hapabapa/iStock Editorial via Getty Images

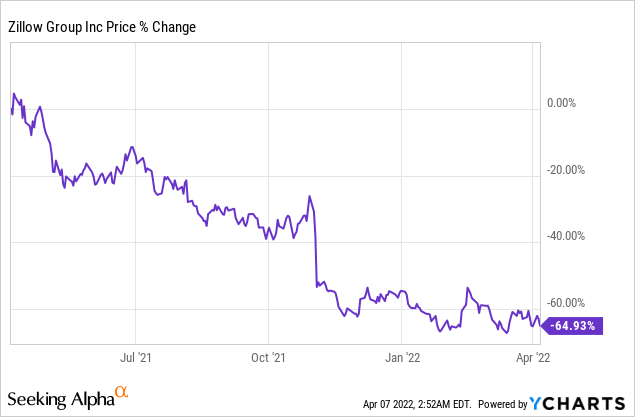

Shares of Zillow Group (NASDAQ:Z) have failed to revalue higher after the online platform for buying and selling real estate announced that it will exit its loss making homebuying business. The company’s fundamentals are set to improve going forward and Zillow’s core business, taking commissions from agents for listings, will likely continue to grow rapidly. I believe Zillow remains interesting long term and the firm’s shares have potential to revalue higher once investors get a clearer understanding of the firm’s business direction!

Zillow: Exiting its homebuying business

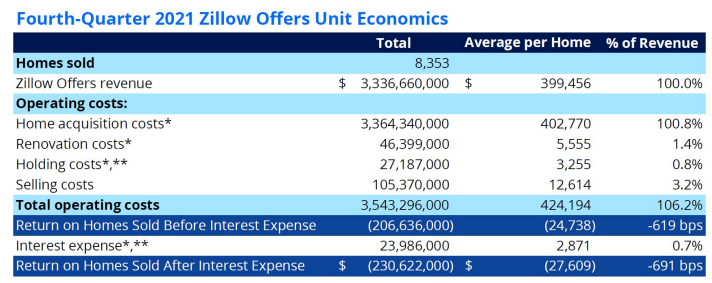

Zillow Offers, also branded as Zillow’s homebuying business, failed to take off. While the market expected that the purchasing, remodeling and flipping of properties would be an engine for profit growth for the company in a rapidly growing real estate market, Zillow could not satisfy these expectations. Zillow Offers generated material revenue growth, but the real estate platform proved to be unable to run this business profitably. Zillow lost $230.6M in the buying, remodeling and flipping business just in the fourth-quarter. Since the platform doesn’t see a path forward to sustainable profitability, management decided in FY 2021 to close this business down and focus on its agent business and related services instead. Given the large losses the homebuying business has created, I believe the decision is the right one for the company.

Zillow

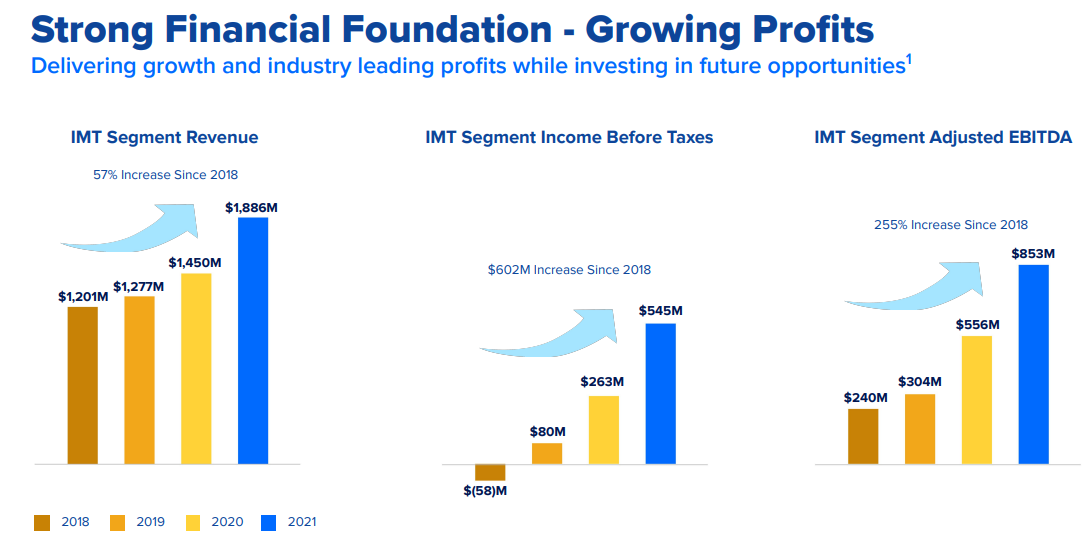

Putting the homebuying business aside, Zillow has a lot of potential to expand its other real estate related services. The biggest revenue source for Zillow is its agent-based commission business that is reflected in the platform’s Internet, Media & Technology/IMT segment. Zillow has achieved steady revenue growth in this segment over the years as real estate values went up and transaction activity increased in an overall bullish market. Zillow’s IMT segment revenues chiefly come from agent commissions, but also include revenues from the sale of advertising/technology solutions to real estate agents as well as revenues from rentals and display advertising. Zillow’s IMT revenues surged 30% year over year to $1.9B in FY 2021 and the segment is widely profitable.

Zillow

Long-term growth opportunity: Zillow targets $5B in revenues by FY 2025

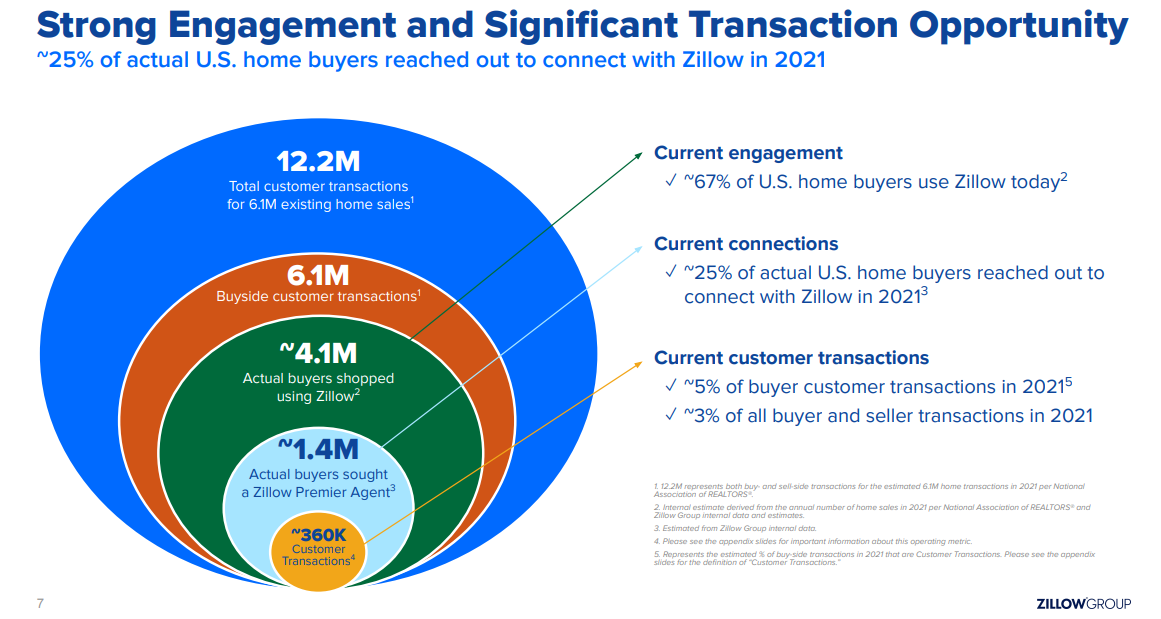

According to Zillow’s internal engagement data, about 67% of U.S. home buyers use Zillow’s platform services at some point. Zillow had 198M average monthly unique users across its mobile apps and websites in the fourth-quarter and its online databases included more than 135M homes. However, Zillow still only participates in a small number of real estate transactions in the U.S., creating a long term opportunity for the firm’s platform growth.

Zillow

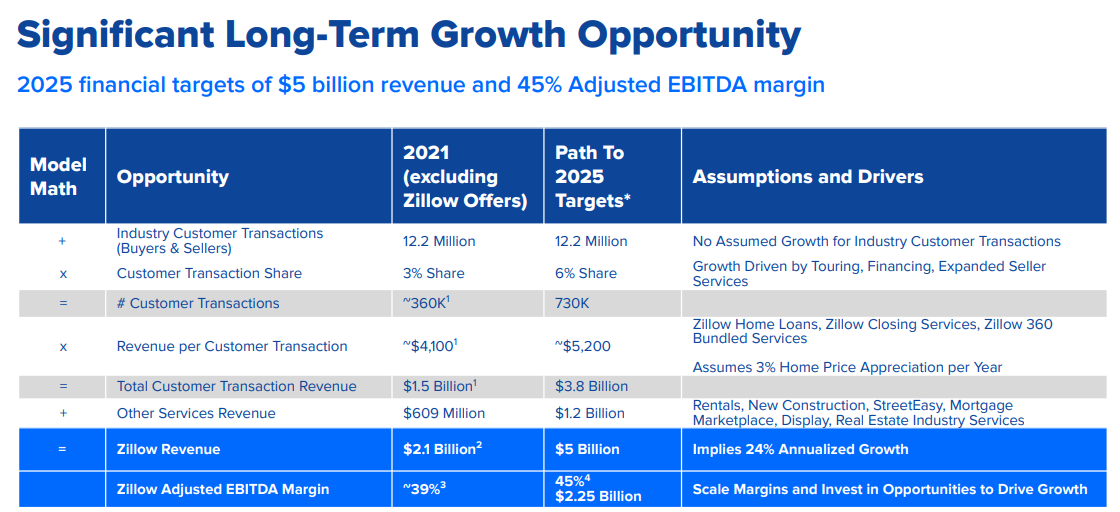

Zillow has detailed its strategy to grow from $2.1B in revenues today (excluding its homebuying business) to $5.0B in FY 2025 which calculates to an annual revenue growth rate of 24% over the next four years. The firm plans to achieve this revenue goal by capturing a growing slice from the large real estate transaction market in the U.S. Zillow wants to chiefly grow its core IMT business which is already seeing strong top line momentum, but also other products like mortgages, rentals and real estate transaction closing services.

Zillow

Assuming that Zillow can achieve its long term financial goal of $5.0B in revenues by FY 2025, which I believe it will, shares of Zillow have a market-capitalization-to-sales ratio of 2.5 X. Because Zillow is exiting its homebuying business, the future Zillow real estate platform will also have less risk, less earnings volatility and require significantly less capital.

Risks with Zillow

Ever since Zillow announced the exit of its loss making homebuying and flipping business, the stock has fallen into a pronounced downtrend. Zillow Offers failed to meet management’s return expectations and proved to be highly volatile which is why the firm decided to close down this business and re-focus on its marketing services and advertising fees. The closing of Zillow Offers was a huge disappointment for investors, but I believe the stock has corrected too much to the downside. If Zillow can convince investors that the commission business is the way to go and that other revenue streams have potential, then shares of Zillow have the potential to revalue higher.

Final thoughts

Zillow stock, from a potential pay-off and risk perspective, looks interesting. Shares have a low sales valuation factor and the core business, real estate listings, shows a lot of promise going forward. Zillow could create new business opportunities for itself by rolling out new products (technology products used by agents, closing services) that result in revenue growth and a larger share of the real estate transaction market. I believe the risk profile is heavily skewed to the upside here and Zillow will see strong growth in its core business going forward!

Be the first to comment