sshepard/E+ via Getty Images

Investment Thesis

Those hoping for a quick stock recovery for Zillow Group, Inc (NASDAQ:Z) will likely be disappointed, since the rising mortgage rates would dampen the previously red-hot property market. Combined with the record high oil and gas prices, rising inflation, and potential recession, we do not expect much positive catalyst ahead for the market, since the S&P 500 Index had also fallen by 21.8% in H1’22 – the most it had fallen in the past fifty years.

Therefore, we expect the bear to maul through the property market as well, leaving Z behind to pick up the pieces in the intermediate term.

Z Is Unlikely To Recover Anytime Soon

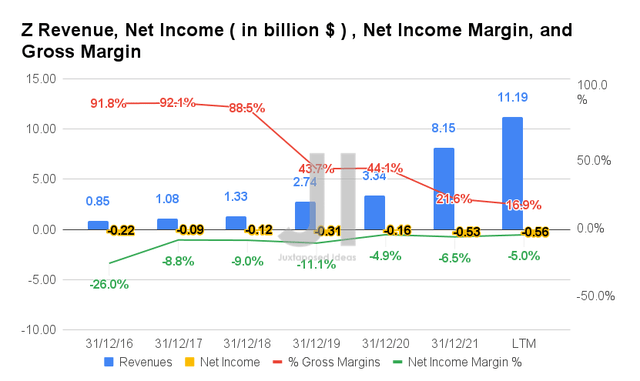

Despite a hot property market in the past two years, Z’s business had definitely suffered from intense iBuying competition, since the company continued to struggle with net income and FCF unprofitability thus far. By the LTM, Z reported revenues of $11.19B and gross margins of 16.9%, representing a massive increase of 335% but a decrease of 26.8 percentage points from FY2020 levels, respectively. In addition, the company reported deepening net losses of -$0.56B and net income margins of -5% in the LTM.

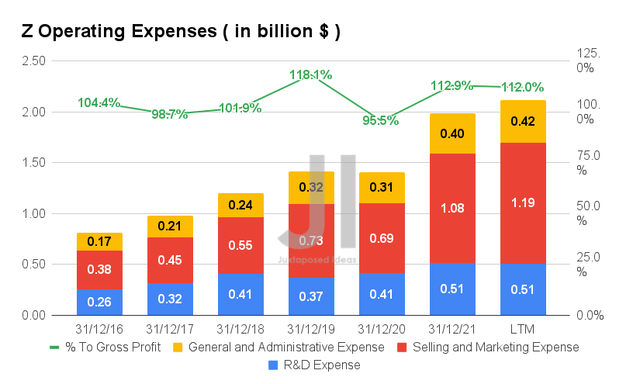

This operating segment explains why Z has continued to struggle with profitability thus far. By the LTM, the company reported $2.12B of operating expenses, representing 112% of its gross profits then. It also indicated a massive increase of 49.2% from FY2019 levels – thereby highlighting Z’s massive continuous cash burn. Nonetheless, since the management has guided a 25% reduction in its workforce by H2’22, we expect a meaningful moderation ahead, potentially contributing to its profitability then.

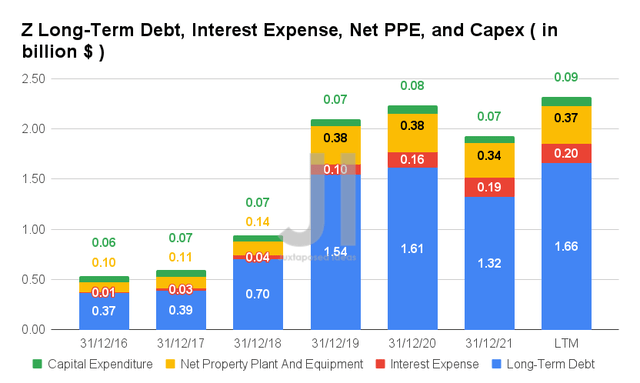

Based on the chart above, Z has relied heavily on long-term debts to fund its existing operations since FY2019. By the LTM, the company reported $1.66B of long-term debts and $0.2B of interest expenses. It is essential to note that these convertible notes comprise $0.6B of debts due 2024, $0.56B due 2025, and $0.49 due 2026. Given Z’s minimal profitability ahead, we expect these to be converted for up to 33.83M of additional shares, based on the original conversion rate. Otherwise, 45.54M shares based on current stock prices, depending on the eventual contract agreement.

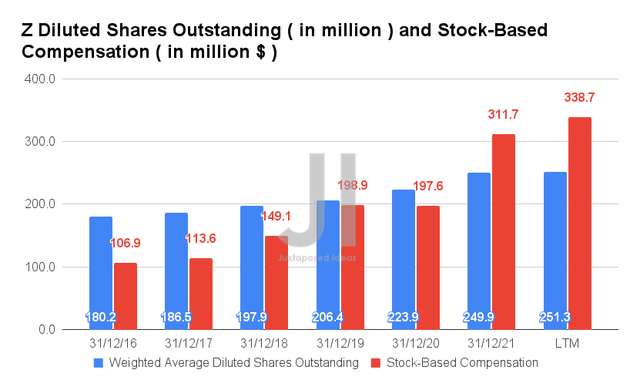

Given its lack of profitability, Z has also continued to depend on Stock-Based Compensation (SBC) since its IPO. The company reported immense SBC expenses of $338.7M in the LTM, representing an increase of 70.2% from FY2019 levels. The massive expenses also accounted for 17.5% of its gross profits and 132% of its operating income in the LTM. As a result, we have also observed a 22% dilutive effect on its existing shareholder, from 206.4M shares outstanding in FY2019 to 251.3M in the LTM.

Combined with the convertible notes discussed above, we speculatively expect a total share count of up to 485.94M by 2026. It will further dilute its existing shareholder by 93.3% based on the current share count in the LTM and a gargantuan 726.1% since its IPO in 2021. Nonetheless, some of this diluted effect could potentially be countered by Z’s $1B share repurchase program, authorized in FQ1’22. Interested investors, take note.

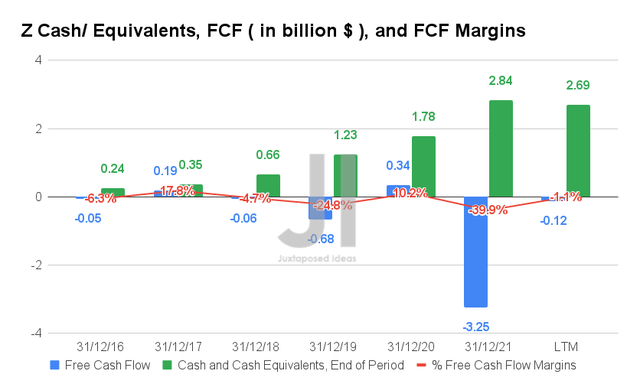

Therefore, given its elevated expenses of $2.12B and capital expenditure of $0.09B in the LTM, it is not hard to see why Z has yet to report positive Free Cash Flow thus far. By the LTM, the company reported an FCF of -$0.12B and an FCF margin of -1.1%. Nonetheless, it appears that Z’s cash and equivalents on its balance sheet look relatively healthy at $2.69B, even after adjusting for the $1.66B of long-term debts.

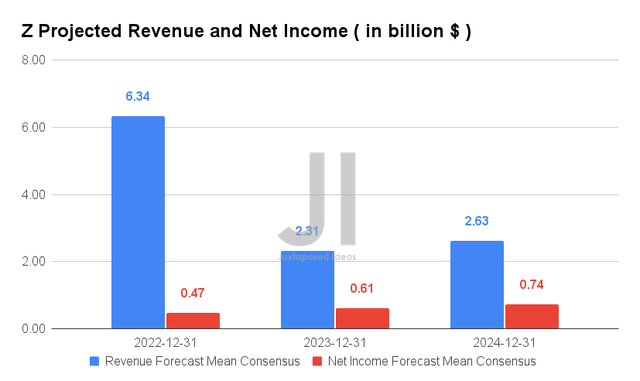

Consensus Estimates On Z’s Future Profitability Is Rather Optimistic

Over the next three years, Z is expected to report a normalization of revenue and net income growth, since starting the iBuying segment in 2018 and abandoning it in late 2021. By FY2024, the company is expected to report an adj. revenue growth at a CAGR of 12.03%, while also reporting net income profitability of $0.74B. Its net income margin is also expected to improve from 26.4% in FY2023 to 28.1% in FY2024.

For FY2022, consensus estimates that Z will report revenues of $6.34B and net incomes of $0.47B, after it has sold most of its massive inventories. Nonetheless, we believe that the estimates are overly optimistic from FY2023 onwards, since Z’s positive net income is unlikely sustainable, given the speculative slowdown in the property market moving forward. We shall see.

In the meantime, analysts will be closely watching its FQ2’22 performance, with consensus revenue estimates of $985.31M and EPS of $0.08, representing YoY declines of -24.78% and -59.74%, respectively. We expect a slight stock recovery, given the rapid-fire sale of its inventory potentially boosting its FCF generation in the short term. Nonetheless, the gains would probably be digested soon after, due to the bear market sentiments.

So, Is Z Stock A Buy, Sell, or Hold?

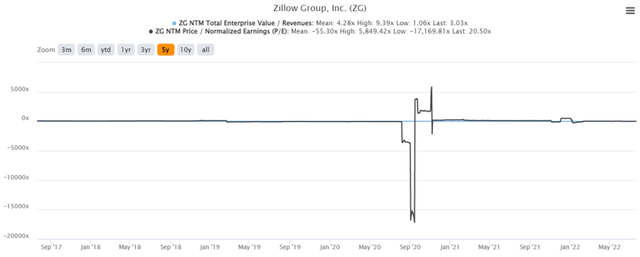

Z 5Y EV/Revenue and P/E Valuations

Z is currently trading at an EV/NTM Revenue of 3.03x and NTM P/E of 20.50x, lower than its 5Y mean of 4.28x and -55.30x, respectively. The stock is also trading at $36.45, down 68% from its 52 weeks high of $114.07, nearing its 52 weeks low of $28.76. It is evident that Z has been on a continuous plunge since February 2021, further worsened by the winding down of its iBuying segment in November 2021. Since then, the stock has been struggling and continued to see-saw to current levels.

Z 5Y Stock Price

Therefore, despite the consensus estimates attractive buy rating with a price target of $47.50, we are not convinced of Z’s 31.18% upside. We believe that the stock has more to fall, given the projected underperformance of the property market.

With the Fed expected to hike the interest rates again this week, we expect to see a marked slowdown in the housing market ahead, due to the increasingly elevated mortgage rates. If Z had struggled to report sustained profitability during the property boom then, we are less optimistic about its prospects in the potential recession. As a result, we expect the stock to continue underperforming in the intermediate term.

In the meantime, we would advise patience for those looking at add now, since Z is expected to report its FQ2’22 performance soon.

Therefore, we rate Z stock as a Hold for now.

Be the first to comment