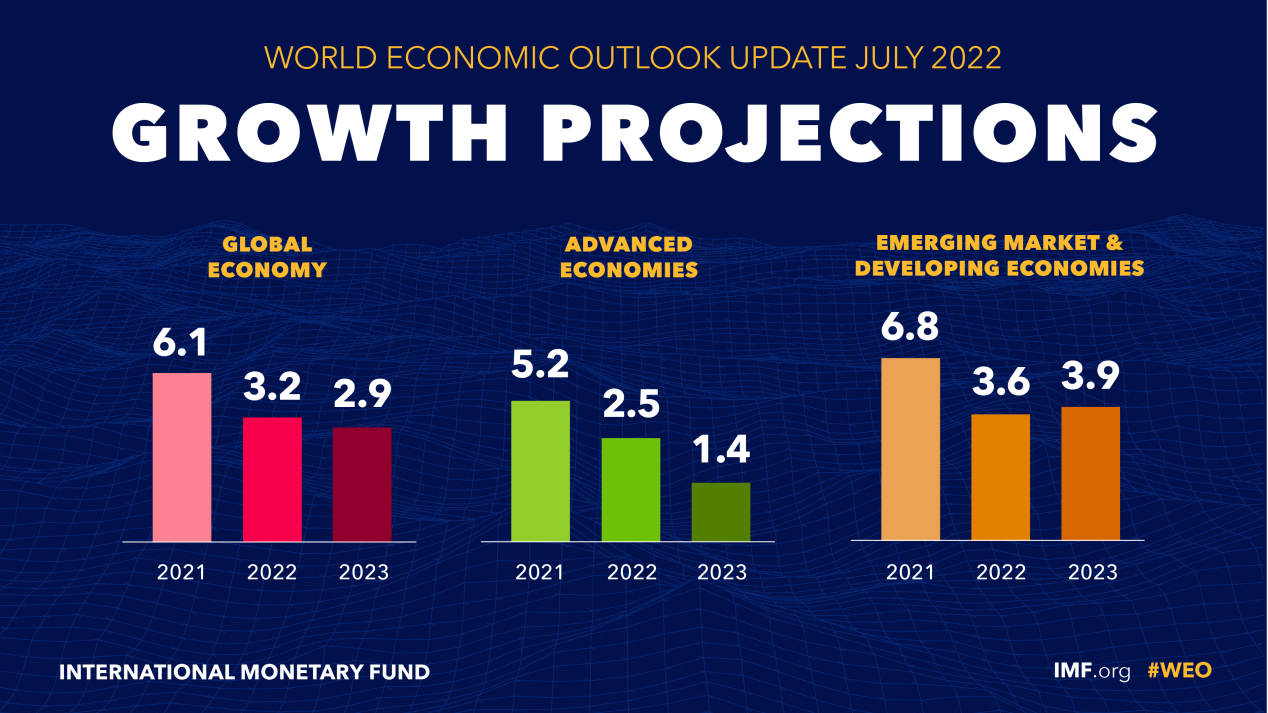

The US economy has already seen two consecutive quarters of negative GDP growth in 2022 which officially puts it into recession territory. Unfortunately, it looks like it could get a whole lot worse for investors and shipping companies. Besides the Fed delivering another interest hike this week, causing a minor market slide, the International Monetary Fund recently downgraded its growth outlook for 2022 and 2023, chiefly due to growing inflation risks. The IMF projects 3.2% growth in 2022 and 2.9% growth in 2023 for the global economy but revised its forecasts down by 0.4% for 2022 and by 0.7% for 2023. The IMF diminished its forecast for 2023 by nearly twice the percentage amount as it did for 2022… which shows that the global economy is slowing much more sharply than expected. In 2023, the global economy may enter uncharted territory, especially if the energy crisis is about to get worse.

IMF

For companies like ZIM Integrated – which are highly dependent on strong global economic growth and vibrant trade flows – the increasingly cloudy economic outlook is set to have a serious effect on its business in two ways, (1) shipping rates are falling and (2) shipping volumes may contract in a global recession. These concerns, but especially the drop in freight rates recently, are behind ZIM Integrated trading down to new 1-year lows in September.

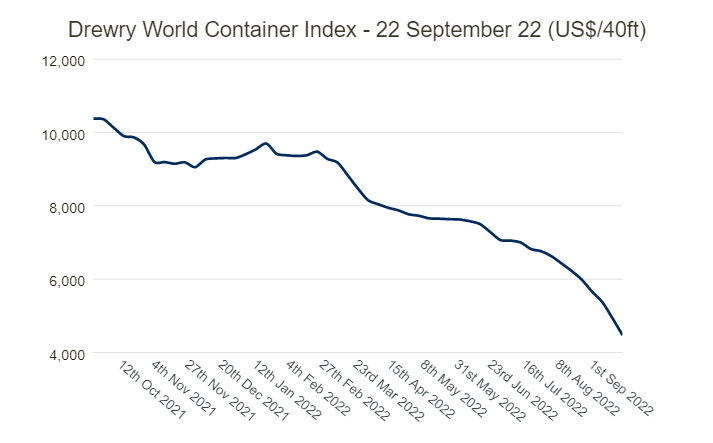

The shipping rate for a 40-foot-long container was around $6,224 a month ago, and they have been in free-fall since. Freight rates for 40-foot long containers are measured by the Drewry World Container Index, and they have dropped another 28% to just $4,472/container in the last month. Shipping a 40-foot container a year ago cost more than $10 thousand, showing that rates have dropped by about 57% since last year.

Drewry World Container Index

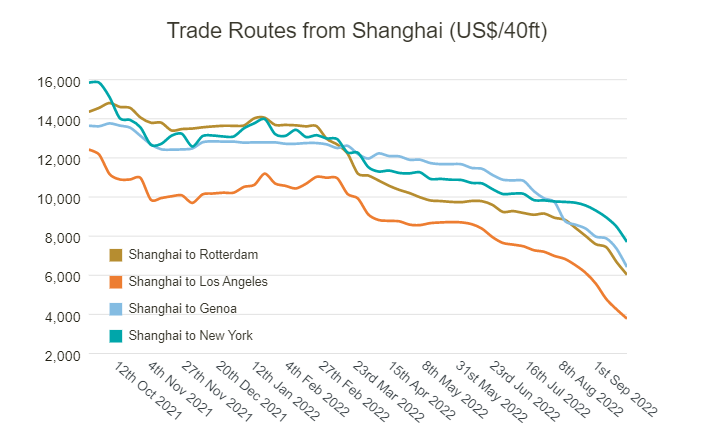

Shipping rates for all major trade routes have dropped in September and the decline is accelerating…

Drewry World Container Index

Value trap: don’t buy the 80% dividend yield

ZIM Integrated pays its dividend on the basis of a variable dividend policy, which limits the company’s financial commitments during times of falling shipping rates and profits. By doing this, ZIM Integrated reduces its cash flow risk while offering shareholders upside in the dividend during good times when profits and freight rates are high.

However, the decline in shipping rates in September foreshadows a significant decline in net profits (and dividends) for ZIM Integrated and its shareholders. For that reason, I believe the 80% dividend yield is a backward-looking measure for investors that doesn’t accurately reflect changes in the company’s net income potential related to a drop in freight rates. The 80% dividend yield is therefore most likely not sustainable and a value trap for investors.

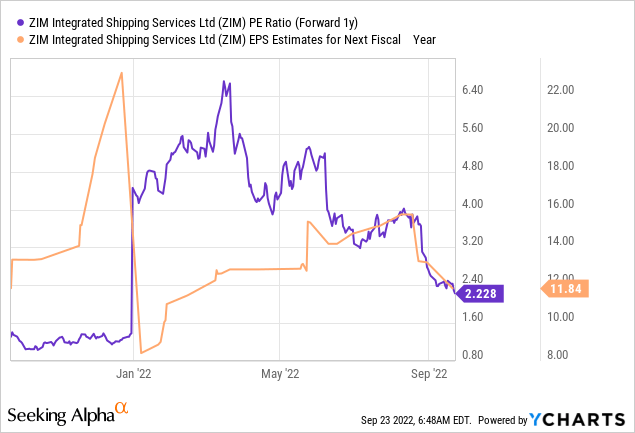

Low P-E ratio may be misleading

ZIM Integrated’s P-E ratio is just 2.2X but is boosted by unusually high profitability related to still elevated shipping rates. A downturn in the shipping industry – which is increasingly likely given growing macroeconomic risks – could result in a major re-rating of ZIM Integrated’s growth and valuation prospects.

Risks with ZIM Integrated

ZIM Integrated has very little influence over shipping rates, which are a function of the strength of the global economy. With the IMF recently down-grading its growth expectations for 2023 and inflation still being a major issue around the world, shipping rates are all but set to come further under pressure. While ZIM Integrated pays its dividend on a variable basis, a downturn in the cargo shipping industry would likely seriously impact the firm’s ability to generate profits, which may result not only in lower dividend payments going forward but also in a re-rating of ZIM Integrated’s shares.

Final thoughts

Container shipping rates are in free-fall – driven by growing concerns over the state of the global economy – and it is the chief reason behind shares of ZIM Integrated dropping to a new 1-year low this week. Shipping rates are still high, however, which indicates material downside not only for cargo rates but also for ZIM Integrated’s shipping near-term profit potential. I believe the risk profile at this point, despite a low P-E ratio, is heavily skewed to the downside and the 80% dividend yield that is often cited as a reason to buy the shipping company, is nothing but a value trap!

Be the first to comment