Michael Vi/iStock Editorial via Getty Images

There’s no arguing it: tech stocks had been hugely overheated since the start of the pandemic, and some level of retrenchment was long overdue. In 2020 and 2021, investors piled into tech thinking that it was the only trade that was immune to wrong – after all, tech is taking over the world! But rising rates in 2022 and a growing fear over valuations have taken a sharp hammer on some of the last several years’ best performing trades.

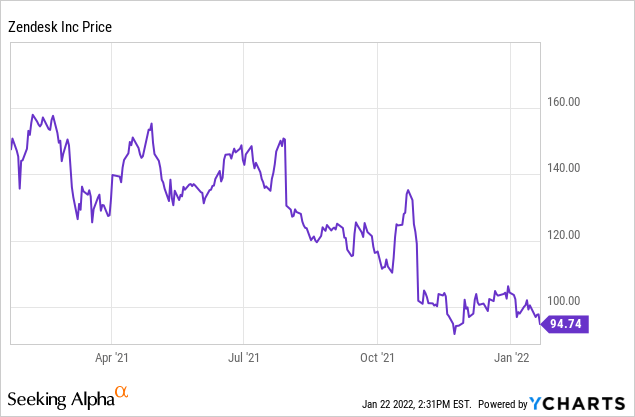

In many cases, however, the pullback has gone too far. Into this bucket falls Zendesk (NYSE:ZEN), one of Silicon Valley’s premier success stories of a software startup that eventually matured into a sizable, profitable giant. A leader in customer-service software, Zendesk stock has fallen roughly 40% over the past year, while losses in January alone have been nearly 10%.

I myself issued a word of warning on Zendesk toward the middle of last year, when the stock was trading closer to the $130 range. At the time, I had cited valuation concerns as the major driver behind a possible pullback for Zendesk, and since then the stock has come down by about 30%. Now, however, at new current levels I’m more willing to buy the rebound on Zendesk, and am upgrading my position on Zendesk to buy.

There are two factors driving the recent pessimism on Zendesk. The first, of course, is the stretched valuation I have already mentioned. The recent correction, in my view, largely takes care of that risk. A quick check on where Zendesk is currently trading: at current share prices near $95, Zendesk trades at a market cap of $11.52 billion. After netting off the $1.54 billion of cash and $1.11 billion of debt on Zendesk’s most recent balance sheet, the company’s resulting enterprise value is $11.08 billion.

For the upcoming FY22, meanwhile, Wall Street analysts are expecting Zendesk to generate $1.69 billion in revenue, representing healthy 27% y/y growth (data from Yahoo Finance). At this revenue estimate, Zendesk trades at just 6.6x EV/FY22 revenue – a major difference to when Zendesk was trading at a low-teens multiple throughout the duration of the pandemic.

The second reason for the overhang on Zendesk’s stock is its proposed acquisition of Momentive Global (NASDAQ:MNTV), better known by its original name – SurveyMonkey. The deal was announced in late October. SurveyMonkey, of course, is a survey-taking software tool that many consumers are aware of. In recent years, the company changed its name to Momentive in order to better reflect its growing shift toward enterprise software and employee/customer experience tools.

In my view, Momentive’s product portfolio and its enterprise shift present a perfect tuck-in opportunity for Zendesk, but several activist investors have come out against the acquisition. One of the key reasons I’m not concerned about the acquisition is that it’s an all-stock deal, at a ratio of 0.225 shares of Zendesk per share of Momentive. Right now, shares of Momentive are trading at only ~$17, which is only ~18% of Zendesk’s levels – reflecting low confidence that the deal will get inked, at least at current terms. Yet I think the decline in value for Momentive alone gives Zendesk the opportunity to acquire >$500 million in annual revenue (a lot of it recurring, thanks to Momentive’s new enterprise offerings) at quite an attractive price, as Momentive’s market cap is currently sitting just shy of $2.5 billion. In any case, once confusion over this deal clears up, I think it will remove a major obstacle for investors and allow them to focus on Zendesk’s fantastic standalone fundamentals.

The bottom line here: I think very few new risks have materialized for Zendesk. I view the possibility of a Momentive acquisition as accretive to Zendesk’s scale and ambition to reach $3.5 billion in revenue by 2024 (versus the ~$1.7 billion it’s expected to do in 2022). Investors should treat this as an opportunity to buy a fantastic growth stock at a heavily reduced price.

Q3 download

Let’s now go through Zendesk’s most recent Q3 results in order to substantiate the fact that on a standalone basis, Zendesk’s organic business growth has been phenomenal, and continued solid quarterly performance should be able to help sentiment in this stock recover once the irrational tech selloff cools down.

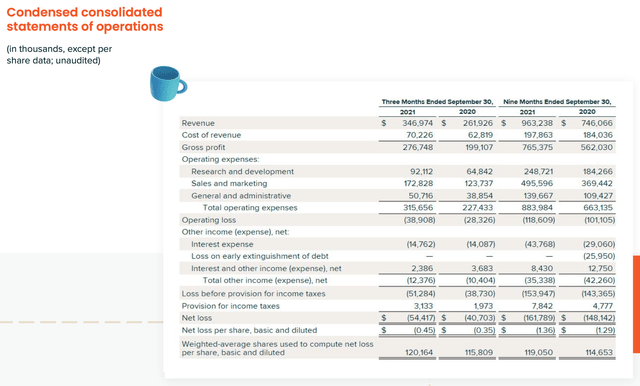

The Q3 earnings summary is shown below:

Zendesk Q3 results Zendesk Q3 shareholder letter

In Q3, Zendesk grew its revenue at a blazing 32% y/y pace to $347.0 million (a very fast pace of revenue growth for a company that has exceeded a >$1 billion annual revenue scale), outpacing Wall Street’s expectations for $335.4 million (+28% y/y) by a respectable four-point margin.

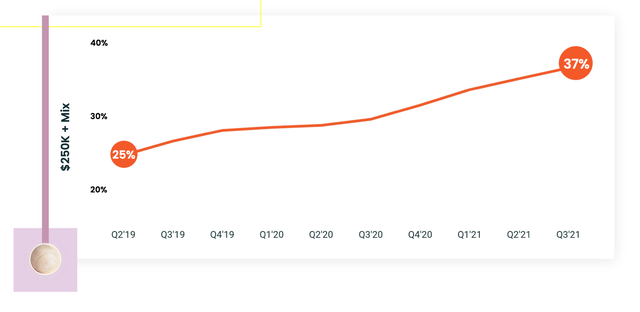

One of the chief recent business objectives for Zendesk has been to shift its focus on selling to enterprise clients, which it defines as customers that generate greater than $250,000 in annual recurring revenue (ARR). It has largely done this by emphasizing sales of its multi-product Zendesk Suite solution, which has proven very popular among enterprise buyers who want a one-stop-shop tool to handle multiple customer needs. Suite now accounts for one-quarter of Zendesk’s overall ARR, up dramatically from just 16% in Q2.

Moreover, Zendesk’s contribution of enterprise (>$250k ARR) customers as a percentage of its total ARR has grown to 37%, and has also steadily grown each quarter:

Zendesk enterprise contribution Zendesk Q3 shareholder letter

Enterprise customers are more favorable for two reasons: their large size and relative slowness at changing internal operations and software make them far less likely to churn than smaller companies; while also presenting a “land and expand” opportunity for Zendesk to sell in more products or expand to different departments within the company.

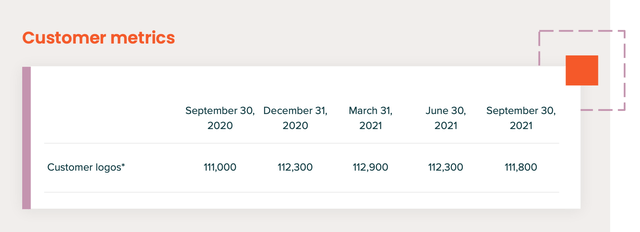

Unsurprisingly, Zendesk’s focus on selling the higher price-tag, all-encompassing Suite solution has driven a slight dip in Zendesk’s customer counts, down to 111.8k total customers this quarter. The company expects this slight downward trend to continue throughout 2022, though I think the fact that these are primarily lower-value customers that are churning and the fact that Zendesk’s growth continues to be strong will make this a non-issue with most investors.

Zendesk customer counts Zendesk Q3 shareholder letter

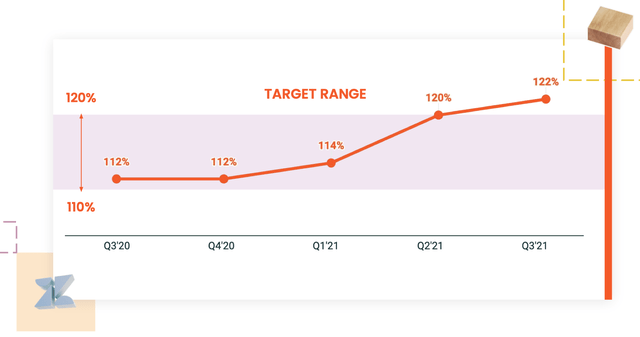

Note as well that Zendesk’s greater enterprise mix has also paved the way for the company to drive improved net revenue retention rates. In Q3, the company hit a 122% net retention rate, indicating that the typical Zendesk customer increases their spend on the platform by 22% in the following year. This metric, too, has seen a gradual upward climb:

Zendesk Q3 net retention rate Zendesk Q3 shareholder letter

Zendesk also notched a sky-high pro forma gross margin of 82% in the quarter, three points higher than 79% in the year-ago Q3 and standing on the high side of most enterprise SaaS peers. Pro forma operating margins declined, however, by a slight two points to 8%, driven by heavier spending on R&D and sales and marketing costs.

We note, however, that with 8% pro forma operating margins and 32% y/y revenue growth, Zendesk technically just squeezes into the definition of a “Rule of 40” company, which emphasizes the fact that its ~6.6x forward revenue multiple looks very cheap. Zendesk has also generated $112.4 million in free cash flow at a rich 12% margin in the trailing three quarters year-to-date, versus a slight cash burn in the year-ago period.

Key takeaways

In my view, Zendesk represents an incredibly attractive rebound opportunity. I’m not so concerned about the impending Momentive acquisition, as I think the fact that it’s an all-stock deal pegged to both companies’ falling share prices means that Zendesk can now purchase the company at a much more favorable price. At <7x forward revenue for >30% y/y growth, Zendesk is now a steal. Hold this for a rebound up to the ~$120 range.

Be the first to comment