adamkaz/E+ via Getty Images

While housing was on fire a mere 9 months ago, today the market is ice cold. With mortgage rates more than doubling, housing affordability has plummeted and transaction volumes are falling off a cliff. All of this has been bad news for Zillow (NASDAQ:Z) shareholders who have seen the stock decline 72% over the past year. While business conditions are likely to remain poor for the foreseeable future and Zillow’s EBITDA will almost certainly decline significantly (or go negative), the company is very well positioned in the medium & longer term. I see the current share price weakness as an opportunity for long-term investors to build a position in a dominant business at an attractive price.

Things are terrible in housing

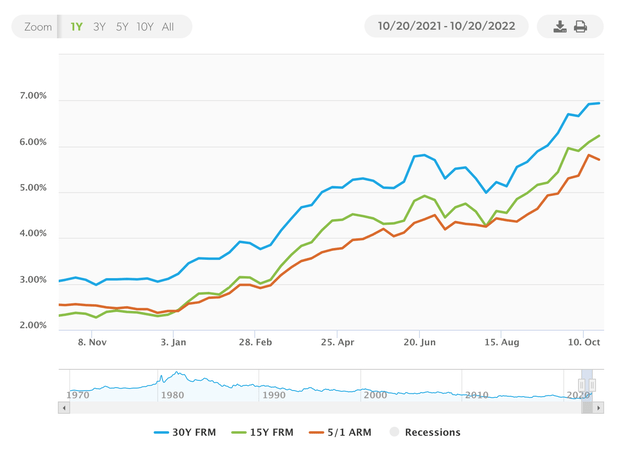

I’m not going to belabor the point because anyone who hasn’t been living under a rock for the past 9 months knows that the US housing market has gone from blazing hot to ice cold. Fed rate hikes have led 30-year mortgage rates to leap from just over 3% in January to nearly 7% today.

Mortgage rates over the past year (Freddie Mac)

This is already having a chilling effect on the housing market which saw the number of transactions decline 23% year-over-year in September and saw the number of new listings fall 7% month-over-month (and down nearly 12% year-over-year). The fall in new listings will likely be a persistent theme in the current mortgage rate environment as people who recently purchased a home (with a low mortgage) or refinanced a home at the low interest rates available from 2019-21 are much less likely to move since purchasing a new home would require them to replace their existing 3-4% mortgage with a 7% mortgage.

In summary, things in the housing market are tough and are likely to remain tough for a while.

This begs the question: why do I own Zillow?

1. Zillow Flex

I believe that Zillow Flex is a game-changer. Zillow Flex was introduced in 2018 and has since been gradually rolled out to more markets (Zillow went exclusively to Flex in Denver and Raleigh earlier this year). Simplistically, instead of simply charging realtors for leads from Zillow, Zillow now invites top performing realtors to become Zillow Flex partners. Under the Flex model, realtors do not pay Zillow for leads. Instead, they become the exclusive Zillow Flex agents in a given territory and share 30-35% of the commissions earned with Zillow. Under this model Zillow now earns a multiple of the revenue it would have earned under its traditional lead-gen sales business model.

For those who are really interested in learning more about the Flex model, this video is a panel of realtors discussing how they’ve implemented Zillow Flex and seen a dramatic uptick in their business. It highlights the willingness realtors need to have to alter (dare I say ‘improve’) their business processes and consumer response times to be compliant with Zillow Flex requirements. By improving customer response times and following a set script focused on setting a viewing appointment on the first call with the agent, conversion rates on leads improve dramatically.

Because Zillow gets a commission per deal from Flex realtors which dwarfs the revenue it received under its lead-gen sale model, Zillow’s revenue and profitability are significantly higher under the Flex business model than the traditional Premiere Agent business model. Similarly, while realtors using this model must share commissions with Zillow, they are able to complete far more transactions and generate higher total revenue and profitability. This seems like a true win-win partnership.

2. Zillow’s strong balance sheet will allow it to weather any storm

Zillow exited the second quarter with a net cash position of ~$1.7 billion. While the housing downturn may be severe and could last years, I have no doubt that Zillow will survive the storm.

Further, because the company has such a strong balance sheet, it may be able to make strategic acquisitions at deeply discounted prices which will enable it to emerge from the downturn even stronger.

3. Zillow may finally succeed in breaking into sell-side transactions

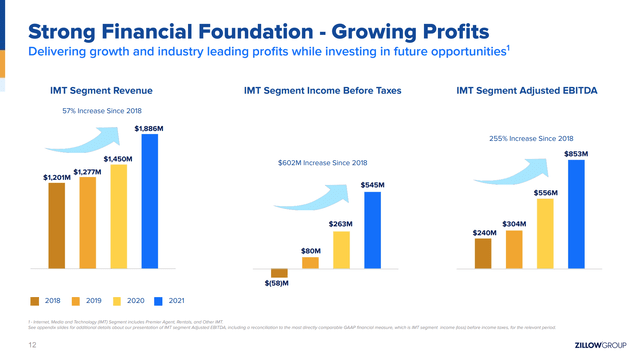

While Zillow has been a successful company, earning EBITDA of $850 million in its core marketing business in 2021, virtually all of this has come from selling leads to buyers agents (or participating via Flex). Zillow has not been successful in selling the leads of prospective home sellers to realtors. So while Zillow is a reasonably successful company, it had effectively been ignoring half the market (there is a buyer’s agent and seller’s agent on each side of the deal).

Zillow’s expensive foray into iBuying was an attempt to generate interest from prospective home sellers. This venture was costly, short-lived, and ultimately failed. However, this did become a way to generate interest from potential home sellers. While Zillow itself will no longer buy homes, Zillow is partnering with other iBuyers, notably Opendoor (OPEN), which will serve Zillow in two ways. First, Zillow will earn commissions from Open Door for leads generated through Zillow. Second, and more importantly, by being viewed as a go-to resource for prospective sellers, Zillow will collect more information (leads) which can either be sold to sellers agents (or more likely participation deals with Zillow Flex).

4. When the housing market turns, Zillow will make a lot of money

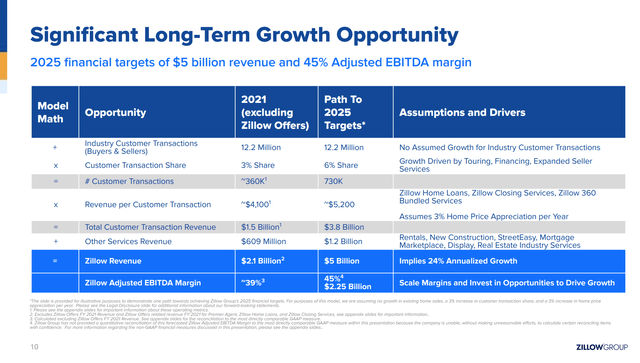

Zillow 2025 Financial Goals (Zillow Investor Presentation)

Given how much the housing market has deteriorated over the past 9 months, it is hard to believe that earlier this year, Zillow put out a presentation targeting $2.25 billion in EBITDA in 2025. Today this looks ludicrous. However, I do believe that when the housing market picks up, the factors I’ve outlined above will allow Zillow to easily surpass its previous revenue/EBITDA levels.

Historical Profitability (Zillow Investor Presentation)

Should Zillow merely match its 2021 EBITDA and were investors willing to place a 15x multiple, Zillow would be worth $58/share (including net cash). In an upside scenario, assuming that Zillow is able to achieve $1.5 billion in EBITDA (halfway between 2021 actual results) and the company’s 2025 target, shares would be worth $97, or more than 3x today’s price.

While I expect Zillow will eventually reach these levels, I think it will probably take longer than 3 years. While it is possible that the Fed could reverse course, cut interest rates, and kick the housing market back into high gear by 2025, to be conservative, I’m assuming that these results are achieved in 2029. As such the base case expectation for Zillow to revert to 2021 EBITDA levels and appreciate 87% is ‘only’ an 11% CAGR if it takes 7 years (my upside scenario would result in a 17% CAGR).

Risks

1. If mortgage rates stay high indefinitely, the level of housing market transactions in the US may not recover to historical averages.

2. Zillow stock is exceptionally volatile.

Conclusion

Given the malaise surrounding the housing market and uncertainty over near-term earnings prospects, Zillow shares are bound to be volatile. Recognizing this, I have been opportunistically adding to my position on down days. I expect that this will become a significant position for me over the course of the next year or so. Ultimately, I believe that Zillow will remain the market leader in helping people to discover homes and that the changes made to its business model will allow it to significantly increase its earnings power.

Be the first to comment