We Are/DigitalVision via Getty Images

Zenvia Inc. (NASDAQ:ZENV) offers a cloud-based communications and customer experience (CX) platform focusing on clients primarily in Latin America. CX refers to how businesses engage with their customers and includes everything from marketing to sales and customer service with all the related analytics and communications channels. The attraction in Zenvia is that this segment is generating strong growth in the region with demand from areas like e-commerce and an ongoing shift towards corporate digitization.

Zenvia recently reported its latest quarterly result highlighted by impressive operating and financial trends which makes the stock appear like a bargain next to some global competitors. While shares of Zenvia have been extremely volatile since its August 2021 IPO amid the broader market selloff in “high-growth tech”, we think it looks interesting at the current level.

Seeking Alpha

ZENV Key Metrics

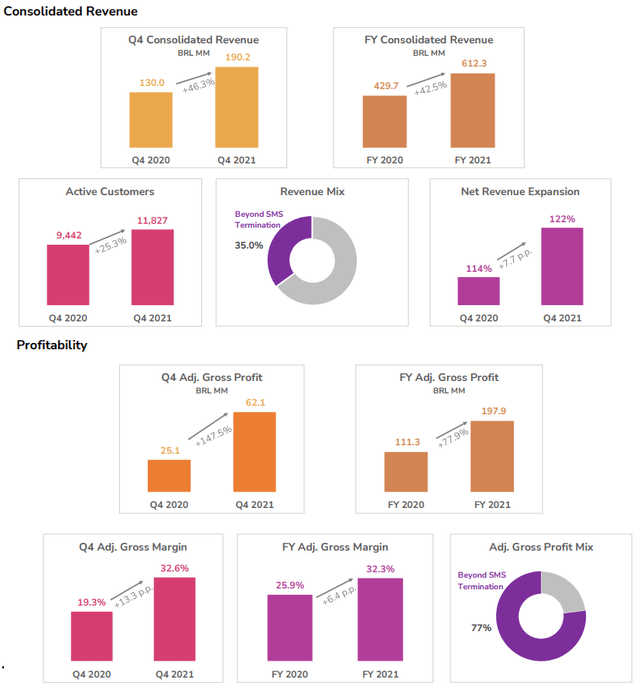

Brazil-based Zenvia Q4 revenue reached BRL 190 million, or approximately $38 million at a BRL 5 per USD exchange rate, climbing 46% year-over-year. Within that amount, 26% growth was recognized as “organic” while a series of strategic acquisitions have also helped the company expand its operating base. On that point, Zenvia now counts on 11,827 business customers, up 25% y/y.

For the full year, revenue reached BRL 612 million, up 42% compared to 2020. The momentum has translated into a trend of improving financials. The gross margin in the quarter reached 32.6% compared to 25.9% last year. While the IPO-related expenses left the company with negative GAAP earnings, an adjusted EBITDA of BRL 40.2 million for the year climbed from just BRL 8.0 million in 2020.

With proceeds from the IPO, Zenvia ended the year with BRL 583 million in cash and equivalents against BRL 144 million in debt. In our view, the net cash balance sheet position is a strong point in the company’s investment profile which provides some flexibility for potential local strategic acquisitions.

source: company IR

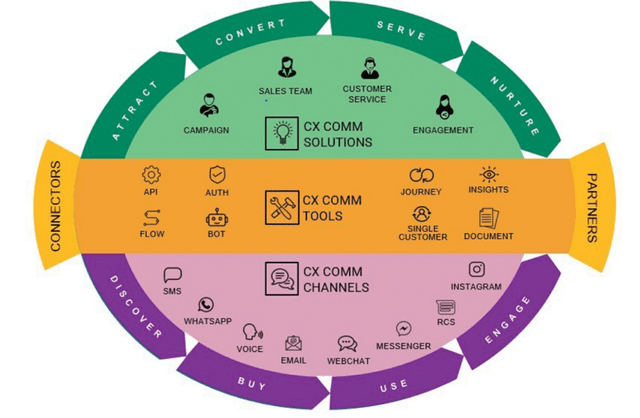

A key product for Zenvia is its “SMS Termination” business which allows companies to communicate with customers by SMS, either in group or on an individual basis through the platform. Companies use this tool, as a starting point for customer service requests or marketing. There is also the flexibility to expand the functionality into other mobile apps like “WhatsApp”, “Facebook Messenger”, traditional email, and more.

That said, an important theme for the company has been the diversification beyond the SMS business into broader software-as-a-service subscriptions which now represent 35% of revenues. This shift is also adding to the higher margins with more value-added services and is part of the bullish thesis for the stock going forward.

source: company IR

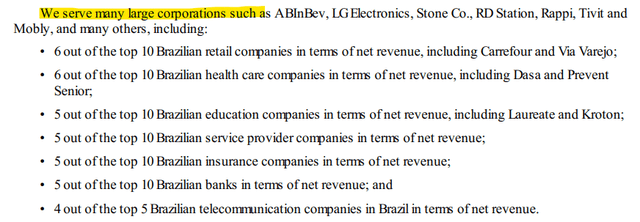

From last year’s IPO filing, Zenvia notes that the company’s platform is used by major corporations which highlight its market penetration, particularly in Brazil, and brand momentum. Part of the growth strategy includes the ability to cross-sell and expand on these existing relationships.

source: company IR

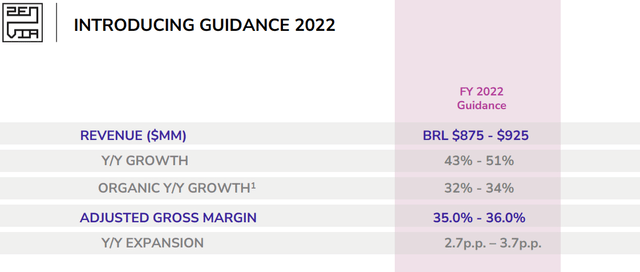

Management is targeting 2022 revenues between BRL 875 million and BRL 925 million representing a y/y increase of 47% at the midpoint. The company also expects to capture some upside to the adjusted gross margin towards 35.5%, around 320 basis points up from 2021. The track here is for positive adjusted EPS in 2022.

source: company IR

Is Zenvia a Good Long-Term Investment?

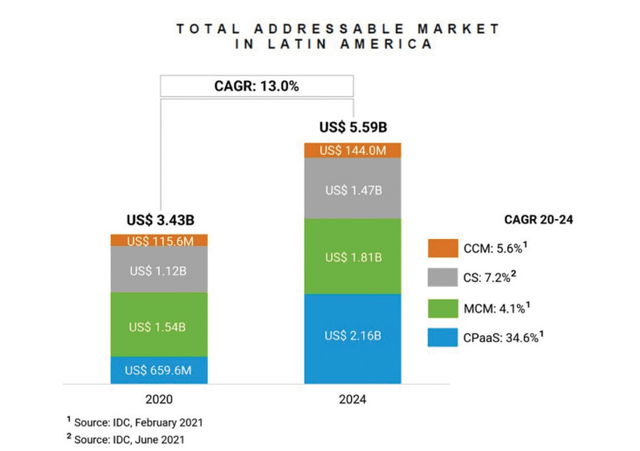

The global market for customer experience and cloud communications as a service (CPaaS) has many global players including names like Twilio Inc. (TWLO), Qualtrics International Inc. (XM), and privately-held “Infobip” among others which all provide comparable or alternative solutions to some degree. According to Zenvia, the addressable market in Latin America is expected to climb by 13% per year through 2024 and reach upwards of $5.6 billion. Zenvia’s result in 2021 suggests the company is effectively capturing market share.

source: company IR

Zenvia benefits regional leadership in Latam and Brazil which is important in this segment considering the unique cultural and language aspects related to customer experience. Notably, Twilio was a pre-IPO investor in Zenvia and remains a shareholder which highlights Zenvia’s market position in Brazil, which is often recognized as difficult for foreign companies to easily penetrate but attractive for the high growth potential.

That may have been the same thinking the investment arm of Chinese tech-conglomerate Tencent Holdings Limited (OTCPK:TCEHY) went through before recently announcing a 10% stake in Zenvia. Putting it all together, there are many reasons to be excited about the long-term prospects of the company.

Is ZENV Overvalued?

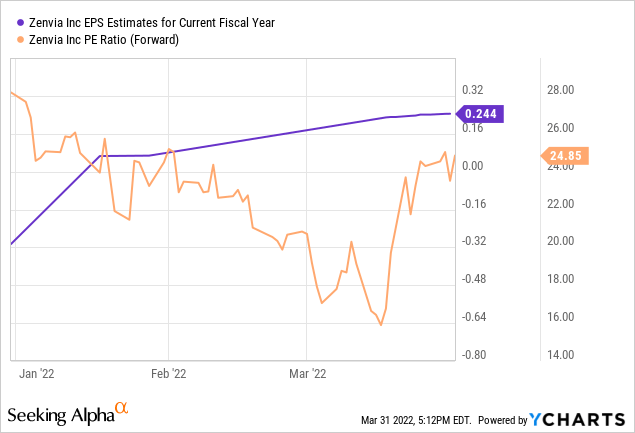

The call we are making is that following what has been a 66% decline from the original $18.00 IPO debut price in August of last year, ZENV is now undervalued. Whether the stock was simply a victim of the broader market selloff or valuation got ahead of itself at the time of the deal, we see upside here. According to consensus estimates, the company is expected to reach non-GAAP EPS of $0.24 this year implying a forward P/E of 25x.

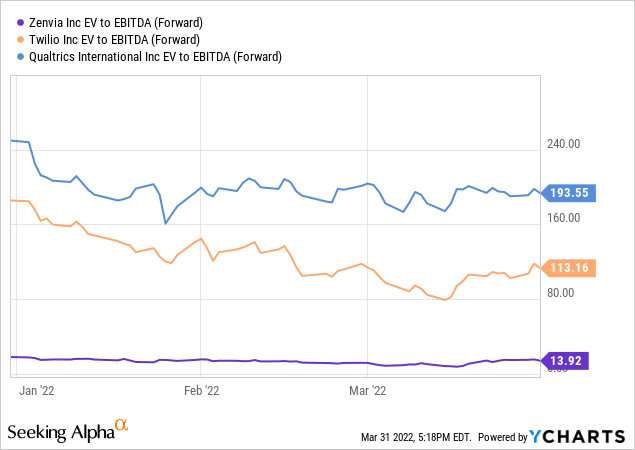

It’s worth mentioning that compared to TWLO and XM which have yet to generate consistent profitability, ZENV trades at a deep discount on an EV to forward EBITDA ratio of 14x. In our view, these are compelling multiples for a company expected to grow revenues near 50% this year while moving financial margins in the right direction. Zenvia’s exposure to the high-growth region in Latin America and Brazil, which has been hot this year, furthers its appeal.

Is ZENV a Buy, Sell, or Hold?

The recent results are strong enough to provide some confidence that Zenvia is moving in the right direction. We rate ZENV as a buy with an initial price target for the year ahead of $8.50 representing a 35x multiple on the current consensus 2022 EPS. The ability of the company to exceed top-line expectations in the upcoming quarters will be critical to setting the stage for a more sustained rally. Revisions higher to earnings estimates can help add momentum to the stock opening the door for even further upside.

In terms of risks, be aware that ZENV as an emerging markets stock and small-cap is subject to wide swings of volatility. With the company based in Brazil, FX translation is also a risk to watch although it could also go in the stock’s favor should the Brazilian Real strengthen from here. Disappointing operating and financial trends in the next few quarters could force a reassessment of the long-term outlook. The number of active customers along with the operating margin are key monitoring points.

Be the first to comment